Form 5329 Instructions

Form 5329 Instructions - Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. To view form 5329 instructions, visit irs.gov. Go to www.irs.gov/form5329 for instructions and the latest information. Use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or. Want more help with form 5329? Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. The following steps are from the 2022 form 5329: Individual retirement accounts (iras) roth iras

Also, use this code if more than one exception applies. The following steps are from the 2022 form 5329: Form 5329 must accompany a taxpayer's annual tax return. Want more help with form 5329? The irs website contains downloadable versions of form 5329 going back to 1975. To view form 5329 instructions, visit irs.gov. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Web note that the form should be the version for that year (i.e., reporting a missed rmd for the tax year 2022 should be done on a 2022 form 5329). Once you have the proper form, fill in your personal details including your name, address, and social security number. Go to www.irs.gov/form5329 for instructions and the latest information.

Form 5329 must accompany a taxpayer's annual tax return. Individual retirement accounts (iras) roth iras Want more help with form 5329? Also, use this code if more than one exception applies. The following steps are from the 2022 form 5329: Web note that the form should be the version for that year (i.e., reporting a missed rmd for the tax year 2022 should be done on a 2022 form 5329). Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Web 12 — other — see form 5329 instructions. Web what is irs form 5329? Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website.

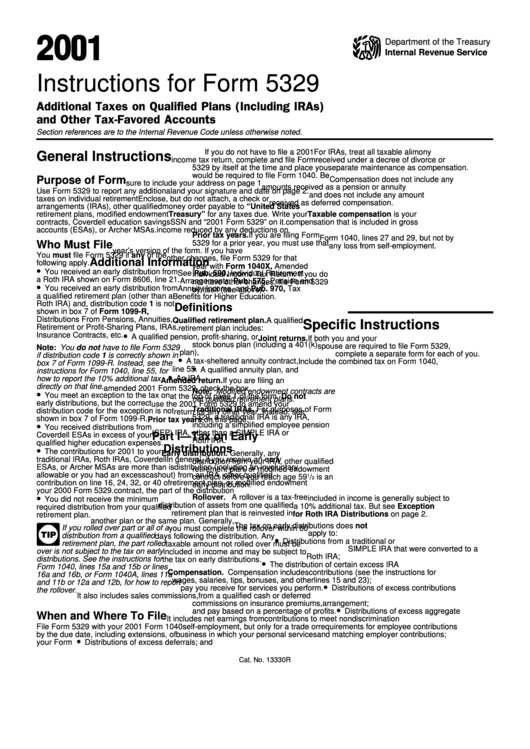

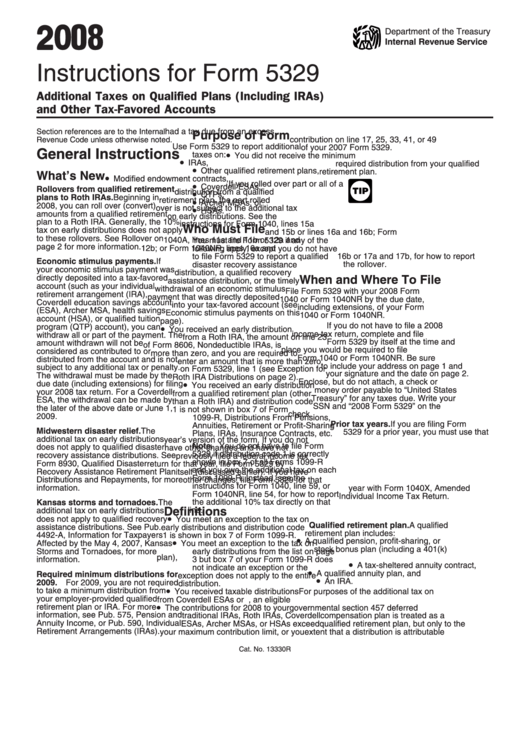

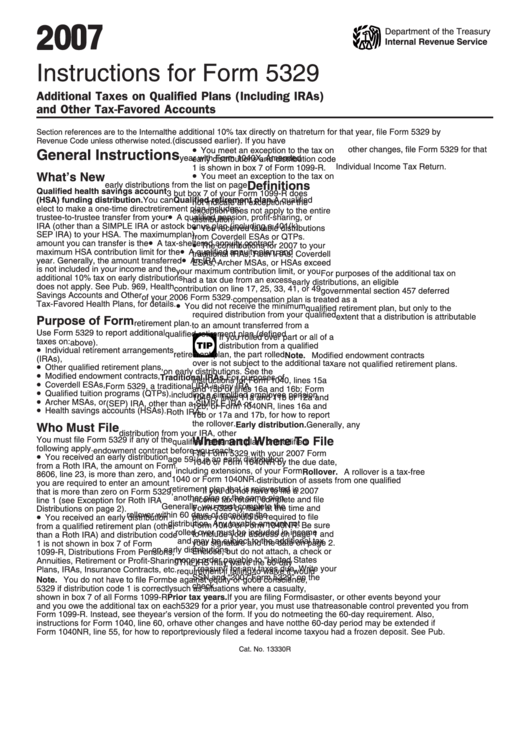

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web note that the form should be the version for that year (i.e., reporting a missed rmd for the tax year 2022 should be done on a 2022 form 5329). Use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or. The following steps are from the 2022 form.

Form 5329 Instructions & Exception Information for IRS Form 5329

Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Want more help with form 5329? Individual retirement accounts (iras) roth iras Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. The following steps are from.

Instructions For Form 5329 Additional Taxes On Qualified Plans

Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. The following steps are from the 2022 form 5329: Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Go to www.irs.gov/form5329 for instructions and the latest.

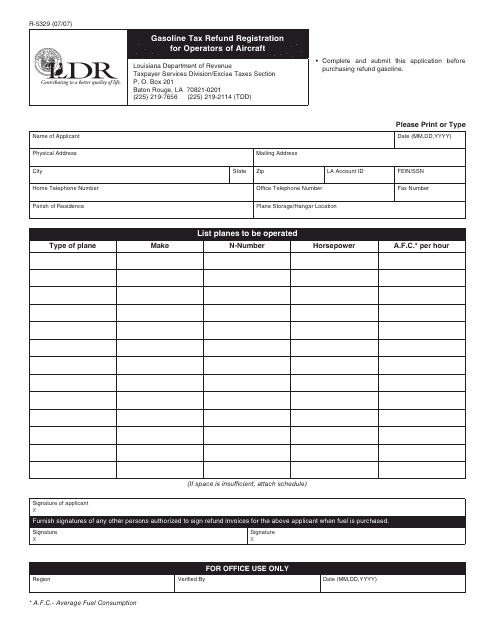

Form R5329 Download Printable PDF or Fill Online Gasoline Tax Refund

Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Web form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Individual retirement accounts (iras) roth iras Want more help with form.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Want more help with form 5329? Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Form 5329 must accompany a taxpayer's annual tax return. The following.

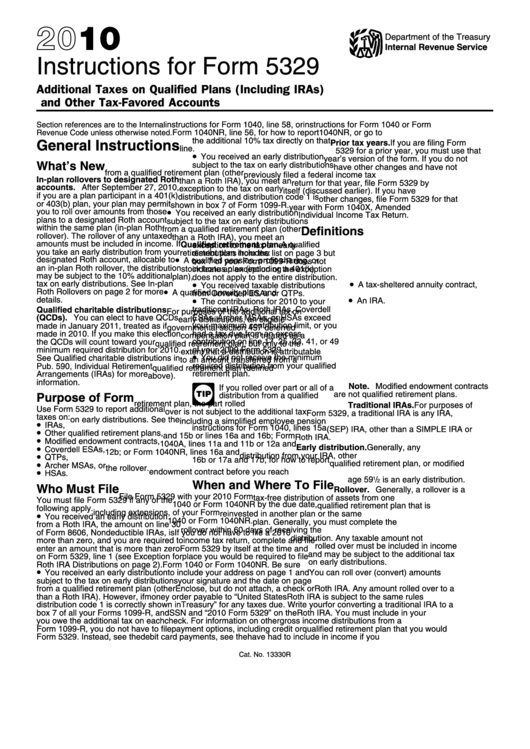

Instructions For Form 5329 2010 printable pdf download

Web what is irs form 5329? Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Individual retirement accounts (iras) roth iras Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own.

Instructions for How to Fill in IRS Form 5329

Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Go to www.irs.gov/form5329 for instructions and the latest information. Web note that the form should be the version.

IRS Form 5329 Instructions How To File Retirement Plan Tax Form IRS

To view form 5329 instructions, visit irs.gov. Web what is irs form 5329? Once you have the proper form, fill in your personal details including your name, address, and social security number. Want more help with form 5329? Also, use this code if more than one exception applies.

Form 5329 Instructions & Exception Information for IRS Form 5329

The irs website contains downloadable versions of form 5329 going back to 1975. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Go to www.irs.gov/form5329 for instructions and the latest information. Form 5329.

Instructions For Form 5329 Additional Taxes Attributable To Iras

Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Once you have the proper form, fill in your personal details including your name, address, and social security number. Individual retirement accounts (iras) roth iras Also, use this code if more than one exception applies..

Web Form 5329 Is The Tax Form Used To Calculate Possibly Irs Penalties From The Situations Listed Above And Possibly Request A Penalty Waiver.

Also, use this code if more than one exception applies. If you’re looking for more help with tax reporting using form 5329, get the help of h&r block. Want more help with form 5329? Form 5329 must accompany a taxpayer's annual tax return.

The Following Steps Are From The 2022 Form 5329:

Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Web note that the form should be the version for that year (i.e., reporting a missed rmd for the tax year 2022 should be done on a 2022 form 5329). Web common triggers for form 5329 include receiving early distributions and making excess contributions to qualified retirement accounts. Web what is irs form 5329?

Go To Www.irs.gov/Form5329 For Instructions And The Latest Information.

Use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or. Once you have the proper form, fill in your personal details including your name, address, and social security number. Web 12 — other — see form 5329 instructions. Individual retirement accounts (iras) roth iras

The Irs Website Contains Downloadable Versions Of Form 5329 Going Back To 1975.

To view form 5329 instructions, visit irs.gov. Web form 5329 instructions get tax form 5329 from a government agency, a tax preparation service, or you can download it from the irs website. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond.