Form 5471 2021

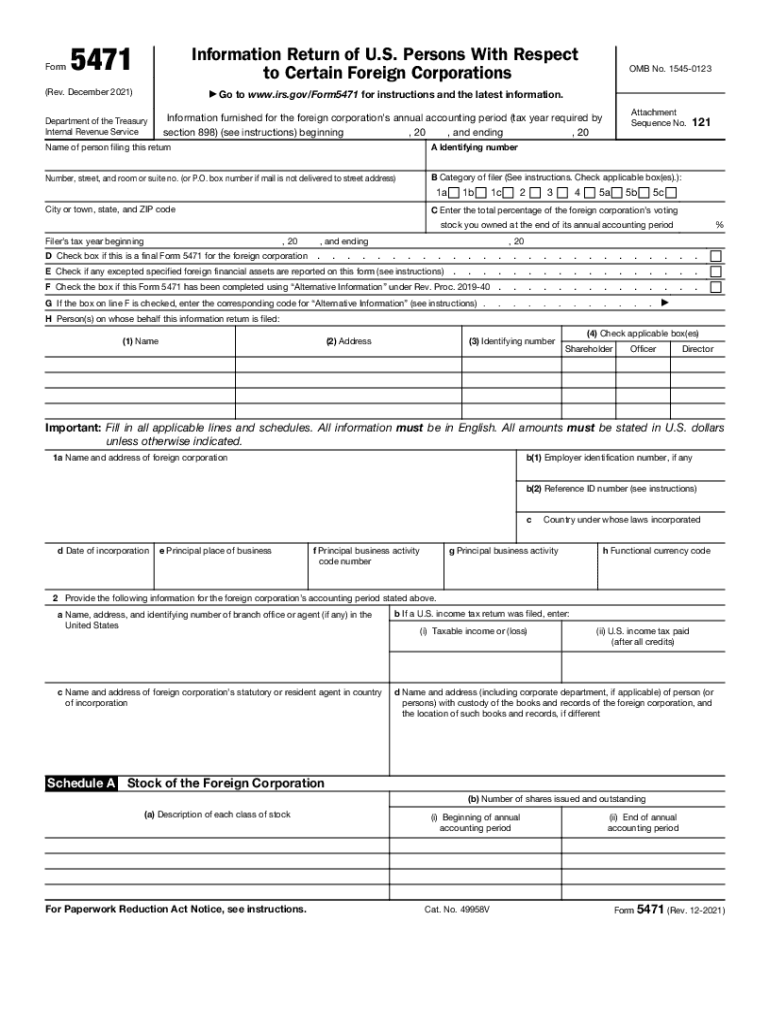

Form 5471 2021 - Also, form 5471 can be filed by u.s. Web information about form 5471, information return of u.s. Persons with respect to certain foreign corporations; Shareholders file form 5471 to satisfy reporting requirements under 6038, 6046, and 965. However, in the case of schedule e (form 5471) filers, Persons with respect to certain foreign corporations. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Form 5471 filers generally use the same category of filer codes used on form 1118. For instructions and the latest information. Form 5471 filers generally use the same

Persons with respect to certain foreign corporations; Form 5471 filers generally use the same category of filer codes used on form 1118. Also, form 5471 can be filed by u.s. Further, in the case of the form 5471 multiple filer exception, the partnership or s. Web for the first year that form 5471 is filed after an entity classification election is made on behalf of the foreign corporation on form 8832, the new ein must be entered on line 1b(1) of form 5471 and the old reference id number must be entered on line 1b(2). Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Web it is the primary form for collection of information about foreign corporations with substantial u.s. Shareholders file form 5471 to satisfy reporting requirements under 6038, 6046, and 965. For instructions and the latest information.

Click + next to the federal forms manila folder (if it is not already expanded), then click + next to the forms and schedules manila folder (if it is not already expanded). Web it is the primary form for collection of information about foreign corporations with substantial u.s. Web information about form 5471, information return of u.s. December 2022) department of the treasury internal revenue service. Also, form 5471 can be filed by u.s. Persons with respect to certain foreign corporations; Web for the first year that form 5471 is filed after an entity classification election is made on behalf of the foreign corporation on form 8832, the new ein must be entered on line 1b(1) of form 5471 and the old reference id number must be entered on line 1b(2). With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Form 5471 filers generally use the same category of filer codes used on form 1118. Shareholders file form 5471 to satisfy reporting requirements under 6038, 6046, and 965.

Demystifying the 2021 IRS Form 5471 Schedule J SF Tax Counsel

Click + next to the federal forms manila folder (if it is not already expanded), then click + next to the forms and schedules manila folder (if it is not already expanded). Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Use the december 2019 revision..

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Use the december 2019 revision. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Form 5471 filers generally use the same category of filer codes used on form 1118. Person has control of a foreign corporation if at any time during that person's tax year, it owns more than 50% of the.

2021 Schedule I1 for IRS Form 5471 SF Tax Counsel

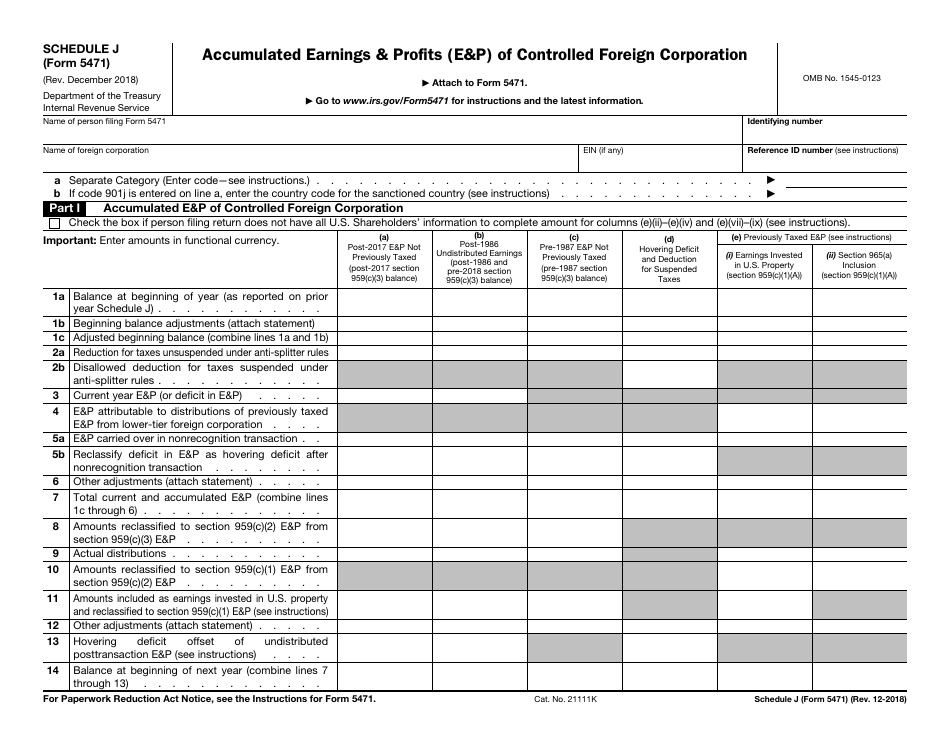

Further, in the case of the form 5471 multiple filer exception, the partnership or s. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Changes to separate schedule j (form 5471). Persons with respect to certain foreign corporations; Persons.

A Deep Dive into the 2021 IRS Form 5471 Schedule J SF Tax Counsel

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Use the december 2019 revision. Changes to separate schedule j (form 5471). Web for the first year that form 5471 is filed after an entity classification election is made on behalf of the foreign corporation on form 8832, the new ein must.

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

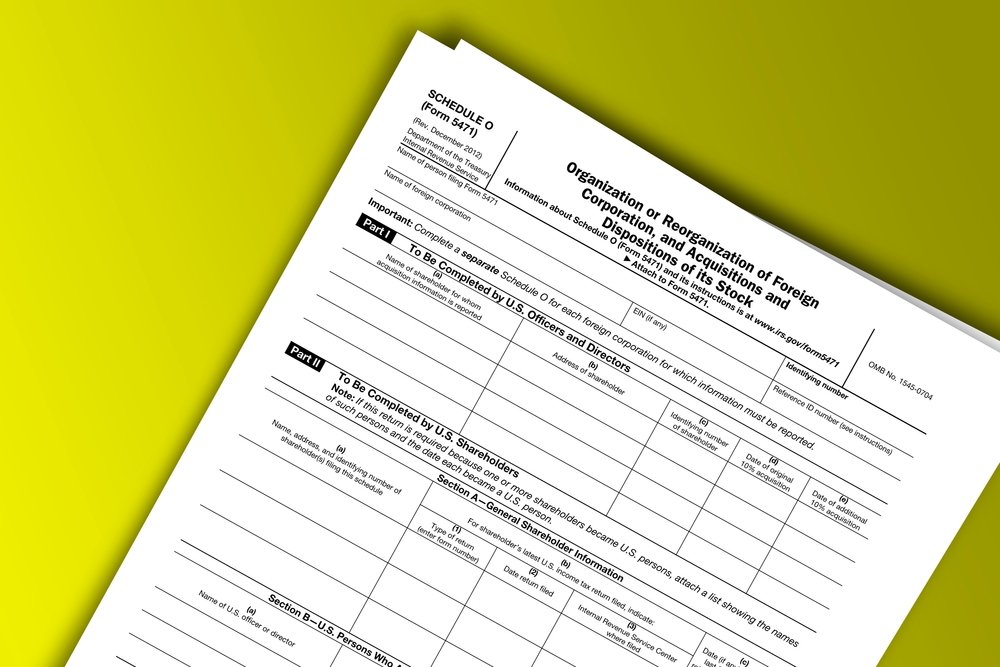

December 2022) department of the treasury internal revenue service. Person has control of a foreign corporation if at any time during that person's tax year, it owns more than 50% of the total combined voting power of all classes of stock of the foreign corporation entitled to vote or more than 50% of total value of shares of all classes.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

December 2022) department of the treasury internal revenue service. Person has control of a foreign corporation if at any time during that person's tax year, it owns more than 50% of the total combined voting power of all classes of stock of the foreign corporation entitled to vote or more than 50% of total value of shares of all classes.

2021 Form IRS 5471 Fill Online, Printable, Fillable, Blank pdfFiller

Information furnished for the foreign corporation’s annual accounting period (tax year required by Shareholders file form 5471 to satisfy reporting requirements under 6038, 6046, and 965. Persons with respect to certain foreign corporations; For instructions and the latest information. Changes to separate schedule j (form 5471).

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Persons with respect to certain foreign corporations; Shareholders file form 5471 to satisfy reporting requirements under 6038, 6046, and 965. Further, in the case of the form 5471 multiple filer exception, the partnership or s. Web it is the primary form for collection of information about foreign corporations with substantial u.s. However, in the case of schedule e (form 5471).

2012 form 5471 instructions Fill out & sign online DocHub

Form 5471 filers generally use the same However, in the case of schedule e (form 5471) filers, File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Web information about form 5471, information return of u.s. For instructions and the latest information.

Demystifying the New 2021 IRS Form 5471 Schedule E and Schedule E1

Online navigation instructions from within your taxact online return, click the tools dropdown, then click forms assistant. Use the december 2019 revision. Person has control of a foreign corporation if at any time during that person's tax year, it owns more than 50% of the total combined voting power of all classes of stock of the foreign corporation entitled to.

Also, Form 5471 Can Be Filed By U.s.

File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Web the internal revenue code imposes penalties for the failure to timely file international information returns on form 5471, information return of u.s. Click + next to the federal forms manila folder (if it is not already expanded), then click + next to the forms and schedules manila folder (if it is not already expanded). However, in the case of schedule e (form 5471) filers,

Information Furnished For The Foreign Corporation’s Annual Accounting Period (Tax Year Required By

Person has control of a foreign corporation if at any time during that person's tax year, it owns more than 50% of the total combined voting power of all classes of stock of the foreign corporation entitled to vote or more than 50% of total value of shares of all classes of stock of the foreign corporation. Changes to separate schedule j (form 5471). Web to complete form 5471 in your taxact program: Form 5471 filers generally use the same

Persons With Respect To Certain Foreign Corporations, Including Recent Updates, Related Forms, And Instructions On How To File.

With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. For instructions and the latest information. Online navigation instructions from within your taxact online return, click the tools dropdown, then click forms assistant. December 2022) department of the treasury internal revenue service.

Form 5471 Filers Generally Use The Same Category Of Filer Codes Used On Form 1118.

Corporation or a foreign corporation engaged in a u.s. Persons with respect to certain foreign corporations; Web information about form 5471, information return of u.s. Persons with respect to certain foreign corporations.