Form 5471 Sch E-1

Form 5471 Sch E-1 - There are different parts to the form,. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. The form 5471 schedules are: December 2021) department of the treasury internal revenue service. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. Web schedule e (form 5471) (rev. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Complete a separate form 5471 and all applicable schedules for each applicable foreign. December 2021) department of the treasury internal revenue service. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation.

Web this is the 9th video in a series which covers the preparation of irs form 5471 for the 2021 tax year. December 2022) department of the treasury internal revenue service. December 2020) department of the treasury internal revenue service. Complete a separate form 5471 and all applicable schedules for each applicable foreign. Web schedule q (form 5471) (rev. Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. Again, brian and riaz will talk. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Persons with respect to certain foreign corporations. December 2021) department of the treasury internal revenue service.

Web schedule e (form 5471) (rev. December 2021) department of the treasury internal revenue service. Web schedule q (form 5471) (rev. Again, brian and riaz will talk. The form 5471 schedules are: Complete a separate form 5471 and all applicable schedules for each applicable foreign. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation. December 2020) department of the treasury internal revenue service. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. December 2021) department of the treasury internal revenue service.

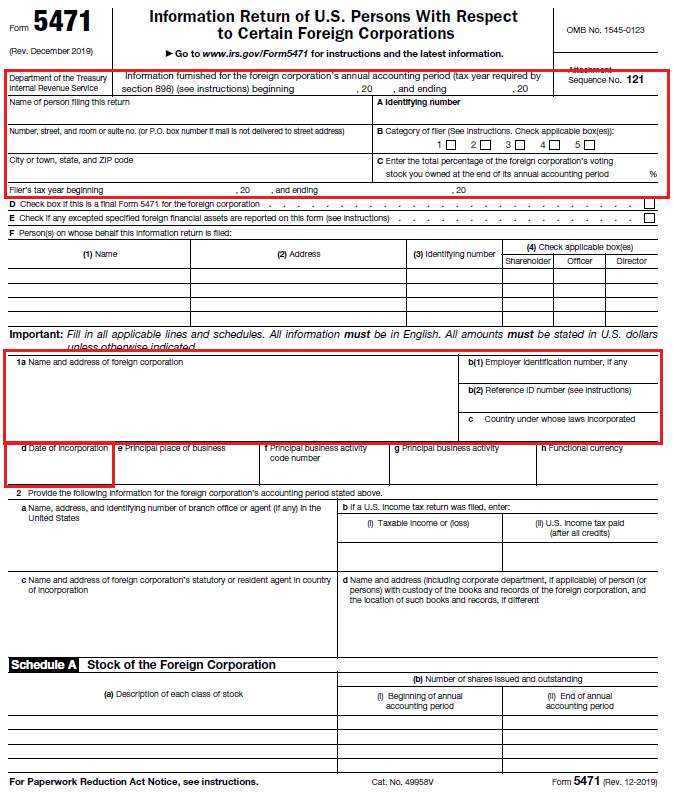

IRS Form 5471 Carries Heavy Penalties and Consequences

Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. Web within form 5471 are 12 schedules you may or may not need to fill out. Report all amounts in u.s. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Persons with respect to certain foreign corporations. Again, brian and riaz will talk. The form 5471 schedules are: There are different parts to the form,. December 2021) department of the treasury internal revenue service.

What is a Dormant Foreign Corporation?

Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. December 2020) department of the treasury internal revenue service. The form 5471 schedules are: December 2022) cfc income by cfc income groups department of.

Form 5471, Page 1 YouTube

Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. December 2021) department of the treasury internal revenue service. Income, war profits, and excess profits taxes paid or accrued. Again, brian and riaz will talk. Report all amounts in u.s.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Web within form 5471 are 12 schedules you may or may not need to fill out. Web changes to separate schedule e (form 5471). Income, war profits, and excess profits taxes paid or accrued. December 2021) department of the treasury internal revenue service. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Again, brian and riaz will talk. The form 5471 schedules are: December 2022) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. Complete a separate form 5471 and all applicable schedules for each applicable foreign corporation. December 2021) department of the treasury internal revenue service.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Web within form 5471 are 12 schedules you may or may not need to fill out. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Web changes to separate schedule e (form 5471)..

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web changes to separate schedule e (form 5471). Web this is the 9th video in a series which covers the preparation of irs form 5471 for the 2021 tax year. December 2021) department of the treasury internal revenue service. Web within form 5471 are 12 schedules you may or may not need to fill out. Web schedule e of form.

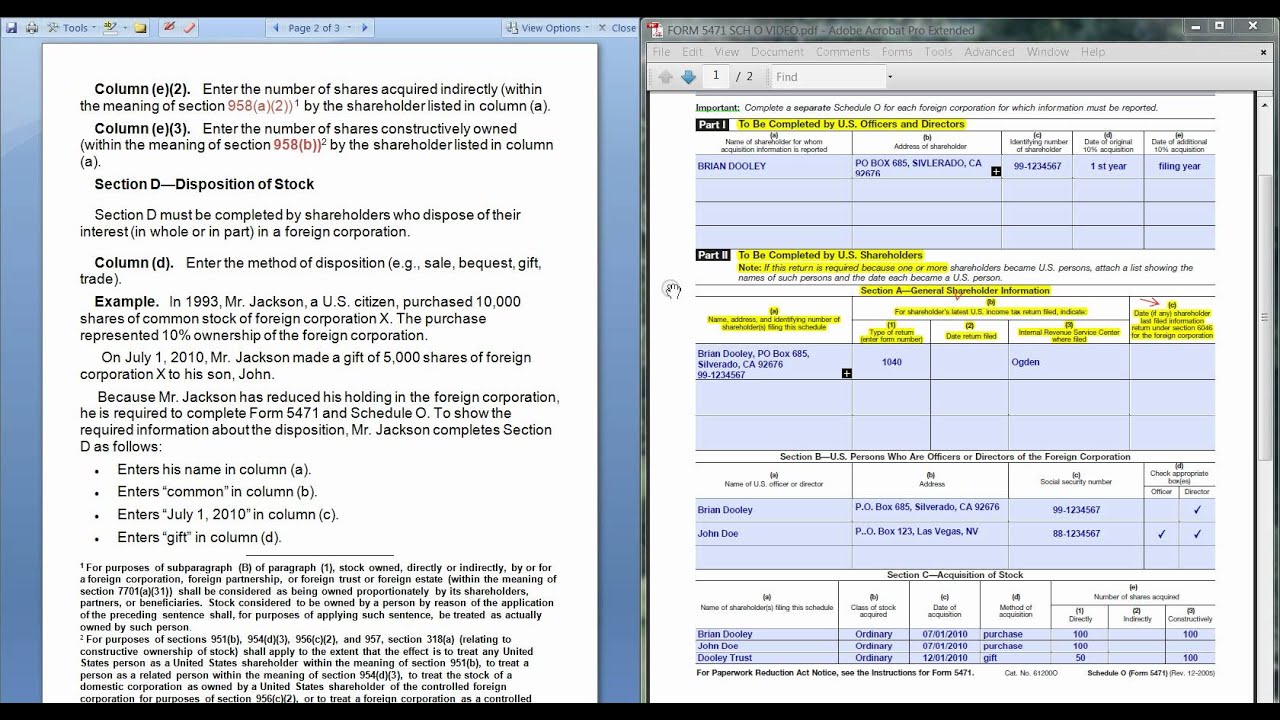

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. December 2021) department of the treasury internal revenue service. Persons with respect to certain foreign corporations. Web schedule e (form 5471) (rev. Report all.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

December 2022) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. Persons with respect to certain foreign corporations. Web schedule e (form 5471) (rev. December 2020) department of the treasury internal revenue service. Complete a separate form 5471 and all applicable schedules for each applicable foreign.

Web This Is The 9Th Video In A Series Which Covers The Preparation Of Irs Form 5471 For The 2021 Tax Year.

Again, brian and riaz will talk. Persons with respect to certain foreign corporations. Web within form 5471 are 12 schedules you may or may not need to fill out. December 2021) department of the treasury internal revenue service.

December 2022) Cfc Income By Cfc Income Groups Department Of The Treasury Internal Revenue Service Attach To Form 5471.

December 2022) department of the treasury internal revenue service. Web schedule e (form 5471) (rev. Income, war profits, and excess profits taxes paid or accrued. December 2021) department of the treasury internal revenue service.

The Form 5471 Schedules Are:

Web schedule q (form 5471) (rev. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. There are different parts to the form,. Complete a separate form 5471 and all applicable schedules for each applicable foreign.

Web Schedule E Of Form 5471 Is Used To Report Taxes Paid Or Accrued By A Foreign Corporation For Which A Foreign Tax Credit Is Allowed And Taxes For Which A Credit May Not Be Taken.

Persons with respect to certain foreign corporations. Web the primary purpose of schedule e is to claim foreign tax credits paid by a foreign corporation involving subpart f inclusions. December 2020) department of the treasury internal revenue service. Report all amounts in u.s.