Form 5472 Filing Requirements

Form 5472 Filing Requirements - Web dec 11, 2018 general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Corporations file form 5472 to provide information required. Web form 5472 requires that the name and identifying information of two types of owners be listed: Web irs form 5472 is a required informational return for any u.s. Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. Web both types of ownership are subject to reporting requirements. Corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in the u.s. The top 10 questions from llc owners.

Web both types of ownership are subject to reporting requirements. Web form 5472 explained: The top 10 questions from llc owners. Corporation with 25% direct or indirect foreign ownership and with reportable transactions with a foreign or domestic. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Web a form 5472 required under this section must be filed with the reporting corporation's income tax return for the taxable year by the due date (including. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web irs form 5472 is a required informational return for any u.s. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web we will summarize the basic requirements of form 5472, and who may be required to file the form.

2 the filing requirement extends to disregarded entities as. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web we will summarize the basic requirements of form 5472, and who may be required to file the form. Corporation with 25% direct or indirect foreign ownership and with reportable transactions with a foreign or domestic. After the tax cuts and jobs act of 2017, the changes to the tax law made. Company with a foreign owner or a foreign shareholder. Web dec 11, 2018 general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the. But the difference can determine how and what is reported. Web form 5472 is required 1 when a foreign person owns at least 25% of the stock of a u.s. Corporations file form 5472 to provide information required.

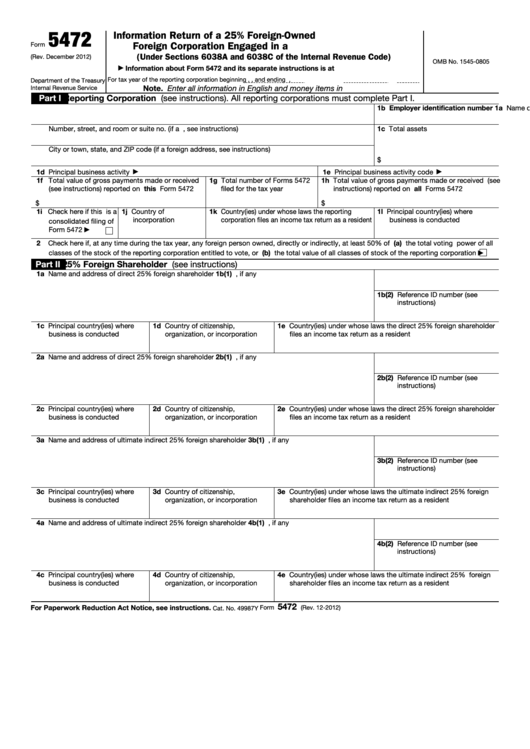

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

Web dec 11, 2018 general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the. Company with a foreign owner or a foreign shareholder. Web irs form 5472 is a required informational return for any u.s. Web a form 5472 required under this section must be filed with.

IRS Form 5472 Foreign Stakeholder Requirements GreenGrowth CPAs

Web form 5472 is the information return of a u.s. Are required to file irs form. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web we will summarize the basic requirements of form 5472, and who may be required to file the form. Web irs form.

The Basics Of Filing Form 5472 PSWNY

2 the filing requirement extends to disregarded entities as. Web dec 11, 2018 general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the. Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. The top.

form 5472 instructions 2018 Fill Online, Printable, Fillable Blank

Web a form 5472 required under this section must be filed with the reporting corporation's income tax return for the taxable year by the due date (including. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. 2 the filing requirement extends to disregarded entities as. Web form.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

After the tax cuts and jobs act of 2017, the changes to the tax law made. Corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in the u.s. Are required to file irs form. Web who has to file? Web irs form 5472 is a required informational return for any u.s.

New Form 5472 Filing Requirements

Web who has to file? Purpose of form 5472 the purpose of international reporting, in general, is. Web form 5472 explained: Web irs form 5472 is a required informational return for any u.s. Corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in the u.s.

Form 5472 Information Return of Corporation Engaged in U.S. Trade

Web form 5472 requires that the name and identifying information of two types of owners be listed: Web who has to file? 2 the filing requirement extends to disregarded entities as. Web both types of ownership are subject to reporting requirements. Web irs form 5472 is a required informational return for any u.s.

Should You File a Form 5471 or Form 5472? Asena Advisors

Corporation with 25% direct or indirect foreign ownership and with reportable transactions with a foreign or domestic. Web dec 11, 2018 general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the. Company with a foreign owner or a foreign shareholder. Web form 5472 is the information return.

Form 5472 2022 IRS Forms

Corporations file form 5472 to provide information required. Are required to file irs form. Corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in the u.s. Web irs form 5472 is a required informational return for any u.s. Web we will summarize the basic requirements of form 5472, and who may be required to.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Company with a foreign owner or a foreign shareholder. But the difference can determine how and what is reported. Web form 5472 is required 1 when a foreign person owns at least 25% of the stock of a u.s. 2 the filing requirement extends to disregarded entities as. Are required to file irs form.

Corporation With 25% Or More Foreign Ownership, Or Foreign Corporations That Do Business Or Trade In The U.s.

Web irs form 5472 is a required informational return for any u.s. Web form 5472 explained: Web generally, a reporting corporation must file form 5472 if it had a reportable transaction with a foreign or domestic related party. Web form 5472 is required 1 when a foreign person owns at least 25% of the stock of a u.s.

But The Difference Can Determine How And What Is Reported.

Web a form 5472 required under this section must be filed with the reporting corporation's income tax return for the taxable year by the due date (including. Any shareholder who owns 25% or more directly; Corporation with 25% direct or indirect foreign ownership and with reportable transactions with a foreign or domestic. Corporations file form 5472 to provide information required.

Web Both Types Of Ownership Are Subject To Reporting Requirements.

Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web form 5472 requires that the name and identifying information of two types of owners be listed: Web dec 11, 2018 general instructions purpose of form use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the. Web we will summarize the basic requirements of form 5472, and who may be required to file the form.

Company With A Foreign Owner Or A Foreign Shareholder.

After the tax cuts and jobs act of 2017, the changes to the tax law made. Purpose of form 5472 the purpose of international reporting, in general, is. Are required to file irs form. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-1024x1024.jpg)