Form 5472 Instruction

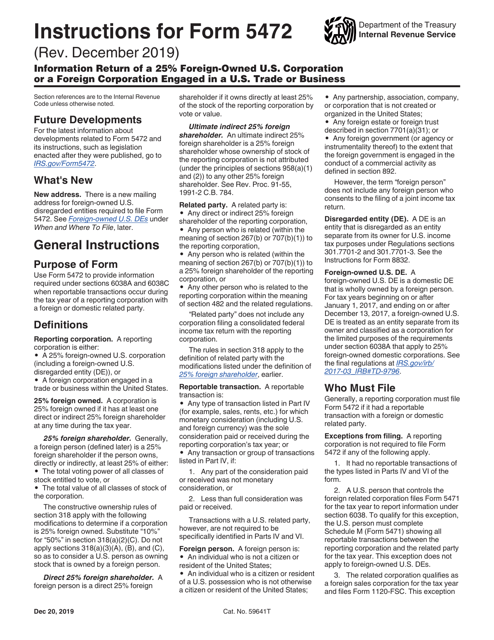

Form 5472 Instruction - Web we will summarize the basic requirements of form 5472, and who may be required to file the form. We ask for the information on this form to carry out the internal revenue laws of the united states. Web reported on this form 5472. Web introductionwho must filehow and when to fileobtaining us employer identification numberinformation to be reportedrecord maintenance. Web form 5472 instructions are available from the irs. Affiliated group are reporting corporations under section. As a starting point, you need to know whether or not you have a duty to submit form 5472 at all. But, the information provided can still be rather confusing. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the.

Just like any other company, the owner. The instructions for form 5472 provide detailed information on how to register for and use. Purpose of form 5472 the purpose of international reporting, in general, is so. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web the form 5472 can be difficult to interpret given the continued references to corporation. Corporations file form 5472 to provide information. We ask for the information on this form to carry out the internal revenue laws of the united states. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Web we will summarize the basic requirements of form 5472, and who may be required to file the form. Web form 5472 explained:

Web irs form 5472: The common parent must attach to form 5472 a schedule stating which members of the u.s. We ask for the information on this form to carry out the internal revenue laws of the united states. The instructions to the form should be consulted in conjunction with completing the. Web information about form 5472, including recent updates, related forms, and instructions on how to file. But, the information provided can still be rather confusing. Just like any other company, the owner. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web the form 5472 can be difficult to interpret given the continued references to corporation. Web we will summarize the basic requirements of form 5472, and who may be required to file the form.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

May 17, 2022 | llc. The instructions to the form should be consulted in conjunction with completing the. Just like any other company, the owner. Web introductionwho must filehow and when to fileobtaining us employer identification numberinformation to be reportedrecord maintenance. Web form 5472 explained:

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

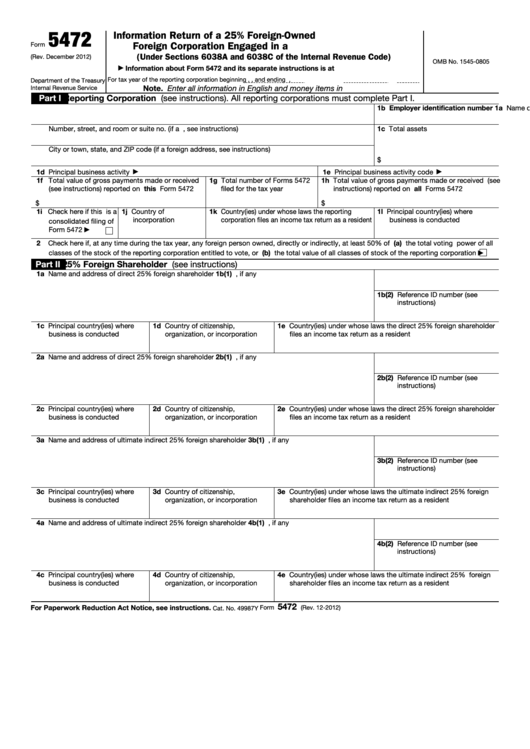

But, the information provided can still be rather confusing. Web the form 5472 can be difficult to interpret given the continued references to corporation. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. $ 1g total number of forms 5472 filed for the tax.

IRS Form 5472 Freeman Law

The instructions to the form should be consulted in conjunction with completing the. Web we will summarize the basic requirements of form 5472, and who may be required to file the form. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. So in this free guide, we’re going to be answering. Web.

Form 5472 Information Return of Corporation Engaged in U.S. Trade

Web irs form 5472: Web form 5472 a schedule stating which members of the u.s. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. $ 1g total number of forms 5472 filed for the tax year 1h total value of gross payments made or.

Form 5472 2022 IRS Forms

Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web form 5472 a schedule stating which members of the u.s. We ask for the information on this form to carry out the internal revenue laws of the united states. May 17, 2022 | llc. Web introductionwho must filehow and when to fileobtaining us.

Download Instructions for IRS Form 5472 Information Return of a 25

The instructions for form 5472 provide detailed information on how to register for and use. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web form 5472 a schedule stating which members of the u.s. Web reported on this form 5472. Web form 5472 instructions are available from the irs.

form 5472 instructions 2018 Fill Online, Printable, Fillable Blank

The instructions for form 5472 provide detailed information on how to register for and use. Web form 5472 explained: So in this free guide, we’re going to be answering. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Web we will summarize the basic.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web form 5472 explained: Web form 5472 instructions are available from the irs. Get an employer identification number (ein) in order to file form 5472, you have to apply for a u.s employer identification number, or ein. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over.

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

We ask for the information on this form to carry out the internal revenue laws of the united states. Web anyone completing a form 5472 must understand the importance of this form and the fact that the irs often uses the form 5472 as a starting point for conducting a transfer. But, the information provided can still be rather confusing..

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Purpose of form 5472 the purpose of international reporting, in general, is so. Affiliated group are reporting corporations under section. Web information about form 5472, including recent updates, related forms, and instructions on how to file. The common parent must attach to form 5472 a schedule stating which members of the u.s. Get an employer identification number (ein) in order.

Web We Will Summarize The Basic Requirements Of Form 5472, And Who May Be Required To File The Form.

Web form 5472 a schedule stating which members of the u.s. Web information about form 5472, including recent updates, related forms, and instructions on how to file. But, the information provided can still be rather confusing. Web irs form 5472:

Affiliated Group Are Reporting Corporations Under Section.

We ask for the information on this form to carry out the internal revenue laws of the united states. So in this free guide, we’re going to be answering. As a starting point, you need to know whether or not you have a duty to submit form 5472 at all. Get an employer identification number (ein) in order to file form 5472, you have to apply for a u.s employer identification number, or ein.

Affiliated Group Are Reporting Corporations Under Section 6038A, And Which Of Those Members Are Joining In The.

Purpose of form 5472 the purpose of international reporting, in general, is so. $ 1g total number of forms 5472 filed for the tax year 1h total value of gross payments made or received reported on all forms. Web form 5472 instructions are available from the irs. Web the form 5472 can be difficult to interpret given the continued references to corporation.

Web Reported On This Form 5472.

Web form 5472 explained: Web introductionwho must filehow and when to fileobtaining us employer identification numberinformation to be reportedrecord maintenance. The top 10 questions from llc owners. The instructions for form 5472 provide detailed information on how to register for and use.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-1024x1024.jpg)