Form 5558 Instructions

Form 5558 Instructions - Only the plan listed on form 5558 will be processed. All your queries are answered right here! You can find further information about the form 5558 and its instruction at the irs.gov website. The form 5500 version selection tool can help determine exactly which form in. However, if you are a single employer and all your plan years end on the same date, file. Download the 5558 tax form in pdf for free. Web to a form 5558. The normal due date is the date the form Web get irs form 5558 to fill out online or print. Web you can use the irs form 5558 (application for extension of time to file certain employee plan returns) to apply for a one time extension of time to file the form 5500 series.

Follow our detailed instructions to request a time extension for employee plan returns. All your queries are answered right here! The normal due date is the date the form In general, a separate form 5558 is used for each return for which you are requesting an extension. The following exception does not apply to form 5330. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2. You can find further information about the form 5558 and its instruction at the irs.gov website. Web you can use the irs form 5558 (application for extension of time to file certain employee plan returns) to apply for a one time extension of time to file the form 5500 series. Download the 5558 tax form in pdf for free. However, if you are a single employer and all your plan years end on the same date, file.

Only the plan listed on form 5558 will be processed. The form 5500 version selection tool can help determine exactly which form in. Lists attached to the form 5558 will not be processed. Download the 5558 tax form in pdf for free. However, if you are a single employer and all your plan years end on the same date, file. Follow our detailed instructions to request a time extension for employee plan returns. The normal due date is the date the form All your queries are answered right here! Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2. In general, a separate form 5558 is used for each return for which you are requesting an extension.

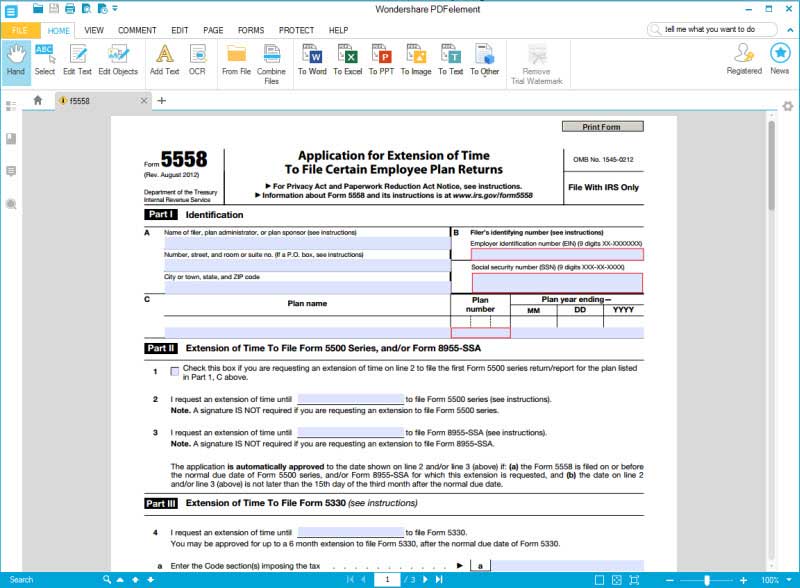

Form 5558 Application for Extension of Time to File Certain Employee

Lists attached to the form 5558 will not be processed. Only the plan listed on form 5558 will be processed. Web get irs form 5558 to fill out online or print. The form 5500 version selection tool can help determine exactly which form in. The normal due date is the date the form

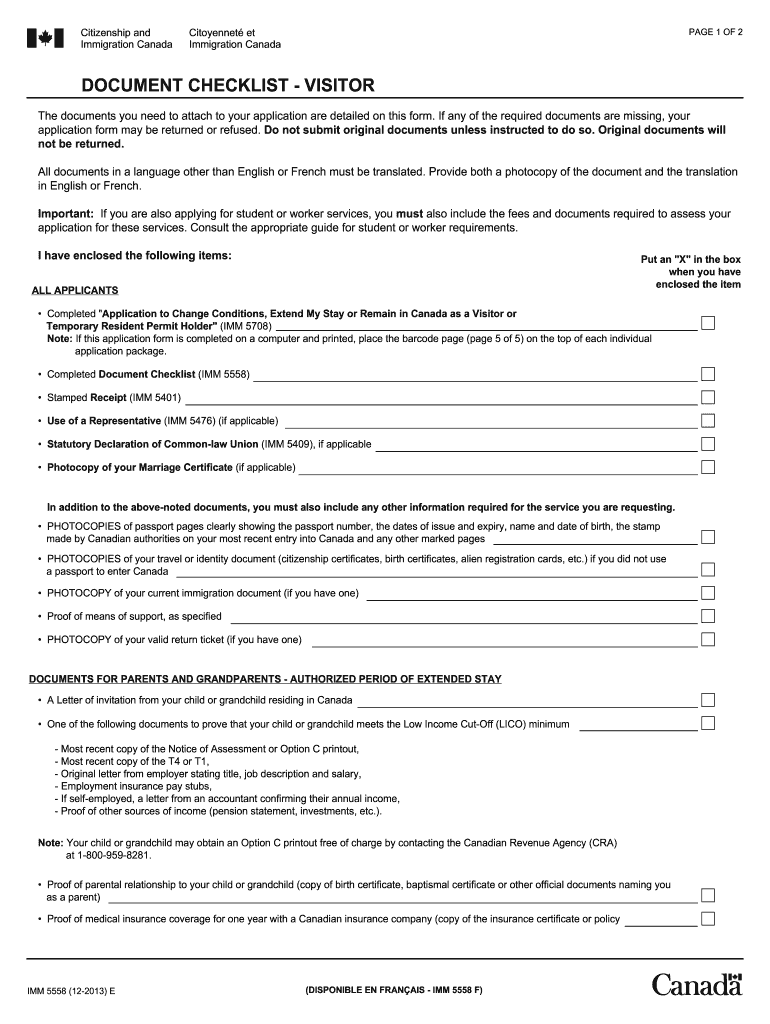

Imm5558 Fill Online, Printable, Fillable, Blank pdfFiller

However, if you are a single employer and all your plan years end on the same date, file. The following exception does not apply to form 5330. Web you can use the irs form 5558 (application for extension of time to file certain employee plan returns) to apply for a one time extension of time to file the form 5500.

Form 5558 Application for Extension of Time to File Certain Employee

Lists attached to the form 5558 will not be processed. The form 5500 version selection tool can help determine exactly which form in. Web get irs form 5558 to fill out online or print. Only the plan listed on form 5558 will be processed. The normal due date is the date the form

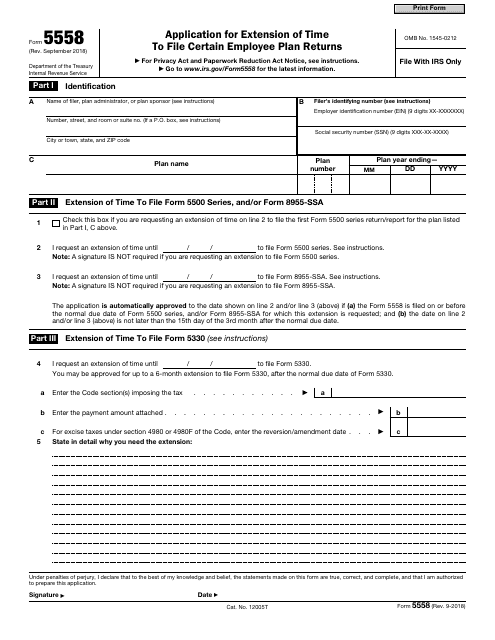

IRS Form 5558 Download Fillable PDF or Fill Online Application for

The normal due date is the date the form You can find further information about the form 5558 and its instruction at the irs.gov website. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2..

FIA Historic Database

The normal due date is the date the form Download the 5558 tax form in pdf for free. You can find further information about the form 5558 and its instruction at the irs.gov website. Lists attached to the form 5558 will not be processed. Web get irs form 5558 to fill out online or print.

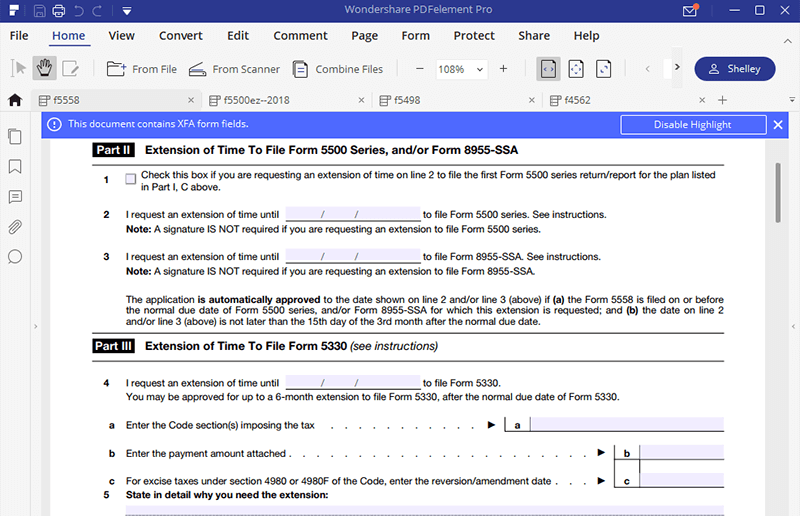

Form 5558 Extension The Complete Guide [Form & IRS Hazards] » Online 5500

The following exception does not apply to form 5330. Web get irs form 5558 to fill out online or print. Follow our detailed instructions to request a time extension for employee plan returns. Download the 5558 tax form in pdf for free. In general, a separate form 5558 is used for each return for which you are requesting an extension.

IRS Form 5558 A Guide to Fill it the Right Way

All your queries are answered right here! Only the plan listed on form 5558 will be processed. You can find further information about the form 5558 and its instruction at the irs.gov website. The form 5500 version selection tool can help determine exactly which form in. Web to a form 5558.

IRS Form 5558 A Guide to Fill it the Right Way

Download the 5558 tax form in pdf for free. Only the plan listed on form 5558 will be processed. Web to a form 5558. Web you can use the irs form 5558 (application for extension of time to file certain employee plan returns) to apply for a one time extension of time to file the form 5500 series. All your.

FIA Historic Database

All your queries are answered right here! In general, a separate form 5558 is used for each return for which you are requesting an extension. Web to a form 5558. The normal due date is the date the form Only the plan listed on form 5558 will be processed.

Web On October 5, 2022 Irs Published Notice And Request For Comments For Proposed Changes To Form 5558, Application For Extension Of Time To File Certain Employee Plan Returns, Allowing For Electronic Filing Through Efast2.

The form 5500 version selection tool can help determine exactly which form in. Web to a form 5558. However, if you are a single employer and all your plan years end on the same date, file. Web you can use the irs form 5558 (application for extension of time to file certain employee plan returns) to apply for a one time extension of time to file the form 5500 series.

The Normal Due Date Is The Date The Form

Web get irs form 5558 to fill out online or print. The following exception does not apply to form 5330. You can find further information about the form 5558 and its instruction at the irs.gov website. In general, a separate form 5558 is used for each return for which you are requesting an extension.

All Your Queries Are Answered Right Here!

Download the 5558 tax form in pdf for free. Follow our detailed instructions to request a time extension for employee plan returns. Only the plan listed on form 5558 will be processed. Lists attached to the form 5558 will not be processed.

![Form 5558 Extension The Complete Guide [Form & IRS Hazards] » Online 5500](https://online5500.com/wp-content/uploads/2022/04/p1-768x512.jpg)