Form 565 Instructions

Form 565 Instructions - Limited partnerships may qualify and make an election. See the instructions for more information. 358, california ending balance sheet. Find the template you need and use advanced editing tools to make it your own. Specific instructions for form 565 13. Web see the instructions for more information. (m m / d d / y. Solved•by intuit•32•updated january 17, 2023. (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than. Name, address, fein, and california sos file.

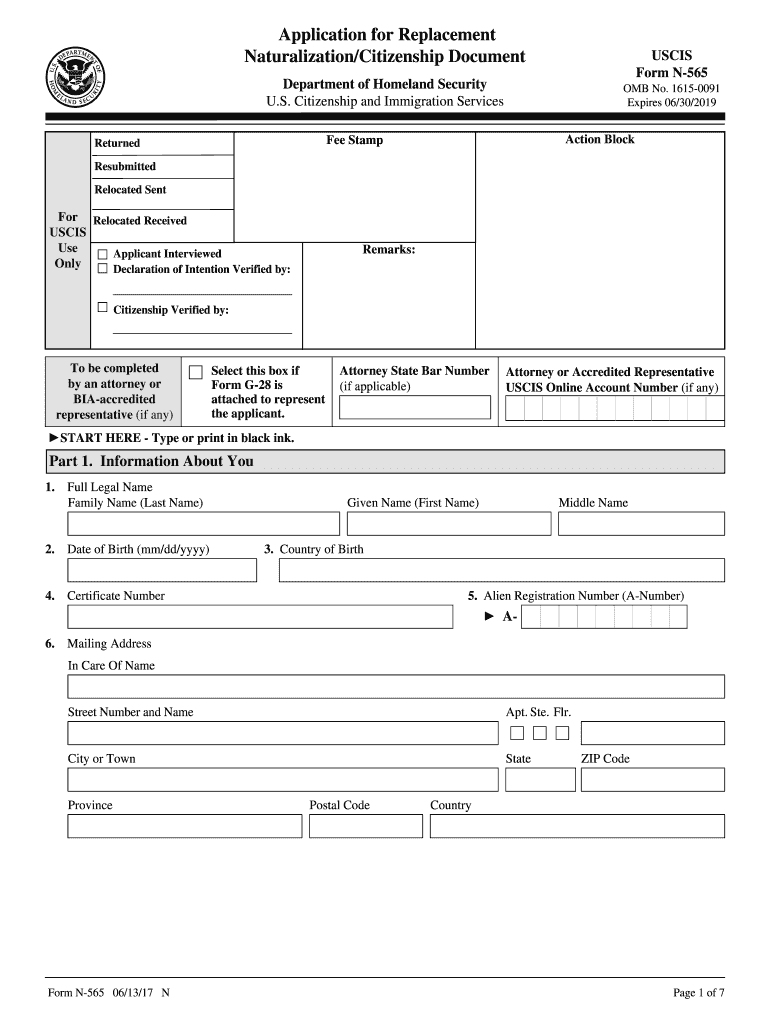

Web print this form more about the california form 565 corporate income tax ty 2022 we last updated the partnership return of income in january 2023, so this is the latest. Enter any items specially allocated to the partners on the applicable line. Specific instructions for form 565 13. Solved•by intuit•32•updated january 17, 2023. Limited partnerships may qualify and make an election. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. 358, california ending balance sheet. Use this form to request a fee waiver (or submit a written request) for certain immigration forms and services based on a. Citizenship and immigration services (uscis) for a. Use this form to apply for a replacement naturalization certificate;.

Ad prepare your citizenship certificate replacement application. Web print this form more about the california form 565 corporate income tax ty 2022 we last updated the partnership return of income in january 2023, so this is the latest. See the instructions for more information. If you prefer to fill. Enter any items specially allocated to the partners on the applicable line. Web see the instructions for more information. Find the template you need and use advanced editing tools to make it your own. Specific instructions for form 565 13. Use this form to request a fee waiver (or submit a written request) for certain immigration forms and services based on a. Use fileright fast & secure online software.

N 565 Fill Out and Sign Printable PDF Template signNow

Web trade or business income and expenses on line 1a through line 22. Name, address, fein, and california sos file. Find the template you need and use advanced editing tools to make it your own. Limited partnerships may qualify and make an election. Web print this form more about the california form 565 corporate income tax ty 2022 we last.

Exquisite Form 565 Bras and Women's Lingerie aBra4Me

Web 2021 partnership return of income. Web print this form more about the california form 565 corporate income tax ty 2022 we last updated the partnership return of income in january 2023, so this is the latest. Use fileright fast & secure online software. Use this form to apply for a replacement naturalization certificate;. Web see the instructions for more.

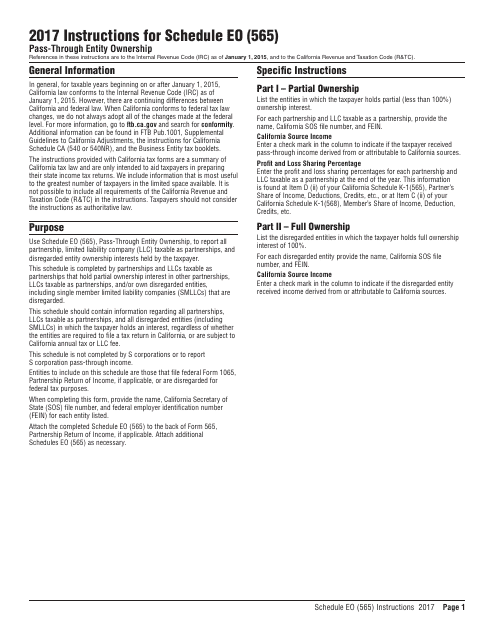

Download Instructions for Form 565 Schedule EO PassThrough Entity

Citizenship and immigration services (uscis) for a. Find the template you need and use advanced editing tools to make it your own. Web see the instructions for more information. 358, california ending balance sheet. Web form 565 fill in all applicable lines and schedules.

Option to Renew/Extend Lease — RPI Form 565 firsttuesday Journal

358, california ending balance sheet. See the instructions for more information. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. If you prefer to fill. Specific instructions for form 565 13.

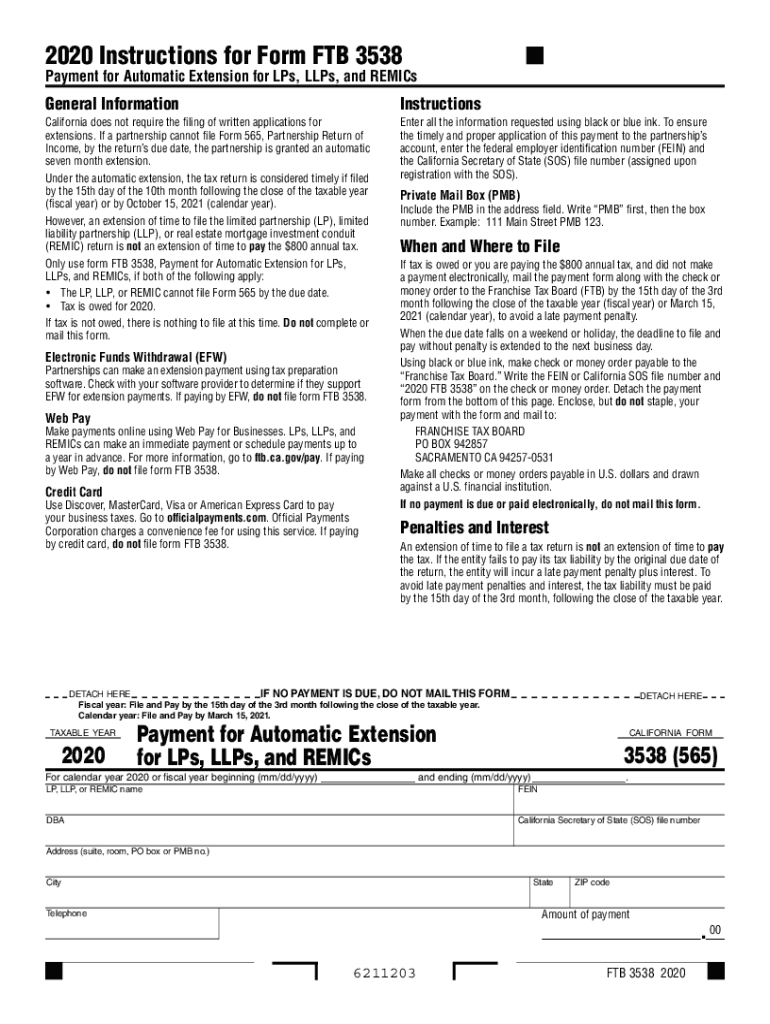

California Form 3538 (565) Payment Voucher For Automatic Extension

Use fileright fast & secure online software. Limited partnerships may qualify and make an election. Web form 565 fill in all applicable lines and schedules. Specific instructions for form 565 13. If you prefer to fill.

2020 Form CA FTB 3538 (565) Fill Online, Printable, Fillable, Blank

Web for more information about investment partnerships, view instructions for form 565. Solved•by intuit•32•updated january 17, 2023. Specific instructions for form 565 13. Enter any items specially allocated to the partners on the applicable line. See the instructions for more information.

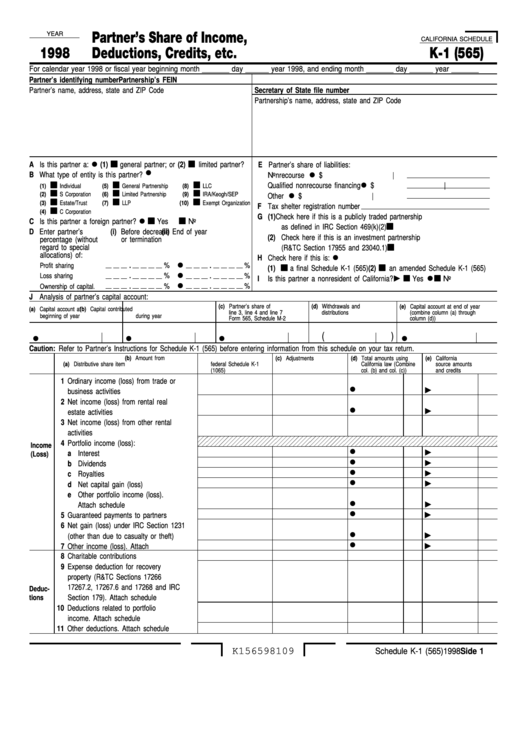

Fillable Form 565 Schedule K1 Partner'S Share Of Deductions

Enter any items specially allocated to the partners on the applicable line. See the instructions for more information. Find the template you need and use advanced editing tools to make it your own. Specific instructions for form 565 13. 358, california ending balance sheet.

Fillable California Form 3538 (565) Payment Voucher For Automatic

Specific instructions for form 565 13. Web 2021 partnership return of income. Ad prepare your citizenship certificate replacement application. Web for more information about investment partnerships, view instructions for form 565. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute.

2011 ca form 565 Fill out & sign online DocHub

Citizenship and immigration services (uscis) for a. Use this form to apply for a replacement naturalization certificate;. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. This article will help you balance the. If you prefer to fill.

Form 565 Download Fillable PDF or Fill Online Credits for Employers in

Web for more information about investment partnerships, view instructions for form 565. Ad prepare your citizenship certificate replacement application. Specific instructions for form 565 13. This article will help you balance the. Use this form to apply for a replacement naturalization certificate;.

Web 2021 Partnership Return Of Income.

Solved•by intuit•32•updated january 17, 2023. Enter any items specially allocated to the partners on the applicable line. Web trade or business income and expenses on line 1a through line 22. Citizenship and immigration services (uscis) for a.

If You Prefer To Fill.

Use fileright fast & secure online software. Ad prepare your citizenship certificate replacement application. Name, address, fein, and california sos file. See the instructions for more information.

Web Form 565 Fill In All Applicable Lines And Schedules.

Find the template you need and use advanced editing tools to make it your own. Web print this form more about the california form 565 corporate income tax ty 2022 we last updated the partnership return of income in january 2023, so this is the latest. Web for more information about investment partnerships, view instructions for form 565. (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than.

Web See The Instructions For More Information.

This article will help you balance the. Limited partnerships may qualify and make an election. 358, california ending balance sheet. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute.