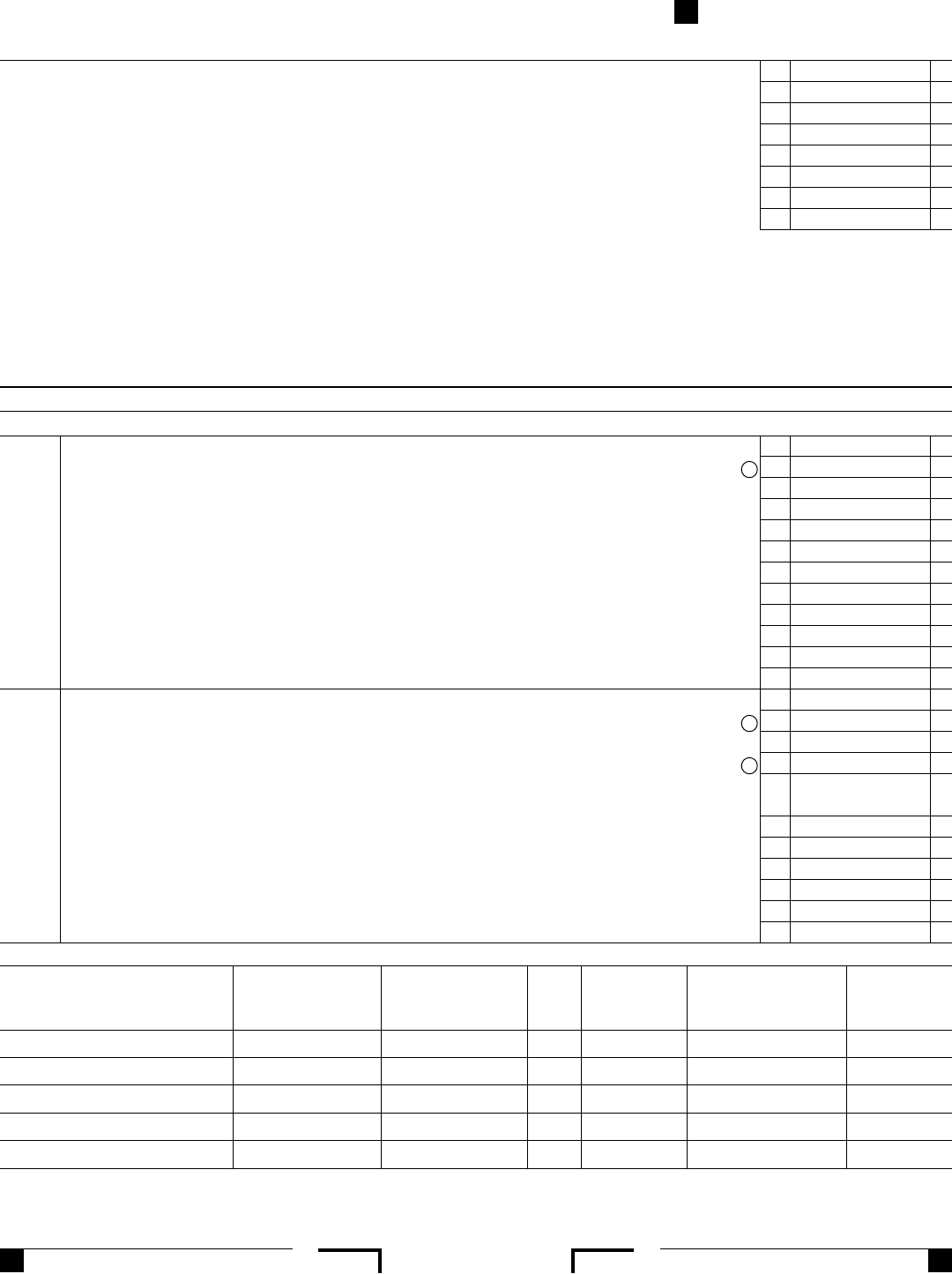

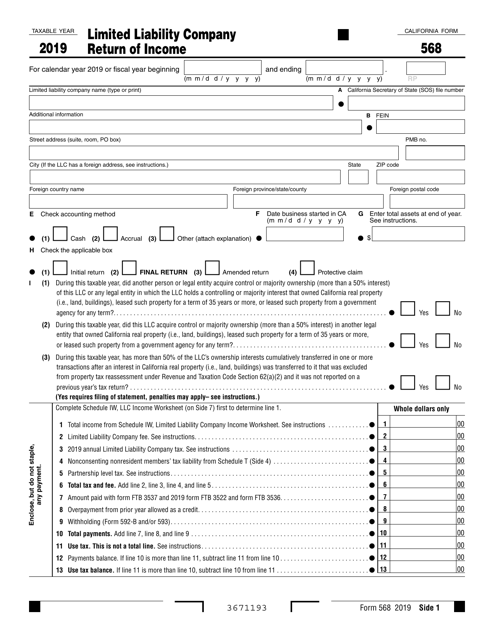

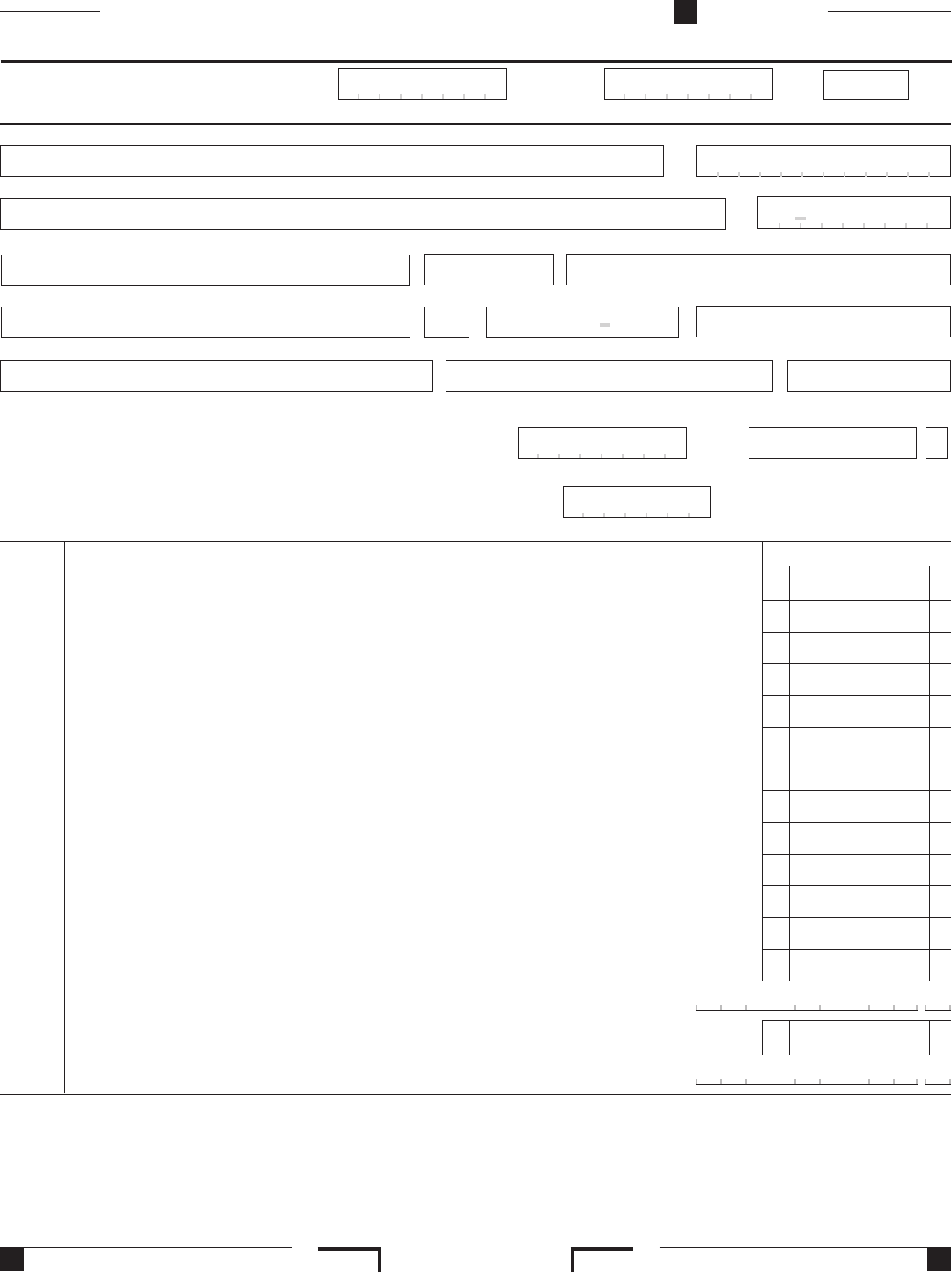

Form 568 Limited Liability Company Return Of Income

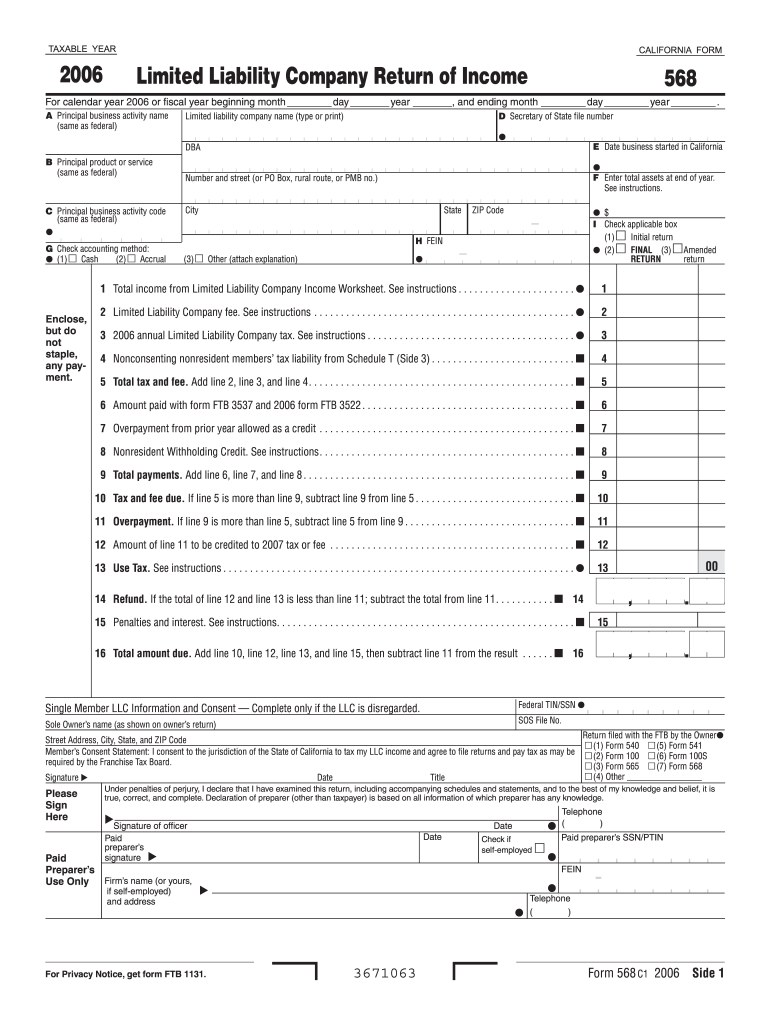

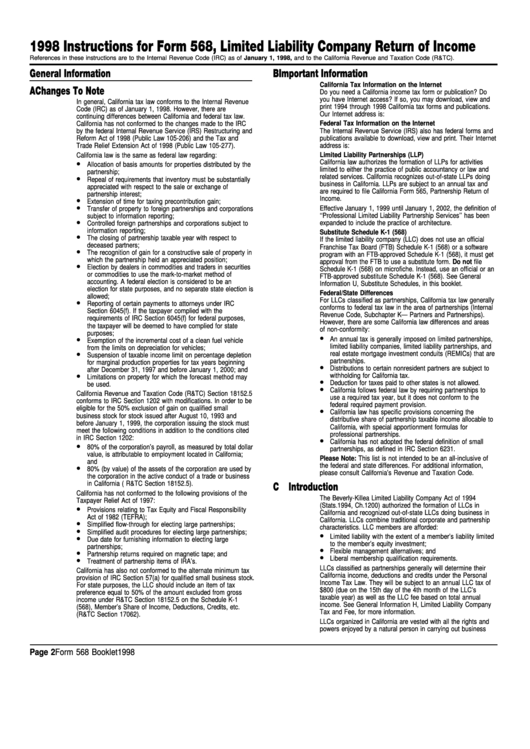

Form 568 Limited Liability Company Return Of Income - Web file limited liability company return of income (form 568) by the original return due date. Web form 568 c12015 side 1. All llcs classified as partnerships or disregarded entities that organize in california, register in california, or conduct. When the tax period started unexpectedly or maybe you just forgot about it, it would probably cause problems for you. It isn't included with the regular ca state partnership formset. Web 2018 limited liability company return of income. Web limited liability companies (llcs) classiied as partnerships ile form 568. Web return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. As the fee owed for 2022 may not be known by the 15th day of the 6th month of the. Web per the ca website limited liability company (llc):

Web per the ca website limited liability company (llc): Web 2016 limited liability company return of income. Web 2018 limited liability company return of income. Line 1—total income from schedule iw. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Llcs may be classiied for tax purposes as a partnership, a corporation, or a disregarded entity. It isn't included with the regular ca state partnership formset. If your llc files on an extension, refer to payment for automatic extension for. Web if you have an llc, here’s how to fill in the california form 568: For calendar year 2016 or fiscal year beginning and ending.

Web limited liability company return of income, side 1, line 2, limited liability company fee. Web 2016 limited liability company return of income. Web ftb 568, limited liability company return of income. Web file limited liability company return of income (form 568) by the original return due date. Web if you have an llc, here’s how to fill in the california form 568: Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. For calendar year 2015 or scal year. Web support completing form 568, limited liability company return of income: 2017 limited liability company return of income. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. 2017 limited liability company return of income. Web if you have an llc, here’s how to fill in the california form 568: Web 2022 form 568 limited liability company return of income 2021.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

For calendar year 2017 or fiscal year beginning and ending. Web ftb 568, limited liability company return of income. When the tax period started unexpectedly or maybe you just forgot about it, it would probably cause problems for you. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568,.

Company Return Instructions 2017

Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Web california form 568 for limited liability company return of income is a separate state formset. Web limited liability companies (llcs) classiied as partnerships ile form 568. For calendar year 2016.

Form 568 Limited Liability Company Return of Fill Out and Sign

Web support completing form 568, limited liability company return of income: Web 2018 limited liability company return of income. For calendar year 2016 or fiscal year beginning and ending. Llcs may be classiied for tax purposes as a partnership, a corporation, or a disregarded entity. It isn't included with the regular ca state partnership formset.

Form 568 Download Fillable PDF or Fill Online Limited Liability Company

For calendar year 2016 or fiscal year beginning and ending. Line 1—total income from schedule iw. Web we last updated california form 568 in february 2023 from the california franchise tax board. All llcs classified as partnerships or disregarded entities that organize in california, register in california, or conduct. Web per the ca website limited liability company (llc):

Instructions For Form 568 Limited Liability Company Return Of

Web if you have an llc, here’s how to fill in the california form 568: Web limited liability company return of income, side 1, line 2, limited liability company fee. Line 1—total income from schedule iw. As the fee owed for 2022 may not be known by the 15th day of the 6th month of the. Web return of income.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

As the fee owed for 2022 may not be known by the 15th day of the 6th month of the. Web we last updated california form 568 in february 2023 from the california franchise tax board. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. 2015 limited liability company return of income. Web form 568 c12015 side 1. Web file limited liability company return of income (form 568) by the original return due date. Web if you have.

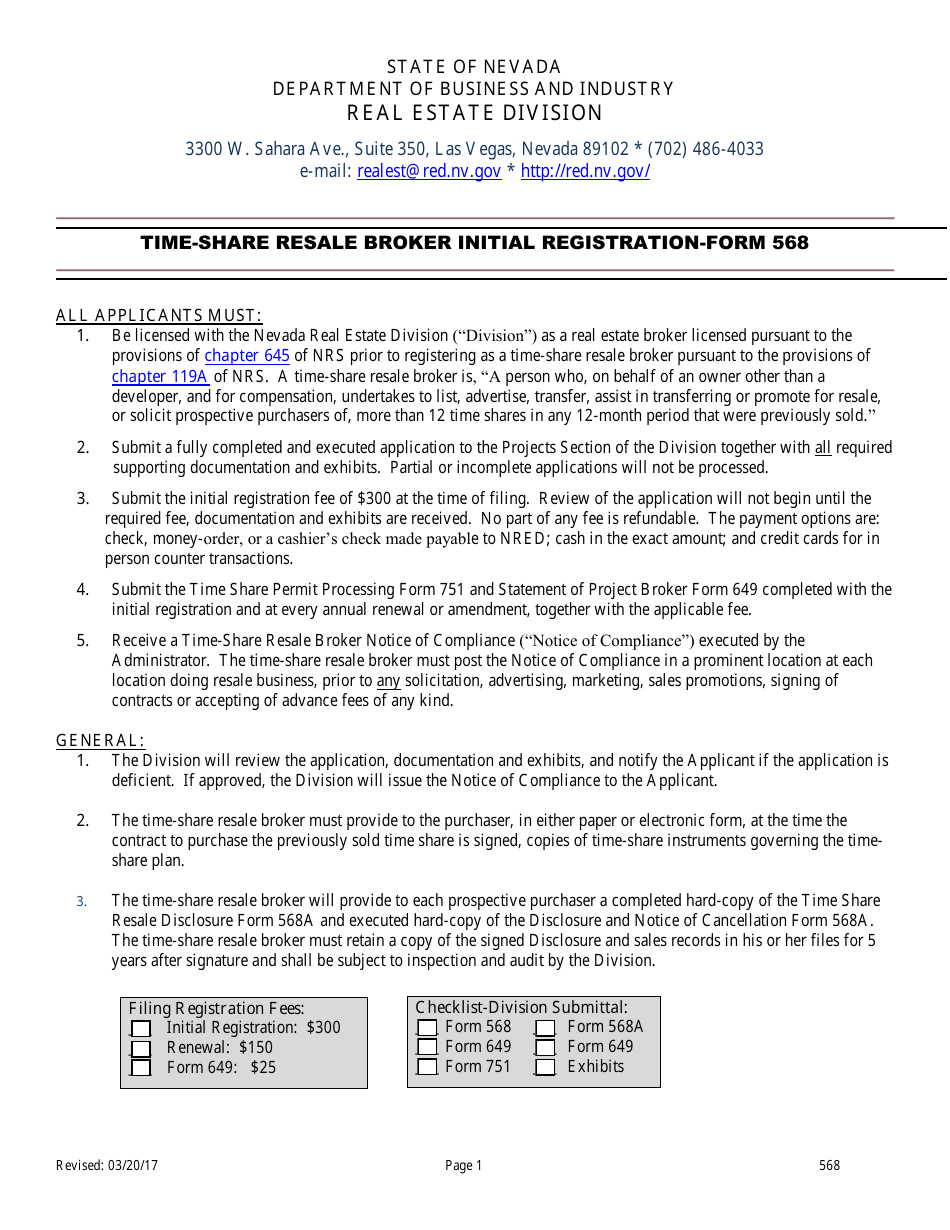

Form 568 Download Fillable PDF or Fill Online TimeShare Resale Broker

For calendar year 2018 or fiscal year beginning and ending. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Line 1—total income from schedule iw. If your llc files on an extension, refer to payment for automatic extension for. As.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Web return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. Web limited liability company return of income, side 1, line 2, limited liability company fee. Web we last updated california form 568 in february 2023 from the california.

Web Follow The Simple Instructions Below:

For calendar year 2017 or fiscal year beginning and ending. When the tax period started unexpectedly or maybe you just forgot about it, it would probably cause problems for you. Web file limited liability company return of income (form 568) by the original return due date. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use.

Web Per The Ca Website Limited Liability Company (Llc):

This form is for income earned in tax year 2022, with tax returns due in april. Line 1—total income from schedule iw. For calendar year 2016 or fiscal year beginning and ending. For calendar year 2015 or scal year.

(M M / D D / Y Y Y Y) (M M / D D / Y Y Y.

As the fee owed for 2022 may not be known by the 15th day of the 6th month of the. Web return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. 1040 california (ca) adding a limited liability return (form 568) to add limited liability,. If your llc files on an extension, refer to payment for automatic extension for.

It Isn't Included With The Regular Ca State Partnership Formset.

Web limited liability company return of income, side 1, line 2, limited liability company fee. Web limited liability companies (llcs) classiied as partnerships ile form 568. All llcs classified as partnerships or disregarded entities that organize in california, register in california, or conduct. Llcs may be classiied for tax purposes as a partnership, a corporation, or a disregarded entity.