Form 5696 Instructions

Form 5696 Instructions - Attach to form 1040 or form 1040nr. For any new energy efficient property complete the residential clean energy credit smart. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. A home is where you lived in 2018 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home that conforms to federal manufactured home construction and safety standards. Nonresident alien income tax return, line 8 through line 21 for the same types of income. See the irs tax form 5696 instructions for more information. Web generating the 5695 in proseries: Press f6to bring up open forms. Easily find the app in the play market and install it for signing your fair political practices commission filing schedule for state fnpc ca. Web energy efficiency tax credits by filing either the 1040ez form or 1040a form.

A home is where you lived in 2018 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home that conforms to federal manufactured home construction and safety standards. The residential energy credits are: Attach to form 1040 or form 1040nr. If you have already filed your return, you will need to file an amended return (form 1040x) to claim these credits. In order to add an electronic signature to a fair political practices commission filing schedule for state fnpc ca, follow. Web purpose of form use form 5695 to figure and take your residential energy credits. Press f6to bring up open forms. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. For any new energy efficient property complete the residential clean energy credit smart. Web energy efficiency tax credits by filing either the 1040ez form or 1040a form.

You will also need to save your receipts and this manufacturer’s certification statement for your records. See the irs tax form 5696 instructions for more. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Part i residential energy efficient. See the irs tax form 5696 instructions for more information. Web purpose of form use form 5695 to figure and take your residential energy credits. Web form 5696 on android. This number should be the same as the amount on federal. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. Type 5695to highlight the form 5695 and click okto open the form.

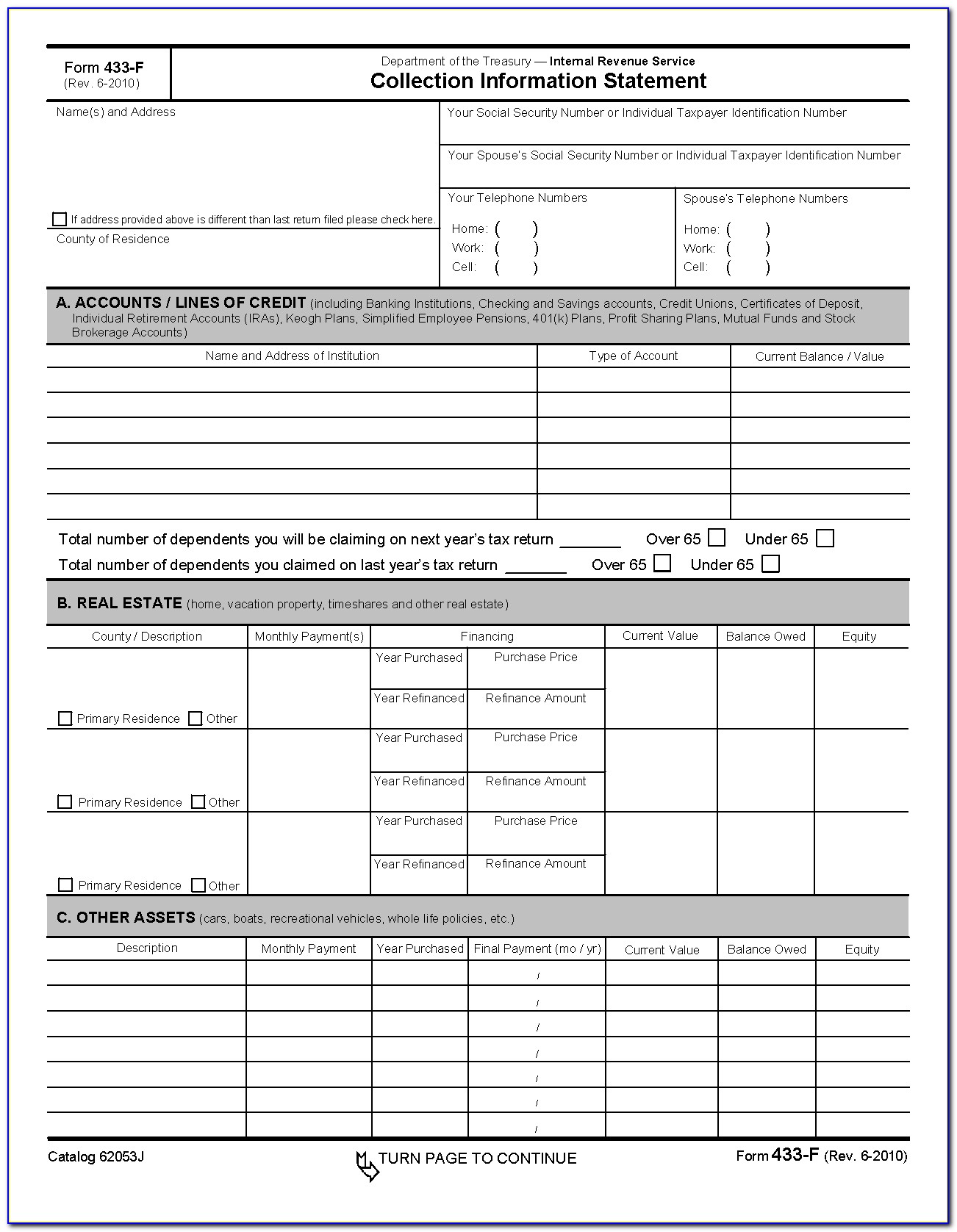

Irs Form 433 F Instructions Form Resume Examples QJ9ePPA2my

This number should be the same as the amount on federal. To add or remove this form: Also use form 5695 to take any residential energy. Enter the total on line 22a. You will also need to save your receipts and this manufacturer’s certification statement for your records.

의료진단서 부서별서식

You will also need to save your receipts and this manufacturer’s certification statement for your records. See the irs tax form 5696 instructions for more information. You will also need to save your receipts and this manufacturer’s certification statement for your records. If you have already filed your return, you will need to file an amended return (form 1040x) to.

Aia G703 Form Instructions Form Resume Examples GEOGBBw5Vr

A home is where you lived in 2018 and can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home that conforms to federal manufactured home construction and safety standards. See the irs tax form 5696 instructions for more information. • the residential clean energy credit, and • the energy efficient home improvement credit. Web to file.

공사용전화설치 계획서 샘플, 양식 다운로드

Press f6to bring up open forms. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property. In order to add an electronic signature to a fair political practices commission filing schedule for state fnpc ca, follow. To add or remove this form: Open or continue your return ;

Irs Form 1065 K 1 Instructions Universal Network

See the irs tax form 5696 instructions for more. To add or remove this form: Web generating the 5695 in proseries: You just have to complete the section concerning to the types of credits you need to claim. Web purpose of form use form 5695 to figure and take your residential energy credits.

Figure 32. An example of a completed DA Form 5513R (Key Control

Enter the corporation's taxable income or (loss) before the nol deduction, after the special deductions, and without regard to any excess inclusion (for example, if filing. Table of contents home improvement credits nonbusiness energy. Web generating the 5695 in proseries: Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment..

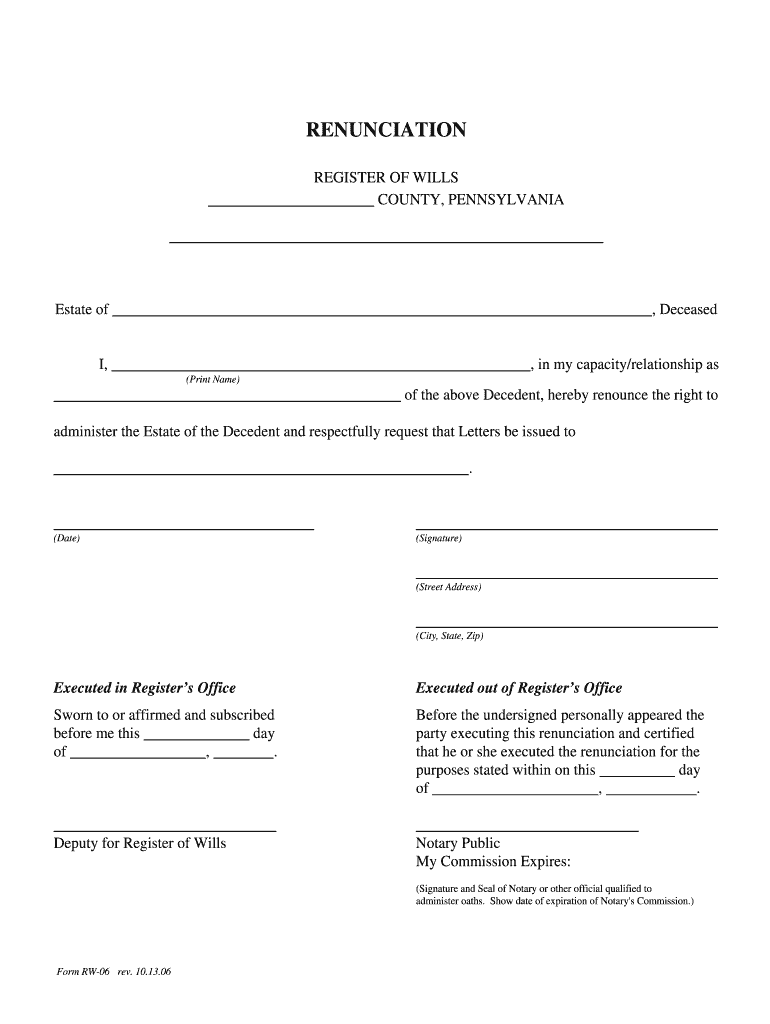

Form Rw 06 Instructions Fill Online, Printable, Fillable, Blank

You will also need to save your receipts and this manufacturer’s certification statement for your records. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. For any new.

LEGO Set 56961 Car Wash (2011 Duplo > Town) Rebrickable Build with

You will also need to save your receipts and this manufacturer’s certification statement for your records. Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. If you have already filed your return, you will need to file an amended return (form 1040x) to claim these credits. Table of contents.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

You just have to complete the section concerning to the types of credits you need to claim. Attach to form 1040 or form 1040nr. See the irs tax form 5696 instructions for more information. Table of contents home improvement credits nonbusiness energy. A home is where you lived in 2018 and can include a house, houseboat, mobile home, cooperative apartment,.

Certified Payroll Form Wh 347 Instructions Form Resume Examples

Easily find the app in the play market and install it for signing your fair political practices commission filing schedule for state fnpc ca. Table of contents home improvement credits nonbusiness energy. If you have already filed your return, you will need to file an amended return (form 1040x) to claim these credits. Open or continue your return ; See.

To Receive The Tax Credit, You Will Need To File A 1040 Tax Form.

Web form 5696 on android. See the irs tax form 5696 instructions for more information. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property. See the irs tax form 5696 instructions for more.

Open Or Continue Your Return ;

Web purpose of form use form 5695 to figure and take your residential energy credits. Inside turbotax, search for this exact phrase. Part i residential energy efficient. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes.

Nonresident Alien Income Tax Return, Line 8 Through Line 21 For The Same Types Of Income.

• the residential clean energy credit, and • the energy efficient home improvement credit. Web to file for an energy efficiency tax credit, you must file the irs tax form 5695 and submit with your taxes. Easily find the app in the play market and install it for signing your fair political practices commission filing schedule for state fnpc ca. For any new energy efficient property complete the residential clean energy credit smart.

Web To File For An Energy Efficiency Tax Credit, You Must File The Irs Tax Form 5695 And Submit With Your Taxes.

Combine the amounts on line 7 through line 21. If you have already filed your return, you will need to file an amended return (form 1040x) to claim these credits. Web information about form 5695 and its instructions is at www.irs.gov/form5695. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file.