Form 5754 Irs

Form 5754 Irs - Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Information about developments affecting these instructions will be posted on both pages. The person receiving the winnings must furnish all the information required by form 5754. Web the irs gets a copy, and the winner gets a copy. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government.

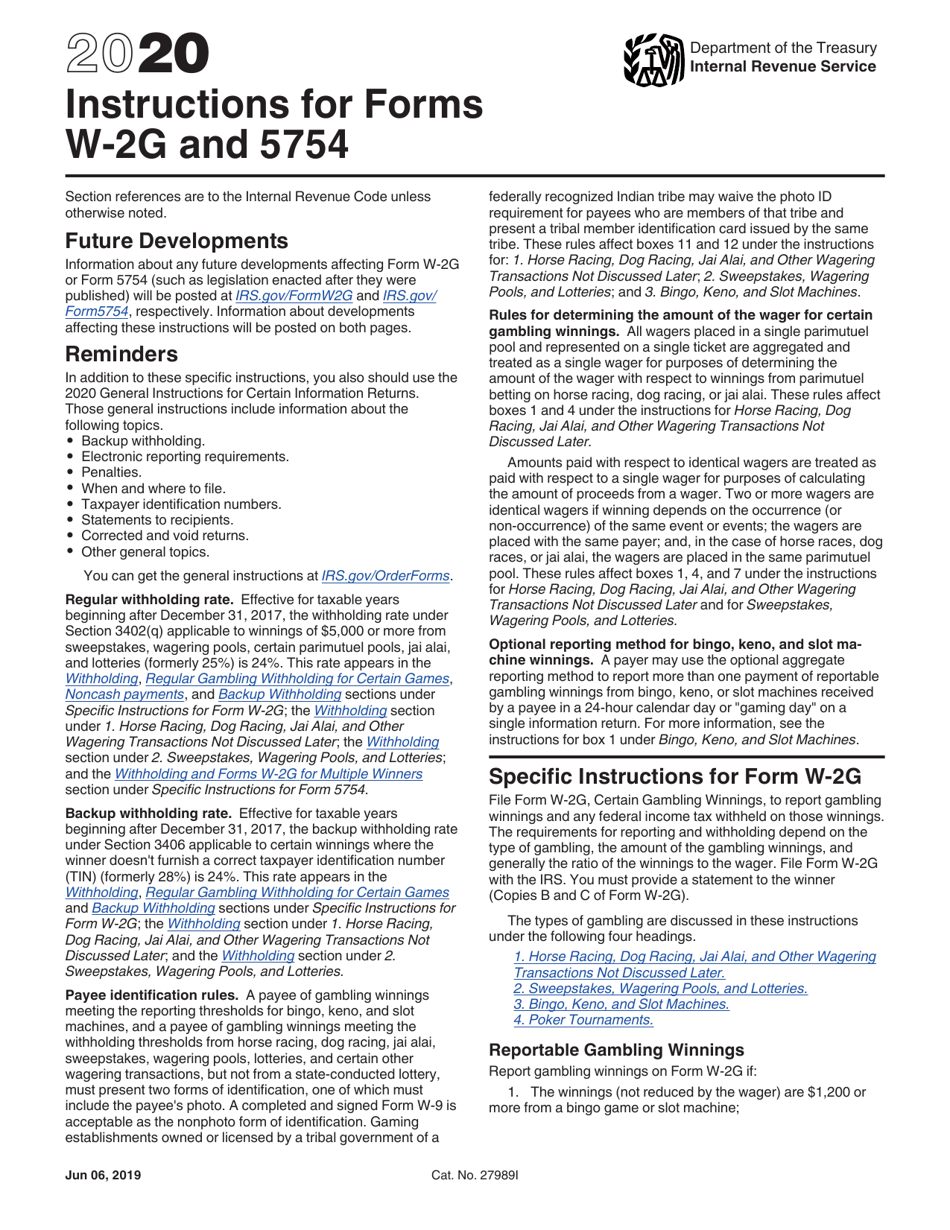

You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling. In order to redistribute the income, all individuals must have a wagering account. Information about developments affecting these instructions will be posted on both pages. Web the irs gets a copy, and the winner gets a copy. Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web about form 5754, statement by person (s) receiving gambling winnings.

In order to redistribute the income, all individuals must have a wagering account. Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling. Web the irs gets a copy, and the winner gets a copy. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. Information about developments affecting these instructions will be posted on both pages.

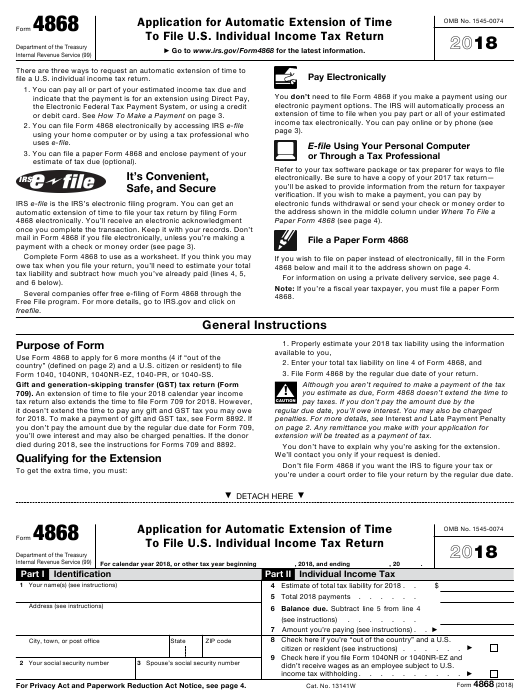

Free Printable Irs Form 4868 Printable Form 2022

Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. Web about form 5754, statement by person (s) receiving gambling winnings. In order to redistribute the income, all individuals must have a wagering account. Web the irs gets a copy, and.

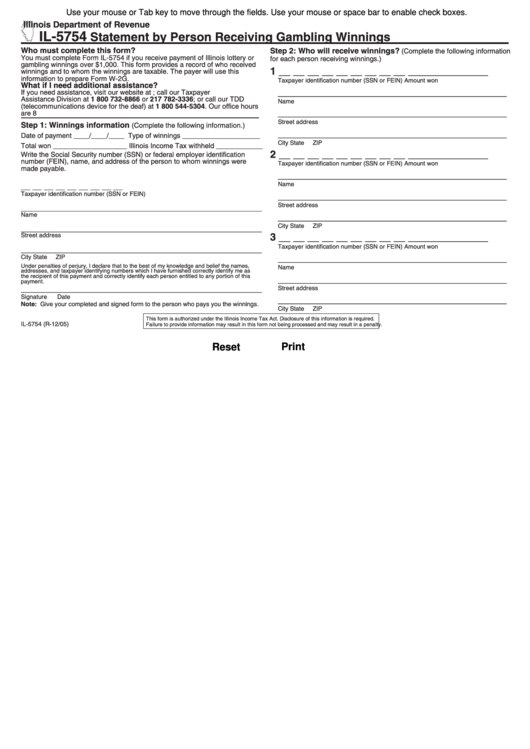

Fillable Form Il5754 Statement By Person Receiving Gambling Winnings

The person receiving the winnings must furnish all the information required by form 5754. In order to redistribute the income, all individuals must have a wagering account. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. Web about form 5754, statement by person.

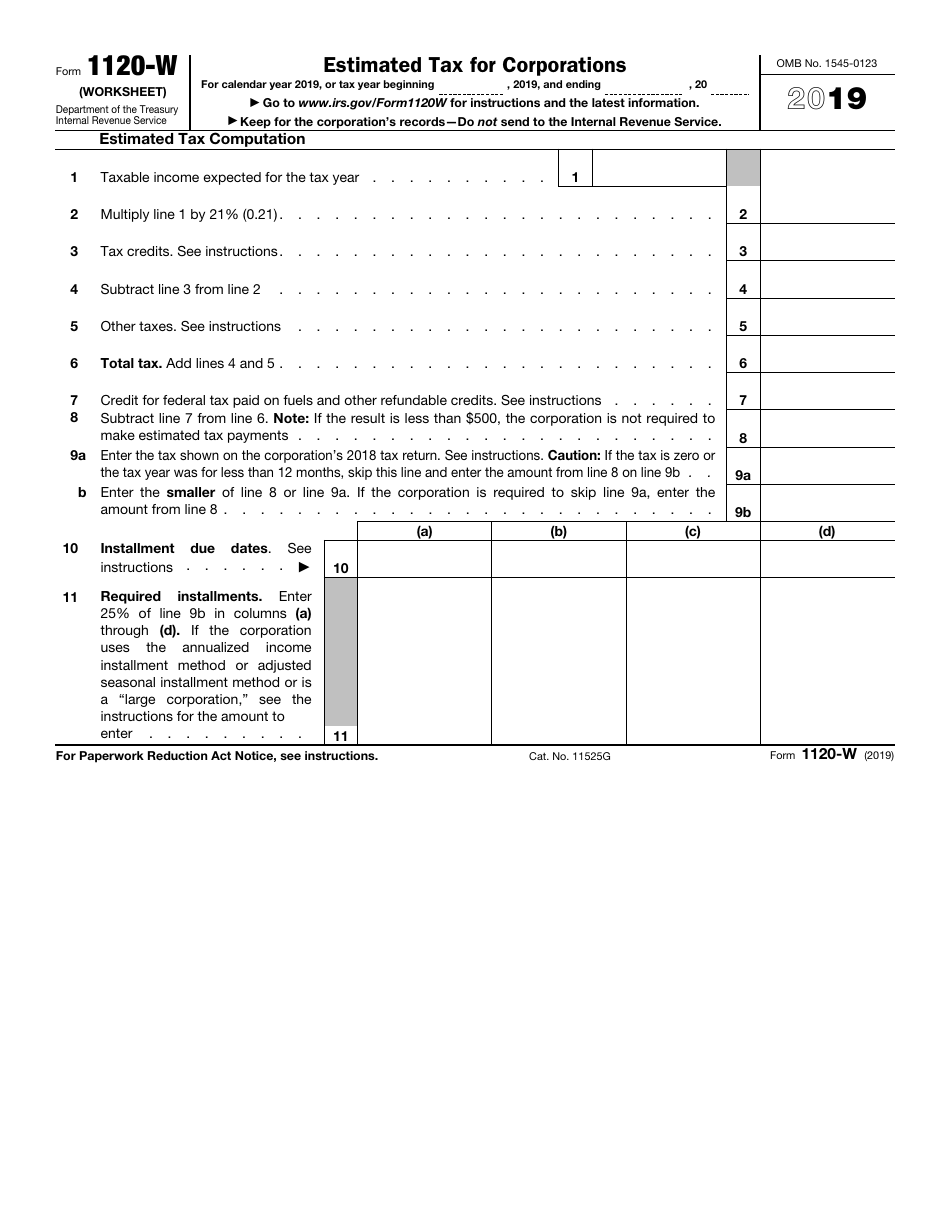

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for

If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. Irs form 5754 is commonly used to.

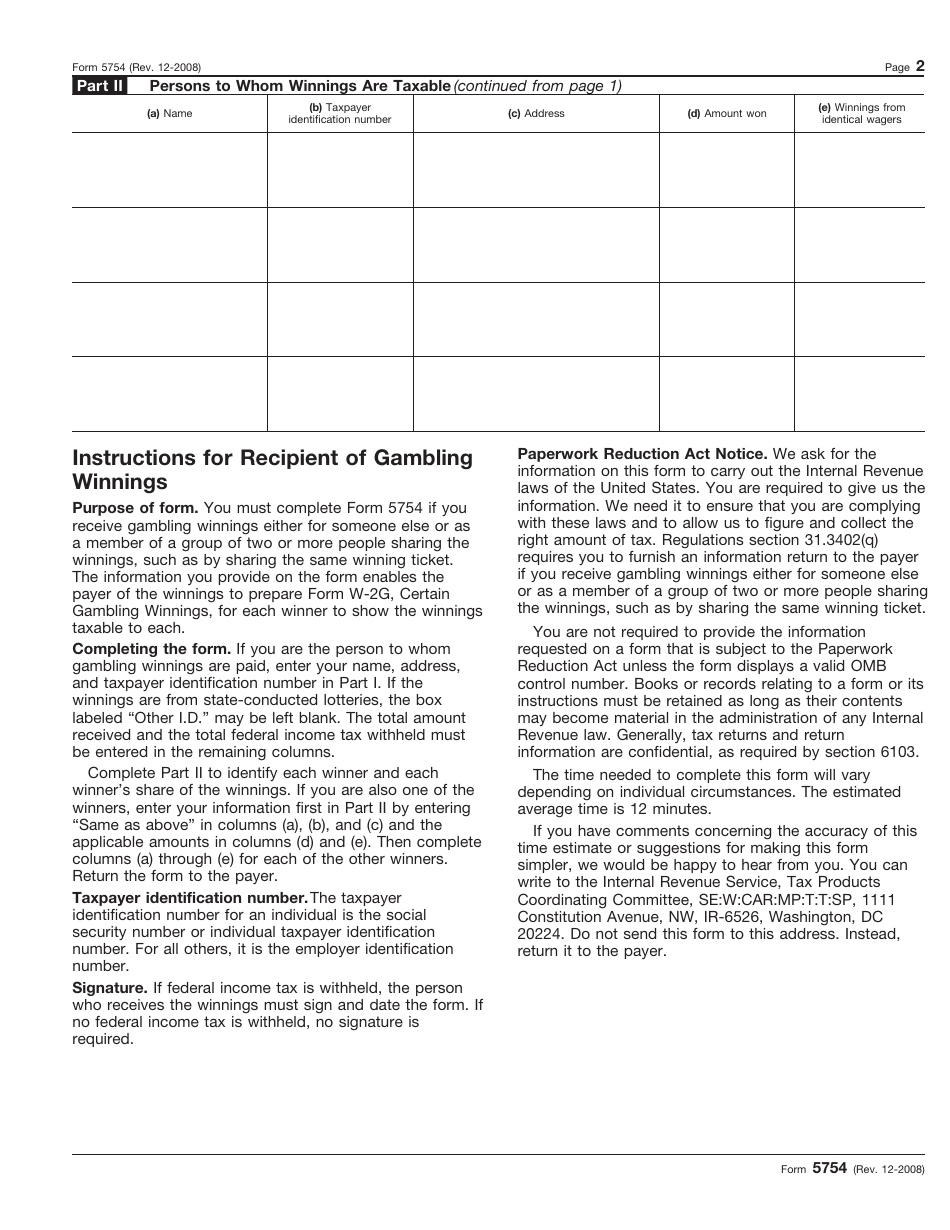

Form 5754 Statement by Person(s) Receiving Gambling Winnings (2008

Web the irs gets a copy, and the winner gets a copy. Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. This form is for income earned in.

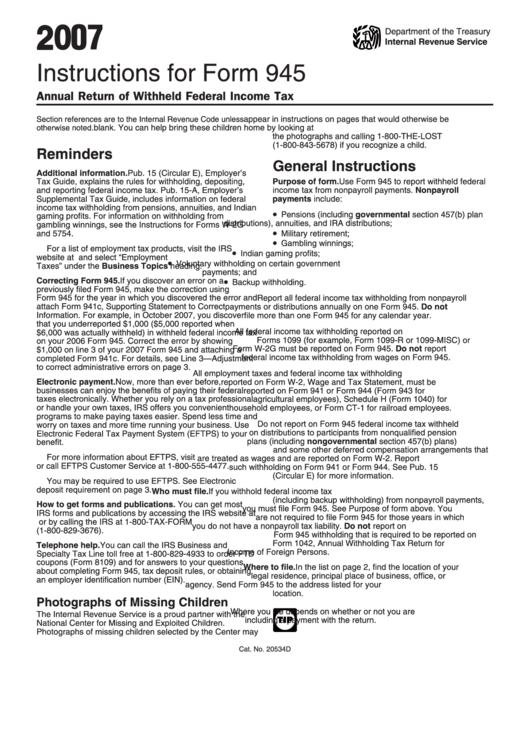

Instructions For Form 945 Annual Return Of Withheld Federal

The person receiving the winnings must furnish all the information required by form 5754. Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. You must complete form 5754 if you receive gambling winnings either for someone else or as a.

IRS Form 5754 Download Fillable PDF or Fill Online Statement by Person

This form is for income earned in tax year 2022, with tax returns due in april 2023. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you.

IRS Form 5754 Download Fillable PDF or Fill Online Statement by Person

Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. Information about developments affecting.

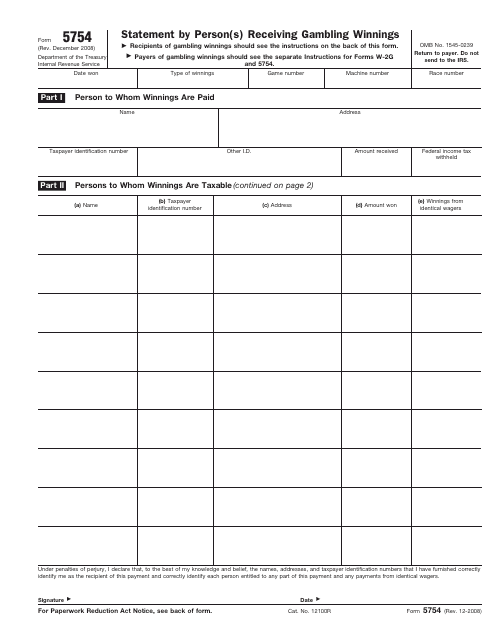

DA Form 5754 Download Fillable PDF or Fill Online Malpractice History

Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player. If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Web about form 5754, statement by.

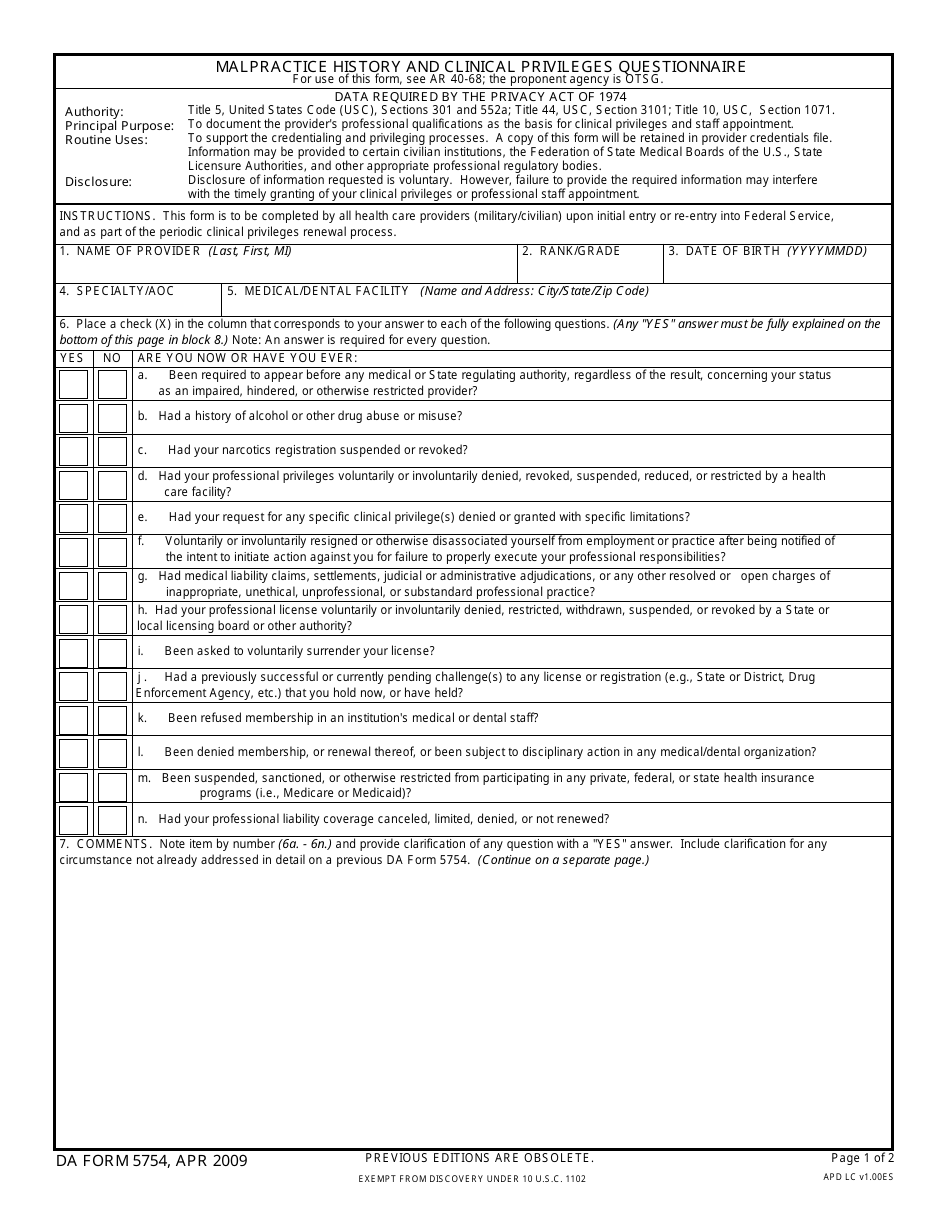

Download Instructions for IRS Form W2 G, 5754 PDF, 2020 Templateroller

Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. This form is for income.

Fill Free fillable Form 5754 2008 Statement of Gambling Winnings PDF form

Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022. You must complete form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people. In order to redistribute the.

Web The Irs Gets A Copy, And The Winner Gets A Copy.

Statement by person(s) receiving gambling winnings federal income tax you must complete form 5754 if you receive gambling. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Information about developments affecting these instructions will be posted on both pages.

In Order To Redistribute The Income, All Individuals Must Have A Wagering Account.

Web we last updated federal form 5754 in february 2023 from the federal internal revenue service. The person receiving the winnings must furnish all the information required by form 5754. Web about form 5754, statement by person (s) receiving gambling winnings. Web we last updated the statement by person(s) receiving gambling winnings in february 2023, so this is the latest version of form 5754, fully updated for tax year 2022.

You Must Complete Form 5754 If You Receive Gambling Winnings Either For Someone Else Or As A Member Of A Group Of Two Or More People.

If multiple persons agree to split the prize winnings, they may need to complete a form 5754 to split the money and the reporting amounts on their. Irs form 5754 is commonly used to document redistribution of income from winning wagers made in one players' account when the wager involved more than one player.