Form 5884-A 2021

Form 5884-A 2021 - Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Form 5884, work opportunity credit, with finalized instructions. Web to receive the tax credit, the employer must submit an application form to the irs along with the business's or owner's tax return. Employers file form 5884 to. Web payroll march 18, 2021, 7:13 pm; You can download or print current or past. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden,. Web we last updated the work opportunity credit in february 2023, so this is the latest version of form 5884, fully updated for tax year 2022. Web the forms are: Qualified wages do not include the following.

Web the forms are: You can download or print current or past. Web we last updated the work opportunity credit in february 2023, so this is the latest version of form 5884, fully updated for tax year 2022. Qualified wages do not include the following. Web payroll march 18, 2021, 7:13 pm; Form 5884, work opportunity credit, with finalized instructions. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden,. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Employers file form 5884 to. Notice and request for comments.

Form 5884, work opportunity credit, with finalized instructions. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden,. Web to receive the tax credit, the employer must submit an application form to the irs along with the business's or owner's tax return. Notice and request for comments. However, this form and its. You can download or print current or past. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Web the forms are: Employers file form 5884 to. Qualified wages do not include the following.

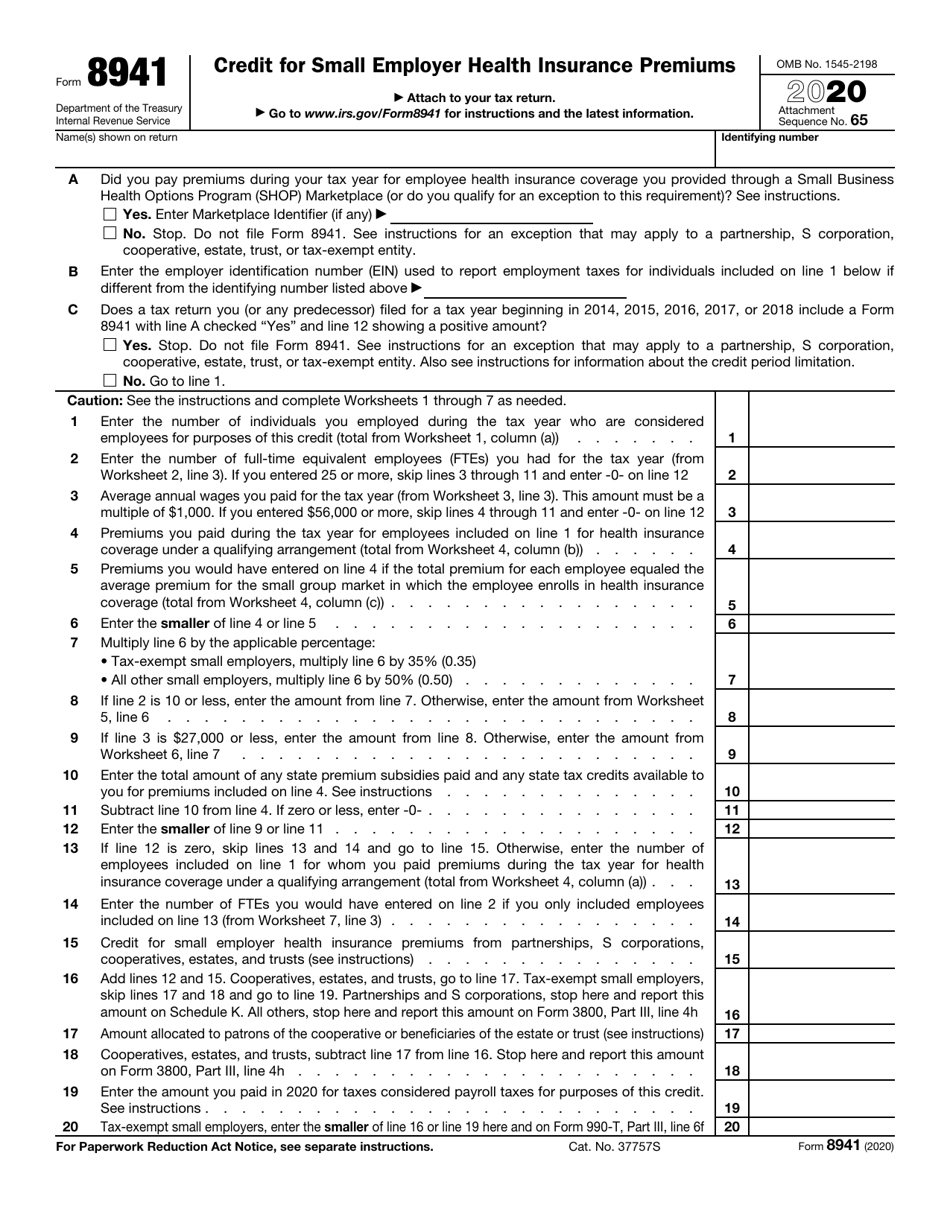

IRS Form 8941 Download Fillable PDF or Fill Online Credit for Small

The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden,. Web to receive the tax credit, the employer must submit an application form to the irs along with the business's or owner's tax return. You can download or print current or past. Web payroll march 18, 2021, 7:13 pm; Notice and request for comments.

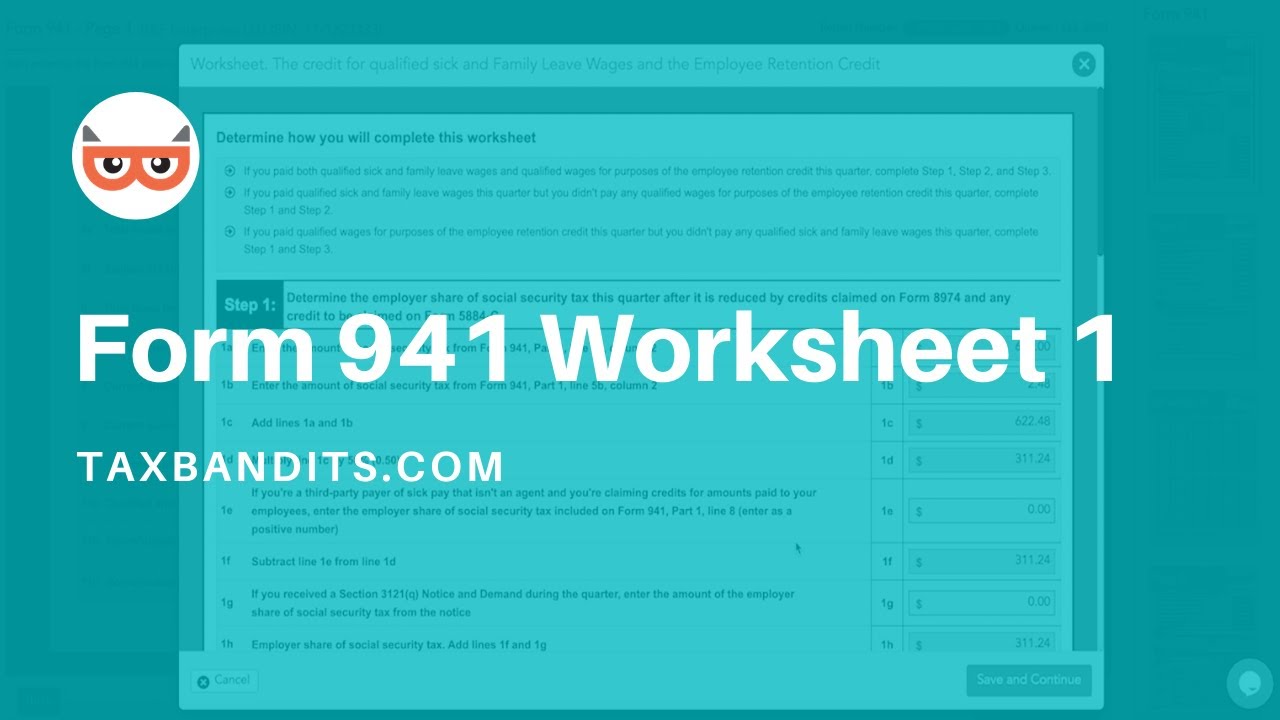

941x Worksheet 1 Excel

You can download or print current or past. Employers file form 5884 to. Web the forms are: However, this form and its. Qualified wages do not include the following.

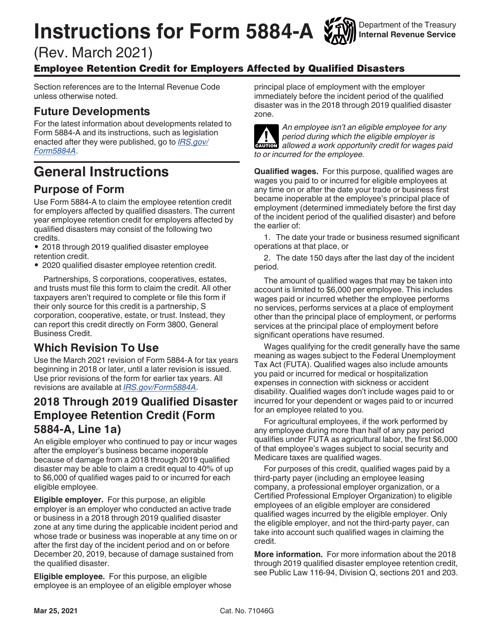

Download Instructions for IRS Form 5884A Employee Retention Credit for

Web what you need to know about form 5884. Web to receive the tax credit, the employer must submit an application form to the irs along with the business's or owner's tax return. Web the forms are: Notice and request for comments. Employers file form 5884 to.

Form 5884 Work Opportunity Credit (2014) Free Download

Form 5884, work opportunity credit, with finalized instructions. You can download or print current or past. Web payroll march 18, 2021, 7:13 pm; However, this form and its. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file.

Instructions for Form 592A Payment Voucher For Foreign Partner Or

Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Web to receive the tax credit, the employer must submit an application form to the irs along with the business's or owner's tax return. Notice and request for comments. Web payroll march 18, 2021, 7:13 pm; Employers file form 5884 to.

The IRS Released Form 941 Worksheet 2 for Q2 2021 Here’s What You Need

Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. Web we last updated the work opportunity credit in february 2023, so this is the latest version of form 5884, fully updated for tax year 2022. Web to receive the tax credit, the employer must submit an application form to the.

941 Worksheet 1 Employee Retention Credit worksheet today

Employers file form 5884 to. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden,. Web we last updated the work opportunity credit in february 2023, so this is the latest version of form 5884, fully updated for tax year 2022. Web what you need to know about form 5884. However, this form and.

IRS Form 5884A for the Employee Retention Credit

The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden,. Form 5884, work opportunity credit, with finalized instructions. Notice and request for comments. Web we last updated the work opportunity credit in february 2023, so this is the latest version of form 5884, fully updated for tax year 2022. You can download or print.

IRS 5884C 2021 Fill and Sign Printable Template Online US Legal Forms

Web the forms are: Web we last updated the work opportunity credit in february 2023, so this is the latest version of form 5884, fully updated for tax year 2022. Form 5884, work opportunity credit, with finalized instructions. Employers file form 5884 to. However, this form and its.

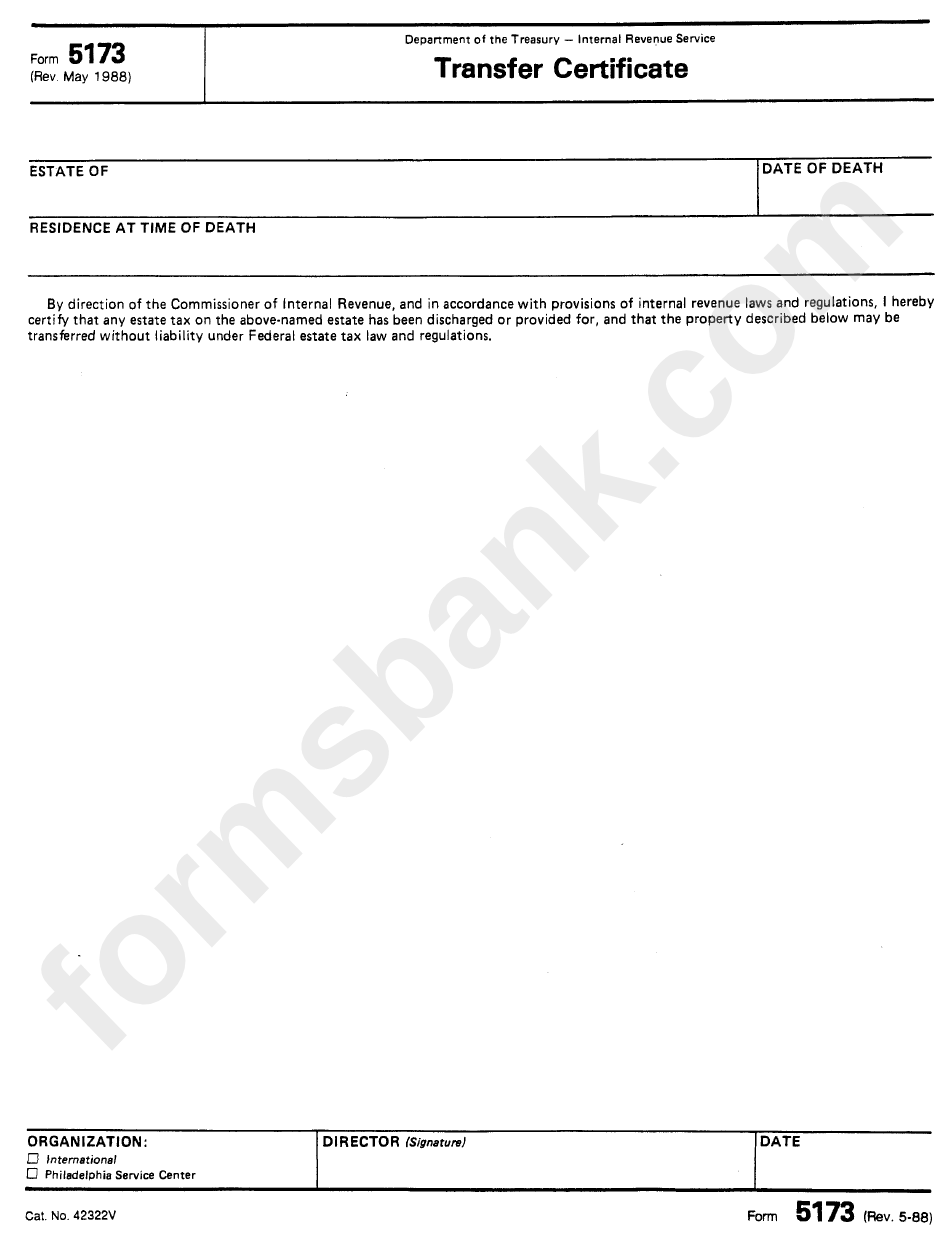

Form 5173 Transfer Certificate Form Inernal Revenue Service

Web the forms are: Web to receive the tax credit, the employer must submit an application form to the irs along with the business's or owner's tax return. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. The internal revenue service, as part of its continuing effort to reduce paperwork.

However, This Form And Its.

Web we last updated the work opportunity credit in february 2023, so this is the latest version of form 5884, fully updated for tax year 2022. Employers file form 5884 to. Form 5884, work opportunity credit, with finalized instructions. Web payroll march 18, 2021, 7:13 pm;

Notice And Request For Comments.

Web to receive the tax credit, the employer must submit an application form to the irs along with the business's or owner's tax return. Web information about form 5884, work opportunity credit, including recent updates, related forms, and instructions on how to file. The internal revenue service, as part of its continuing effort to reduce paperwork and respondent burden,. Web the forms are:

Web What You Need To Know About Form 5884.

Qualified wages do not include the following. You can download or print current or past.