Form 6198 Instructions 2022

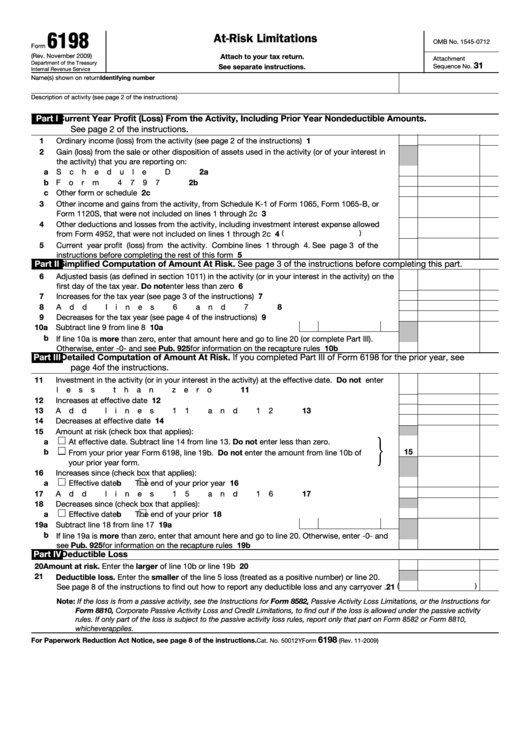

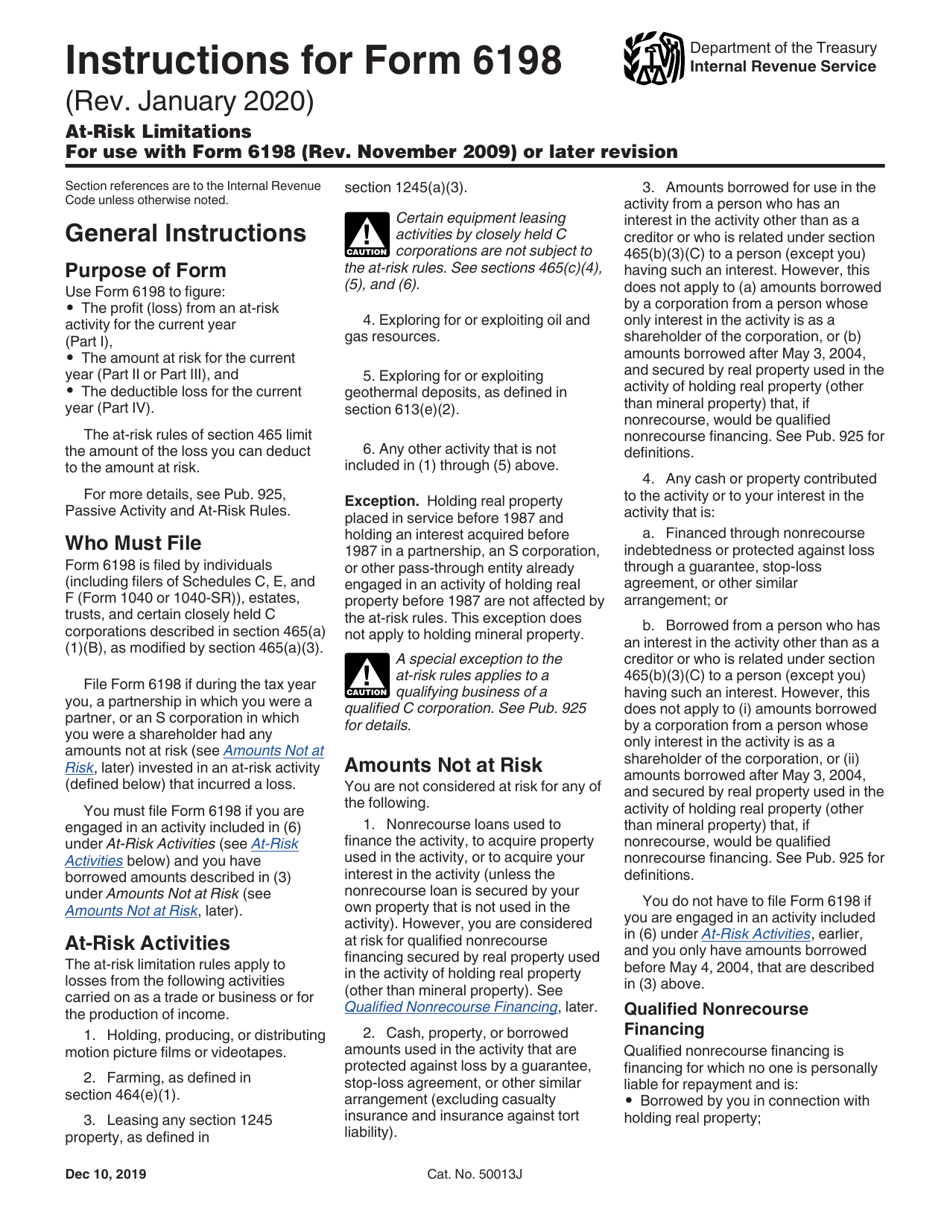

Form 6198 Instructions 2022 - For instructions and the latest information. Description of activity (see instructions) part i Amount at risk for the current tax year; Attach to your tax return. Application for enrollment to practice before the internal revenue service. Web 2022 01/30/2023 inst 6198: Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 8833: Occupational tax and registration return for wagering. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. The first part of the publication discusses the passive activity rules.

December 2020) department of the treasury internal revenue service. You must file form 6198 if you are engaged in an activity included in (6) under Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 8833: But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Let’s start by walking through irs form 6198, step by step. Description of activity (see instructions) part i Web 2022 01/30/2023 inst 6198: Amount at risk for the current tax year; Amount you can deduct for your business losses in a given tax year; Occupational tax and registration return for wagering.

Most investors go into business expecting to make a profit. Application for enrollment to practice before the internal revenue service. Amount at risk for the current tax year; December 2020) department of the treasury internal revenue service. Amount you can deduct for your business losses in a given tax year; Let’s start by walking through irs form 6198, step by step. Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 8833: But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Occupational tax and registration return for wagering. The first part of the publication discusses the passive activity rules.

Fillable Form 6198 AtRisk Limitations printable pdf download

Amount you can deduct for your business losses in a given tax year; Let’s start by walking through irs form 6198, step by step. For instructions and the latest information. You must file form 6198 if you are engaged in an activity included in (6) under December 2020) department of the treasury internal revenue service.

2018 Instruction 1040 Tax Tables Irs Review Home Decor

For instructions and the latest information. Application for enrollment to practice before the internal revenue service. Description of activity (see instructions) part i Attach to your tax return. Most investors go into business expecting to make a profit.

Form 8615 Edit, Fill, Sign Online Handypdf

For instructions and the latest information. Amount you can deduct for your business losses in a given tax year; Description of activity (see instructions) part i Let’s start by walking through irs form 6198, step by step. December 2020) department of the treasury internal revenue service.

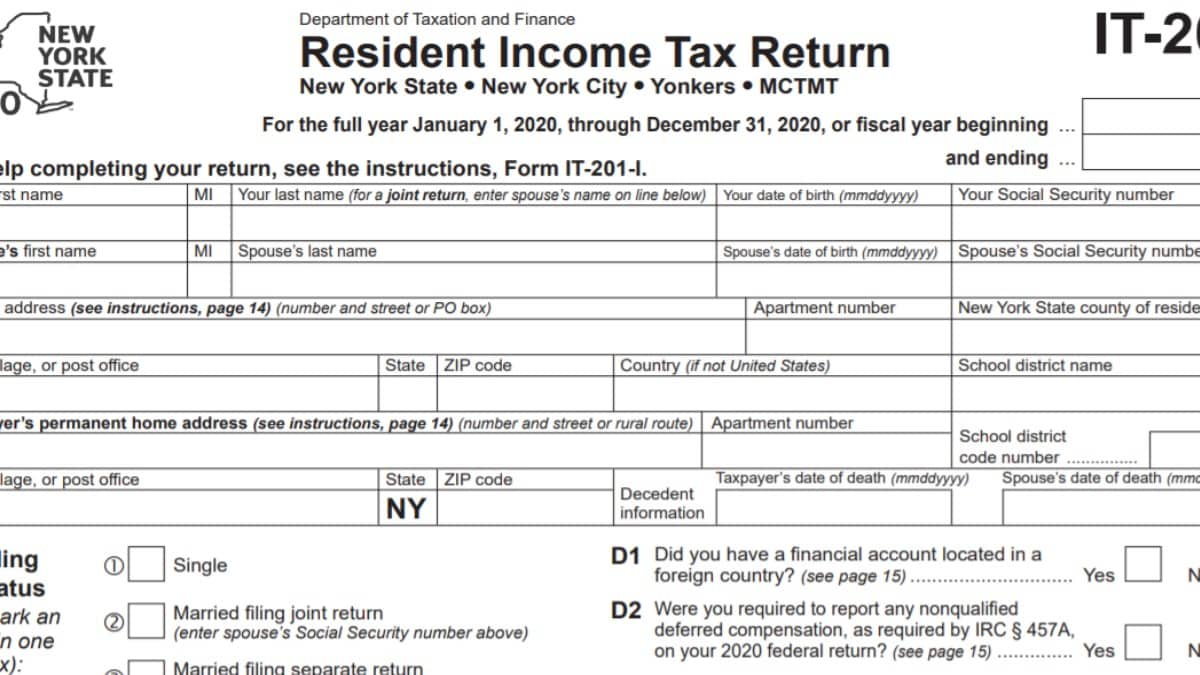

IT201 Instructions 2022 2023 State Taxes TaxUni

Occupational tax and registration return for wagering. Most investors go into business expecting to make a profit. Amount at risk for the current tax year; Description of activity (see instructions) part i Amount you can deduct for your business losses in a given tax year;

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

For instructions and the latest information. Application for enrollment to practice before the internal revenue service. Let’s start by walking through irs form 6198, step by step. December 2020) department of the treasury internal revenue service. You must file form 6198 if you are engaged in an activity included in (6) under

Form 6198 AtRisk Limitations (2009) Free Download

For instructions and the latest information. Occupational tax and registration return for wagering. You must file form 6198 if you are engaged in an activity included in (6) under Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 8833: Let’s start by walking through irs form 6198, step by step.

1040 schedule c form 2018 Fill out & sign online DocHub

The first part of the publication discusses the passive activity rules. Web 2022 01/30/2023 inst 6198: Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 8833: December 2020) department of the treasury internal revenue service. Let’s start by walking through irs form 6198, step by step.

Form 6198 atRisk Limitations Inscription on the Piece of Paper Stock

But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Amount at risk for the current tax year; Let’s start by walking through irs form 6198, step by step. Description of activity (see instructions) part i Amount you can deduct for your business losses in a given tax year;

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

Application for enrollment to practice before the internal revenue service. Attach to your tax return. Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 8833: December 2020) department of the treasury internal revenue service. Most investors go into business expecting to make a profit.

Practical Nursing Physical Form Career Center

Let’s start by walking through irs form 6198, step by step. Description of activity (see instructions) part i Application for enrollment to practice before the internal revenue service. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Amount you can deduct for your business losses in a given tax year;

Occupational Tax And Registration Return For Wagering.

Most investors go into business expecting to make a profit. Web 2022 01/30/2023 inst 6198: Instructions for form 8615, tax for certain children who have unearned income 2022 11/17/2022 form 8833: Application for enrollment to practice before the internal revenue service.

The First Part Of The Publication Discusses The Passive Activity Rules.

Amount you can deduct for your business losses in a given tax year; Description of activity (see instructions) part i Let’s start by walking through irs form 6198, step by step. You must file form 6198 if you are engaged in an activity included in (6) under

For Instructions And The Latest Information.

Amount at risk for the current tax year; But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Attach to your tax return. December 2020) department of the treasury internal revenue service.