Form 668-A

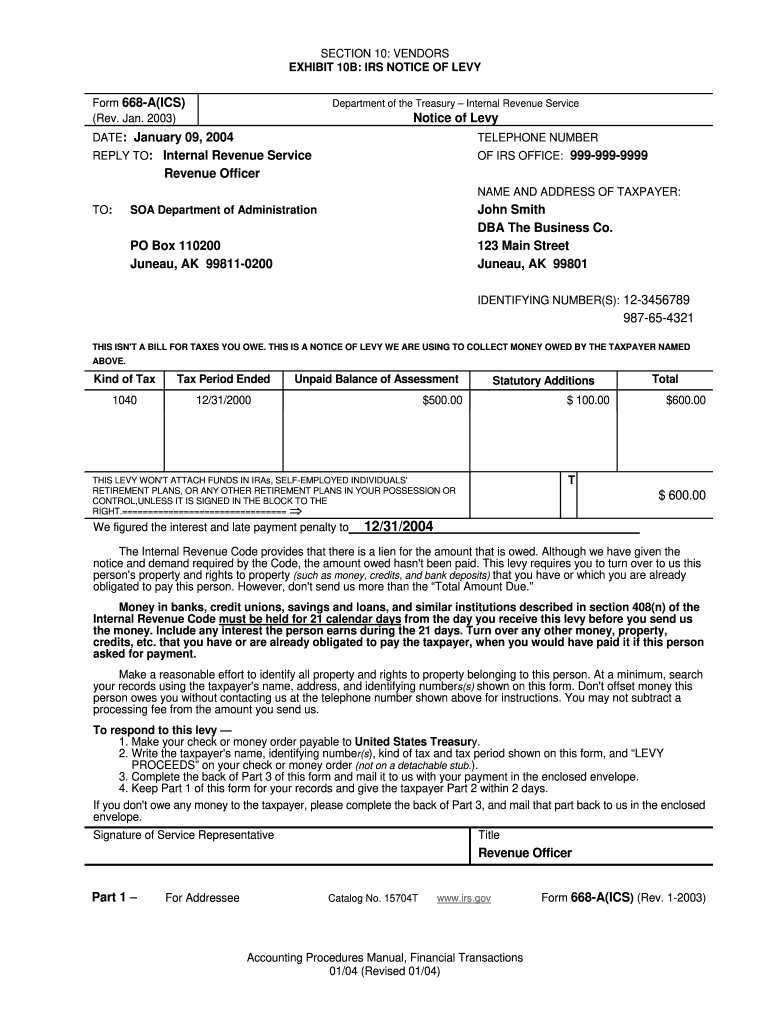

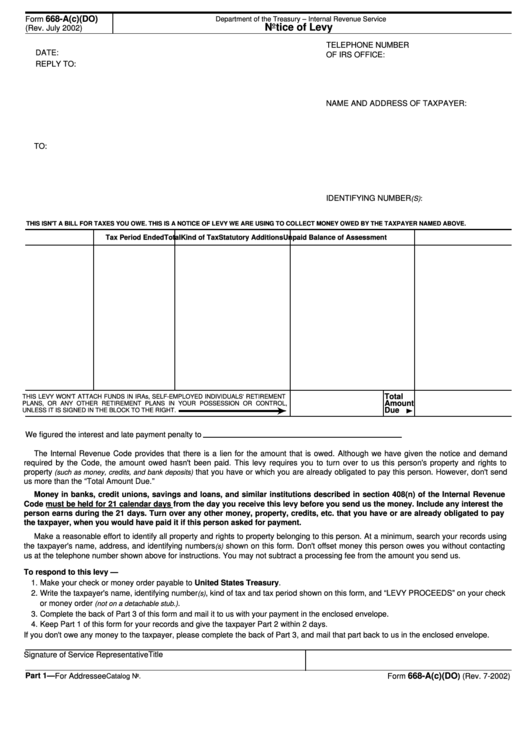

Form 668-A - For example, this form is used to levy bank accounts and business receivables. Web how to complete the form 668 aids on the web: Web an irs employee is required to give you their manager’s name and phone number when requested. It’s often sent to your. To get started on the blank, use the fill camp; Sign online button or tick the preview image of the blank. Make a reasonable effort to identify all property and rights to property belonging to this person. As result, the irs has taken collection. No arrangement was made to resolve the irs back taxes. Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications.

No arrangement was made to resolve the irs back taxes. It’s a notice of an irs wage garnishment. This form is used to levy on or in combination with seizure of intangible personal property held by a third party, such as a bank or other financial. It is most often used for bank accounts. Make a reasonable effort to identify all property and rights to property belonging to this person. To get started on the blank, use the fill camp; Your bank will hold the money in escrow as. Web you received irs letter 668a because you have unpaid irs back taxes. It’s often sent to your. Discovering documents is not the difficult component when it comes to web document management;.

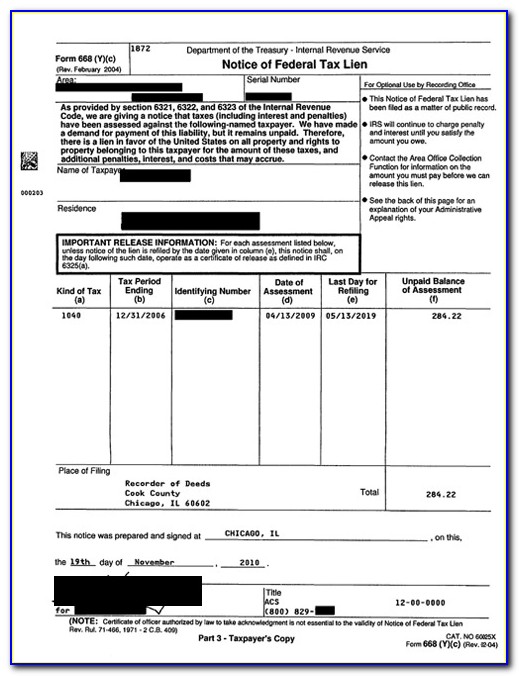

Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf. Sign online button or tick the preview image of the blank. To get started on the blank, use the fill camp; As result, the irs has taken collection. It is most often used for bank accounts. Once a lien arises, the irs generally can’t release it until. No arrangement was made to resolve the irs back taxes. It’s a notice of an irs wage garnishment. Make a reasonable effort to identify all property and rights to property belonging to this person. Web how to complete the form 668 aids on the web:

Texas Notice Of Intent To Lien Form Form Resume Examples aEDvnpED1Y

Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? For example, this form is used to levy bank accounts and business receivables. Once a lien arises, the irs generally can’t release it until. Over the last 20 years we have empowered. Form 4668 for businesses is essentially the same as form 4549 sent to.

Irs form 668 a pdf Fill out & sign online DocHub

It is most often used for bank accounts. For example, this form is used to levy bank accounts and business receivables. It’s a notice of an irs wage garnishment. Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? Over the last 20 years we have empowered.

No download needed irs form 668y pdf Fill out & sign online DocHub

Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Web how to complete the form 668 aids on the web: It’s often sent to your. Web an irs employee is required to give you their manager’s name and phone number when requested. Sign online button or tick the preview.

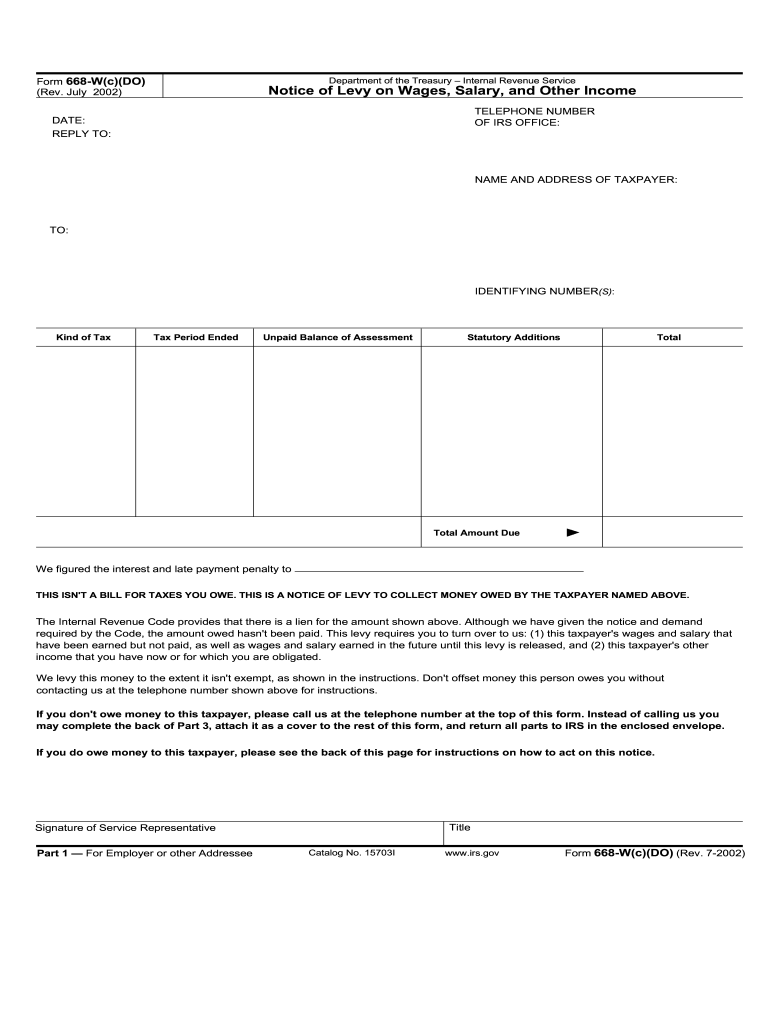

Federal Levy Form 668 W 2021 Fill Out and Sign Printable PDF Template

This form is used to levy on or in combination with seizure of intangible personal property held by a third party, such as a bank or other financial. Discovering documents is not the difficult component when it comes to web document management;. It is most often used for bank accounts. Sign online button or tick the preview image of the.

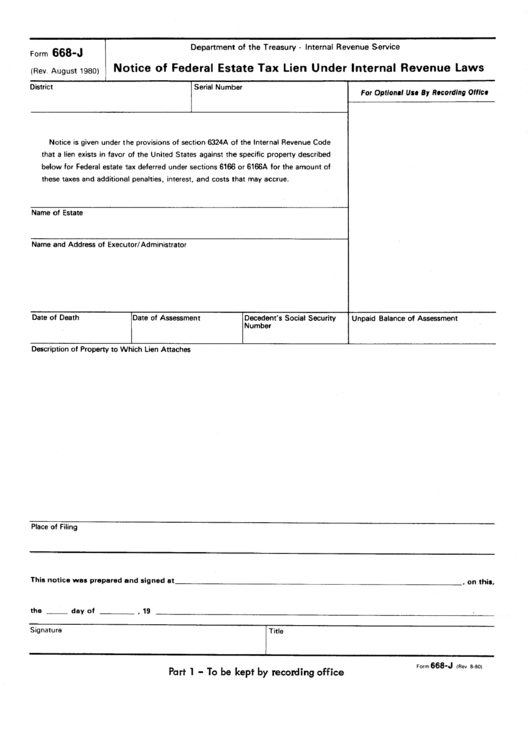

Form 668J Notice Of Federal Estate Tax Lien Under Internal Revenue

The irs also uses this form to create levies on pension and. It’s a notice of an irs wage garnishment. Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Sign online button or tick the preview image of the blank. For example, this form is used to levy bank.

Fillable Form 668A Notice Of Levy printable pdf download

Web how to complete the form 668 aids on the web: The irs also uses this form to create levies on pension and. Your bank will hold the money in escrow as. For example, this form is used to levy bank accounts and business receivables. This form is used to levy on or in combination with seizure of intangible personal.

Irs Form 668 W Form Resume Examples G28BOqX1gE

Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? It’s often sent to your. As result, the irs has taken collection. Make a reasonable effort to identify all property and rights to property belonging to this person. It is most often used for bank accounts.

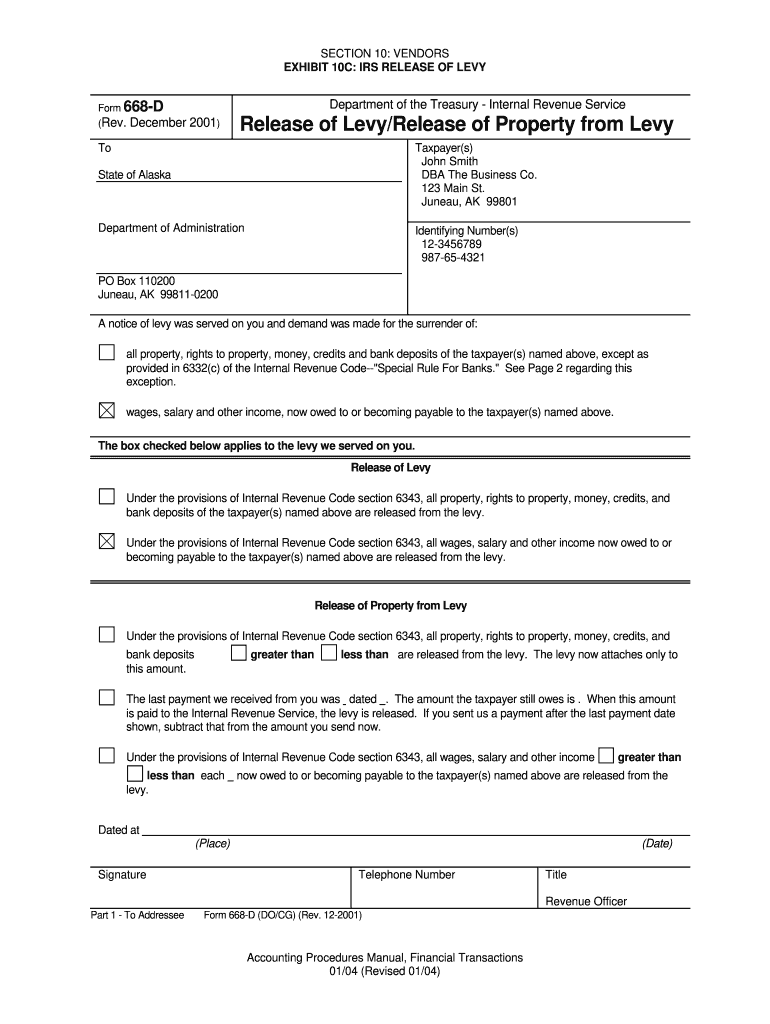

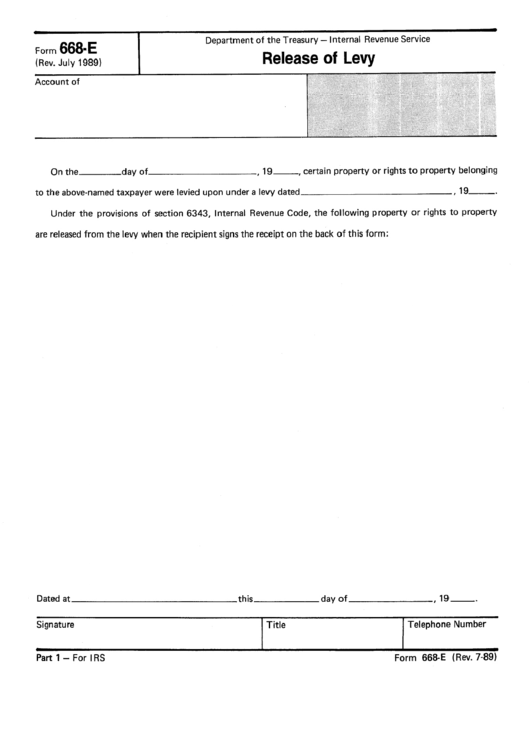

Federal Tax Lien Certificate Of Release Of Federal Tax Lien Form 668

Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? Make a reasonable effort to identify all property and rights to property belonging to this person. Discovering documents is not the difficult component when it comes to web document management;. Over the last 20 years we have empowered. To get started on the blank, use.

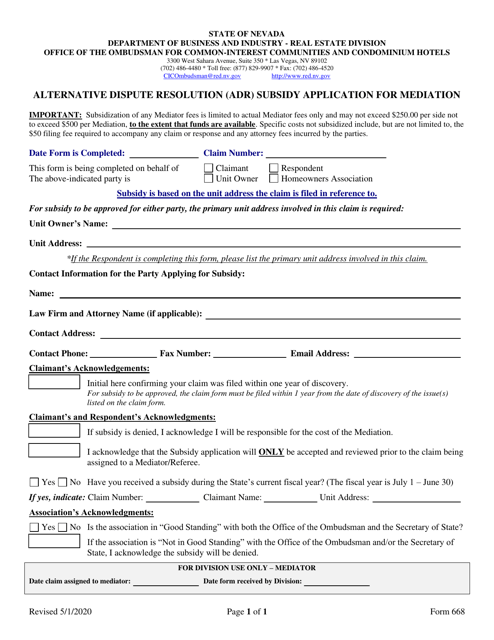

Form 668 Download Fillable PDF or Fill Online Alternative Dispute

Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. It’s often sent to your. Sign online button or tick the preview image of the blank. Web how to complete the form 668 aids on the web: As result, the irs has taken collection.

Discovering Documents Is Not The Difficult Component When It Comes To Web Document Management;.

Make a reasonable effort to identify all property and rights to property belonging to this person. Sign online button or tick the preview image of the blank. Over the last 20 years we have empowered. Web how to complete the form 668 aids on the web:

No Arrangement Was Made To Resolve The Irs Back Taxes.

Your bank will hold the money in escrow as. Web an irs employee is required to give you their manager’s name and phone number when requested. The irs also uses this form to create levies on pension and. For example, this form is used to levy bank accounts and business receivables.

It’s Often Sent To Your.

It is most often used for bank accounts. Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Web you received irs letter 668a because you have unpaid irs back taxes. This form is used to levy on or in combination with seizure of intangible personal property held by a third party, such as a bank or other financial.

Once A Lien Arises, The Irs Generally Can’t Release It Until.

Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? To get started on the blank, use the fill camp; As result, the irs has taken collection. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf.