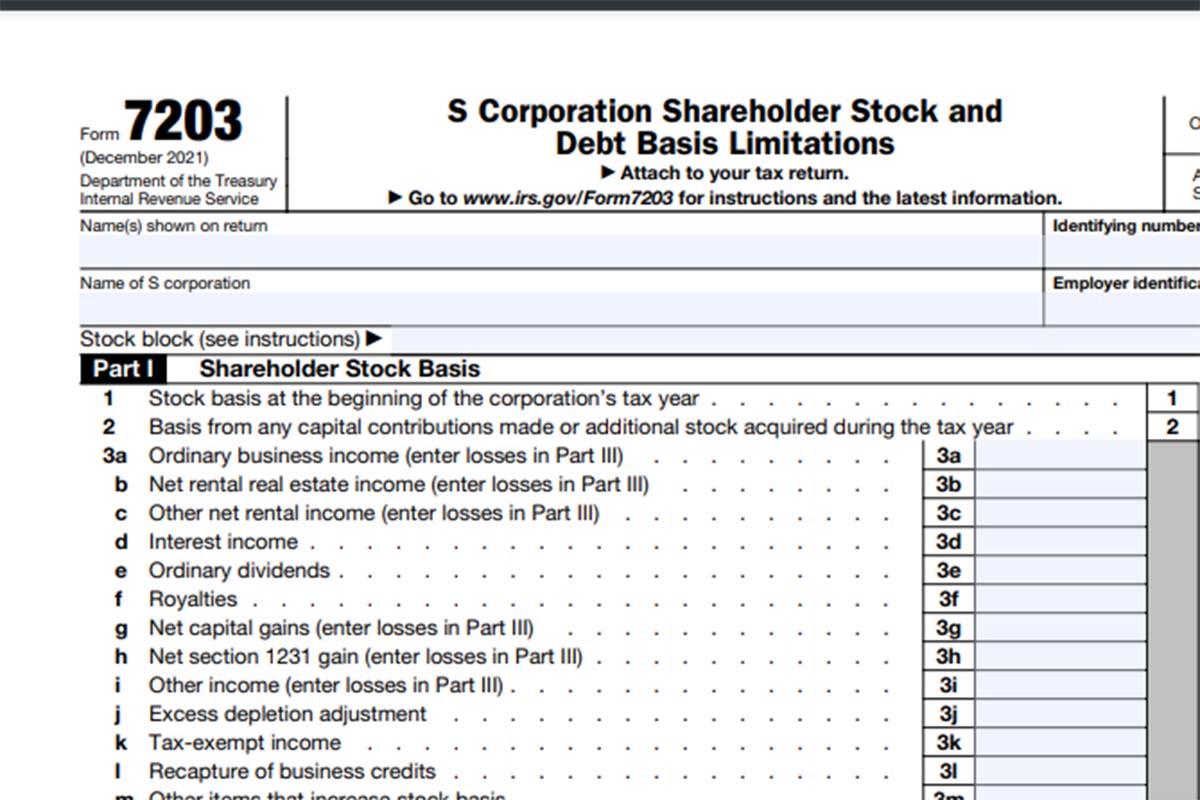

Form 7203 Stock Basis

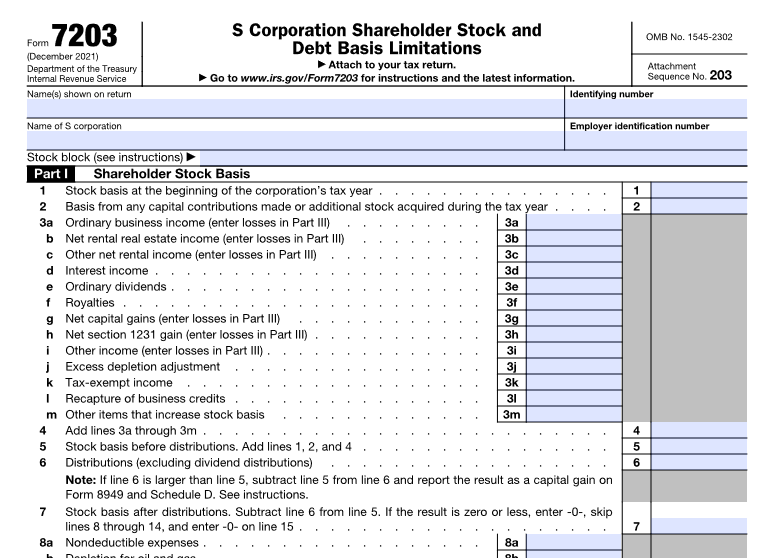

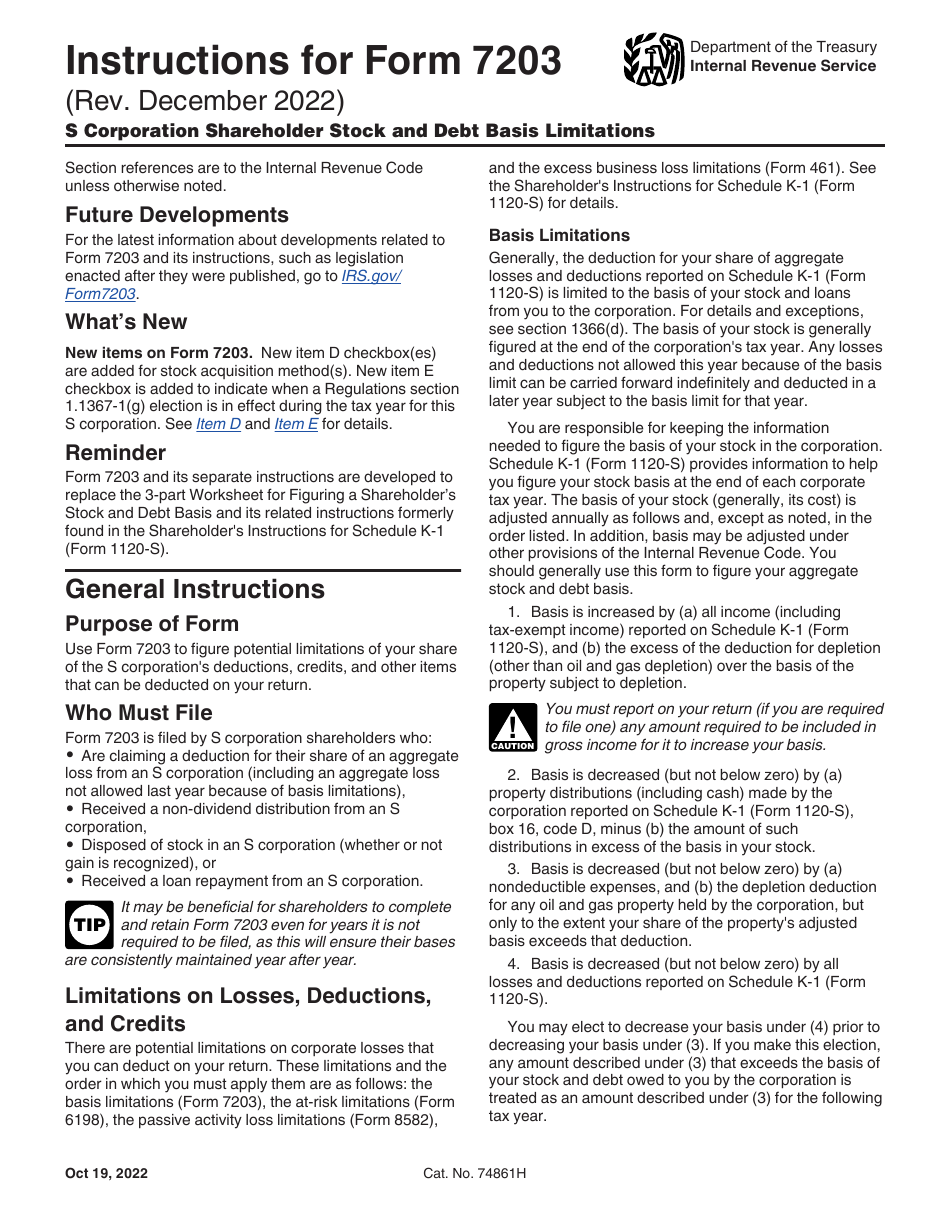

Form 7203 Stock Basis - Web irs seeking comments on form 7203. Form 7203 is generated for a 1040 return when: In 2022, john decides to sell 50 shares of company a stock. Basis from capital contributions made or additional stock acquired during year excess depletion. Other code sections might also cause a reduction in s. By office of advocacy on jul 21, 2021. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Select the quickzoom to form 7203 for stock and basis. Web form 7203 has three parts: Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return.

S corporation shareholder stock and debt basis limitations. In 2022, john decides to sell 50 shares of company a stock. On july 19, 2021, the internal revenue service (irs) issued a notice and request for. Select the quickzoom to form 7203 for stock and basis. Web stock basis at beginning of year this entry is mandatory to generate the form. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Form 7203 is generated for a 1040 return when: Web using form 7203, john can track the basis of each stock block separately directly on his income tax return.

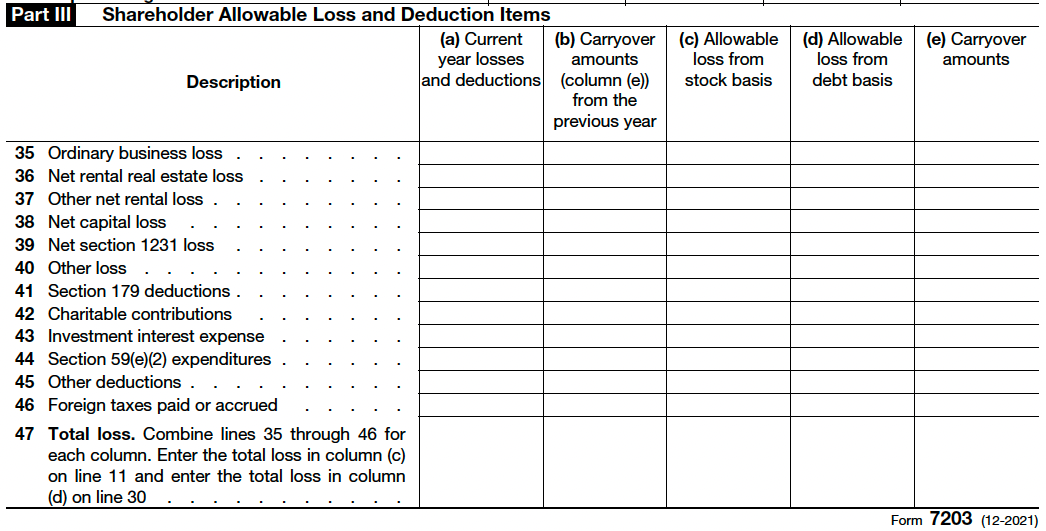

Web form 7203 has three parts: Form 7203 is generated for a 1040 return when: Basis from any capital contributions made or additional stock acquired during the tax year. Other code sections might also cause a reduction in s. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. S corporation shareholder stock and debt basis limitations. By office of advocacy on jul 21, 2021. Select the quickzoom to form 7203 for stock and basis. Web stock basis at beginning of year this entry is mandatory to generate the form. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367.

Form 7203 S Corporation Shareholder Basis AB FinWright LLP

Web stock basis at beginning of year this entry is mandatory to generate the form. Form 7203 is generated for a 1040 return when: By office of advocacy on jul 21, 2021. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. S corporation shareholder stock and debt basis limitations.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Basis from any capital contributions made or additional stock acquired during the tax year. Other code sections might also cause a reduction in s. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. In 2022, john decides to sell 50 shares of company.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

On july 19, 2021, the internal revenue service (irs) issued a notice and request for. Web irs seeking comments on form 7203. Web form 7203 has three parts: Basis from any capital contributions made or additional stock acquired during the tax year. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367.

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

S corporation shareholder stock and debt basis limitations. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Part i of form 7203 addresses adjustments to stock basis as.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web irs seeking comments on form 7203. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Select the quickzoom to form 7203 for stock and basis. Basis from capital contributions made or additional stock.

More Basis Disclosures This Year for S corporation Shareholders Need

Basis from any capital contributions made or additional stock acquired during the tax year. Web form 7203 has three parts: This form is required to be attached. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Web stock basis at the beginning of the corporation’s tax year.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Form 7203 is generated for a 1040 return when: Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet. Web january 19, 2021 the irs recently issued a new draft form 7203,.

IRS Form 7203 Fileable PDF Version

S corporation shareholder stock and debt basis limitations. On july 19, 2021, the internal revenue service (irs) issued a notice and request for. Basis from capital contributions made or additional stock acquired during year excess depletion. Web irs seeking comments on form 7203. This form is required to be attached.

Form7203PartI PBMares

Form 7203 is generated for a 1040 return when: Basis from capital contributions made or additional stock acquired during year excess depletion. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Select the quickzoom to form 7203 for stock and basis. Other code.

Download Instructions for IRS Form 7203 S Corporation Shareholder Stock

Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Other code sections might also cause a reduction in s. Web january 19, 2021 the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Form 7203 is a new form developed by irs to.

Web Form 7203 Has Three Parts:

S corporation shareholder stock and debt basis limitations. Web january 19, 2021 the irs recently issued a new draft form 7203, s corporation shareholder stock and debt basis limitations, and the corresponding draft. Form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return.

Form 7203 Is Generated For A 1040 Return When:

Select the quickzoom to form 7203 for stock and basis. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. This form is required to be attached. Other code sections might also cause a reduction in s.

Web Stock Basis At The Beginning Of The Corporation’s Tax Year.

Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Web stock basis at beginning of year this entry is mandatory to generate the form. Basis from capital contributions made or additional stock acquired during year excess depletion. Basis from any capital contributions made or additional stock acquired during the tax year.

In 2022, John Decides To Sell 50 Shares Of Company A Stock.

Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. By office of advocacy on jul 21, 2021. On july 19, 2021, the internal revenue service (irs) issued a notice and request for. Web irs seeking comments on form 7203.