Form 7216 Pdf

Form 7216 Pdf - Web final treasury regulations under irc 7216, disclosure or use of tax information by preparers of returns, became effective december 28, 2012. Web cui (when filled in) page 2 of 3 cui (when filled in) previous edition is obsolete. If you consent to the disclosure of your tax return. Web get the form 7216 pdf accomplished. Web january 21, 2022 educational are you nervous about asking 1040 clients to sign a 7216 consent form? Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. However, with our predesigned web templates, everything gets simpler. Type, draw, or upload an image of your handwritten signature and place it where you need it. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them.

Disclosure and use of your tax return information. Web january 21, 2022 educational are you nervous about asking 1040 clients to sign a 7216 consent form? Unless authorized by law, we cannot disclose your tax return information to third parties for purposes other than those. Web follow the simple instructions below: Consent to use form written in accordance with internal revenue code section 7216. Web federal law requires this consent form be provided to you. Web cui (when filled in) page 2 of 3 cui (when filled in) previous edition is obsolete. Web get the form 7216 pdf accomplished. Easily fill out pdf blank, edit, and sign them. If you consent to the disclosure of your tax return.

Web the regulations also describe specific and limited exceptions that allow a preparer (through use of the irc section 7216 consent form) to use or disclose return. Disclosure of this information is. Web get the form 7216 pdf accomplished. Use of tax return information is defined as any circumstance in which the. Web form 8716 pdf. Web federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more than one). Web january 21, 2022 educational are you nervous about asking 1040 clients to sign a 7216 consent form? Save or instantly send your ready documents. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants through a shareable link. Web regulations under 26 u.s.c.

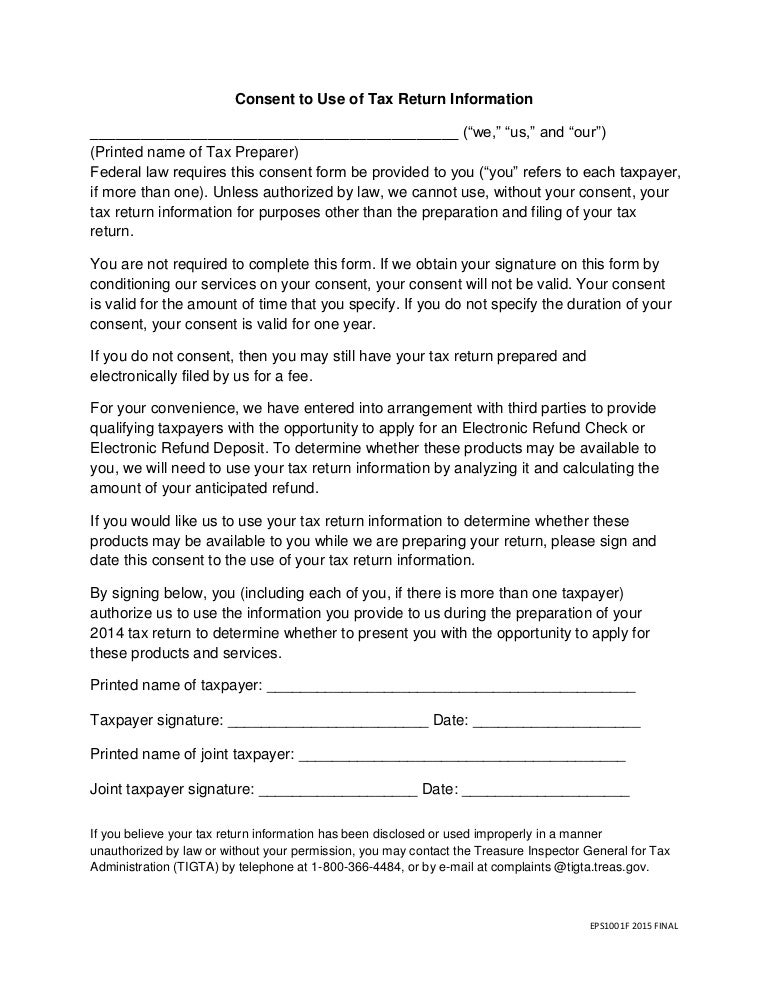

Form 7216 Sample Fill And Sign Printable Template Online Gambaran

Consent to use form written in accordance with internal revenue code section 7216. Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. Web cui (when filled in) page 2 of 3 cui (when filled in) previous edition is obsolete..

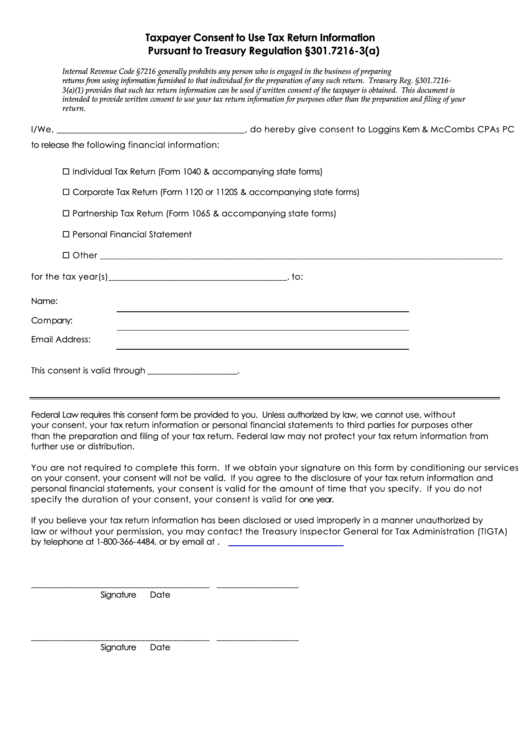

Fillable Taxpayer Consent To Use Tax Return Information printable pdf

Download your updated document, export it to the cloud, print it from the editor, or share it with other participants through a shareable link. Section 7216) to protect privacy and prevent unauthorized access of tax return information. Web get the form 7216 pdf accomplished. Web cui (when filled in) page 2 of 3 cui (when filled in) previous edition is.

7216 Consent Form Irs Printable Consent Form

Web federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more than one). Easily add and underline text, insert pictures, checkmarks, and icons, drop new fillable fields, and rearrange or remove pages from your paperwork. Disclosure of this information is. Web get the form 7216 pdf accomplished. Has this anxiety prevented you from.

Debbie Bliss Esther PDF at WEBS

Web irc 7216(a) imposes criminal penalties on tax return preparers who knowingly or recklessly make unauthorized disclosures or uses of information furnished in connection with the. Save or instantly send your ready documents. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants through a shareable link. Web federal law.

7558 KIMTECH SCIENCE* Delicate Task Wipers, 200 Sheets (previously 7216

Web the regulations also describe specific and limited exceptions that allow a preparer (through use of the irc section 7216 consent form) to use or disclose return. Web complete form 7216 download online with us legal forms. Web irc 7216(a) imposes criminal penalties on tax return preparers who knowingly or recklessly make unauthorized disclosures or uses of information furnished in.

Form 7216 Fill Online, Printable, Fillable, Blank pdfFiller

Consent to use form written in accordance with internal revenue code section 7216. If you consent to the disclosure of your tax return. Has this anxiety prevented you from relieving workload. Download your updated document, export it to the cloud, print it from the editor, or share it with other participants through a shareable link. Section 7216) to protect privacy.

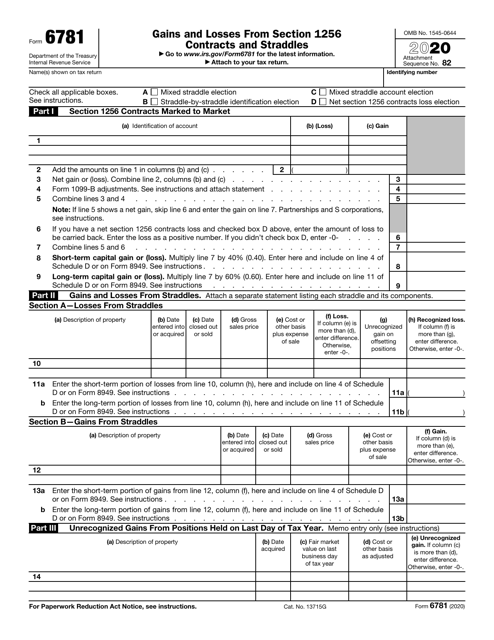

IRS Form 6781 Download Fillable PDF or Fill Online Gains and Losses

Web federal law requires you to obtain client consent to disclose tax return information to third parties for purposes of assembling information, calculations, diagnostics, and processing. Web federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more than one). Web form 8716 pdf. Web federal law requires this consent form be provided to.

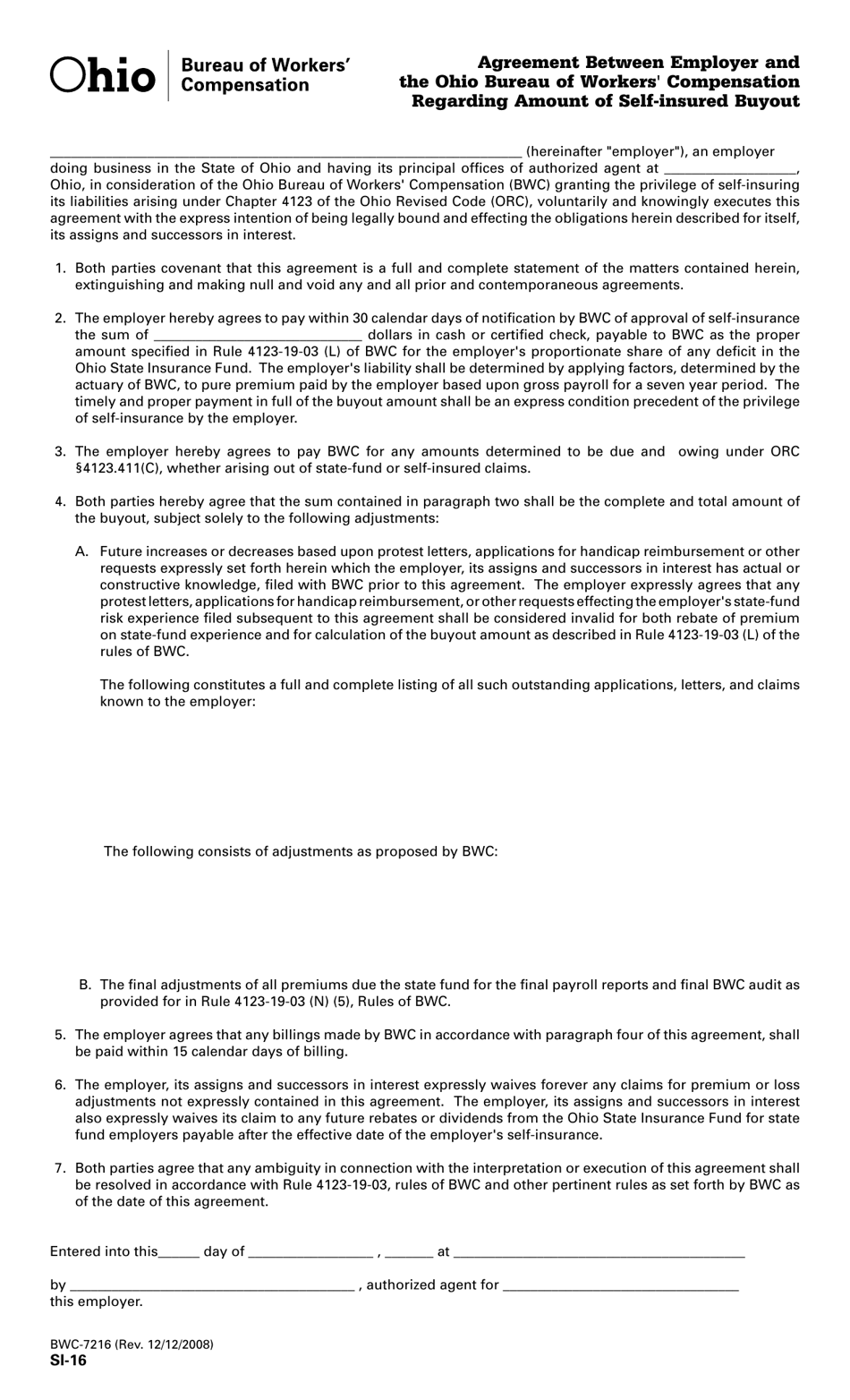

Form SI16 (BWC7216) Download Printable PDF or Fill Online Agreement

Disclosure of this information is. Save or instantly send your ready documents. Web federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more than one). Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number.

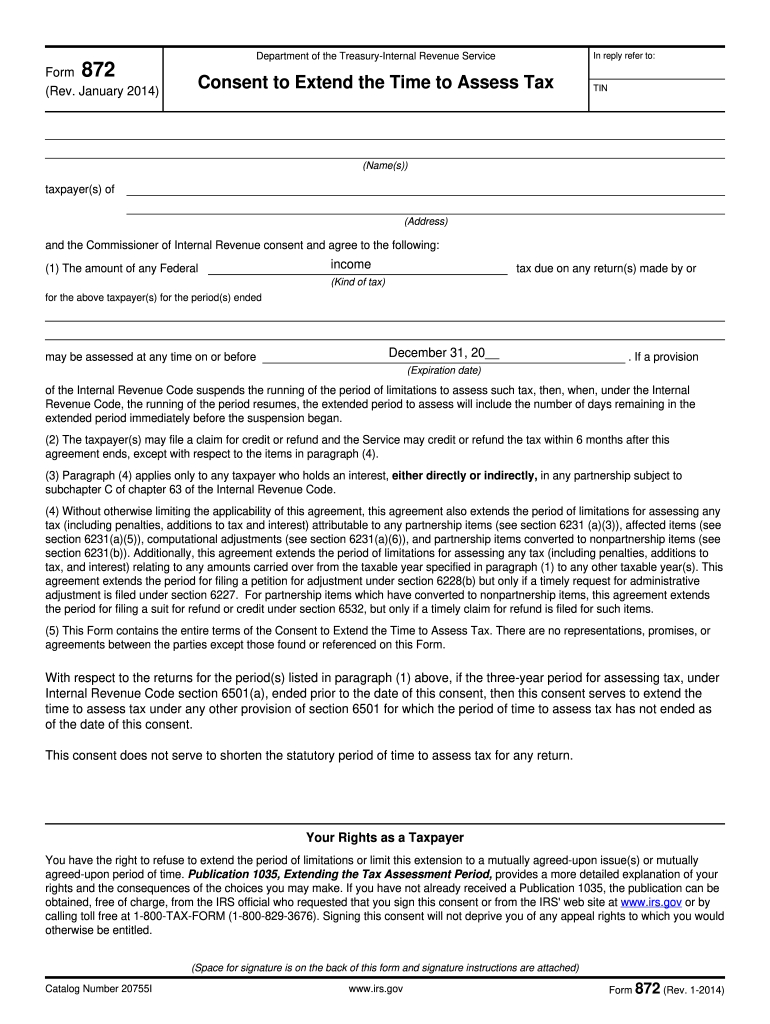

20142022 Form IRS 872 Fill Online, Printable, Fillable, Blank pdfFiller

Consent to use form written in accordance with internal revenue code section 7216. Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. Unless authorized by law, we cannot use, without your consent, your tax. Web need help with your.

MAGIC FORM 7216 BALENLİ TÜLLÜ GECELİK Dila İç Giyim

Type, draw, or upload an image of your handwritten signature and place it where you need it. Web the § 7216 regulations permit tax return preparers to use a list of client names, addresses, email addresses, phone numbers and each client’s income tax form number to provide. Disclosure of this information is. Web get the form 7216 pdf accomplished. Web.

Unless Authorized By Law, We Cannot Disclose Your Tax Return Information To Third Parties For Purposes Other Than Those.

Easily add and underline text, insert pictures, checkmarks, and icons, drop new fillable fields, and rearrange or remove pages from your paperwork. Web final treasury regulations under irc 7216, disclosure or use of tax information by preparers of returns, became effective december 28, 2012. Web regulations under 26 u.s.c. Has this anxiety prevented you from relieving workload.

Web Federal Law Requires This Consent Form Be Provided To You (“You” Refers To Each Taxpayer, If More Than One).

Web cui (when filled in) page 2 of 3 cui (when filled in) previous edition is obsolete. However, with our predesigned web templates, everything gets simpler. Web federal law requires this consent form be provided to you. Web follow the simple instructions below:

Web January 21, 2022 Educational Are You Nervous About Asking 1040 Clients To Sign A 7216 Consent Form?

Web complete form 7216 download online with us legal forms. If you consent to the disclosure of your tax return. Disclosure of this information is. Section 7216) to protect privacy and prevent unauthorized access of tax return information.

Unless Authorized By Law, We Cannot Use, Without Your Consent, Your Tax.

Easily fill out pdf blank, edit, and sign them. Web the regulations also describe specific and limited exceptions that allow a preparer (through use of the irc section 7216 consent form) to use or disclose return. Web irc 7216(a) imposes criminal penalties on tax return preparers who knowingly or recklessly make unauthorized disclosures or uses of information furnished in connection with the. Office of associate chief counsel (procedure & administration) room 5503, cc:p&a.