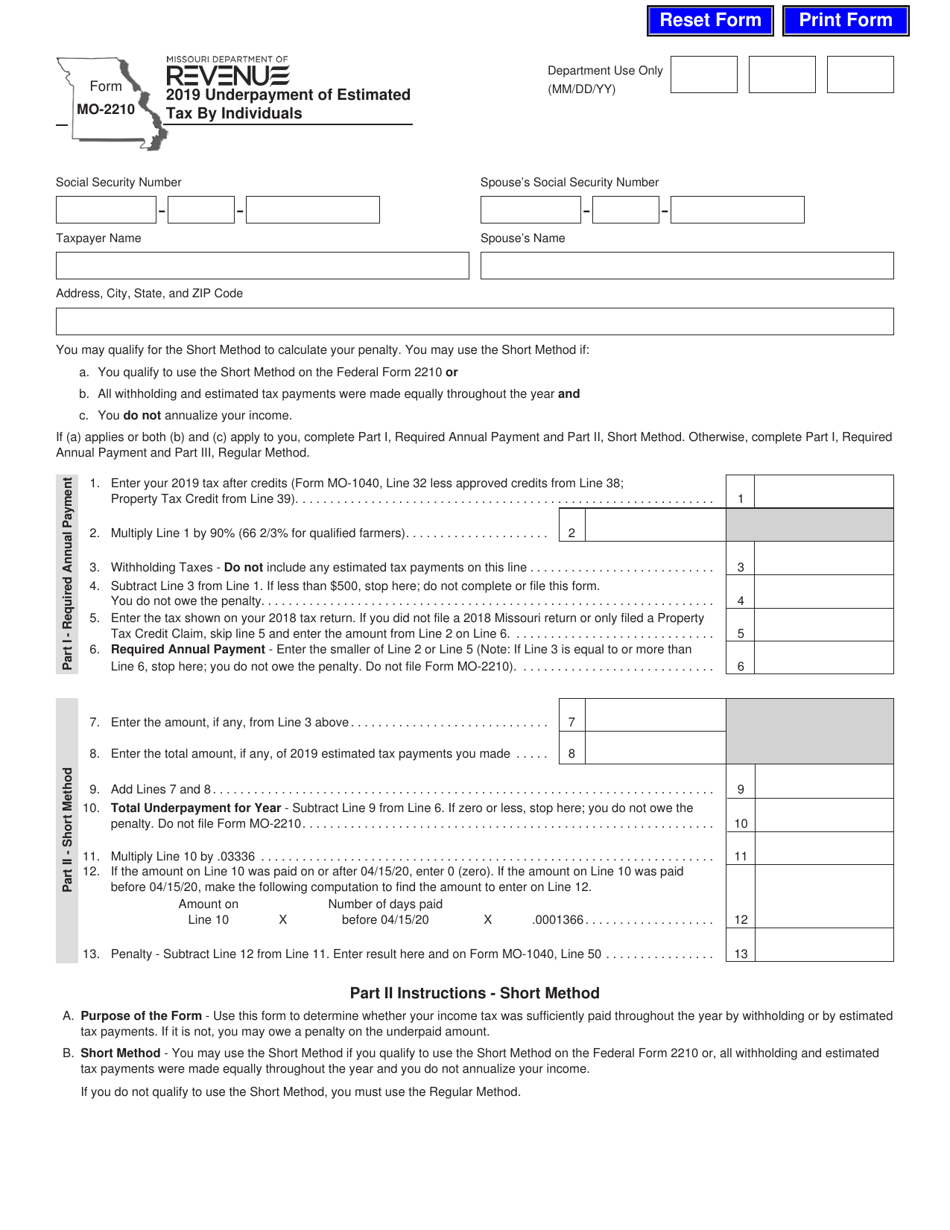

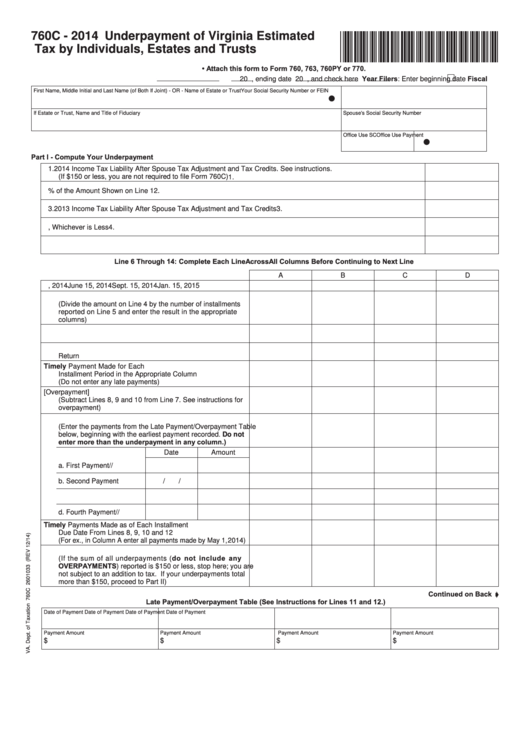

Form 760C Virginia

Form 760C Virginia - Web form 760c reports that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Select the template you need in the collection of legal form samples. Web form 760 is the general income tax return for virginia residents; Web for line 3 of your 2020 form 760c, you need to enter the 2019 income tax liability after spouse tax adjustment and tax credits. How do i know if i need to complete form 760c? Any installment due date, you must. Web 1 reply 9 replies kathryng3 expert alumni april 5, 2020 12:50 pm yes, you can find this prior year tax liability for line 3 by getting a copy of your 2018 form 760, and. Web virginia 760c form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 41 votes how to fill out and sign va 760c form online? If your tax is underpaid as of. Use get form or simply click on the template preview to open it in the editor.

Other virginia statements or schedules ; Choose the get form key. Web execute va 760c in a couple of minutes by following the recommendations below: Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. Web 1 reply 9 replies kathryng3 expert alumni april 5, 2020 12:50 pm yes, you can find this prior year tax liability for line 3 by getting a copy of your 2018 form 760, and. Select the template you need in the collection of legal form samples. Web for line 3 of your 2020 form 760c, you need to enter the 2019 income tax liability after spouse tax adjustment and tax credits. Ad register and subscribe now to work on your va form 760c & more fillable forms. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Web general instructions purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or making.

Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. How do i know if i need to complete form 760c? Choose the get form key. Select the template you need in the collection of legal form samples. Web form 760c—underpayment of virginia estimated tax by individuals, estates, and trusts form 200*—virginia letter tax return form 770/p/cg—fiduciary and unified. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. If your tax is underpaid as of. Web form 760c reports that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Start completing the fillable fields. Web form 760c or form 760f ;

Penalty For Underpayment Of Estimated Tax Virginia TAXIRIN

Web execute va 760c in a couple of minutes by following the recommendations below: Web form 760c or form 760f ; Choose the get form key. Web 1 reply 9 replies kathryng3 expert alumni april 5, 2020 12:50 pm yes, you can find this prior year tax liability for line 3 by getting a copy of your 2018 form 760,.

1960 Remington 760C Carbine Ad Fastest Handling

Choose the get form key. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. Web form 760c reports that income was not earned evenly and reports the periods that income was earned so that any penalties or.

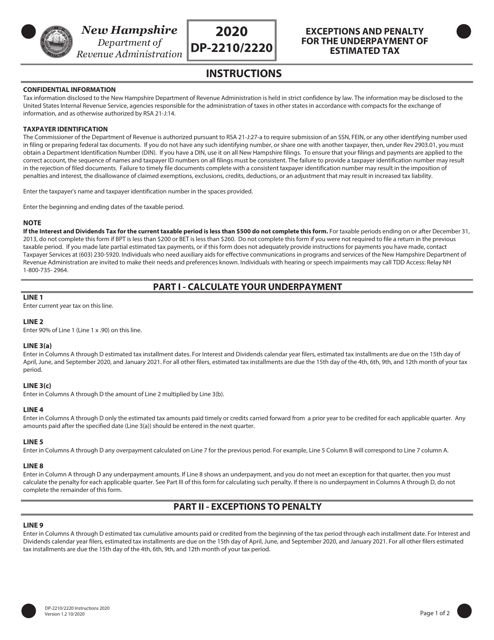

Download Instructions for Form DP2210/2220 Exceptions and Penalty for

Any installment due date, you must. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. Web general instructions purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income.

760cg Fill Online, Printable, Fillable, Blank pdfFiller

Web here's how it works 02. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web execute va 760c in a couple of minutes by following the recommendations below: Web general instructions purpose of form 760c virginia law requires that you pay your income tax in.

2021 Form VA 760C Fill Online, Printable, Fillable, Blank pdfFiller

Other virginia statements or schedules ; Web form 760c or form 760f ; Web form 760c reports that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Web execute va 760c in a couple of minutes by following the recommendations below: The net amount of tax, after the.

Fill Free fillable Form 1. *VA760C120888* 760C 2020 Underpayment

Share your form with others send. Web for line 3 of your 2020 form 760c, you need to enter the 2019 income tax liability after spouse tax adjustment and tax credits. We last updated the resident individual income tax return in january 2023, so. If your tax is underpaid as of. How do i know if i need to complete.

Apparently Unprecedented Tax Question (Form 760C Line 3) personalfinance

Ad register and subscribe now to work on your va form 760c & more fillable forms. How do i know if i need to complete form 760c? Web execute va 760c in a couple of minutes by following the recommendations below: Web if you owe more than $150 to the state of virginia at the end of the tax year,.

Empisal 760c overlocker in Tzaneen Clasf homeandgarden

Edit your virginia 760c tax online type text, add images, blackout confidential details, add comments, highlights and more. Share your form with others send. Web general instructions purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or making. Get ready for tax season deadlines by.

FD760C Power Tools Fujita Electric

Web 1 reply 9 replies kathryng3 expert alumni april 5, 2020 12:50 pm yes, you can find this prior year tax liability for line 3 by getting a copy of your 2018 form 760, and. Get ready for tax season deadlines by completing any required tax forms today. Web here's how it works 02. Choose the get form key. Web.

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

How do i know if i need to complete form 760c? Use get form or simply click on the template preview to open it in the editor. If your tax is underpaid as of. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or.

Web Form 760C Virginia — Underpayment Of Estimated Tax By Individuals, Estates, And Trusts Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This.

Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. Select the template you need in the collection of legal form samples. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. Other virginia statements or schedules ;

Web Here's How It Works 02.

Web execute va 760c in a couple of minutes by following the recommendations below: Ad register and subscribe now to work on your va form 760c & more fillable forms. Web form 760c reports that income was not earned evenly and reports the periods that income was earned so that any penalties or interest are mitigated. Get your online template and fill it in using.

Web 1 Reply 9 Replies Kathryng3 Expert Alumni April 5, 2020 12:50 Pm Yes, You Can Find This Prior Year Tax Liability For Line 3 By Getting A Copy Of Your 2018 Form 760, And.

Web form 760 is the general income tax return for virginia residents; Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Use get form or simply click on the template preview to open it in the editor. Any installment due date, you must.

Share Your Form With Others Send.

If your tax is underpaid as of. Ad register and subscribe now to work on your va form 760c & more fillable forms. Web for line 3 of your 2020 form 760c, you need to enter the 2019 income tax liability after spouse tax adjustment and tax credits. Web general instructions purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or making.