Form 8300 Letter To Customer

Form 8300 Letter To Customer - Web where to file form 8300 • u.s. Web this statement must include the name, address, contact person and telephone number of your business and the aggregate amount of reportable cash. Web for example, if a customer makes weekly payments in cash for a vehicle to a dealer, the dealer must file a form 8300 within 15 days of when the total amount. Web form 8300 is a joint form issued by the irs and the financial crimes enforcement network (fincen) and is used by the government to track individuals that evade taxes and those. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Web customer notification letter form 8300. Web under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the business has filed a form 8300. Web generally, any dealership that collects $10,000 in cash and/or cash equivalents in a single or in two or more related transactions must complete a form. Territory businesses • required written statement for customers • recordkeeping • penalties • putting it all together • exercises. We are required by the internal revenue service to report all transactions involving more than $10,000 in cash or cash equivalents as defined in 26 u.s.c.

Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Web this statement must include the name, address, contact person and telephone number of your business and the aggregate amount of reportable cash. Web pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you gave us $[amount] in cash or cash. Web generally, any dealership that collects $10,000 in cash and/or cash equivalents in a single or in two or more related transactions must complete a form. The customer notification letter form 8300 is a document used by businesses to notify their customers of the filing. Territory businesses • required written statement for customers • recordkeeping • penalties • putting it all together • exercises. Web under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the business has filed a form 8300. Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. Web form 8300 is a joint form issued by the irs and the financial crimes enforcement network (fincen) and is used by the government to track individuals that evade taxes and those.

Web generally, any dealership that collects $10,000 in cash and/or cash equivalents in a single or in two or more related transactions must complete a form. Web pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you gave us $[amount] in cash or cash. Territory businesses • required written statement for customers • recordkeeping • penalties • putting it all together • exercises. Web form 8300 is a joint form issued by the irs and the financial crimes enforcement network (fincen) and is used by the government to track individuals that evade taxes and those. Save or instantly send your ready documents. Web this letter serves as notification that rutgers, the state university of new jersey has sent a request to file form 8300 with the irs on [date], indicating that you gave us $[amount]. Web where to file form 8300 • u.s. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Web complete form 8300 letter to customer online with us legal forms. Web information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms and.

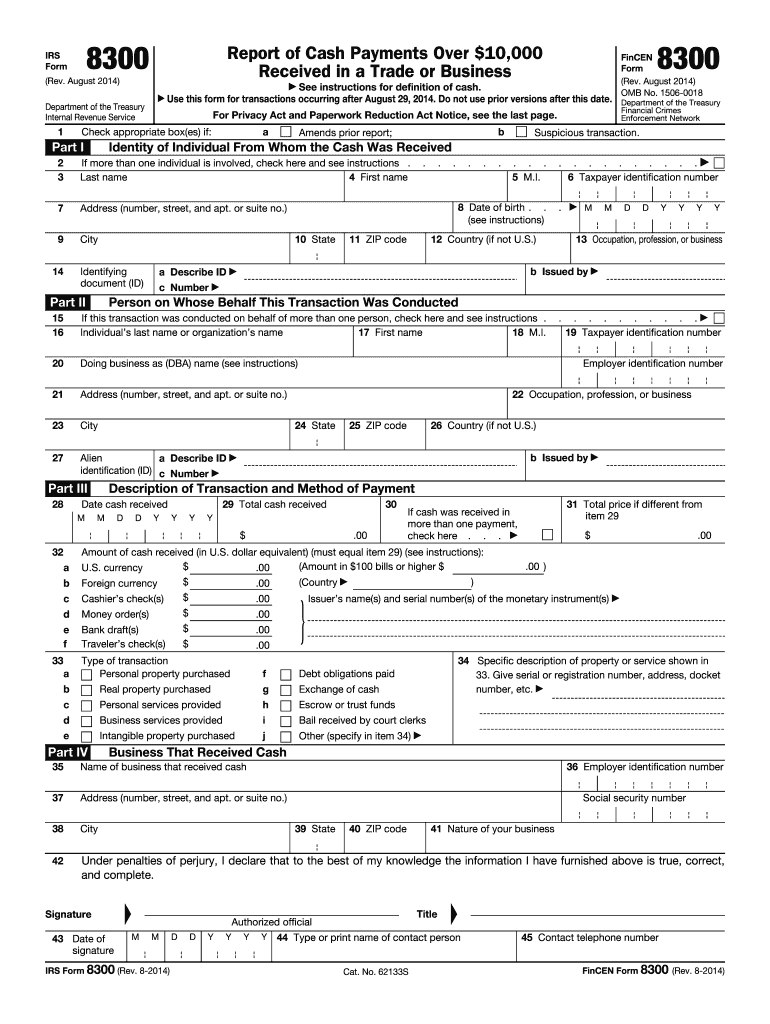

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Web informing customers about form 8300 filing. Web where to file form 8300 • u.s. Web customer notification letter form 8300. Web this statement must include the name, address, contact person and telephone number of your business and the aggregate amount of reportable cash. Web information about form 8300, report of cash payments over $10,000 received in a trade or.

Электроника [Download 28+] Sample Letter For Form 8300

Show details how it works upload the irs. Web where to file form 8300 • u.s. Territory businesses • required written statement for customers • recordkeeping • penalties • putting it all together • exercises. Drug dealers and terrorists often have. Web complete form 8300 letter to customer online with us legal forms.

IRS Form 8300 Reporting Cash Sales Over 10,000

Web for example, if a customer makes weekly payments in cash for a vehicle to a dealer, the dealer must file a form 8300 within 15 days of when the total amount. Web informing customers about form 8300 filing. The customer notification letter form 8300 is a document used by businesses to notify their customers of the filing. Territory businesses.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Web where to file form 8300 • u.s. Web either way, the dealer needs to file only one form 8300. Web complete form 8300 letter to customer online with us legal forms. Web information about form 8300, report of cash payments over $10,000 received in a trade or business, including recent updates, related forms and. Web this letter serves as.

Form 8300 Explanation And Reference Guide

Show details how it works upload the irs. Web form 8300 is a joint form issued by the irs and the financial crimes enforcement network (fincen) and is used by the government to track individuals that evade taxes and those. Territory businesses • required written statement for customers • recordkeeping • penalties • putting it all together • exercises. Web.

Irs 8300 Form Fill Out and Sign Printable PDF Template signNow

Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Web complete form 8300 letter to customer online with us legal forms. Web generally, any dealership that collects $10,000 in cash.

Understanding How to Report Large Cash Transactions (Form 8300) Roger

Show details how it works upload the irs. Web complete form 8300 letter to customer online with us legal forms. Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. A form 8300 filer must give each party named on the form written notice by january 31 of the year following.

The IRS Form 8300 and How it Works

Web complete form 8300 letter to customer online with us legal forms. We are required by the internal revenue service to report all transactions involving more than $10,000 in cash or cash equivalents as defined in 26 u.s.c. Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single.

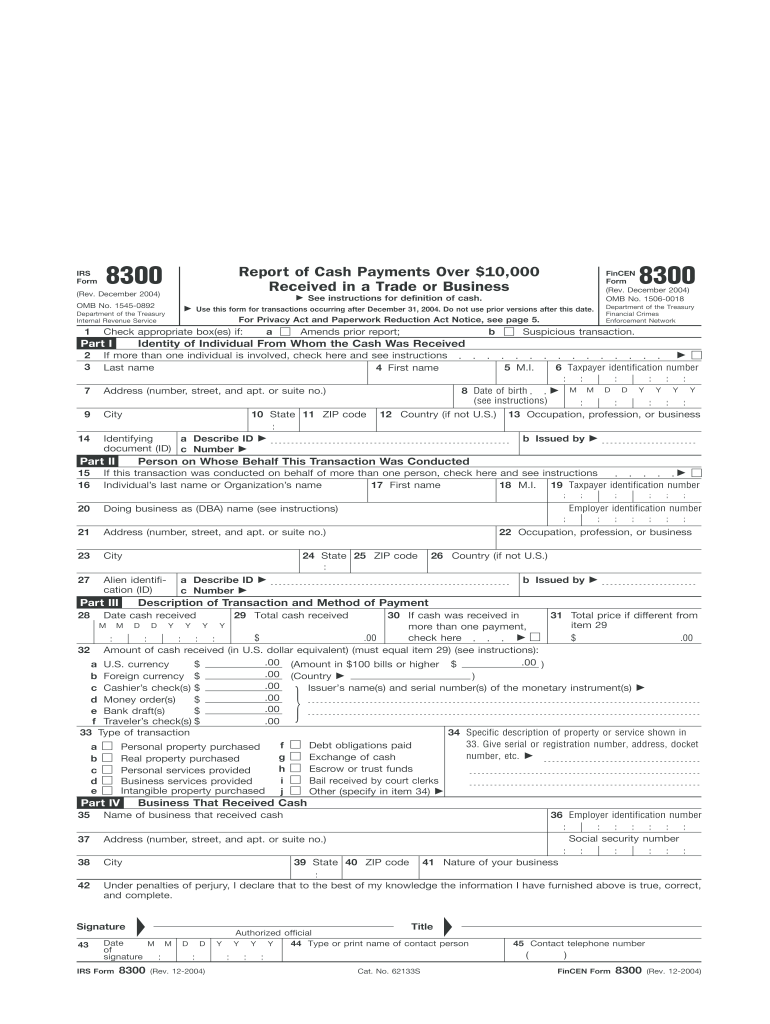

2004 Form IRS 8300 Fill Online, Printable, Fillable, Blank PDFfiller

Web complete form 8300 letter to customer online with us legal forms. Web this letter serves as notification that rutgers, the state university of new jersey has sent a request to file form 8300 with the irs on [date], indicating that you gave us $[amount]. Web form 8300 is a joint form issued by the irs and the financial crimes.

88 FORM 8300 LETTER, LETTER 8300 FORM Form

Web either way, the dealer needs to file only one form 8300. Web this letter serves as notification that rutgers, the state university of new jersey has sent a request to file form 8300 with the irs on [date], indicating that you gave us $[amount]. Web customer notification letter form 8300. We are required by the internal revenue service to.

Web 8300 Form Letter To Customer Rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 Satisfied 50 Votes How To Fill Out And Sign 8300 Notification Letter Online?

Web informing customers about form 8300 filing. Web pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you gave us $[amount] in cash or cash. A dealership doesn’t file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000 cashier check. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related.

A Form 8300 Filer Must Give Each Party Named On The Form Written Notice By January 31 Of The Year Following The.

Web where to file form 8300 • u.s. Show details how it works upload the irs. Territory businesses • required written statement for customers • recordkeeping • penalties • putting it all together • exercises. Save or instantly send your ready documents.

Web This Statement Must Include The Name, Address, Contact Person And Telephone Number Of Your Business And The Aggregate Amount Of Reportable Cash.

Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. We are required by the internal revenue service to report all transactions involving more than $10,000 in cash or cash equivalents as defined in 26 u.s.c. Web under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the business has filed a form 8300. Drug dealers and terrorists often have.

Web For Example, If A Customer Makes Weekly Payments In Cash For A Vehicle To A Dealer, The Dealer Must File A Form 8300 Within 15 Days Of When The Total Amount.

Web this letter serves as notification that rutgers, the state university of new jersey has sent a request to file form 8300 with the irs on [date], indicating that you gave us $[amount]. The customer notification letter form 8300 is a document used by businesses to notify their customers of the filing. Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Web customer notification letter form 8300.

![Электроника [Download 28+] Sample Letter For Form 8300](https://www.communitytax.com/wp-content/uploads/2018/04/irs-form-8300.jpg)