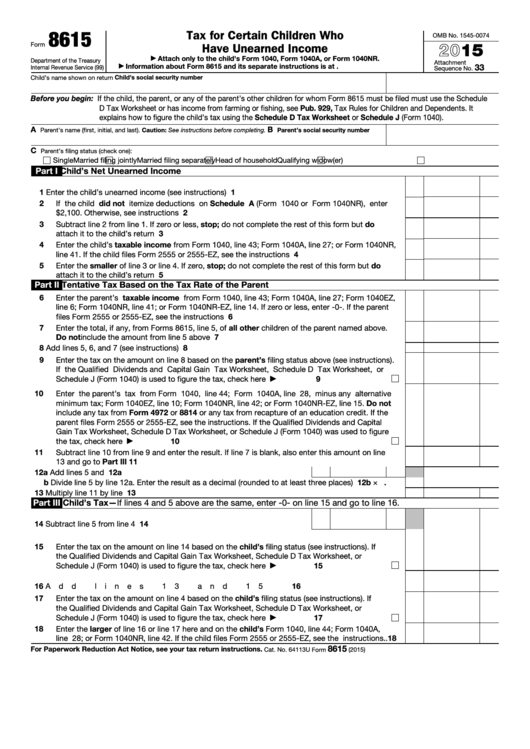

Form 8615 Pdf

Form 8615 Pdf - For paperwork reduction act notice, see your tax return instructions. Ad upload, modify or create forms. Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. The 8615 form was created by the irs in an. The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web form 8615 must be filed for anyone who meets all of the following conditions. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Department of the treasury internal revenue service. Texas health and human services subject: Get ready for tax season deadlines by completing any required tax forms today.

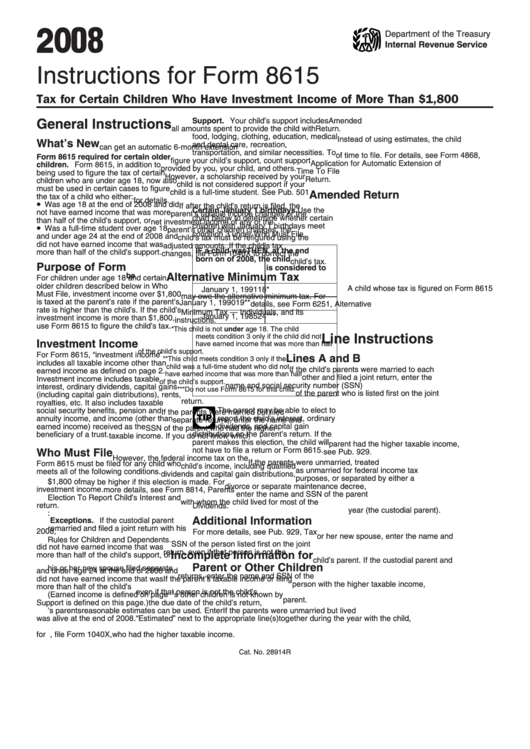

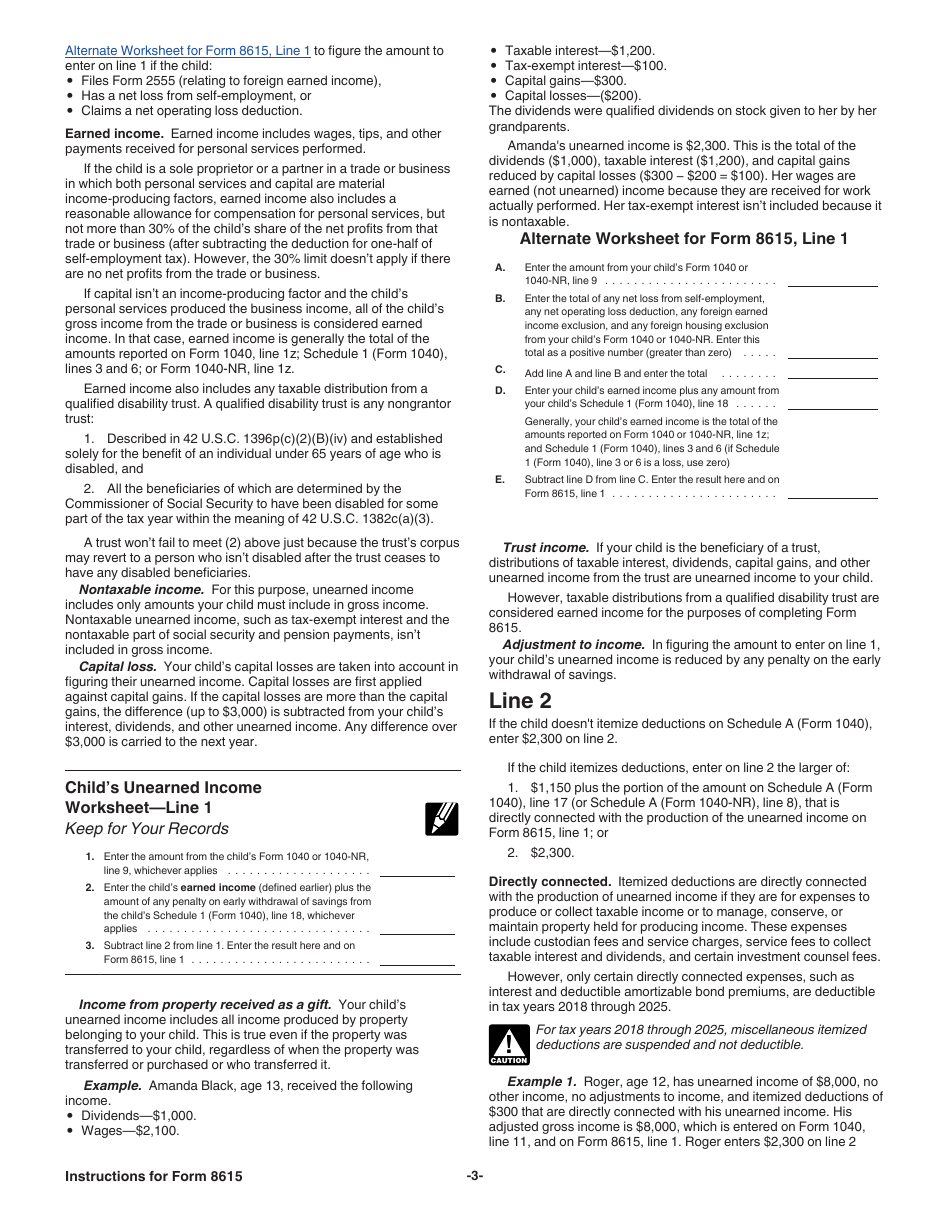

Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Try it for free now! For form 8615, unearned income includes all taxable income other. Section references are to the. Web kiddie tax (form 8615) changes for tax years 2020 and beyond. Complete, edit or print tax forms instantly. Ad upload, modify or create forms. Use get form or simply click on the template preview to open it in the editor. Web instructions for form 8615. It is used only with the 1040nr or 1040 form for the child.

Tax for certain children who have unearned income. For paperwork reduction act notice, see your tax return instructions. Web if the child's unearned income is more than $2,000, use form 8615 to figure the child's tax. Get ready for tax season deadlines by completing any required tax forms today. Ad upload, modify or create forms. Start completing the fillable fields and. Department of the treasury internal revenue service. You are required to file a tax return. It is used only with the 1040nr or 1040 form for the child. Use get form or simply click on the template preview to open it in the editor.

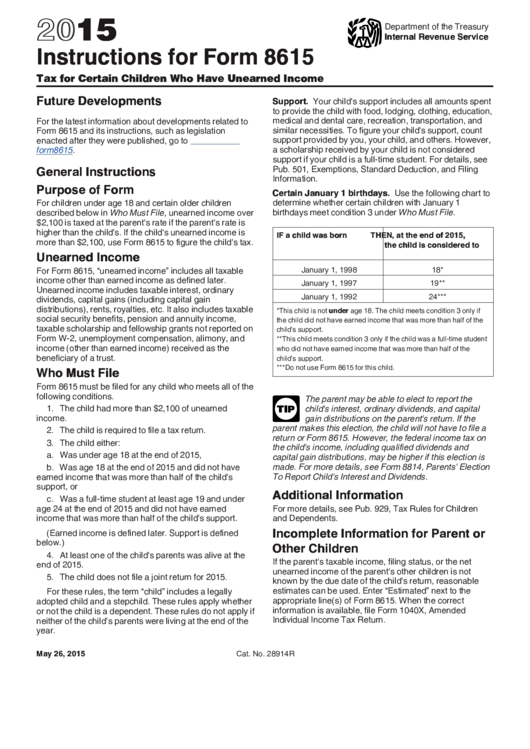

Instructions for IRS Form 8615 Tax For Certain Children Who Have

Start completing the fillable fields and. Ad upload, modify or create forms. Unearned income typically refers to investment income such as interest, dividends,. Department of the treasury internal revenue service. For form 8615, unearned income includes all taxable income other.

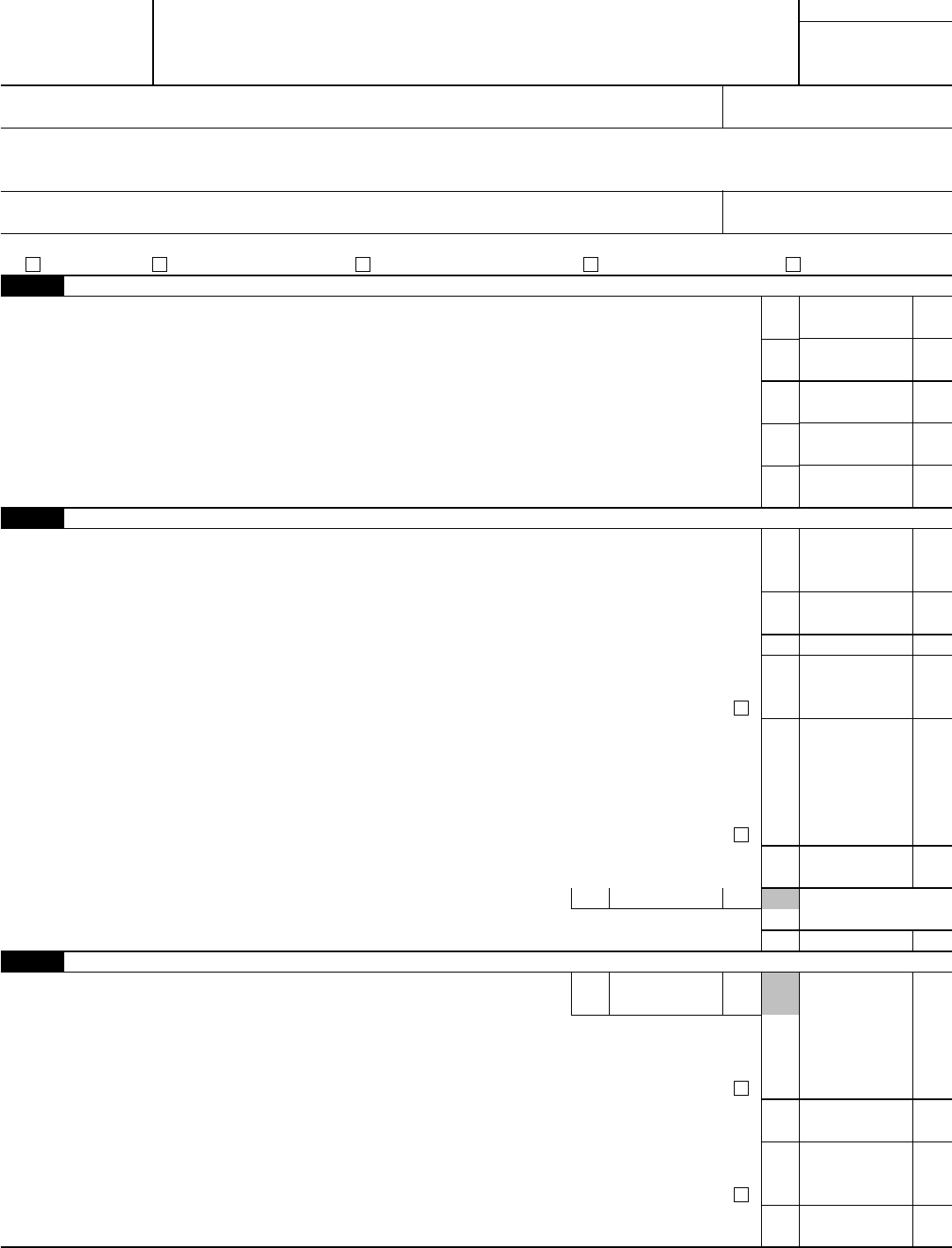

Fillable Form 8615 Tax For Certain Children Who Have Unearned

Use get form or simply click on the template preview to open it in the editor. Web and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned income tax worksheet, enter the amount from that form or. Web instructions for form 8615. Web form 8615 department of the treasury internal revenue service.

Instructions For Form 8615 Tax For Certain Children Who Have

The 8615 form was created by the irs in an. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's rate if the parent's rate is higher. Web form 8615 is used to calculate taxes on certain children's unearned income. The tax for certain children.

AIOU B.ED Code 8615 Past Papers Download free

Web form 8615 must be filed for any child who meets all of parent makes this election, the child will not have to file a the following conditions. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income attach to your form 1040 or form 1040nr. Try it for free now!.

Form 8615 Edit, Fill, Sign Online Handypdf

Web kiddie tax (form 8615) changes for tax years 2020 and beyond. Section references are to the. Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Web for children under age 18 and certain older children described below in.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Ad get ready for tax season deadlines by completing any required tax forms today. It is used only with the 1040nr or 1040 form for the child. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's rate if the parent's rate is higher. The.

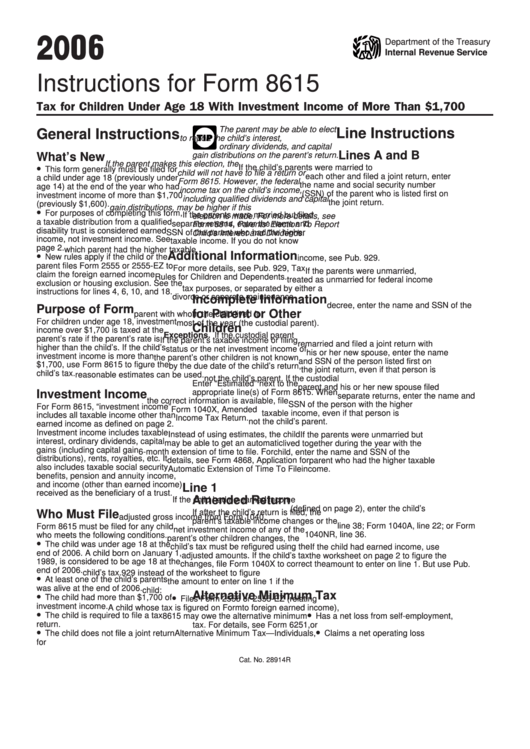

Instructions For Form 8615 Tax For Children Under Age 18 With

Use get form or simply click on the template preview to open it in the editor. Ad upload, modify or create forms. The service delivery logs are available for the documentation of a service event for individualized skills and socialization. The 8615 form was created by the irs in an. Unearned income typically refers to investment income such as interest,.

Form 8615 Office Depot

Unearned income typically refers to investment income such as interest, dividends,. Try it for free now! For form 8615, unearned income includes all taxable income other. Web this form is called tax for certain children who have unearned income. Web instructions for form 8615.

Form 8615 Instructions (2015) printable pdf download

Try it for free now! Web form 8615 is used to calculate taxes on certain children's unearned income. Web for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's rate if the parent's rate is higher. It is used only with the 1040nr or 1040 form.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Complete, edit or print tax forms instantly. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income attach to your form 1040 or form 1040nr. Get ready for tax season deadlines by completing any required tax forms today. Ad upload, modify or create forms. Start completing the fillable fields and.

Web And Capital Gain Tax Worksheet, The Schedule D Tax Worksheet, Schedule J, Form 8615, Or The Foreign Earned Income Tax Worksheet, Enter The Amount From That Form Or.

Unearned income typically refers to investment income such as interest, dividends,. Web form 8615 must be filed for any child who meets all of parent makes this election, the child will not have to file a the following conditions. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income attach to your form 1040 or form 1040nr. Texas health and human services subject:

It Is Used Only With The 1040Nr Or 1040 Form For The Child.

Complete, edit or print tax forms instantly. Start completing the fillable fields and. Ad upload, modify or create forms. Web if the child's unearned income is more than $2,000, use form 8615 to figure the child's tax.

Tax For Certain Children Who Have Unearned Income.

Web for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's rate if the parent's rate is higher. The tax for certain children who have unearned income that is reported on form 8615 was. Department of the treasury internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today.

For Paperwork Reduction Act Notice, See Your Tax Return Instructions.

You had more than $2,200 of unearned income. You are required to file a tax return. The service delivery logs are available for the documentation of a service event for individualized skills and socialization. The 8615 form was created by the irs in an.