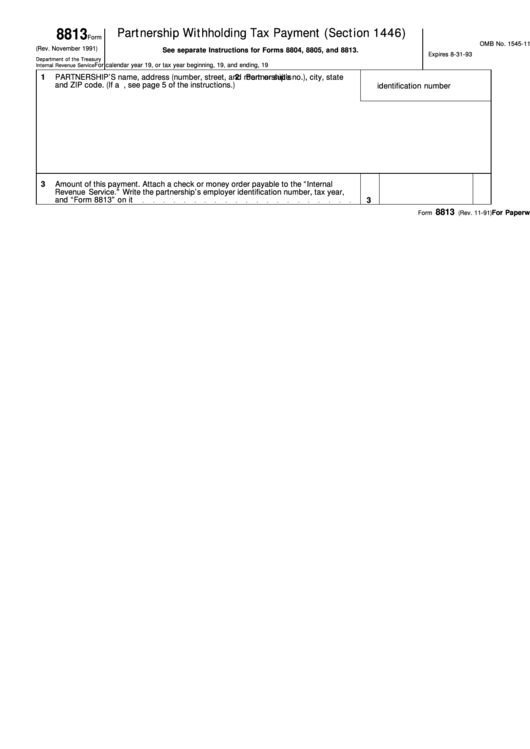

Form 8813 Instructions

Form 8813 Instructions - Taxpayer identification number (tin) to ensure proper crediting of the withholding tax when reporting to the irs, a partnership must provide a u.s. Internal revenue service form 8813(rev. Instructions for forms 8804, 8805 and 8813 2010 inst 8804, 8805 and 8813: Instructions for forms 8804, 8805 and 8813 2009 form 8813: Mail this voucher with a check Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and codes, and more. Web form 8813 is used by a partnership to pay the withholding tax under section 1446. Web inst 8804, 8805 and 8813: You can print other federal tax forms here. Don't attach the forms in pdf format to the form 1065 return.

Web form 8813 is used by a partnership to pay the withholding tax under section 1446. Instructions for forms 8804, 8805 and 8813 2009 form 8813: Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. Partnership withholding tax payment voucher (section 1446) Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income. Web form 8813 partnership withholding tax payment voucher (section 1446) omb no. Form 8813 must accompany each payment of section 1446 tax made during the partnership's tax year. Web form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually complete the forms and file them ny mail to the address specific in the irs instructions. Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign partners. Mail this voucher with a check

Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. Form 8813 must accompany each payment of section. Use form 8813 to pay the withholding tax under section 1446 to the united states treasury. Web instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax based on effectively connected taxable income allocable to foreign partners. Don't attach the forms in pdf format to the form 1065 return. Taxpayer identification number (tin) to ensure proper crediting of the withholding tax when reporting to the irs, a partnership must provide a u.s. Mail this voucher with a check See separate instructions for forms 8804, 8805, and 8813. 10681h partnership withholding tax payment voucher (section 1446) department of the treasury internal revenue service for paperwork reduction act notice, see separate instructions for forms 8804, 8805, and 8813. Internal revenue service form 8813(rev.

Scantron Form No 882 E Instructions Universal Network

See separate instructions for forms 8804, 8805, and 8813. Form 8813 must accompany each payment of section. You can print other federal tax forms here. Web form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually complete the forms and file them ny mail to the address specific in the irs instructions. Internal revenue service form 8813(rev.

8813

You can print other federal tax forms here. Partnership withholding tax payment voucher (section 1446) Web inst 8804, 8805 and 8813: Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and codes, and more. Instructions for forms 8804, 8805, and.

Form 8813 Partnership Withholding Tax Payment Voucher (Section 1446)…

Use form 8813 to pay the withholding tax under section 1446 to the united states treasury. Form 8813 must accompany each payment of section. Don't attach the forms in pdf format to the form 1065 return. Web form 8813 is used by a partnership to pay the withholding tax under section 1446. Mail this voucher with a check

Texas Blue Form 2022

Taxpayer identification number (tin) to ensure proper crediting of the withholding tax when reporting to the irs, a partnership must provide a u.s. Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. Instructions for forms 8804, 8805 and 8813 2009 form 8813: You can.

Form 8813 Instructions 2022 Fill online, Printable, Fillable Blank

Web form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually complete the forms and file them ny mail to the address specific in the irs instructions. Web inst 8804, 8805 and 8813: Partnership withholding tax payment voucher (section 1446) Instructions for forms 8804, 8805 and 8813 2011 inst 8804, 8805 and 8813: You can print other.

Form 8813 Partnership Withholding Tax Payment (Section 1446

Web form 8813 partnership withholding tax payment voucher (section 1446) omb no. Internal revenue service form 8813(rev. Form 8813 must accompany each payment of section 1446 tax made during the partnership's tax year. Instructions for forms 8804, 8805, and 8813 provides guidance to filers of forms 8804, 8805, and 8813 on how to pay and report section 1446 withholding tax.

LEGO Battle at the Pass Set 8813 Instructions Comes In Brick Owl

Web form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually complete the forms and file them ny mail to the address specific in the irs instructions. Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and.

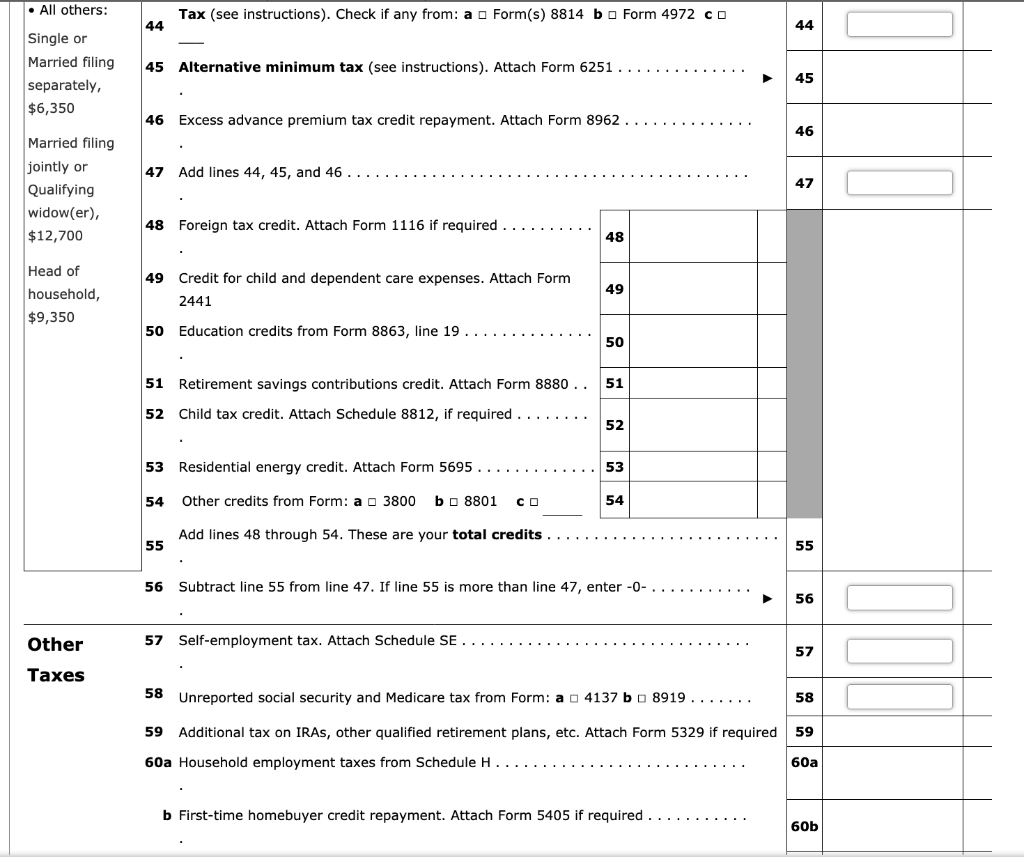

Note This Problem Is For The 2017 Tax Year. Janic...

Instructions for forms 8804, 8805 and 8813 2009 form 8813: Web use form 8813 to pay the withholding tax under section 1446 to the united states treasury. You can print other federal tax forms here. Mail this voucher with a check Web form 8813 is used by a partnership to pay the withholding tax under section 1446.

Download Instructions for IRS Form 8804, 8805, 8813 PDF Templateroller

Partnership withholding tax payment voucher (section 1446) Internal revenue service form 8813(rev. Mail this voucher with a check Form 8813 must accompany each payment of section. Web inst 8804, 8805 and 8813:

3.21.15 Withholding on Foreign Partners Internal Revenue Service

See separate instructions for forms 8804, 8805, and 8813. Form 8813 must accompany each payment of section 1446 tax made during the partnership's tax year. Web form 8813 is used by a partnership to pay the withholding tax under section 1446. Web form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually complete the forms and file.

Instructions For Forms 8804, 8805, And 8813 Provides Guidance To Filers Of Forms 8804, 8805, And 8813 On How To Pay And Report Section 1446 Withholding Tax Based On Effectively Connected Taxable Income.

Partnership withholding tax payment voucher (section 1446) Internal revenue service form 8813(rev. Web this is your quick reference guide for using the electronic federal tax payment system (eftps), with guides for making a payment, cancelling a payment, irs tax form numbers and codes, and more. Form 8813 must accompany each payment of section.

Web Inst 8804, 8805 And 8813:

Mail this voucher with a check 10681h partnership withholding tax payment voucher (section 1446) department of the treasury internal revenue service for paperwork reduction act notice, see separate instructions for forms 8804, 8805, and 8813. Web we last updated the partnership withholding tax payment voucher (section 1446) in february 2023, so this is the latest version of form 8813, fully updated for tax year 2022. Web use form 8813 to pay the withholding tax under section 1446 to the united states treasury.

Taxpayer Identification Number (Tin) To Ensure Proper Crediting Of The Withholding Tax When Reporting To The Irs, A Partnership Must Provide A U.s.

Web form 8813, partnership withholding tax payment voucher (section 1446) you'll need to manually complete the forms and file them ny mail to the address specific in the irs instructions. Instructions for forms 8804, 8805 and 8813 2011 inst 8804, 8805 and 8813: Web file form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership's tax year for u.s. Don't attach the forms in pdf format to the form 1065 return.

Web Instructions For Forms 8804, 8805, And 8813 Provides Guidance To Filers Of Forms 8804, 8805, And 8813 On How To Pay And Report Section 1446 Withholding Tax Based On Effectively Connected Taxable Income Allocable To Foreign Partners.

Form 8813 must accompany each payment of section 1446 tax made during the partnership's tax year. Instructions for forms 8804, 8805 and 8813 2009 form 8813: Use form 8813 to pay the withholding tax under section 1446 to the united states treasury. See separate instructions for forms 8804, 8805, and 8813.