Form 8829 2021

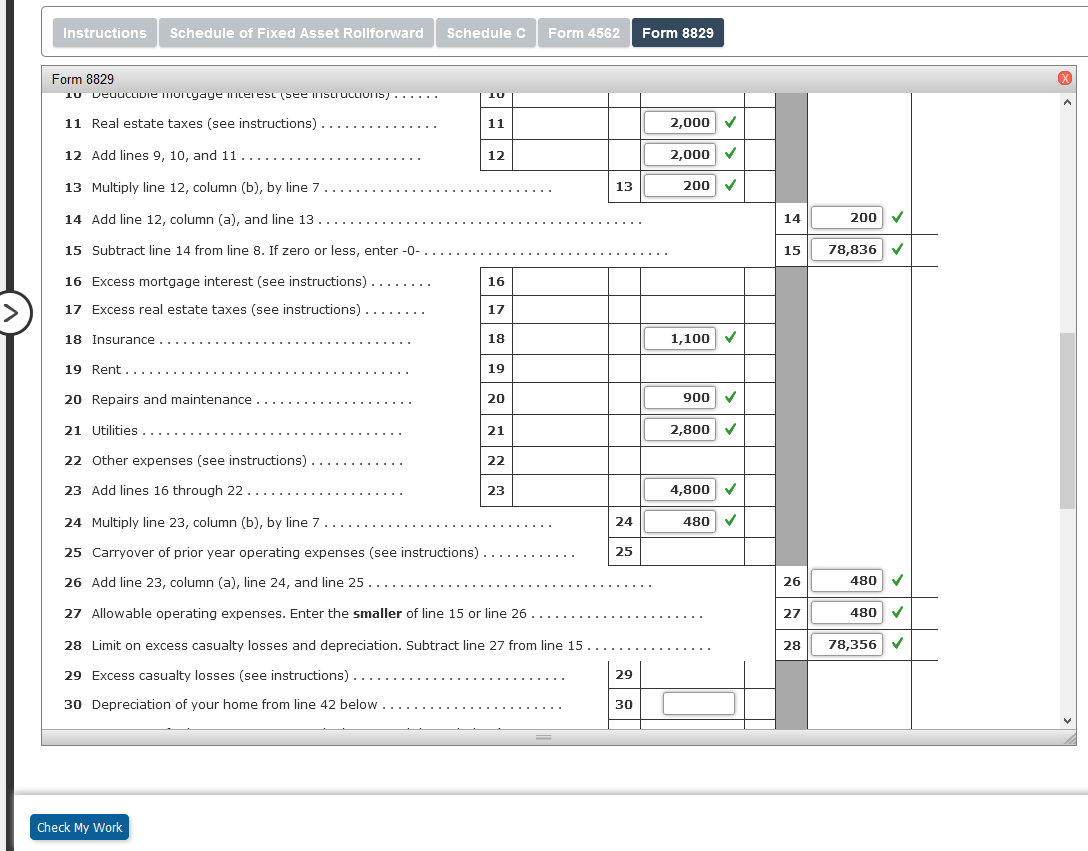

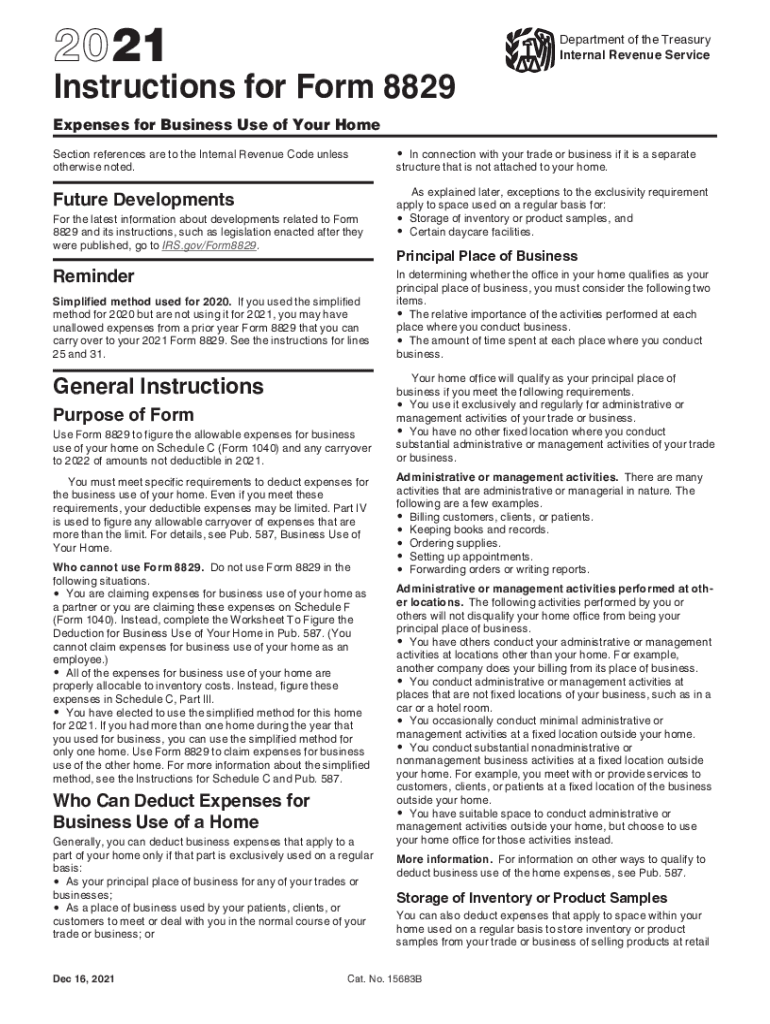

Form 8829 2021 - Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. Go to www.irs.gov/form8829 for instructions and the latest information. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Use get form or simply click on the template preview to open it in the editor. Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) file only with schedule c (form 1040). Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web irs form 8829 helps you determine what you can and cannot claim. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts.

Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. Use the cross or check marks in the top toolbar to select your answers in the list boxes. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) file only with schedule c (form 1040). Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Go to www.irs.gov/form8829 for instructions and the latest information. Use a separate form 8829 for each home you used for business during the year. Use a separate form 8829 for each home you used for the business during the year.

Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) file only with schedule c (form 1040). Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Go to www.irs.gov/form8829 for instructions and the latest information. Use a separate form 8829 for each home you used for business during the year. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Web irs form 8829 helps you determine what you can and cannot claim. Use a separate form 8829 for each home you used for the business during the year. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Start completing the fillable fields and carefully type in required information.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Use a separate form 8829 for each home you used for business during the year. One of the many benefits of working at home is that you can deduct legitimate expenses from.

Form_8829_explainer_PDF3 Camden County, NJ

Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) file only with schedule c (form 1040). Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. One of the many benefits of working at home is that you can deduct legitimate expenses from your taxes..

Simplified Method Worksheet 2021 Home Office Simplified Method

Use a separate form 8829 for each home you used for business during the year. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Web irs form 8829 is one of two ways to claim a home office deduction on your business.

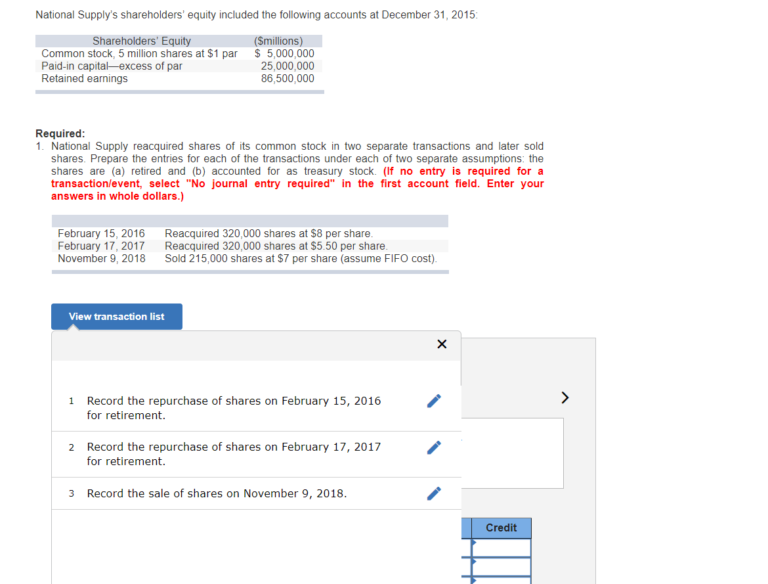

I NEED HELP WITH THE BLANKS PLEASE. """ALL

Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Use get form or simply click on the template preview to open it in the editor. Web the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments..

Deadline Corp. reported net of 1,692,900 for 2017. Deadline's

Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) file only with schedule c (form 1040). Irs form 8829 is used by small business owners to calculate the allowable expenses for business use of their home or apartment and total the amount of allowable deductions for operating expenses and losses..

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Use get form or simply click on the.

Form 8829 for the Home Office Deduction Credit Karma

Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. One of the many benefits of working at home is that you can deduct legitimate expenses.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

You must meet specific requirements to deduct expenses for the business use of your. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Use get form.

Revisiting Form 8829 Business Use of Home Expenses for 2020 Lear

Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Web form 8829, also called the expense for business use of your home, is the irs.

2018 Irs Instructions Form Pdf Fill Out and Sign Printable PDF

Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Start completing the fillable fields and carefully type in required information. Use get form.

One Of The Many Benefits Of Working At Home Is That You Can Deduct Legitimate Expenses From Your Taxes.

Start completing the fillable fields and carefully type in required information. Web internal revenue service (irs) form 8829 is the form used to calculate these deductions. Web form 8829, also called the expense for business use of your home, is the irs form you use to calculate and deduct your home office expenses. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts.

Web Form 8829 2021 Expenses For Business Use Of Your Home Department Of The Treasury Internal Revenue Service (99) File Only With Schedule C (Form 1040).

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of. Go to www.irs.gov/form8829 for instructions and the latest information. Web irs form 8829 helps you determine what you can and cannot claim.

Web Information About Form 8829, Expenses For Business Use Of Your Home, Including Recent Updates, Related Forms And Instructions On How To File.

Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Use a separate form 8829 for each home you used for the business during the year.

Web We Last Updated Federal Form 8829 In December 2022 From The Federal Internal Revenue Service.

Use get form or simply click on the template preview to open it in the editor. Use a separate form 8829 for each home you used for business during the year. You must meet specific requirements to deduct expenses for the business use of your. Web the irs and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments.