Form 8846 Instructions

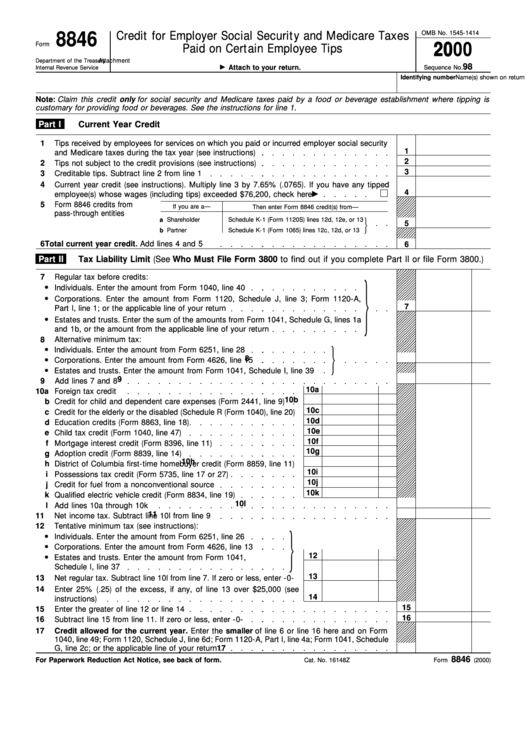

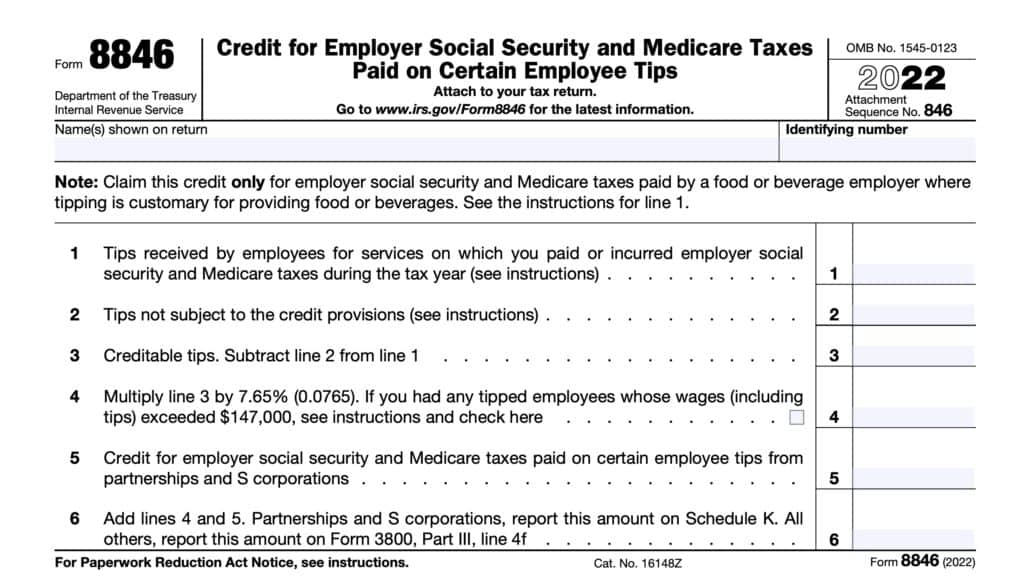

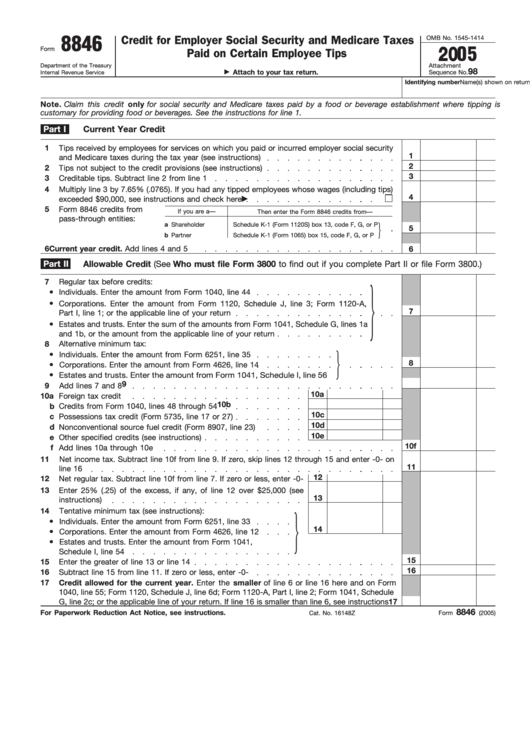

Form 8846 Instructions - Web irs form 8846 instructions by forrest baumhover july 5, 2023 reading time: 5 minutes watch video get the form! You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Web the fica tip credit can be requested when business tax returns are filed. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Include tips received from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Web published on december 19, 2022 last modified on may 30, 2023 category: You should only file form 8846 if you meet both of the following conditions: Web instructions for form 8846 are on page 2 of the form. Web form8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see instructions) 3

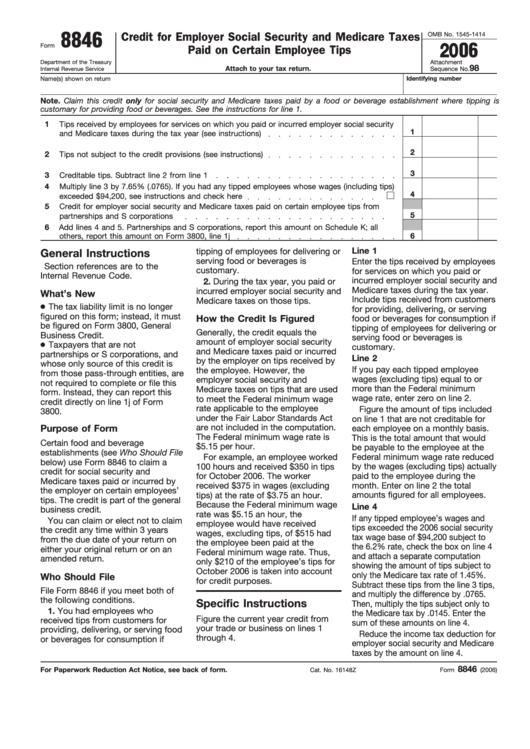

Step by step instructions comments the internal revenue code allows for certain business owners to take business tax credits to reduce their employee payroll costs. Determining if the fica tax tip applies to your business can be a challenge. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web published on december 19, 2022 last modified on may 30, 2023 category: It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. See participation in a reportable transaction, later, to determine if you participated in a reportable transaction. Web line 1 enter the tips received by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year. 5 minutes watch video get the form! You should only file form 8846 if you meet both of the following conditions: Web the fica tip credit can be requested when business tax returns are filed.

Web who should file file form 8846 if you meet both of the following conditions. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web form8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see instructions) 3 Web about form 8846, credit for employer social security and medicare taxes paid on certain employee tips. The credit applies to social security and medicare taxes that the employer pays on some employee tips. Web the fica tip credit can be requested when business tax returns are filed. Web irs form 8846 instructions by forrest baumhover july 5, 2023 reading time: Irs forms table of contents irs form 8846 how to calculate the credit qualifying conditions for tip income completing form 8846 filing for prior years filing for employee tax credits there are currently 15.3 million employees in the restaurant industry. Determining if the fica tax tip applies to your business can be a challenge. Web form 8846 gives certain food and beverage establishments a general business tax credit.

Form 8846 Credit for Employer Social Security and Medicare Taxes

See participation in a reportable transaction, later, to determine if you participated in a reportable transaction. For more information on the disclosure rules, see regulations. Web form 8846 gives certain food and beverage establishments a general business tax credit. Web instructions for form 8846 are on page 2 of the form. You had employees who received tips from customers for.

U.S. TREAS Form treasirs88462001

It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. 5 minutes watch video get the form! Web line 1 enter the tips received by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year. Web published.

Credit For Employer Social Security And Medicare Taxes Paid On Certain

Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Filing this form can help your business reduce its tax burden. Determining if the fica tax tip applies to your business can be a challenge. Web who should file file form 8846.

Form 8846 Credit for Employer Social Security and Medicare Taxes

Include tips received from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Determining if the fica tax tip applies to your business can be a challenge. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes.

IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. Determining if the fica tax.

Tax Forms Teach Me! Personal Finance

5 minutes watch video get the form! Filing this form can help your business reduce its tax burden. It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. See participation in a reportable transaction, later, to determine if you participated in a reportable transaction. Web about.

Fillable Form 8846 Credit For Employer Social Security And Medicare

Step by step instructions comments the internal revenue code allows for certain business owners to take business tax credits to reduce their employee payroll costs. The credit applies to social security and medicare taxes that the employer pays on some employee tips. Irs forms table of contents irs form 8846 how to calculate the credit qualifying conditions for tip income.

Fillable Form 8846 Credit For Employer Social Security And Medicare

Determining if the fica tax tip applies to your business can be a challenge. 5 minutes watch video get the form! Web published on december 19, 2022 last modified on may 30, 2023 category: For more information on the disclosure rules, see regulations. Certain food and beverage establishments use this form to claim a credit for social security and medicare.

Form 8846 In Quickbooks FORM.UDLVIRTUAL.EDU.PE

Web irs form 8846 instructions by forrest baumhover july 5, 2023 reading time: For more information on the disclosure rules, see regulations. Irs forms table of contents irs form 8846 how to calculate the credit qualifying conditions for tip income completing form 8846 filing for prior years filing for employee tax credits there are currently 15.3 million employees in the.

IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

Web the fica tip credit can be requested when business tax returns are filed. You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Determining if the fica tax tip applies to your business can be a challenge. Web.

It Is Reported On Irs Form 8846, Which Is Sometimes Called Credit For Employer Social Security And Medicare Taxes Paid On Certain Employee Tips.

5 minutes watch video get the form! Web form 8846 gives certain food and beverage establishments a general business tax credit. You should only file form 8846 if you meet both of the following conditions: Web form8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see instructions) 3

Filing This Form Can Help Your Business Reduce Its Tax Burden.

Include tips received from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary. Web about form 8846, credit for employer social security and medicare taxes paid on certain employee tips. See participation in a reportable transaction, later, to determine if you participated in a reportable transaction. You had employees who received tips from customers for providing, delivering, or serving food or beverages for consumption if tipping of employees for delivering or serving food or beverages is customary.

You Had Employees Who Received Tips From Customers For Providing, Delivering, Or Serving Food Or Beverages For Consumption If Tipping Of Employees For Delivering Or Serving Food Or Beverages Is Customary.

For more information on the disclosure rules, see regulations. The credit applies to social security and medicare taxes that the employer pays on some employee tips. Web line 1 enter the tips received by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year. Web instructions for form 8846 are on page 2 of the form.

Certain Food And Beverage Establishments Use This Form To Claim A Credit For Social Security And Medicare Taxes Paid Or Incurred By The Employer On Certain Employees’ Tips.

Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web who should file file form 8846 if you meet both of the following conditions. Step by step instructions comments the internal revenue code allows for certain business owners to take business tax credits to reduce their employee payroll costs. Irs forms table of contents irs form 8846 how to calculate the credit qualifying conditions for tip income completing form 8846 filing for prior years filing for employee tax credits there are currently 15.3 million employees in the restaurant industry.