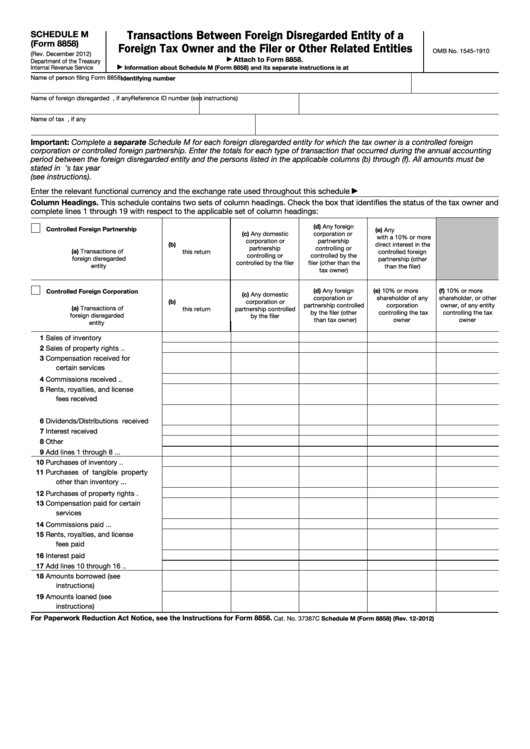

Form 8858 Sch M

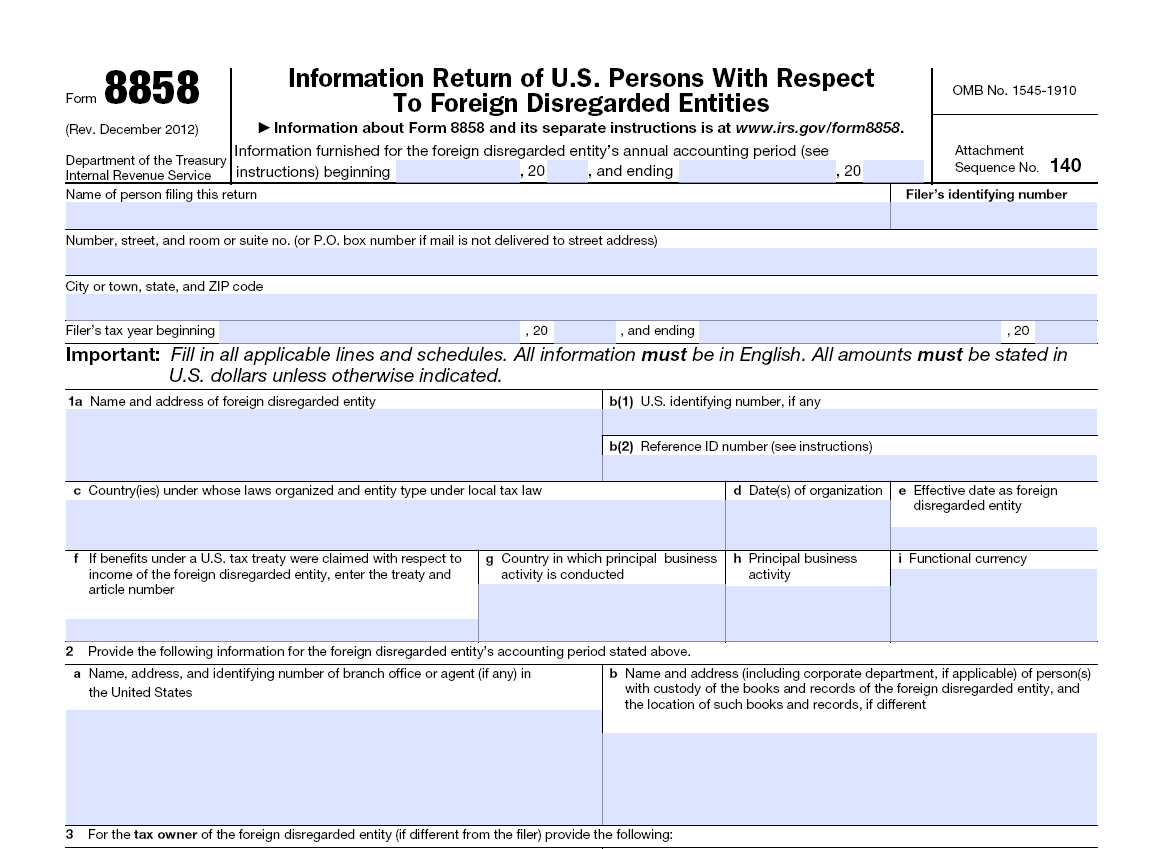

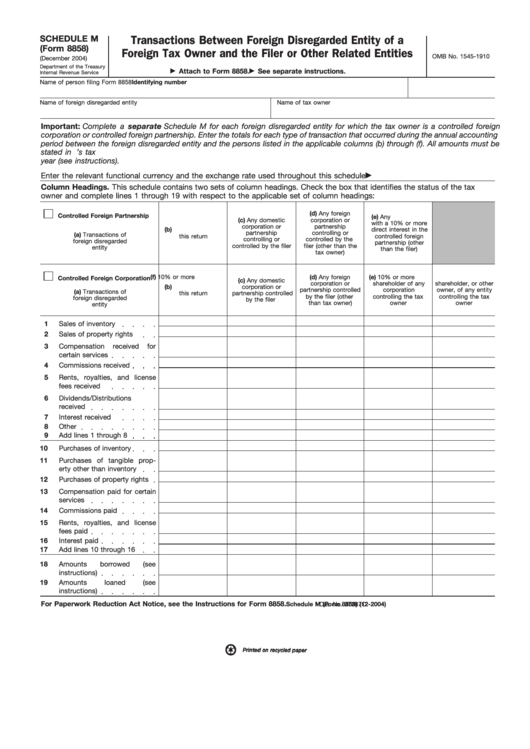

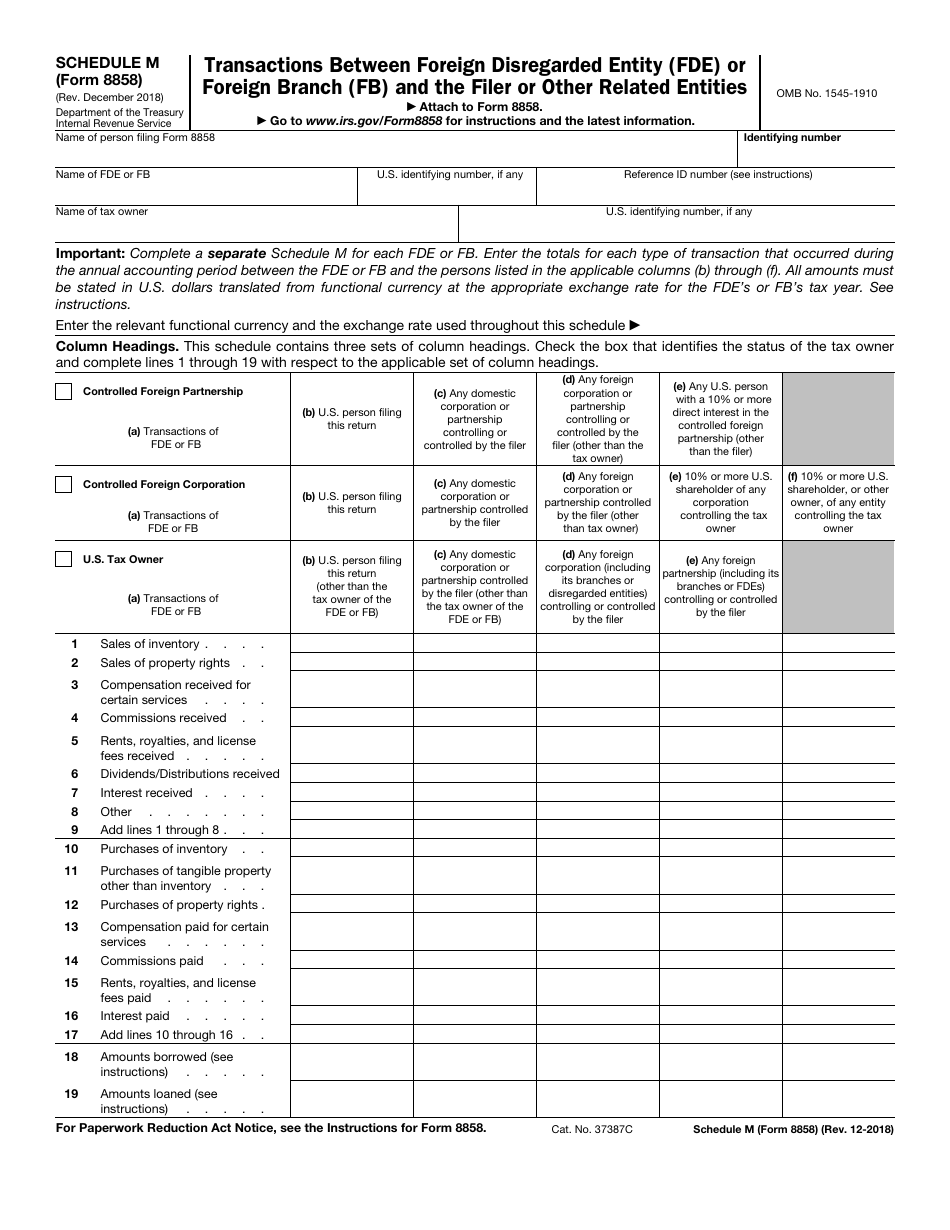

Form 8858 Sch M - Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that occurred during the fde’s or fb’s annual accounting period ending with or within the u.s. Web schedule m (form 8858) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities (rev. Go to www.irs.gov/form8858 for instructions. Person shareholder of transactions of foreign corporation controlled foreign filing this return corporation (other than the u.s. Taxpayer who owns a foreign business or an interest in a foreign business (corporation, partnership or llc), there are a number of forms that you must complete and file with your standard 1040f income tax return. Go to www.irs.gov/form8858 for instructions and the latest information. September 2021) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities department of the treasury internal revenue service attach to form 8858. Web (d) any other foreign corporation or partnership controlled by u.s. Web schedule m (form 8858). Web the irs 8858 form is used to report foreign disregarded entities (fde) and branches.

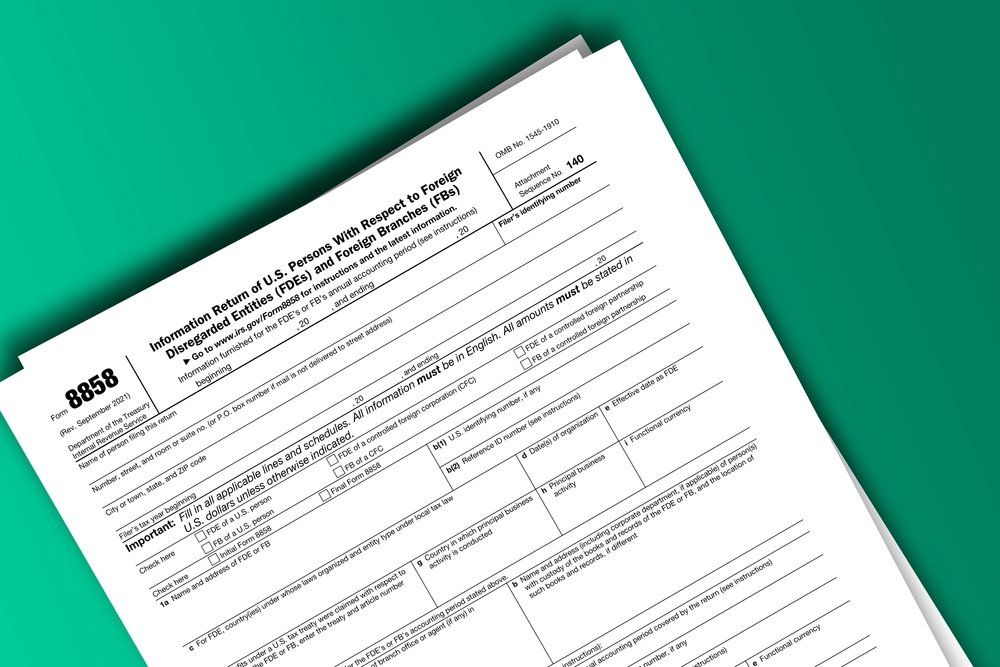

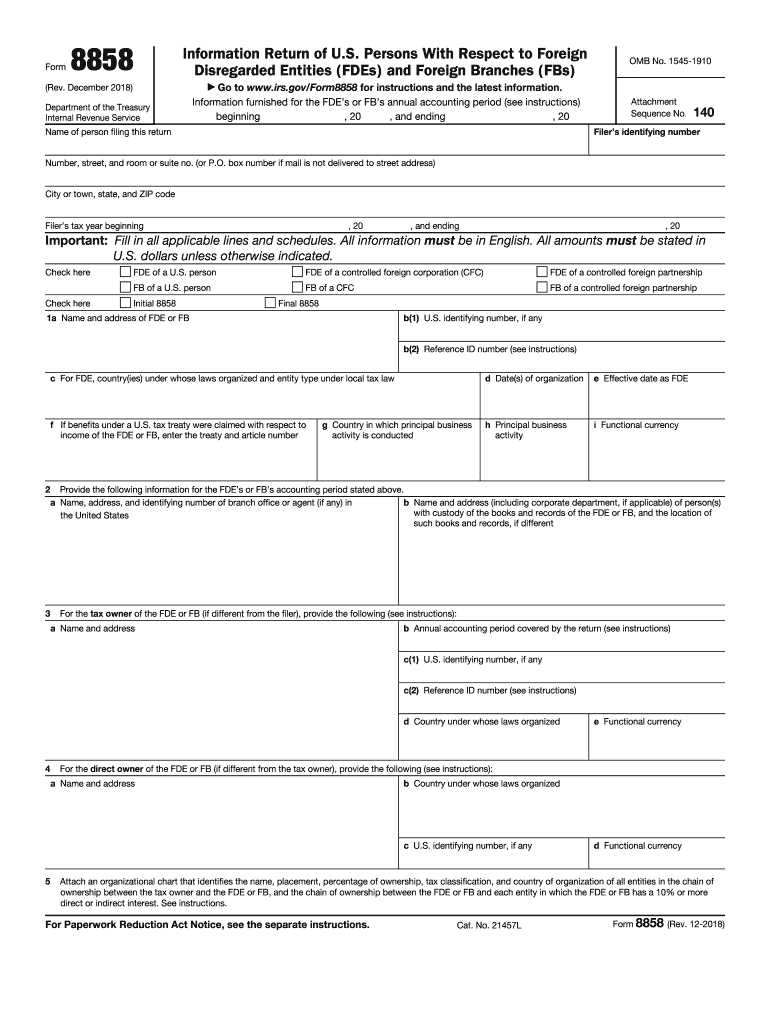

Web form 8858 is used by certain u.s. Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs), which expanded the requirement to file this form to include the reporting of foreign branch operations of u.s. Person filing this return 10% or more u.s. Web schedule m (form 8858) (rev. September 2021) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities department of the treasury internal revenue service attach to form 8858. Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs). Go to www.irs.gov/form8858 for instructions. Web (d) any other foreign corporation or partnership controlled by u.s. September 2021) department of the treasury internal revenue service name of person filing form 8858 omb no. When there is a foreign disregarded entity, the rules are different.

September 2021) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities department of the treasury internal revenue service attach to form 8858. Web schedule m (form 8858) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities (rev. Web in december 2018, the irs issued revised instructions to form 8858, information return of u.s. Complete the entire form 8858 and the separate schedule m (form 8858). Category 4 filers of form 5471. September 2021) department of the treasury internal revenue service name of person filing form 8858 omb no. Web the irs 8858 form is used to report foreign disregarded entities (fde) and branches. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances, indirectly or constructively to satisfy the reporting requirements of sections 6011, 6012, 6031, and 6038, and related regulations. Web schedule m (form 8858). Us taxes on foreign disregarded entities as an expat or u.s.

Form 8858 (Schedule M) Transactions between Foreign Disregarded

Us taxes on foreign disregarded entities as an expat or u.s. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances, indirectly or constructively to satisfy the reporting requirements of sections 6011, 6012, 6031, and 6038, and related regulations. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the.

Form 8858 (Schedule M) Transactions between Foreign Disregarded

Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that occurred during the fde’s or fb’s annual accounting period ending with or within the u.s. Web in december 2018, the irs issued revised instructions to form 8858, information return of u.s. Persons that own a foreign.

US Expat Tax Compliance Foreign Disregarded EntitiesUS Expat Tax

Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs), which expanded the requirement to file this form to include the reporting of foreign branch operations of u.s. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances, indirectly or constructively to satisfy the reporting requirements of sections 6011, 6012, 6031, and 6038, and related.

Fill Free fillable F8858sm Schedule M (Form 8858) (Rev. December 2018

Web (d) any other foreign corporation or partnership controlled by u.s. Complete the entire form 8858 and the separate schedule m (form 8858). Web form 8858 is used by certain u.s. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances, indirectly or constructively to satisfy the reporting requirements of sections 6011, 6012, 6031, and 6038, and.

Fillable Schedule M (Form 8858) Transactions Between Foreign

Web schedule m (form 8858) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities (rev. Web form 8858 is used by certain u.s. Go to www.irs.gov/form8858 for instructions and the latest information. Web the irs 8858 form is used to report foreign disregarded entities (fde) and branches. Taxpayer who owns a foreign.

IRS Form 8858 Used With Respect to Foreign Disregarded Entities SF

September 2021) department of the treasury internal revenue service. Us taxes on foreign disregarded entities as an expat or u.s. Web schedule m (form 8858) (rev. Person shareholder of transactions of foreign corporation controlled foreign filing this return corporation (other than the u.s. Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs).

IRS Form 8858 Schedule M Download Fillable PDF or Fill Online

September 2021) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities department of the treasury internal revenue service attach to form 8858. Persons that are required to file form 5471 with respect to a controlled foreign corporation (cfc) that is a tax owner of an fde or operates an fb at any.

Fillable Form 8858 Schedule M Transactions Between Foreign

September 2021) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities department of the treasury internal revenue service attach to form 8858. Web form 8858 is used by certain u.s. Web (d) any other foreign corporation or partnership controlled by u.s. Person that is required to file schedule m (form 8858) (see.

Form 8858 Information Return of U.S. Persons With Respect to Foreign

Web schedule m (form 8858) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities (rev. Web schedule m (form 8858) (rev. Persons with respect to foreign disregarded entities (fdes) and foreign branches (fbs). Web form 8858 is used by certain u.s. Us taxes on foreign disregarded entities as an expat or u.s.

Form 8858 Fill out & sign online DocHub

Taxpayer who owns a foreign business or an interest in a foreign business (corporation, partnership or llc), there are a number of forms that you must complete and file with your standard 1040f income tax return. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that.

Us Taxes On Foreign Disregarded Entities As An Expat Or U.s.

Go to www.irs.gov/form8858 for instructions. Web in december 2018, the irs issued revised instructions to form 8858, information return of u.s. Persons that own a foreign disregarded entity (fde) directly or, in certain circumstances, indirectly or constructively to satisfy the reporting requirements of sections 6011, 6012, 6031, and 6038, and related regulations. Person that is required to file schedule m (form 8858) (see who must file, earlier) must file the schedule to report the transactions that occurred during the fde’s or fb’s annual accounting period ending with or within the u.s.

Persons With Respect To Foreign Disregarded Entities (Fdes) And Foreign Branches (Fbs).

September 2021) transactions between foreign disregarded entity (fde) or foreign branch (fb) and the filer or other related entities department of the treasury internal revenue service attach to form 8858. Web (d) any other foreign corporation or partnership controlled by u.s. Web schedule m (form 8858) (rev. Taxpayer who owns a foreign business or an interest in a foreign business (corporation, partnership or llc), there are a number of forms that you must complete and file with your standard 1040f income tax return.

Web Form 8858 Is Used By Certain U.s.

When there is a foreign disregarded entity, the rules are different. Persons that are required to file form 5471 with respect to a controlled foreign corporation (cfc) that is a tax owner of an fde or operates an fb at any time during the cfc's annual accounting period. September 2021) department of the treasury internal revenue service name of person filing form 8858 omb no. Category 4 filers of form 5471.

Persons With Respect To Foreign Disregarded Entities (Fdes) And Foreign Branches (Fbs), Which Expanded The Requirement To File This Form To Include The Reporting Of Foreign Branch Operations Of U.s.

Web the irs 8858 form is used to report foreign disregarded entities (fde) and branches. Go to www.irs.gov/form8858 for instructions and the latest information. Complete the entire form 8858 and the separate schedule m (form 8858). Web schedule m (form 8858).