Form 886-A Irs

Form 886-A Irs - Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended returns, for. Web the validity of the issues involved, and. Web 22 hours agosyros to report second quarter 2023 financial results on tuesday, august 8, 2023. Web usted puede calificar para el estado civil de cabeza de familia si reúne los tres requisitos siguientes: Web a letter from your employer on company letterhead or stationary indicating dates of employment and gross amount of wages paid and withholdings deducted. Web form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Web a statement of account from a child support agency. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web in other words, if the taxpayer has the opportunity to a full or partial refund if the tax benefits are not sustained, then this type of transaction is considered to be a transaction which is. Web irs form 886 a rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 136 votes how to fill out and sign 886 a form online?

Web when and how to file. Get ready for tax season deadlines by completing any required tax forms today. Web the validity of the issues involved, and. Web a letter from your employer on company letterhead or stationary indicating dates of employment and gross amount of wages paid and withholdings deducted. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended returns, for. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web what makes the irs form 886 a legally valid? Web usted puede calificar para el estado civil de cabeza de familia si reúne los tres requisitos siguientes: Web 22 hours agosyros to report second quarter 2023 financial results on tuesday, august 8, 2023. Web there are several ways to submit form 4868.

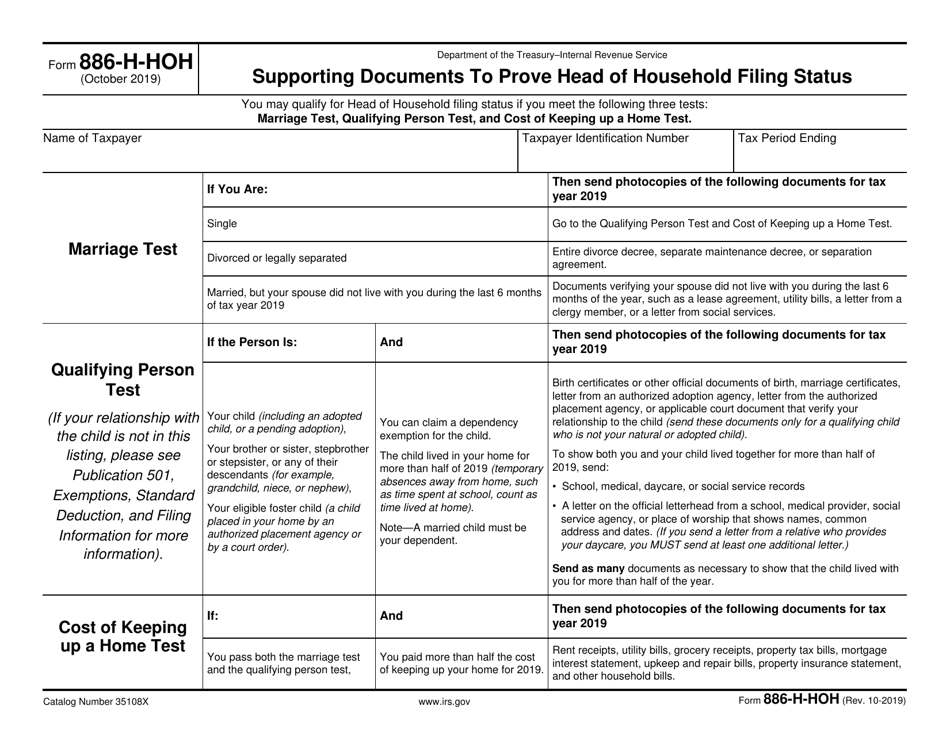

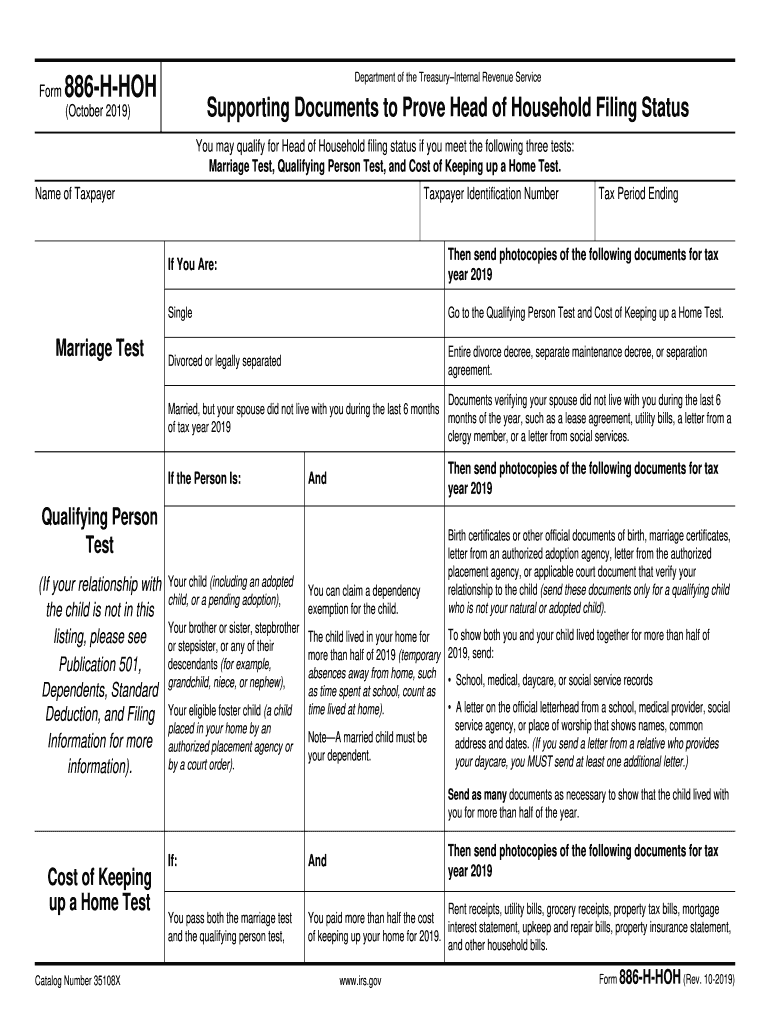

Web supporting documents to prove head of household filing status you may qualify for head of household filing status if you meet the following three tests: Web a statement of account from a child support agency. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Web when and how to file. Web the validity of the issues involved, and. Web a letter from your employer on company letterhead or stationary indicating dates of employment and gross amount of wages paid and withholdings deducted. Taxpayers can fax the separate. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended returns, for. Ad access irs tax forms.

IRS Form 886HHOH Download Fillable PDF or Fill Online Supporting

Web there are several ways to submit form 4868. The form 886 l isn’t an. A statement that a closing conference was or was not held with the taxpayer. A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for. Web the validity of the issues involved, and.

Irs Form 886 A Worksheet Escolagersonalvesgui

The form 886 l isn’t an. Web there are several ways to submit form 4868. Web when and how to file. Ad access irs tax forms. Web supporting documents to prove head of household filing status you may qualify for head of household filing status if you meet the following three tests:

Audit Form 886A Tax Lawyer Answer & Response to IRS

Web the validity of the issues involved, and. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended returns, for. Web supporting documents to prove head of household filing status you may qualify for head of household filing status if you meet the following three tests: Web usted puede.

irs form 886a may 2022 Fill Online, Printable, Fillable Blank form

Complete, edit or print tax forms instantly. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Get your online template and fill it.

Irs Form 886 A Worksheet Ivuyteq

Web when and how to file. Web supporting documents to prove head of household filing status you may qualify for head of household filing status if you meet the following three tests: The form 886 l isn’t an. A statement that a closing conference was or was not held with the taxpayer. Web irs form 886 a rating ★ ★.

H Hoh Fill Out and Sign Printable PDF Template signNow

Taxpayers can fax the separate. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended returns, for. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if you are filing more than one form 8886 with your tax.

2018 IRS Form 886HEIC Fill Online, Printable, Fillable, Blank PDFfiller

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web a statement of account from a child support agency. Web usted puede calificar para el estado civil de cabeza de familia si reúne los tres requisitos siguientes: El requisito de matrimonio, el requisito de persona calificada, y el. Get ready.

IRS Audit Letter 566(CG) Sample 4

Taxpayers can fax the separate. Web when and how to file. More from h&r block in addition to sending form. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web supporting documents to prove head of household filing status you may qualify for head of household filing status if you meet.

2011 IRS Form 886HEIC Fill Online, Printable, Fillable, Blank pdfFiller

More from h&r block in addition to sending form. Web irs form 886 a rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 136 votes how to fill out and sign 886 a form online? El requisito de matrimonio, el requisito de persona calificada, y el. Web supporting documents to prove.

Irs Form 886 A Worksheet Promotiontablecovers

Web supporting documents to prove head of household filing status you may qualify for head of household filing status if you meet the following three tests: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web a letter from your employer on company letterhead or stationary indicating dates of employment.

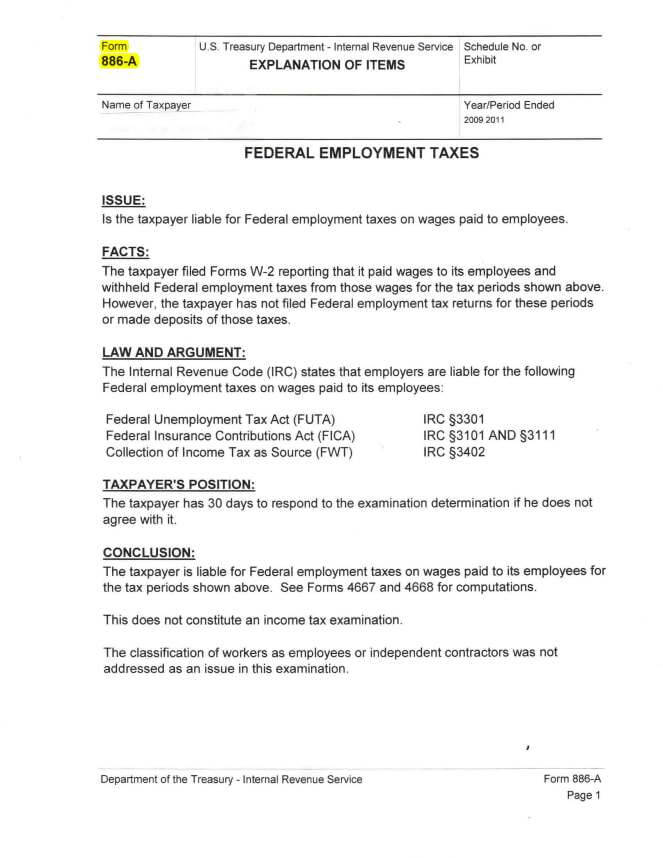

The Title Of Irs Form 886A Is Explanation Of Items.

Get ready for tax season deadlines by completing any required tax forms today. Web irs form 886 a rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 136 votes how to fill out and sign 886 a form online? Web supporting documents to prove head of household filing status you may qualify for head of household filing status if you meet the following three tests: Ad access irs tax forms.

El Requisito De Matrimonio, El Requisito De Persona Calificada, Y El.

Web a letter from your employer on company letterhead or stationary indicating dates of employment and gross amount of wages paid and withholdings deducted. Web 22 hours agosyros to report second quarter 2023 financial results on tuesday, august 8, 2023. Web form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. A statement that a closing conference was or was not held with the taxpayer.

Web There Are Several Ways To Submit Form 4868.

Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Web usted puede calificar para el estado civil de cabeza de familia si reúne los tres requisitos siguientes: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for.

Web If You Are Filing More Than One Form 8886 With Your Tax Return, Sequentially Number Each Form 8886 And Enter The Statement Number For This Form 8886.

More from h&r block in addition to sending form. Web when and how to file. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended returns, for. Web in other words, if the taxpayer has the opportunity to a full or partial refund if the tax benefits are not sustained, then this type of transaction is considered to be a transaction which is.