Form 8868 Mailing Address

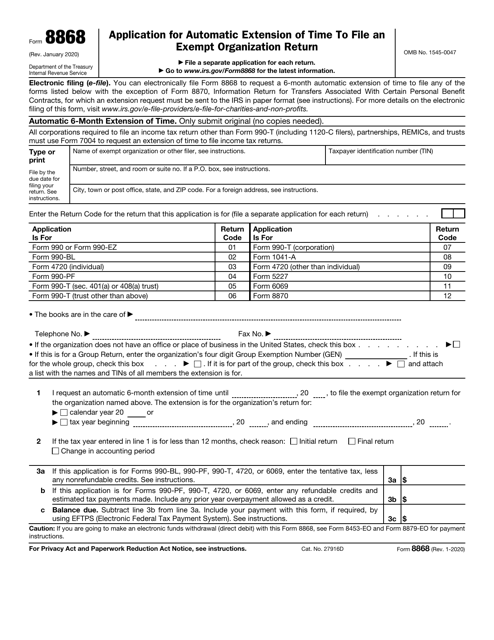

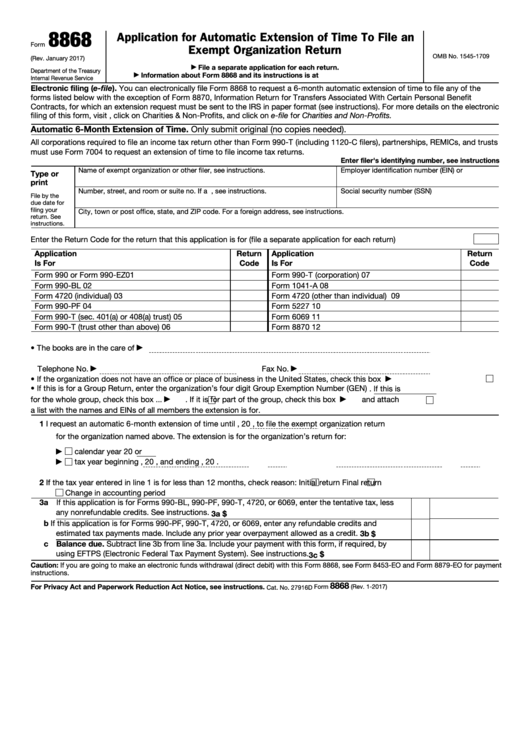

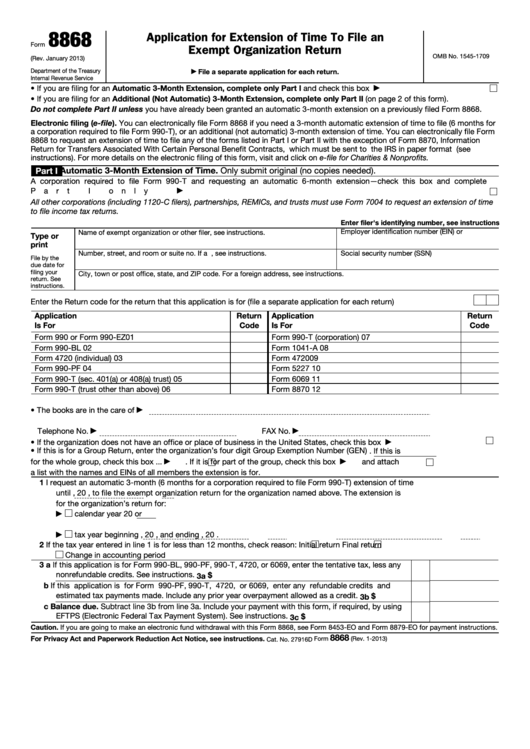

Form 8868 Mailing Address - If you file timely form 8868 via paper and. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Complete the form and mail it to the below address: Use form 8868, application for extension of time to file an exempt organization return pdf, to. Arkansas, connecticut, delaware, district of columbia, illinois, indiana, iowa, kentucky,. A new address shown on form 8868. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. The irs may also extend your time to file a return if you have changed your address. The irs does accept this form online and by mail. Web form 4868 addresses for taxpayers and tax professionals.

Income tax return for certain political organizations. Web if the organization’s mailing address has changed since it filed its last return, use form 8822, change of address, to notify the irs of the change. Web extension of time to file exempt organization returns. Tax liability and payment for 2022. The irs does accept this form online and by mail. Can you mail form 8868? It contains 0 bedroom and 1 bathroom. If yes, what is their mailing address? Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. Web form 4868 addresses for taxpayers and tax professionals.

If yes, what is their mailing address? Complete the form and mail it to the below address: You can mail your extension form 8868 and. A new address shown on form 8868. If you file timely form 8868 via paper and. Web form 4868 addresses for taxpayers and tax professionals. The irs may also extend your time to file a return if you have changed your address. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. Can you mail form 8868? Organization details such as name, address, ein/tax id, tax year.

File Form 8868 Online Efile 990 Extension with the IRS

Web extension of time to file exempt organization returns. It contains 0 bedroom and 1 bathroom. 8868 fielding st, detroit, mi is a single family home that contains 807 sq ft and was built in 1948. Web if the organization’s mailing address has changed since it filed its last return, use form 8822, change of address, to notify the irs.

How to File A LastMinute 990 Extension With Form 8868

If yes, what is their mailing address? Can you mail form 8868? Organization details such as name, address, ein/tax id, tax year. Web extension of time to file exempt organization returns. A new address shown on form 8868.

This Is Where You Need To Mail Your Form 7004 This Year Blog

Ad download or email irs 8868 & more fillable forms, register and subscribe now! Tax liability and payment for 2022. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. The irs does accept this form online and by mail. Income.

File Form 8868 Online Efile 990 Extension with the IRS

Arkansas, connecticut, delaware, district of columbia, illinois, indiana, iowa, kentucky,. A new address shown on form 8868. Organization details such as name, address, ein/tax id, tax year. The irs does accept this form online and by mail. 8868 fielding st, detroit, mi is a single family home that contains 807 sq ft and was built in 1948.

Form 8868 Application for Extension of Time to File an Exempt

If you need more time to file your nonprofit tax. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Complete the form and mail it to the below address: If your organization's mailing address has changed since the last time it filed a return, use form 8822, change of address, to notify the irs about.

Form 8868 Fillable and Editable PDF Template

If you need more time to file your nonprofit tax. 8868 fielding st, detroit, mi is a single family home that contains 807 sq ft and was built in 1948. You can mail your extension form 8868 and. Use form 8868, application for extension of time to file an exempt organization return pdf, to. It contains 0 bedroom and 1.

IRS Form 8868 Download Fillable PDF or Fill Online Application for

Web extension of time to file exempt organization returns. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. Tax liability and payment for 2022. 8868 fielding st, detroit, mi is a single family home that contains 807 sq ft and.

Fillable Form 8868 Application For Automatic Extension Of Time To

A new address shown on form 8868. Web extension of time to file exempt organization returns. The irs does accept this form online and by mail. Ad download or email irs 8868 & more fillable forms, register and subscribe now! 8868 fielding st, detroit, mi is a single family home that contains 807 sq ft and was built in 1948.

File Form 8868 Online Efile 990 Extension with the IRS

Web extension of time to file exempt organization returns. Web if the organization’s mailing address has changed since it filed its last return, use form 8822, change of address, to notify the irs of the change. 8868 fielding st, detroit, mi is a single family home that contains 807 sq ft and was built in 1948. Organization details such as.

Fillable Form 8868 Application For Extension Of Time To File An

If you file timely form 8868 via paper and. Arkansas, connecticut, delaware, district of columbia, illinois, indiana, iowa, kentucky,. Web extension of time to file exempt organization returns. The irs does accept this form online and by mail. If you need more time to file your nonprofit tax.

Income Tax Return For Certain Political Organizations.

If you need more time to file your nonprofit tax. Web if the organization’s mailing address has changed since it filed its last return, use form 8822, change of address, to notify the irs of the change. If yes, what is their mailing address? Web extension of time to file exempt organization returns.

It Contains 0 Bedroom And 1 Bathroom.

Organization details such as name, address, ein/tax id, tax year. Arkansas, connecticut, delaware, district of columbia, illinois, indiana, iowa, kentucky,. Tax liability and payment for 2022. The irs may also extend your time to file a return if you have changed your address.

Use Form 8868, Application For Extension Of Time To File An Exempt Organization Return Pdf, To.

If your organization's mailing address has changed since the last time it filed a return, use form 8822, change of address, to notify the irs about the address change. A new address shown on form 8868. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your. Web form 4868 addresses for taxpayers and tax professionals.

Complete The Form And Mail It To The Below Address:

Can you mail form 8868? You can mail your extension form 8868 and. If you file timely form 8868 via paper and. The irs does accept this form online and by mail.