Form 8915 F Instructions

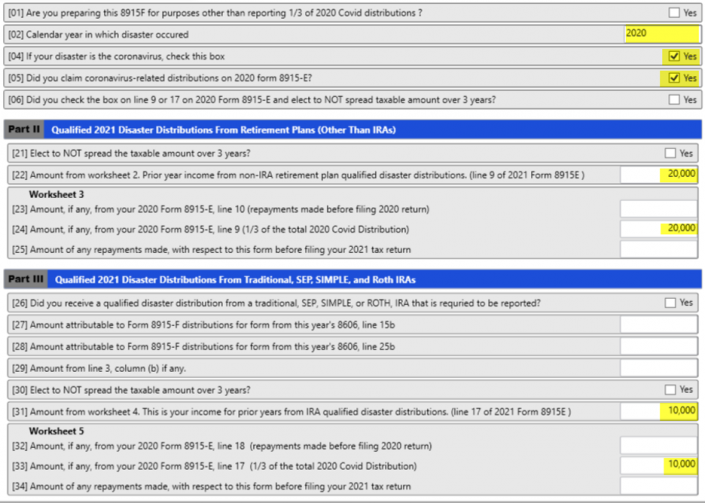

Form 8915 F Instructions - Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. There were no disaster distributions allowed in 2021. Web before you begin (see instructions for details): Create an 1040 file with any name. You can choose to use worksheet 1b even if you are not required to do so. Screens for these forms can be. Previous versions of form 8915 only lasted. .1 who must file.2 when and where to file.2 what is a qualified. Web before you begin (see instructions for details): Do not enter the prior year distribution on 1099, roth, 8608 or 5329.

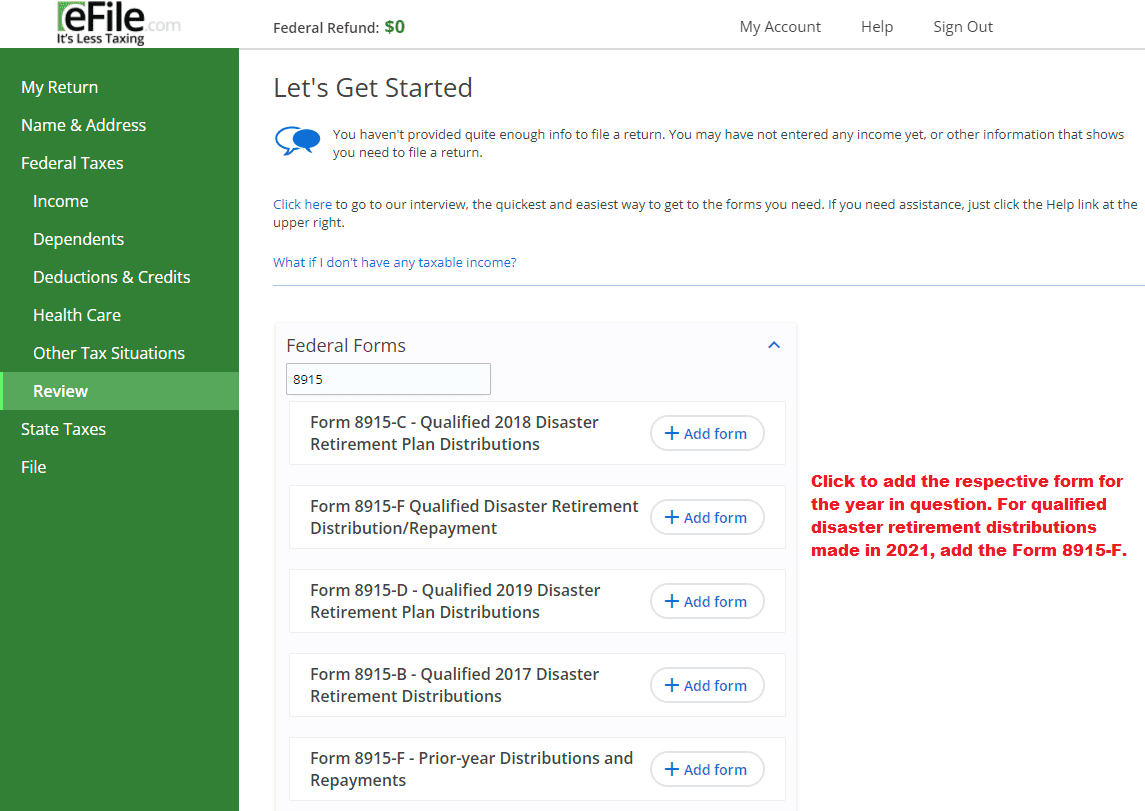

Screens for these forms can be. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. Web from the main menu of the tax return select: Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. Create an 1040 file with any name. Generally this will match the distribution that was taxable but if you took. .1 who must file.2 when and where to file.2 what is a qualified. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not required to do so. Previous versions of form 8915 only lasted.

.1 who must file.2 when and where to file.2 what is a qualified. Generally this will match the distribution that was taxable but if you took. Web before you begin (see instructions for details): Previous versions of form 8915 only lasted. You can choose to use worksheet 1b even if you are not required to do so. Screens for these forms can be. There were no disaster distributions allowed in 2021. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. Create an 1040 file with any name. Web from the main menu of the tax return select:

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

You can choose to use worksheet 1b even if you are not required to do so. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. Create an 1040 file with any name. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web before you begin (see instructions.

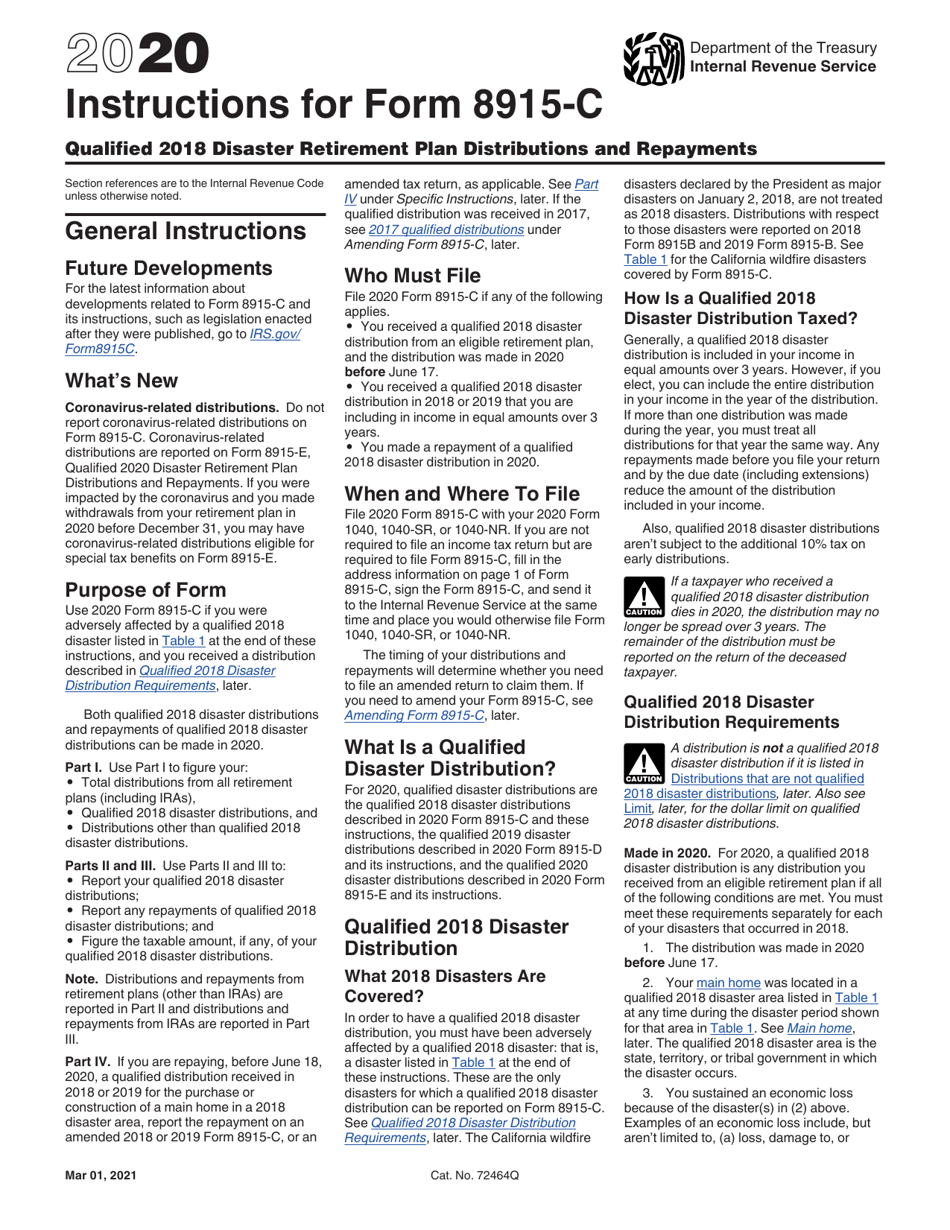

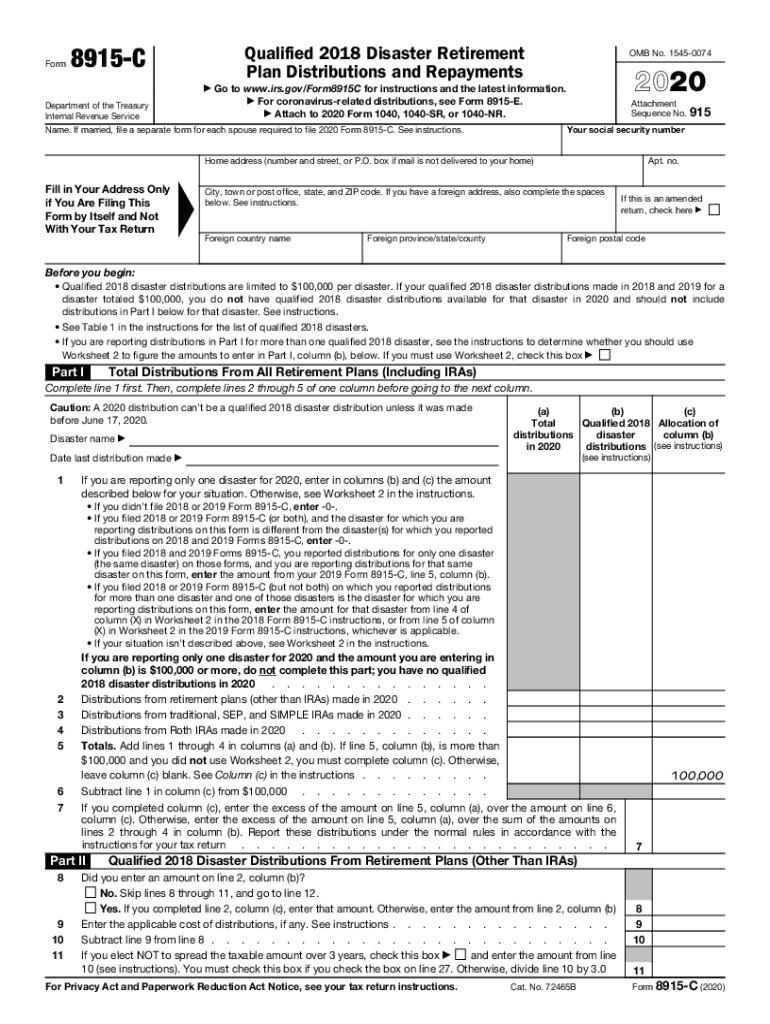

Download Instructions for IRS Form 8915C Qualified 2018 Disaster

Screens for these forms can be. Generally this will match the distribution that was taxable but if you took. .1 who must file.2 when and where to file.2 what is a qualified. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. There were no disaster distributions allowed in 2021.

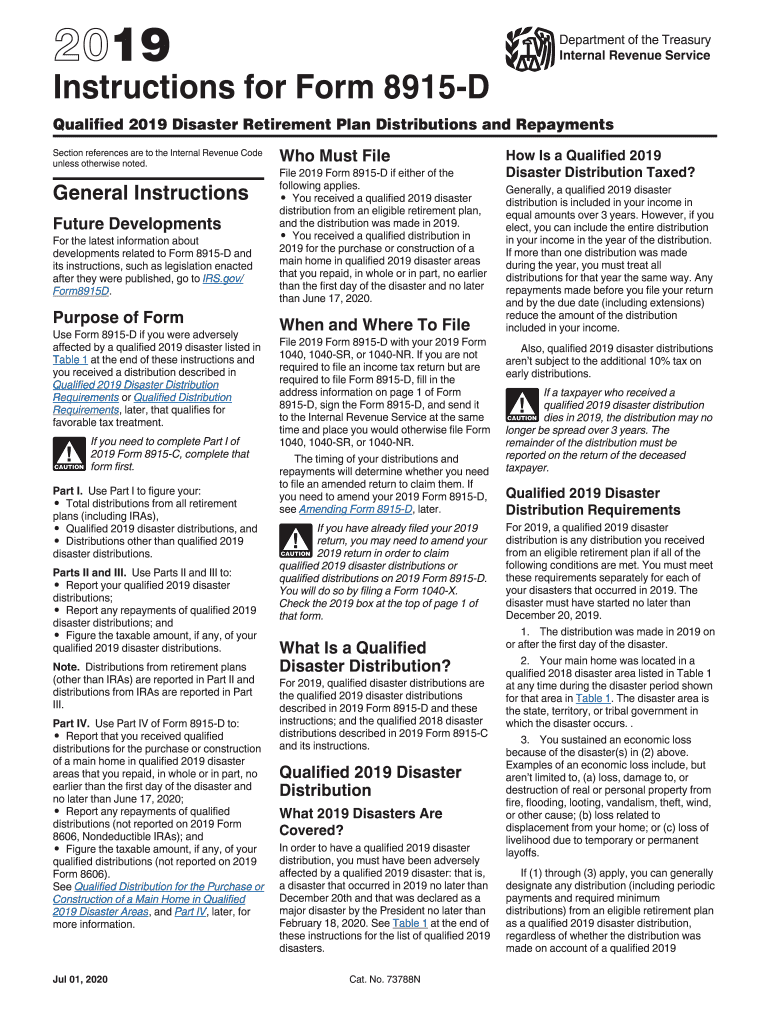

Irs Instructions 8915 Form Fill Out and Sign Printable PDF Template

Generally this will match the distribution that was taxable but if you took. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web before you begin (see instructions for details): You can choose to use worksheet 1b even if you are not required to do so. Web before you begin (see instructions for details):

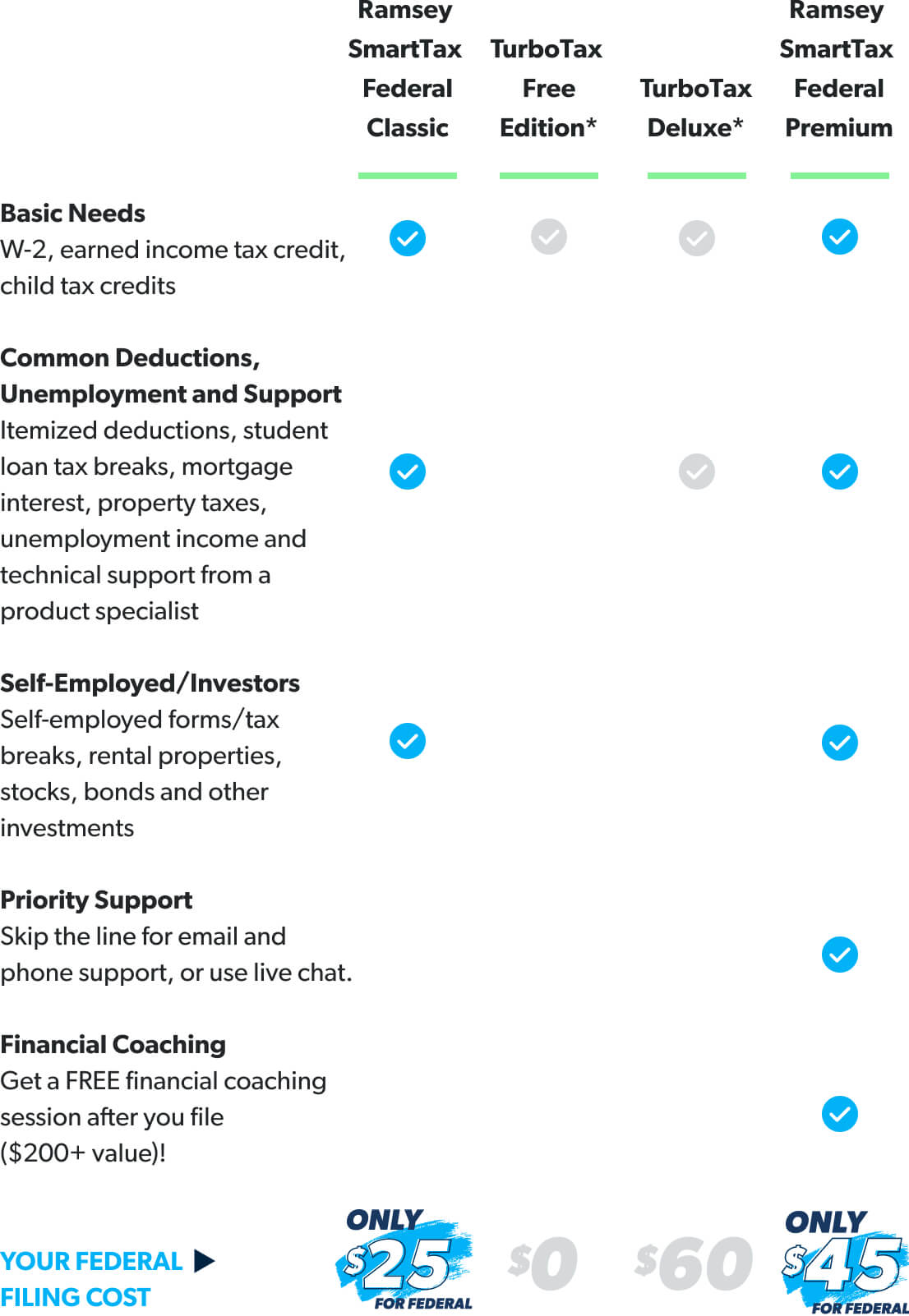

form 8915 e instructions turbotax Renita Wimberly

Web before you begin (see instructions for details): Generally this will match the distribution that was taxable but if you took. Web from the main menu of the tax return select: Do not enter the prior year distribution on 1099, roth, 8608 or 5329. See worksheet 1b, later, to determine whether you must use worksheet 1b.

DiasterRelated Early Distributions via Form 8915

You can choose to use worksheet 1b even if you are not required to do so. There were no disaster distributions allowed in 2021. Previous versions of form 8915 only lasted. Web from the main menu of the tax return select: Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the.

Basic 8915F Instructions for 2021 Taxware Systems

Generally this will match the distribution that was taxable but if you took. Previous versions of form 8915 only lasted. Web before you begin (see instructions for details): This is the amount of early withdrawal. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

See worksheet 1b, later, to determine whether you must use worksheet 1b. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. Generally this will match the distribution that was taxable but if you took. This is the amount of early withdrawal. Screens for these forms can be.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

This is the amount of early withdrawal. Web from the main menu of the tax return select: See worksheet 1b, later, to determine whether you must use worksheet 1b. .1 who must file.2 when and where to file.2 what is a qualified. Generally this will match the distribution that was taxable but if you took.

8915c Fill out & sign online DocHub

Do not enter the prior year distribution on 1099, roth, 8608 or 5329. Generally this will match the distribution that was taxable but if you took. Web before you begin (see instructions for details): Web before you begin (see instructions for details): This is the amount of early withdrawal.

form 8915 e instructions turbotax Renita Wimberly

There were no disaster distributions allowed in 2021. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. .1 who must file.2 when and where to file.2 what is a qualified. Web from the main menu of the tax return select: Web before you begin (see instructions for details):

This Is The Amount Of Early Withdrawal.

Generally this will match the distribution that was taxable but if you took. Web from the main menu of the tax return select: Do not enter the prior year distribution on 1099, roth, 8608 or 5329. See worksheet 1b, later, to determine whether you must use worksheet 1b.

Previous Versions Of Form 8915 Only Lasted.

There were no disaster distributions allowed in 2021. Create an 1040 file with any name. Web before you begin (see instructions for details): .1 who must file.2 when and where to file.2 what is a qualified.

Screens For These Forms Can Be.

Web before you begin (see instructions for details): You can choose to use worksheet 1b even if you are not required to do so. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the.