Form 8938 Filing Requirements

Form 8938 Filing Requirements - Web review a chart comparing the foreign asset types and filing requirements for form 8938 and the foreign bank and financial accounts (fbar) form. You are unmarried and the total value of your specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year Web find out if you need to file irs form 8938 with the expat tax preparation experts at h&r block. You must file form 8938 if: Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Examples of financial accounts include: Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the financial crimes enforcement network (fincen) on fincen form 114, report of foreign bank and financial accounts (fbar). Web owning the following types of assets also must be reported on form 8938 if your total foreign asset value exceeds the appropriate threshold: Web refer to form 8938 instructions for more information on assets that do not have to be reported.

Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. You are unmarried and the total value of your specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year The form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Form 8938 threshold & requirements. Web find out if you need to file irs form 8938 with the expat tax preparation experts at h&r block. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the financial crimes enforcement network (fincen) on fincen form 114, report of foreign bank and financial accounts (fbar). Examples of financial accounts include: Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. You are a specified person (either a specified individual or a specified domestic entity).

See specified individual, specified domestic entity,. Retirement assets maintained at foreign institutions. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. You are a specified person (either a specified individual or a specified domestic entity). The form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. Web refer to form 8938 instructions for more information on assets that do not have to be reported. Web owning the following types of assets also must be reported on form 8938 if your total foreign asset value exceeds the appropriate threshold: One of the most confusing parts of filing taxes as an expat is knowing which forms you have to fill out and what income you need to report. Web if you are required to file form 8938, you must report the specified foreign financial assets in which you have an interest even if none of the assets affects your tax liability for the year.

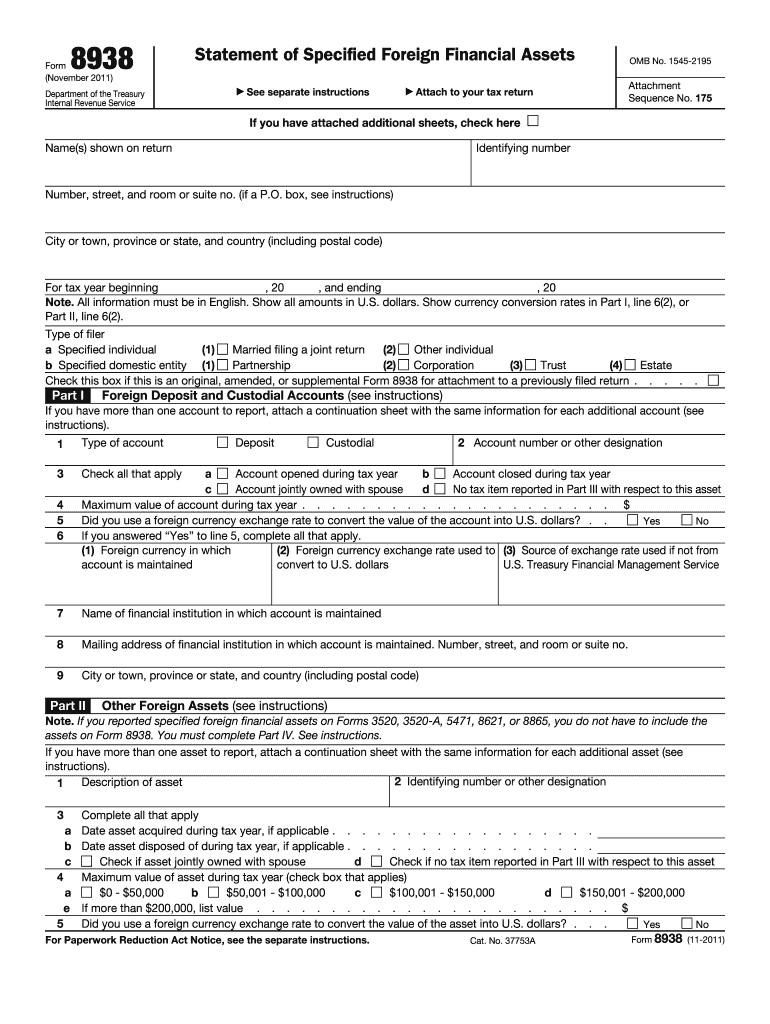

Form 8938 Blank Sample to Fill out Online in PDF

You are unmarried and the total value of your specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year Web you must file form 8938 if you must file an income tax return and: Web if you are required to file form 8938,.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

You are a specified person (either a specified individual or a specified domestic entity). Web owning the following types of assets also must be reported on form 8938 if your total foreign asset value exceeds the appropriate threshold: See specified individual, specified domestic entity,. Web you must file form 8938 if you must file an income tax return and: You.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web review a chart comparing the foreign asset types and filing requirements for form 8938 and the foreign bank and financial accounts (fbar) form. Retirement assets maintained at foreign institutions. Bonds issued by a foreign company. You are a specified person (either a specified individual or a specified domestic entity). Web taxpayers generally have an obligation to report their foreign.

Review a chart comparing the foreign asset types and filing

You are a specified person (either a specified individual or a specified domestic entity). Web find out if you need to file irs form 8938 with the expat tax preparation experts at h&r block. Web review a chart comparing the foreign asset types and filing requirements for form 8938 and the foreign bank and financial accounts (fbar) form. Web information.

IRS Reporting Requirements for Foreign Account Ownership and Trust

Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. Web owning the following types of assets also must be reported on form 8938 if your total foreign asset value exceeds the appropriate threshold: Examples of financial accounts include: See specified.

Form 8938 Who Has to Report Foreign Assets & How to File

Retirement assets maintained at foreign institutions. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web find out if you need to file irs form 8938 with the expat tax preparation experts at h&r block..

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web refer to form 8938 instructions for more information on assets that do not have to be reported. Bonds issued by a foreign company. The form.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Examples of financial accounts include: Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Form 8938 threshold & requirements. The form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Web find out if you need.

Comparison of Form 8938 and FBAR Requirements ZMB Tax Consultants

Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web review a chart comparing the foreign asset types and filing requirements for form 8938 and the foreign bank and financial accounts (fbar) form. Retirement assets maintained at foreign institutions. You must file form 8938 if: Web owning the.

Form 8938 Filing Requirements US Expats and FATCA Bright!Tax Expat

Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web if you are required to file form 8938, you.

Web We Have Prepared A Summary Explaining The Basics Of Form 8938, Who Has To File, And When.

You must file form 8938 if: Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the financial crimes enforcement network (fincen) on fincen form 114, report of foreign bank and financial accounts (fbar). Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. See specified individual, specified domestic entity,.

Web Refer To Form 8938 Instructions For More Information On Assets That Do Not Have To Be Reported.

Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. One of the most confusing parts of filing taxes as an expat is knowing which forms you have to fill out and what income you need to report. You are unmarried and the total value of your specified foreign financial assets is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the tax year Web review a chart comparing the foreign asset types and filing requirements for form 8938 and the foreign bank and financial accounts (fbar) form.

Web Find Out If You Need To File Irs Form 8938 With The Expat Tax Preparation Experts At H&R Block.

Form 8938 threshold & requirements. The form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Web you must file form 8938 if you must file an income tax return and: Bonds issued by a foreign company.

Web If You Are Required To File Form 8938, You Must Report The Specified Foreign Financial Assets In Which You Have An Interest Even If None Of The Assets Affects Your Tax Liability For The Year.

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Any level of ownership in a foreign business entity or trust. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Retirement assets maintained at foreign institutions.