Form 8949 Software

Form 8949 Software - Form 8949 allows you and the irs to reconcile amounts. Web as a tax software product manager or developer, your tax software application can greatly simplify and streamline the tax prep experience of investors and traders by integrating. You then integrate the results with your tax software. Complete, edit or print tax forms instantly. For detailed integration information, click on the name in the software. Web how to integrate the form 8949.com app outputs with freetaxusa tax software freetaxusa has added the ability to attach supporting documents for sales of stocks. Web we can convert your spreadsheet of realized gain and loss information to irs schedule d, form 8949, and form 8949 statements. Upload, modify or create forms. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Easily find the legal forms software you're looking for w/ our comparison grid.

Ad review the best legal forms software for 2023. Web how to integrate the form 8949.com app outputs with freetaxusa tax software freetaxusa has added the ability to attach supporting documents for sales of stocks. Easily find the legal forms software you're looking for w/ our comparison grid. Sales and other dispositions of capital assets. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Form 8949 allows you and the irs to reconcile amounts. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Ad review the best legal forms software for 2023. Web where is form 8949? Web trademax is a full featured form 8949 capital gain and wash sales calculator tax software designed for active trader or investors to handle wash sales and manage their trade data.

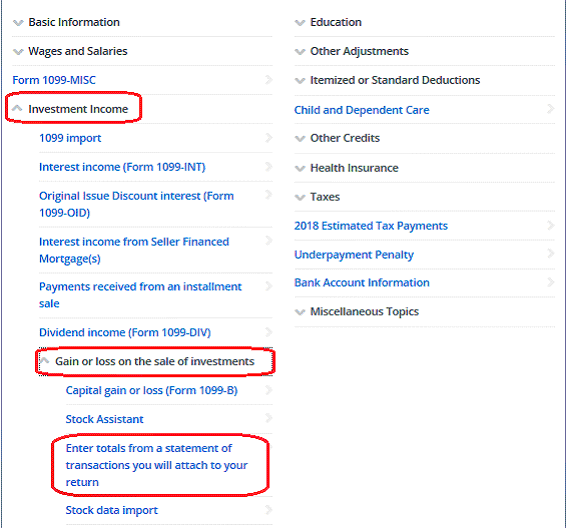

Web we can convert your spreadsheet of realized gain and loss information to irs schedule d, form 8949, and form 8949 statements. Web most people use the schedule d form to report capital gains and losses that result from the sale or trade of certain property during the year. Web as a tax software product manager or developer, your tax software application can greatly simplify and streamline the tax prep experience of investors and traders by integrating. Complete, edit or print tax forms instantly. Sales and other dispositions of capital assets. Form 8949 (sales and other dispositions of capital assets) records the details of your. Web using this method, a form 8949 can be generated with the software, and provide accurate tax reporting. Easily find the legal forms software you're looking for w/ our comparison grid. For detailed integration information, click on the name in the software. Web what is form 8949 used for?

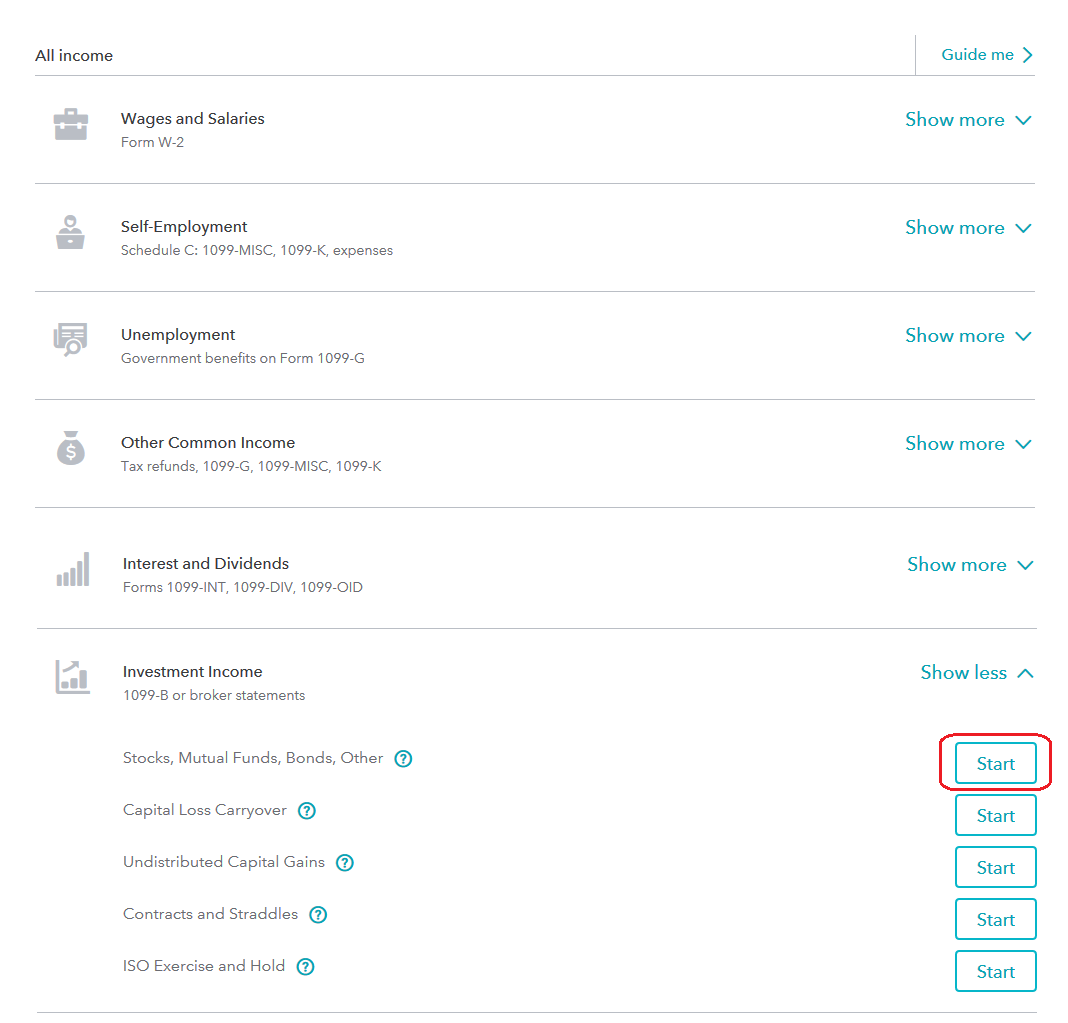

Entering Form 8949 Totals Into TurboTax® TradeLog Software

Web we can convert your spreadsheet of realized gain and loss information to irs schedule d, form 8949, and form 8949 statements. Complete, edit or print tax forms instantly. For detailed integration information, click on the name in the software. You can upload an excel. Web most people use the schedule d form to report capital gains and losses that.

Form 8949 Sales and Other Dispositions of Capital Assets (2014) Free

Sales and other dispositions of capital assets. Web what is form 8949 used for? Complete, edit or print tax forms instantly. (3) review the app results. You can upload an excel.

Form 8949 Instructions & Information on Capital Gains/Losses Form

Web what is form 8949 used for? Web use form 8949 to report sales and exchanges of capital assets. (3) review the app results. Ad access irs tax forms. Web how to integrate the form 8949.com app outputs with freetaxusa tax software freetaxusa has added the ability to attach supporting documents for sales of stocks.

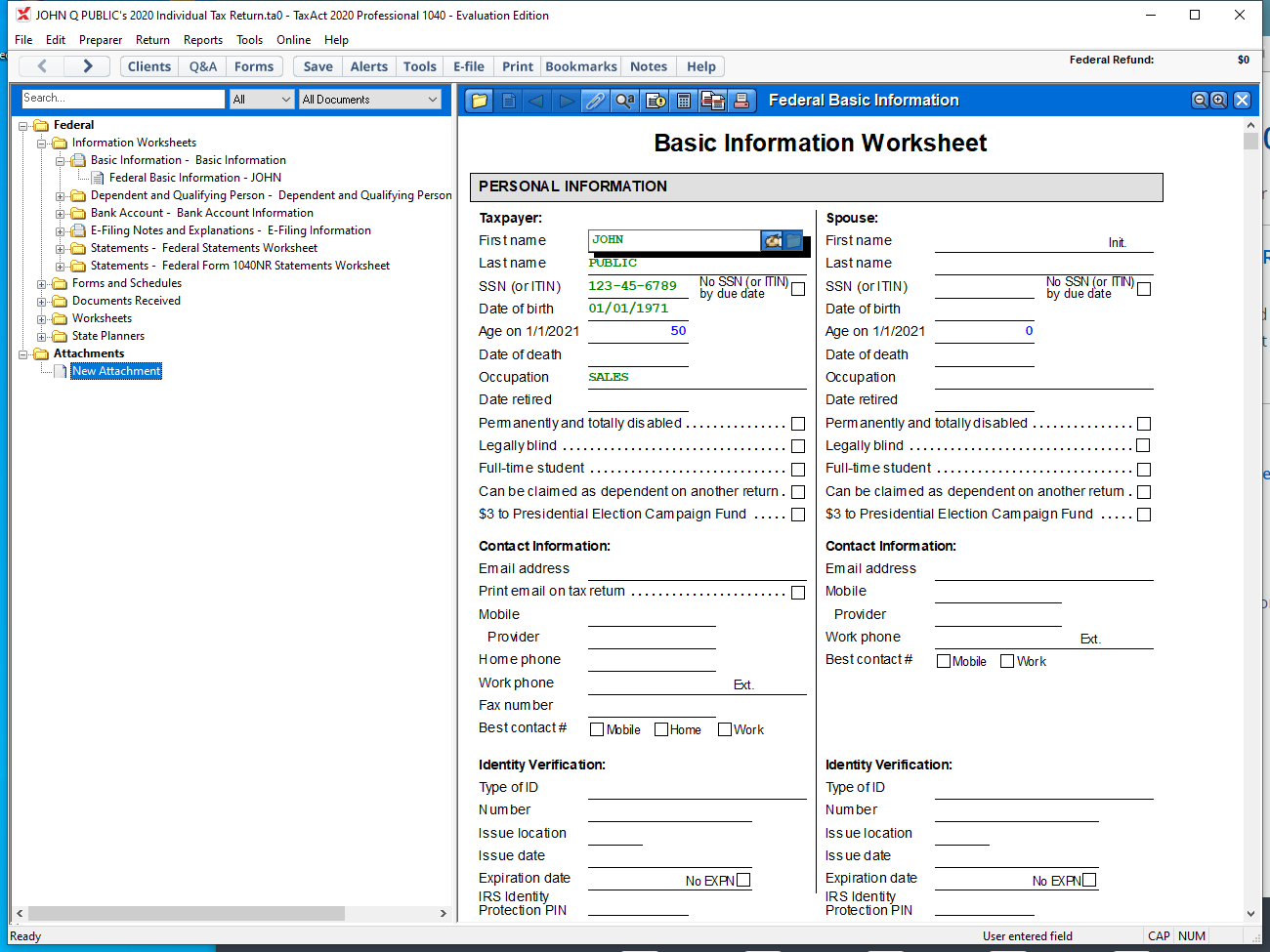

Form 8949 Reporting for Users of Tax Act Professional Tax Software

Upload, modify or create forms. Complete, edit or print tax forms instantly. Web download now developer's description by irs use form 8949 to report sales and exchanges of capital assets. Ad access irs tax forms. In order to fully comply with irs tax reporting requirements as outlined in.

Form 8949 Fillable and Editable Digital Blanks in PDF

Complete, edit or print tax forms instantly. (3) review the app results. Web where is form 8949? Sales and other dispositions of capital assets. You can upload an excel.

File IRS Form 8949 to Report Your Capital Gains or Losses

Web how to integrate the form 8949.com app outputs with freetaxusa tax software freetaxusa has added the ability to attach supporting documents for sales of stocks. Form 8949 (sales and other dispositions of capital assets) records the details of your. Ad access irs tax forms. Easily find the legal forms software you're looking for w/ our comparison grid. Web using.

In the following Form 8949 example,the highlighted section below shows

Sales and other dispositions of capital assets. Form 8949 (sales and other dispositions of capital assets) records the details of your. (3) review the app results. Upload, modify or create forms. Form 8949 allows you and the irs to reconcile amounts.

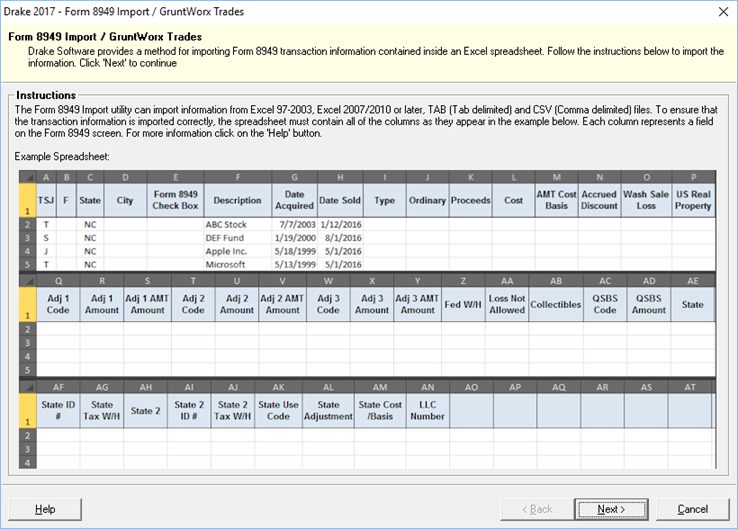

Form 8949 Import/GruntWorx Trades

Form 8949 allows you and the irs to reconcile amounts. Web we can convert your spreadsheet of realized gain and loss information to irs schedule d, form 8949, and form 8949 statements. Web where is form 8949? Web how to integrate the form 8949.com app outputs with freetaxusa tax software freetaxusa has added the ability to attach supporting documents for.

Mailing In Your IRS Form 8949 After eFiling Your Return

Sales and other dispositions of capital assets. Easily find the legal forms software you're looking for w/ our comparison grid. You can upload an excel. Easily find the legal forms software you're looking for w/ our comparison grid. Form 8949 (sales and other dispositions of capital assets) records the details of your.

Web What Is Form 8949 Used For?

Web where is form 8949? For detailed integration information, click on the name in the software. You then integrate the results with your tax software. Solved•by turbotax•6685•updated april 12, 2023.

Easily Find The Legal Forms Software You're Looking For W/ Our Comparison Grid.

Upload, modify or create forms. Web as a tax software product manager or developer, your tax software application can greatly simplify and streamline the tax prep experience of investors and traders by integrating. Form 8949 (sales and other dispositions of capital assets) records the details of your. Easily find the legal forms software you're looking for w/ our comparison grid.

Web Download Now Developer's Description By Irs Use Form 8949 To Report Sales And Exchanges Of Capital Assets.

Ad review the best legal forms software for 2023. Ad review the best legal forms software for 2023. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Web how to integrate the form 8949.com app outputs with freetaxusa tax software freetaxusa has added the ability to attach supporting documents for sales of stocks.

Complete, Edit Or Print Tax Forms Instantly.

Web using this method, a form 8949 can be generated with the software, and provide accurate tax reporting. If you exchange or sell capital assets, report them on your federal tax return using form 8949: In order to fully comply with irs tax reporting requirements as outlined in. Web we can convert your spreadsheet of realized gain and loss information to irs schedule d, form 8949, and form 8949 statements.