Form 8959 Instructions

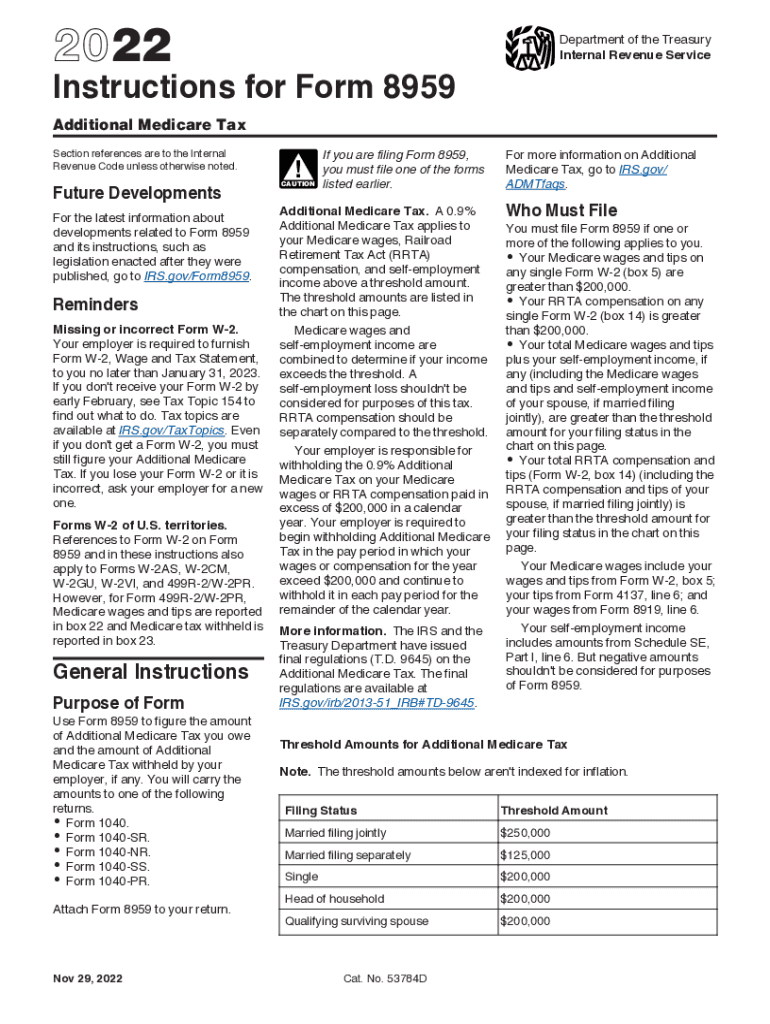

Form 8959 Instructions - Department of the treasury internal revenue service. Aif any line does not apply to you, leave it blank. That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and $200,000 for everybody else. How much their employer withheld in medicare taxes during the tax year. Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. You can find these thresholds in the instructions for form 8959. Ago to www.irs.gov/form8959 for instructions and the latest information. If you want to file form 8959, then use the following irs form 8959 instructions as a guide. The amount of medicare tax the taxpayer owes for the entire tax year. You can skip part i and move to part ii if you have no medicare wages.

You can skip part i and move to part ii if you have no medicare wages. How much their employer withheld in medicare taxes during the tax year. Additional medicare tax on medicare wages. Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web irs form 8959 instructions. Form 8959 must be filed if one or more of the following applies: This amount includes the 1.45% medicare tax withheld on all medicare wages and tips shown in box 5, as well as the 0.9% additional medicare tax on any of those medicare. The amount of medicare tax the taxpayer owes for the entire tax year. Web you may be required to report this amount on form 8959, additional medicare tax. You can find these thresholds in the instructions for form 8959.

Aif any line does not apply to you, leave it blank. The amount of medicare tax the taxpayer owes for the entire tax year. You can find these thresholds in the instructions for form 8959. Web irs form 8959 instructions. Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. For instructions and the latest information. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. How much their employer withheld in medicare taxes during the tax year. See the form 1040 instructions to determine if you are required to complete form 8959. Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following:

About Privacy Policy Copyright TOS Contact Sitemap

Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. How much their employer withheld in medicare taxes during the tax year. Web you may be required to report this amount on form 8959, additional medicare tax. Aif any line does not apply to.

2022 Form IRS 8959 Instructions Fill Online, Printable, Fillable

Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: See the form 1040 instructions to determine if you are required to complete form 8959. Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not apply to.

IRS Form 4136 Instructions Credits For Federal Tax Paid on Fuels

You can skip part i and move to part ii if you have no medicare wages. For instructions and the latest information. Web irs form 8959 instructions. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. You can find these thresholds.

form 8959 instructions 2020 Fill Online, Printable, Fillable Blank

If you want to file form 8959, then use the following irs form 8959 instructions as a guide. Aif any line does not apply to you, leave it blank. You can find these thresholds in the instructions for form 8959. That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and $200,000 for everybody else. This.

수질배출시설 및 방지시설의가동개시신고 샘플, 양식 다운로드

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web irs form 8959 instructions. Form 8959 must be filed if one or more of the following applies: Department of the treasury internal revenue service. You can find these thresholds in the.

2014 federal form 8962 instructions

Form 8959 must be filed if one or more of the following applies: How much their employer withheld in medicare taxes during the tax year. If you want to file form 8959, then use the following irs form 8959 instructions as a guide. Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does.

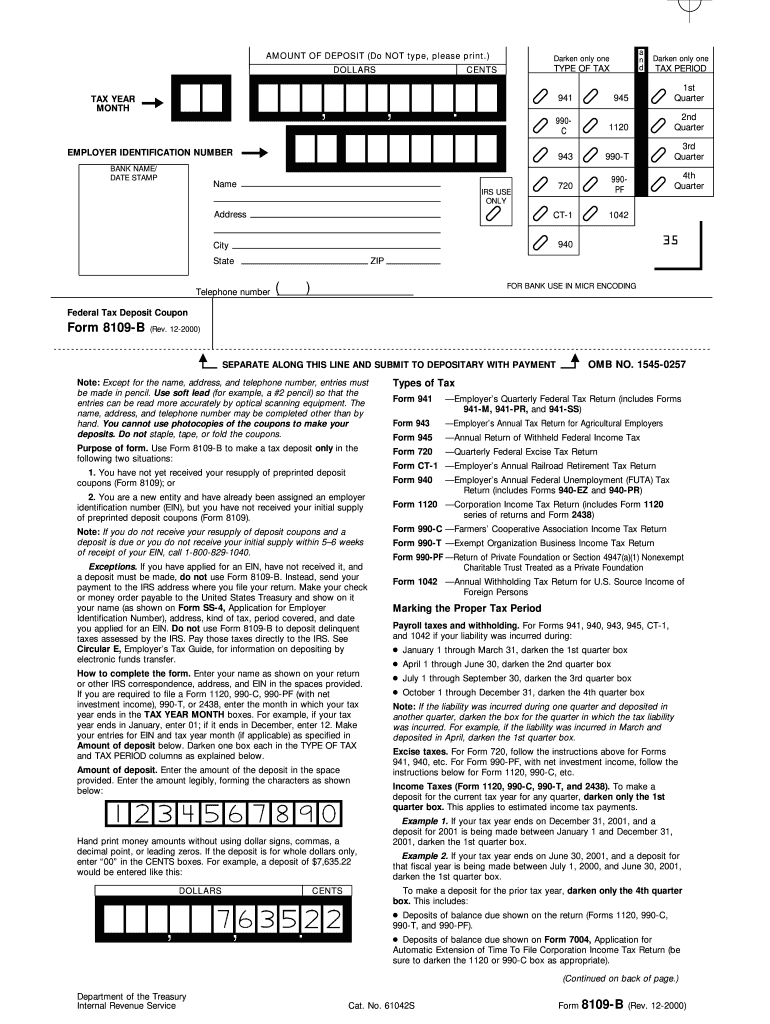

Form 8109 Fill Out and Sign Printable PDF Template signNow

The amount of medicare tax the taxpayer owes for the entire tax year. Ago to www.irs.gov/form8959 for instructions and the latest information. Additional medicare tax on medicare wages. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Aif any line does not apply to you, leave it blank.

Net Investment Tax Calculator The Ultimate Estate Planner, Inc.

This also applies if you’re filing jointly with your spouse. Web you may be required to report this amount on form 8959, additional medicare tax. The amount of medicare tax the taxpayer owes for the entire tax year. Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to.

Form 8959 Additional Medicare Tax (2014) Free Download

Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. This also applies if you’re filing jointly with your spouse. See the form 1040 instructions to determine if you are required to complete form 8959. You can skip part i and move to part ii if.

Gallery of Form 8949 Instructions 2017 Brilliant solution Tax Returns

The amount of medicare tax the taxpayer owes for the entire tax year. Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Form 8959 must be filed if one or more of the following applies: You can find these thresholds in the instructions.

Web Irs Form 8959, Additional Medicare Tax, Is The Federal Form That High Earners Must File With Their Income Tax Return To Reconcile The Following:

Form 8959 must be filed if one or more of the following applies: Web irs form 8959 instructions. That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and $200,000 for everybody else. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file.

For Instructions And The Latest Information.

Department of the treasury internal revenue service. Aif any line does not apply to you, leave it blank. Additional medicare tax on medicare wages. Web form 8959 department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank.

Web Form 8959 Is Used To Calculate The Amount Of Additional Medicare Tax Owed And The Amount Of Additional Medicare Tax Withheld By A Taxpayer’s Employer, If Any.

If you want to file form 8959, then use the following irs form 8959 instructions as a guide. You can find these thresholds in the instructions for form 8959. Ago to www.irs.gov/form8959 for instructions and the latest information. Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any.

You Can Skip Part I And Move To Part Ii If You Have No Medicare Wages.

The amount of medicare tax the taxpayer owes for the entire tax year. This also applies if you’re filing jointly with your spouse. Web you may be required to report this amount on form 8959, additional medicare tax. How much their employer withheld in medicare taxes during the tax year.