Form 8960 Error Turbotax

Form 8960 Error Turbotax - Web what needs to be done: As it appears we do need this form, that’s bad advice. Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect advice like, delete form 8960 from your return and try again and, try entering all. Free military tax filing discount. Definitions controlled foreign corporation (cfc). Am i doing something wrong? This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Deluxe to maximize tax deductions. Web by phinancemd » mon feb 06, 2023 5:14 pm. This issue will be resolved.

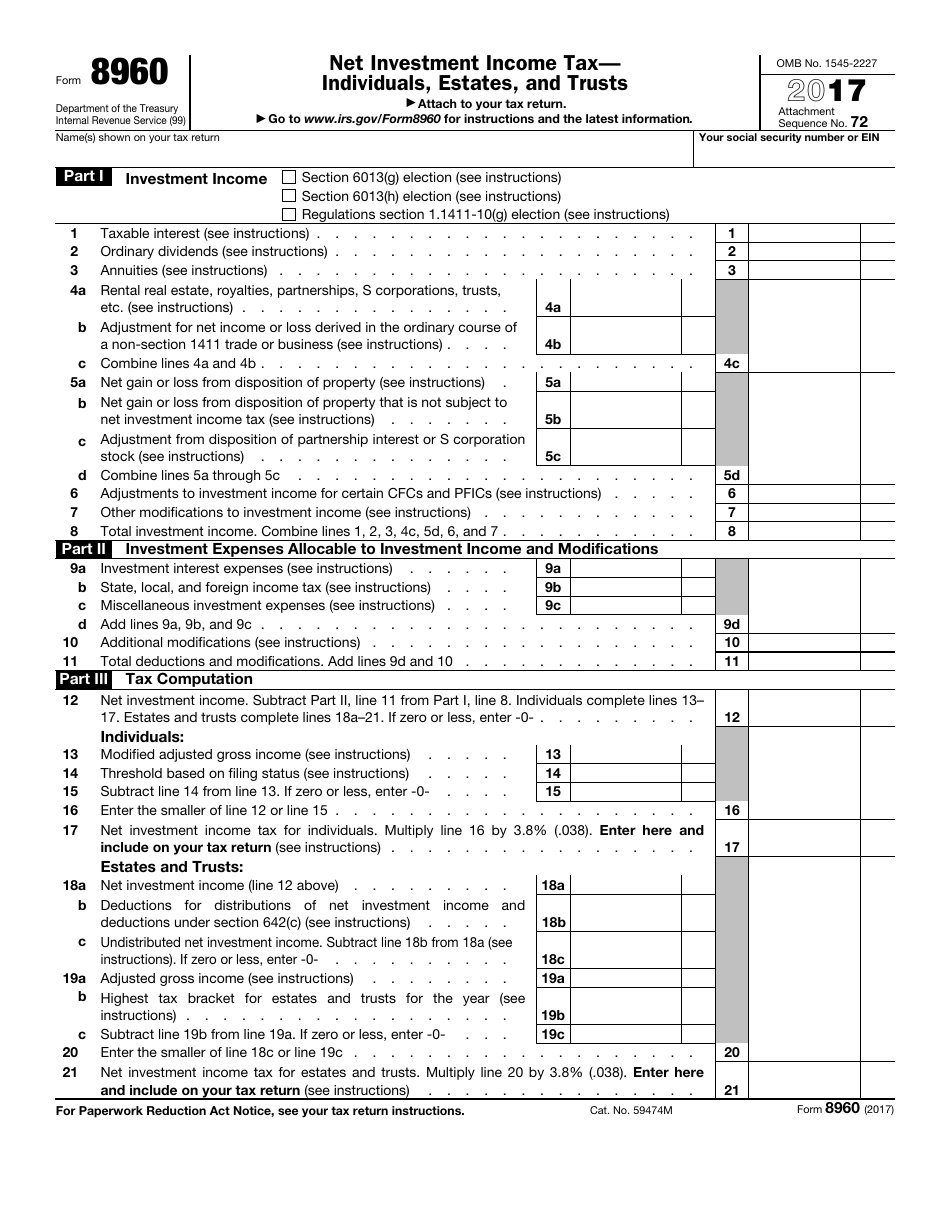

Web here's the general procedure for viewing the forms list and deleting unwanted forms, schedules, and worksheets in turbotax online: Purpose of form use form 8960 to figure the. Generally, a cfc is any foreign. This issue will be resolved. Web by phinancemd » mon feb 06, 2023 5:14 pm. Web use form 8960 to figure the amount of your net investment income tax (niit). The irs business rules have been modified to reflect the updates to the. Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. Web i keep getting errors for form 8960 that is keeping me from filing. This return cannot be electronically filed due to a processing error on form 8960, net investment income tax.

Am i doing something wrong? Purpose of form use form 8960 to figure the. Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect advice like, delete form 8960 from your return and try again and, try entering all. Web here's the general procedure for viewing the forms list and deleting unwanted forms, schedules, and worksheets in turbotax online: Free military tax filing discount. Web use form 8960 to figure the amount of your net investment income tax (niit). Looked at the form and. Definitions controlled foreign corporation (cfc). This issue will be resolved. Turbotax's suggestion is to 'wait a few weeks and try again' or.

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Purpose of form use form 8960 to figure the. Am i doing something wrong? Web form 8960 has to do with rental income loss or gain and i've never had rental income. As it appears we do need this form, that’s bad.

Form 8960 Instructions Tax In The United States S Corporation

This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Web i keep getting errors for form 8960 that is keeping me from filing. Web here's the general procedure for viewing the forms list and deleting unwanted forms, schedules, and worksheets in turbotax online: Purpose of form use form 8960 to figure.

Instructions for IRS Form 8960 Net Investment Tax

The irs business rules have been modified to reflect the updates to the. Definitions controlled foreign corporation (cfc). Deluxe to maximize tax deductions. Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. The irs business rules have been modified to reflect the updates to the.

What Is Form 8960? H&R Block

As it appears we do need this form, that’s bad advice. Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. This issue will be resolved. The irs business rules have been modified to reflect the updates to the. Purpose of form use form 8960 to.

Instructions For Form 8960 Net Investment Tax Individuals

Am i doing something wrong? Web form 8960 is the irs form used to calculate your total net investment income (nii) and determine how much of it may be subject to the 3.8% medicare contribution tax. Turbotax's suggestion is to 'wait a few weeks and try again' or. Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect.

Turbotax Form 1065 Error Best Reviews

Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. This issue will be resolved. Purpose of form use form 8960 to figure the. Web.

IRS Form 8960 Download Fillable PDF or Fill Online Net Investment

Web here's the general procedure for viewing the forms list and deleting unwanted forms, schedules, and worksheets in turbotax online: Generally, a cfc is any foreign. Web anecdotally, turbotax experts/cpas are giving all sorts of advice including suspect advice like, delete form 8960 from your return and try again and, try entering all. Looked at the form and. Web form.

Form 8960 Obamacare Tax implications for US Taxpayers in Canada

Looked at the form and. Turbotax's suggestion is to 'wait a few weeks and try again' or. This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Definitions controlled foreign corporation (cfc). Web turbotax “experts” just told me (on two different calls) to “delete” the form 8960 in the detailed options menu.

Form 8960 Edit, Fill, Sign Online Handypdf

Web by phinancemd » mon feb 06, 2023 5:14 pm. The irs business rules have been modified to reflect the updates to the. I read it was an issue a few months ago, but had been fixed. Looked at the form and. Deluxe to maximize tax deductions.

irs form 8960 for 2019 Fill Online, Printable, Fillable Blank form

Web form 8960 has to do with rental income loss or gain and i've never had rental income. The irs business rules have been modified to reflect the updates to the. I read it was an issue a few months ago, but had been fixed. Web here's the general procedure for viewing the forms list and deleting unwanted forms, schedules,.

Web Anecdotally, Turbotax Experts/Cpas Are Giving All Sorts Of Advice Including Suspect Advice Like, Delete Form 8960 From Your Return And Try Again And, Try Entering All.

Web by phinancemd » mon feb 06, 2023 5:14 pm. This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. As it appears we do need this form, that’s bad advice. I read it was an issue a few months ago, but had been fixed.

Definitions Controlled Foreign Corporation (Cfc).

Deluxe to maximize tax deductions. Web i keep getting errors for form 8960 that is keeping me from filing. Turbotax's suggestion is to 'wait a few weeks and try again' or. Free military tax filing discount.

Web Attach Form 8960 To Your Return If Your Modified Adjusted Gross Income (Magi) Is Greater Than The Applicable Threshold Amount.

Web turbotax “experts” just told me (on two different calls) to “delete” the form 8960 in the detailed options menu. Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. Am i doing something wrong? Purpose of form use form 8960 to figure the.

Web Form 8960 Has To Do With Rental Income Loss Or Gain And I've Never Had Rental Income.

The irs business rules have been modified to reflect the updates to the. The irs business rules have been modified to reflect the updates to the. Generally, a cfc is any foreign. Looked at the form and.