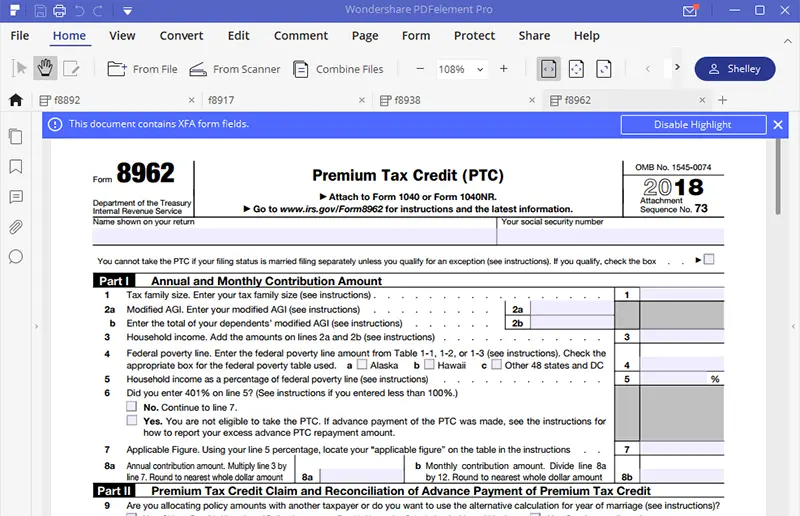

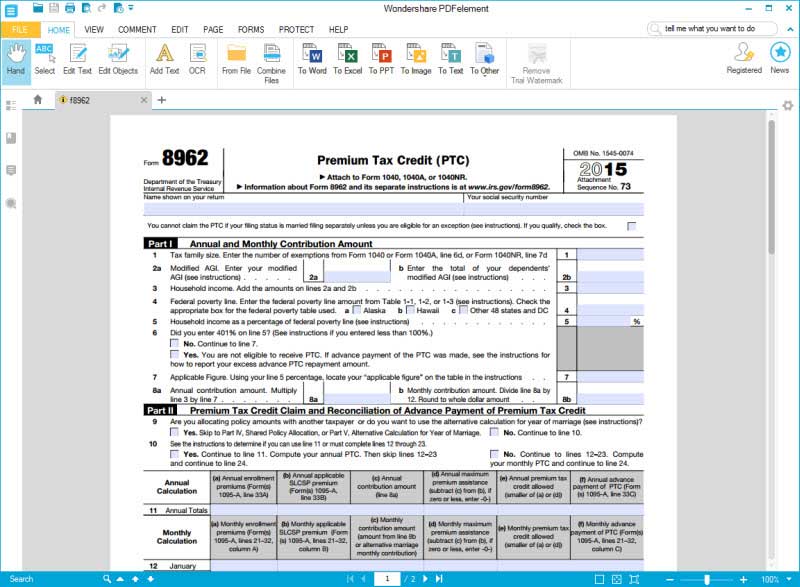

Form 8962 Instructions 2020

Form 8962 Instructions 2020 - Web this article will help you with frequently asked questions about the premium tax credit, including how to resolve diagnostic ref. Web how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms, instructions & tools form. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit. Stick to these simple instructions to get irs 4562 instructions prepared for submitting: Complete, edit or print tax forms instantly. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. 73 name shown on your return your social. Web you must use form 8962 to reconcile your estimated and actual income for the year. Web they must file form 8962 when they file their 2020 tax return. Web go to www.irs.gov/form8962 for instructions and the latest information.

Ad access irs tax forms. 73 name shown on your return your social. Web the internal revenue service announced today that taxpayers with excess aptc for 2020 are not required to file form 8962, premium tax credit, or report an. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit. Select the document you need in the library of templates. Web they must file form 8962 when they file their 2020 tax return. Easy, fast, secure & free to try! Web the american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess advance premium tax credit repayment for certain filers. Do your 2021, 2020, 2019, 2018 all the way back to 2000 Web how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms, instructions & tools form.

Taxpayers claiming a net ptc should. Web the internal revenue service announced today that taxpayers with excess aptc for 2020 are not required to file form 8962, premium tax credit, or report an. Web it only takes a few minutes. Web how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms, instructions & tools form. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit. Get ready for tax season deadlines by completing any required tax forms today. Web this article will help you with frequently asked questions about the premium tax credit, including how to resolve diagnostic ref. Complete, edit or print tax forms instantly. Form 8962 is used either (1) to reconcile a premium tax. Web 406 rows instructions for form 8962 (2022) instructions for form 8962.

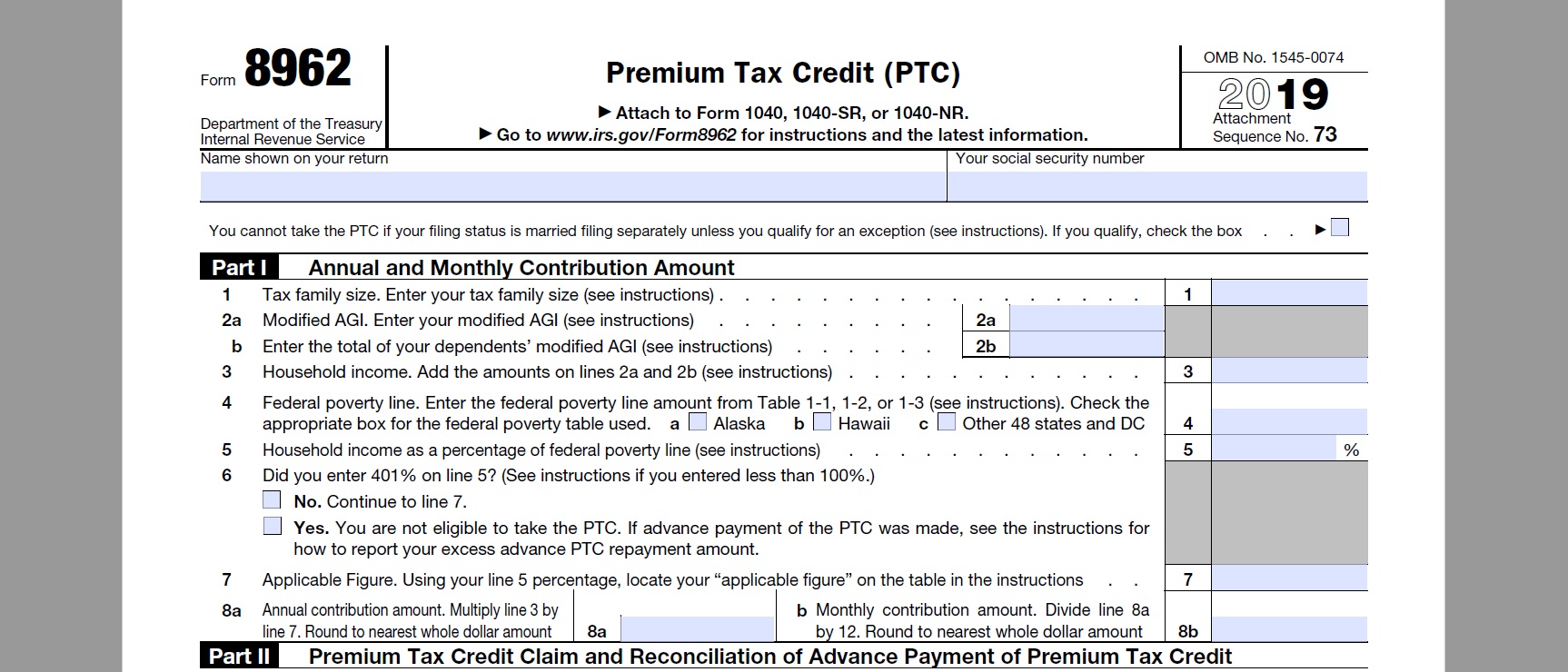

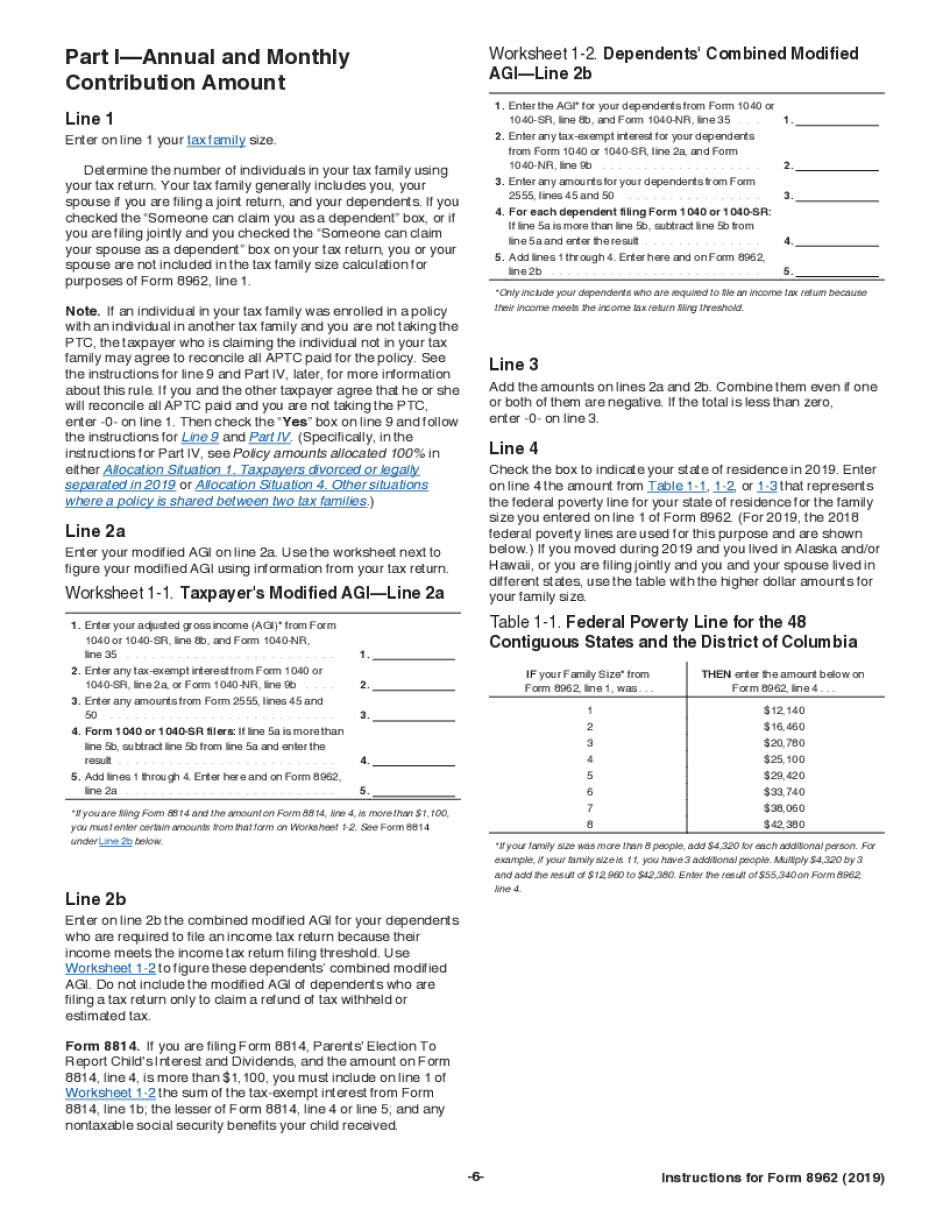

IRS 2019 Health Insurance Subsidy Tax Credit Reconciliation

Web go to www.irs.gov/form8962 for instructions and the latest information. Web this article will help you with frequently asked questions about the premium tax credit, including how to resolve diagnostic ref. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement. Web how to apply & enroll picking a plan check if.

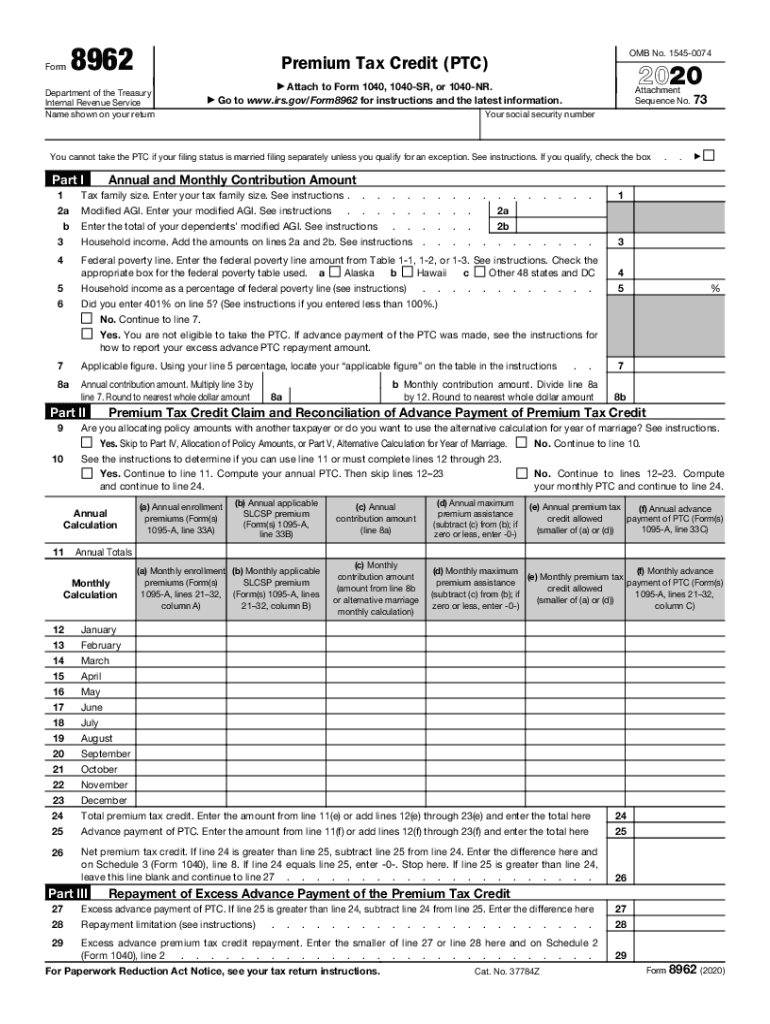

8962 Form Fill Out and Sign Printable PDF Template signNow

Click on the button get form to open it and start editing. Do your 2021, 2020, 2019, 2018 all the way back to 2000 73 name shown on your return your social. Ad access irs tax forms. See the instructions for form 8962 for more information.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Do your 2021, 2020, 2019, 2018 all the way back to 2000 Web the internal revenue service announced today that taxpayers with excess aptc for 2020 are not required to file form 8962, premium tax credit, or report an. See the instructions for form 8962 for more information. Select the document you need in the library of templates. Ad access.

Form 8962 Edit, Fill, Sign Online Handypdf

Easy, fast, secure & free to try! Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web the internal revenue service announced today that taxpayers with excess aptc for 2020 are not required to file form 8962, premium tax credit, or report an. Ad access irs tax forms. Form 8962 is used either (1) to reconcile a.

how to fill out form 8962 step by step Fill Online, Printable

Fill out all necessary fields in the selected doc making use of our powerful pdf. Form 8962 is used either (1) to reconcile a premium tax. Web go to www.irs.gov/form8962 for instructions and the latest information. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with.

Instructions for Form 8962 for 2018 KasenhasLopez

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. 73 name shown on your return your social. Web form 8962 at the end of these instructions. Click on the button get form to open it and start editing. Form 8962 is used either (1) to reconcile a premium tax.

Free Fillable 8962 Form Printable Forms Free Online

Easy, fast, secure & free to try! Complete, edit or print tax forms instantly. Web the internal revenue service announced today that taxpayers with excess aptc for 2020 are not required to file form 8962, premium tax credit, or report an. Get ready for tax season deadlines by completing any required tax forms today. Web you must use form 8962.

How To Fill Out Tax Form 8962

Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Web the american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess advance premium tax credit repayment for certain filers. Easy, fast, secure & free to try! Select the document you need in the library of templates..

irs form 8962 instructions Fill Online, Printable, Fillable Blank

See the instructions for form 8962 for more information. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit. 42135, how to complete form 8962 when your. Ad access irs tax forms. Web how to apply & enroll picking a plan.

The American Rescue Plan, Signed Into Law On March 11, 2021, Includes A Provision That Eliminates The Requirement.

Complete, edit or print tax forms instantly. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web this article will help you with frequently asked questions about the premium tax credit, including how to resolve diagnostic ref.

Web How To Apply & Enroll Picking A Plan Check If You Can Change Plans Report Income/Family Changes New, Lower Costs Available Health Care Tax Forms, Instructions & Tools Form.

Web it only takes a few minutes. Click on the button get form to open it and start editing. Stick to these simple instructions to get irs 4562 instructions prepared for submitting: Ad access irs tax forms.

Web Form 8962 At The End Of These Instructions.

73 name shown on your return your social. Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Web go to www.irs.gov/form8962 for instructions and the latest information. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit.

Taxpayers Claiming A Net Ptc Should.

See the instructions for form 8962 for more information. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Form 8962 is used either (1) to reconcile a premium tax. Select the document you need in the library of templates.