Form 8962 Instructions 2022

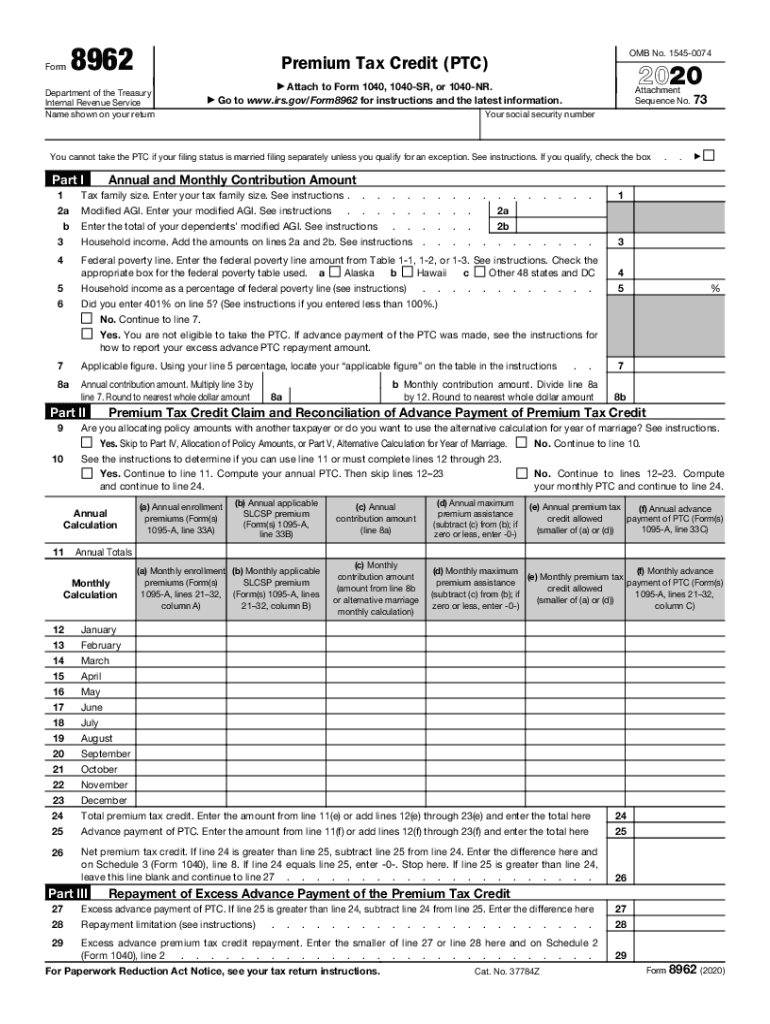

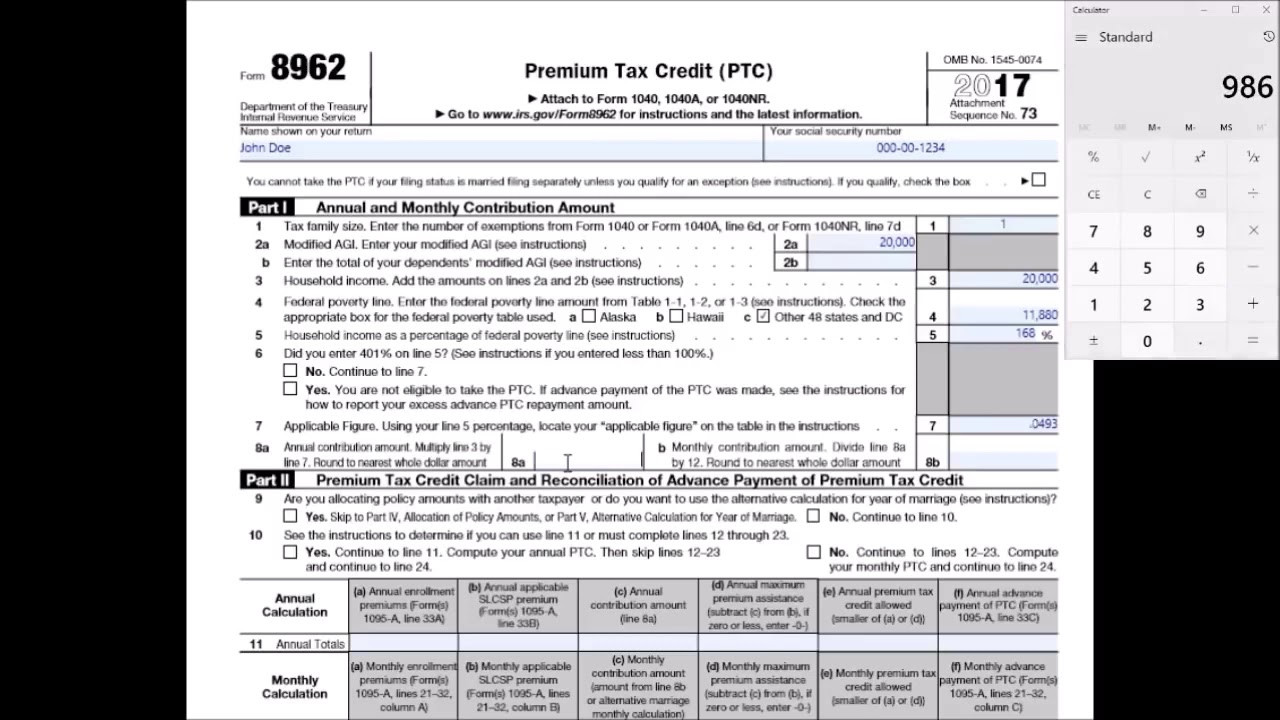

Form 8962 Instructions 2022 - Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health insurance marketplace. 73 name shown on your return your social security number a. Enter your tax family size. You’ll need it to complete form 8962, premium tax credit. If you qualify, check the box part i annual and monthly contribution amount 1 tax family size. Web check the box to indicate your state of residence in 2022. Web this form includes details about the marketplace insurance you and household members had in 2022. On line 26, you’ll find out if you used more or less premium tax credit than you qualify for based on your final 2022 income. By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception.

Web check the box to indicate your state of residence in 2022. Web complete all sections of form 8962. Enter on line 4 the amount from table. If you qualify, check the box part i annual and monthly contribution amount 1 tax family size. Web updated december 20, 2022 form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. This will affect the amount of your refund or tax due. Web instructions for irs form 8962: Web 2022 attachment sequence no. You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception. Include your completed form 8962 with your 2022 federal tax.

Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health insurance marketplace. By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). Enter your tax family size. Include your completed form 8962 with your 2022 federal tax. This form is only used by taxpayers who purchased a health plan through the health insurance marketplace, including healthcare.gov. Enter on line 4 the amount from table. Web this form includes details about the marketplace insurance you and household members had in 2022. Web complete all sections of form 8962. Web updated december 20, 2022 form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. You can get it from:

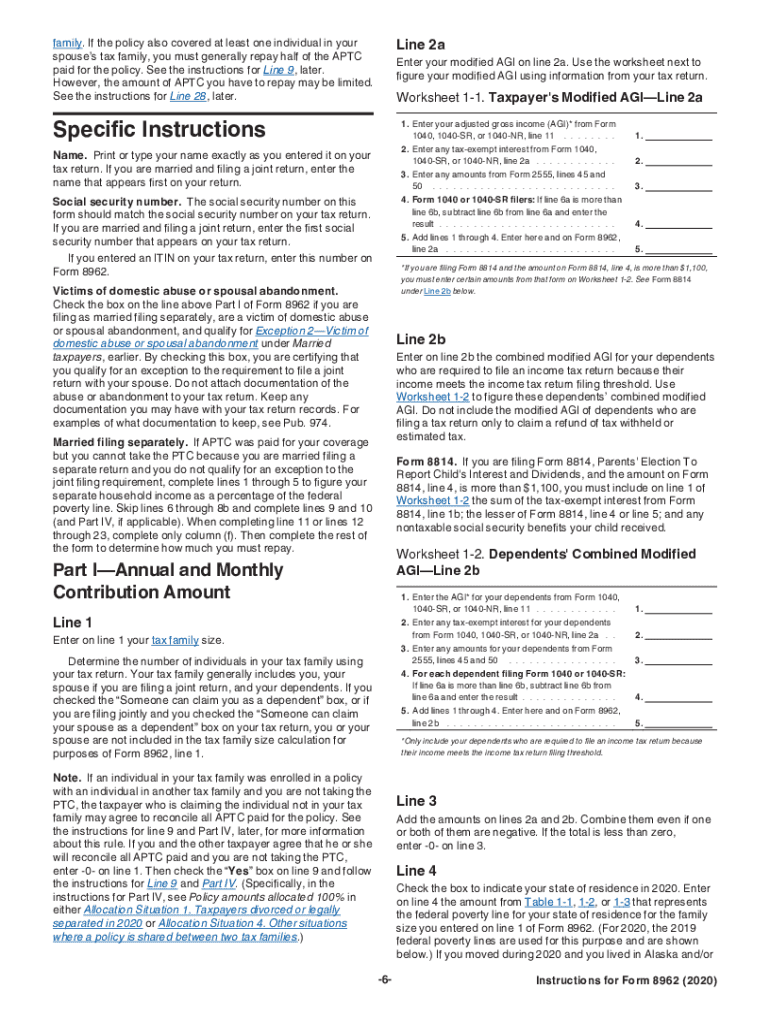

2019 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

73 name shown on your return your social security number a. Now on to part ii, premium tax credit claim and reconciliation of advance payment of premium tax credit. This form is only used by taxpayers who purchased a health plan through the health insurance marketplace, including healthcare.gov. By the end of part i, you’ll have your annual and monthly.

Free Fillable 8962 Form Printable Forms Free Online

You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception. Enter your tax family size. If you qualify, check the box part i annual and monthly contribution amount 1 tax family size. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you.

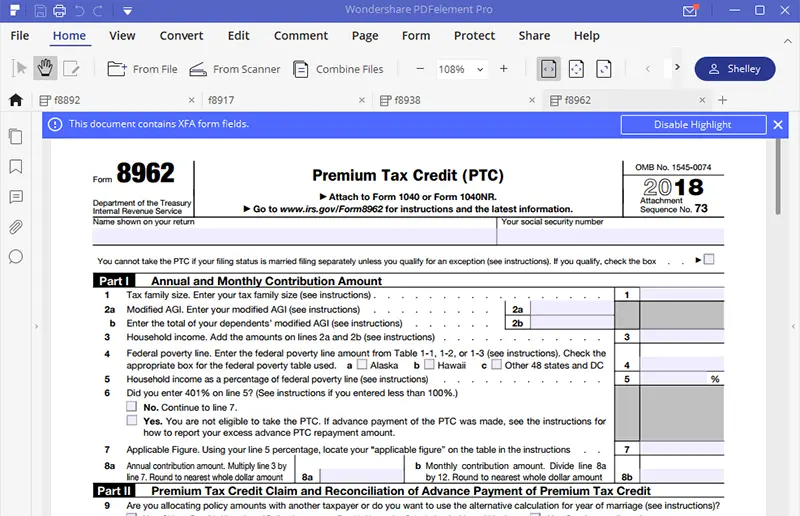

Form 8962 Fill Out and Sign Printable PDF Template signNow

On line 26, you’ll find out if you used more or less premium tax credit than you qualify for based on your final 2022 income. Enter your tax family size. Web 2022 attachment sequence no. You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception. Web instructions for irs form 8962:

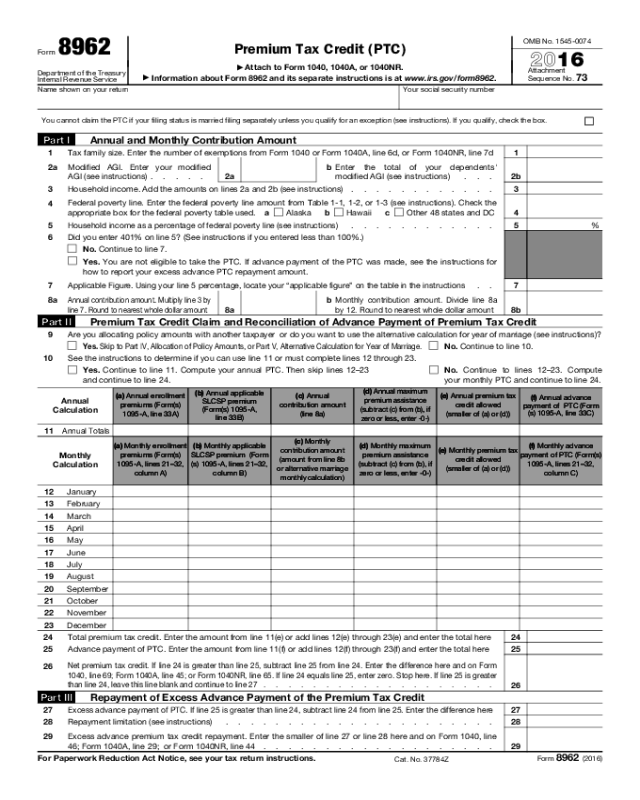

Irs Form 8962 For 2016 Printable Master of Documents

Now on to part ii, premium tax credit claim and reconciliation of advance payment of premium tax credit. You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception. If you qualify, check the box part i annual and monthly contribution amount 1 tax family size. Include your completed form 8962 with.

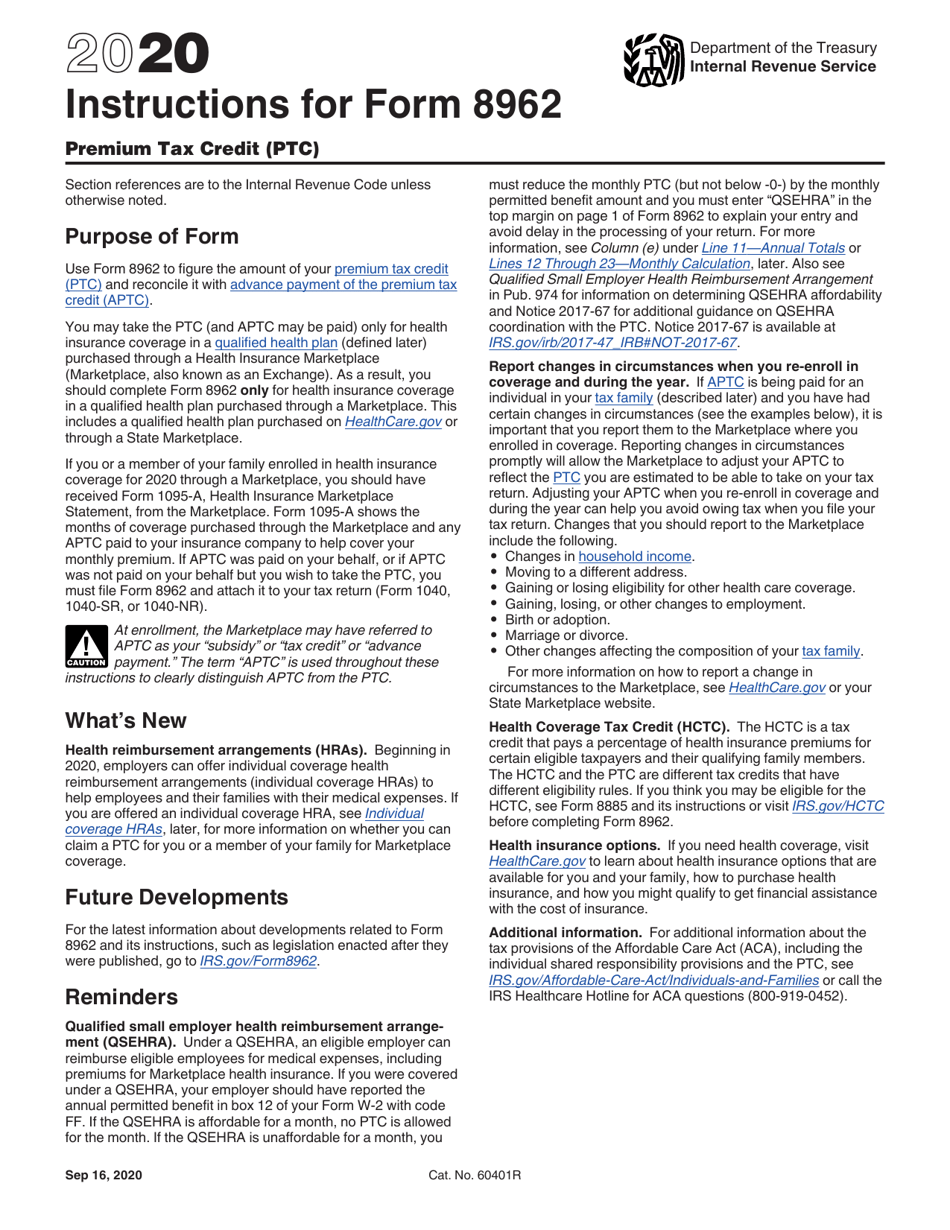

IRS Instructions 8962 2022 Form Printable Blank PDF Online

This will affect the amount of your refund or tax due. Web this form includes details about the marketplace insurance you and household members had in 2022. On line 26, you’ll find out if you used more or less premium tax credit than you qualify for based on your final 2022 income. Web complete all sections of form 8962. Include.

IRS Form 8962 LinebyLine Instructions 2022 How to Fill out Form 8962

Include your completed form 8962 with your 2022 federal tax. Web consult the table in the irs instructions for form 8962 to fill out the form. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health insurance marketplace. Web instructions for irs.

How To Fill Out Tax Form 8962

By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). Include your completed form 8962 with your 2022 federal tax. You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception. Web instructions for irs form 8962: Web updated december 20, 2022 form 8962.

Instructions for Form 8962 for 2018 KasenhasLopez

Now on to part ii, premium tax credit claim and reconciliation of advance payment of premium tax credit. On line 26, you’ll find out if you used more or less premium tax credit than you qualify for based on your final 2022 income. Include your completed form 8962 with your 2022 federal tax. This will affect the amount of your.

8962 Form Fill Out and Sign Printable PDF Template signNow

Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health insurance marketplace. Web updated december 20, 2022 form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. This form is.

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample

Web instructions for irs form 8962: You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception. On line 26, you’ll find out if you used more or less premium tax credit than you qualify for based on your final 2022 income. Web this form includes details about the marketplace insurance you.

First, You’ll Need To Obtain Irs Form 8962.

Web instructions for irs form 8962: Include your completed form 8962 with your 2022 federal tax. You can get it from: Web updated december 20, 2022 form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid.

Web Complete All Sections Of Form 8962.

Web this form includes details about the marketplace insurance you and household members had in 2022. By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). You’ll need it to complete form 8962, premium tax credit. Enter your tax family size.

This Will Affect The Amount Of Your Refund Or Tax Due.

Enter on line 4 the amount from table. Web check the box to indicate your state of residence in 2022. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health insurance marketplace. 73 name shown on your return your social security number a.

Now On To Part Ii, Premium Tax Credit Claim And Reconciliation Of Advance Payment Of Premium Tax Credit.

Web consult the table in the irs instructions for form 8962 to fill out the form. Web 2022 attachment sequence no. If you qualify, check the box part i annual and monthly contribution amount 1 tax family size. You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception.