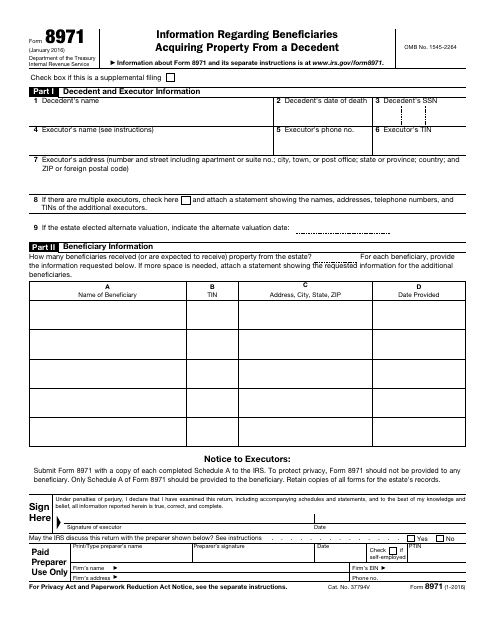

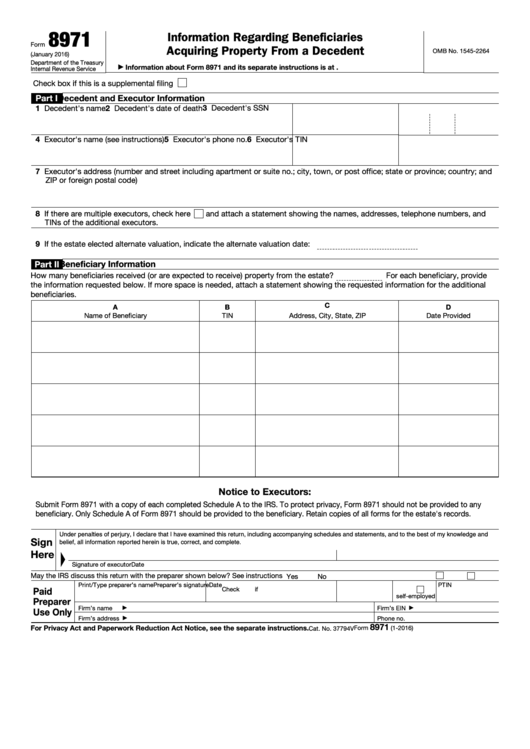

Form 8971 Instructions 2022

Form 8971 Instructions 2022 - Retain copies of all forms for the estate's records. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. One schedule a is provided to each beneficiary receiving property from an estate. Web about form 8971, information regarding beneficiaries acquiring property from a decedent. Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Schedule a, attached to form 8971, is used to provide each beneficiary with information that must be reported under the new statute. Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. It is not clear that form 8971 is required under these circumstances. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate.

Web form 8971, along with a copy of every schedule a, is used to report values to the irs. Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Web about form 8971, information regarding beneficiaries acquiring property from a decedent. It is not clear that form 8971 is required under these circumstances. Only schedule a of form 8971 should be provided to the beneficiary. Retain copies of all forms for the estate's records. Download this form print this form Schedule a, attached to form 8971, is used to provide each beneficiary with information that must be reported under the new statute. Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. This item is used to.

Web form 8971, along with a copy of every schedule a, is used to report values to the irs. Web about form 8971, information regarding beneficiaries acquiring property from a decedent. Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after july 2015. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Web federal information regarding beneficiaries acquiring property from a decedent form 8971 pdf form content report error it appears you don't have a pdf plugin for this browser. Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Schedule a, attached to form 8971, is used to provide each beneficiary with information that must be reported under the new statute. Only schedule a of form 8971 should be provided to the beneficiary. Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death.

IRS Form 8971 A Guide to Reporting Property From A Decedent

Web about form 8971, information regarding beneficiaries acquiring property from a decedent. Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: This item is used to. Submit form 8971 with a copy.

IRS Form 8971 Download Fillable PDF or Fill Online Information

Download this form print this form Schedule a, attached to form 8971, is used to provide each beneficiary with information that must be reported under the new statute. Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after july 2015. One.

Form 8962 Fill Out and Sign Printable PDF Template signNow

One schedule a is provided to each beneficiary receiving property from an estate. Web the new form 8971, information regarding beneficiaries acquiring property from a decedent, will be used by executors to report the required information to the irs. Only schedule a of form 8971 should be provided to the beneficiary. Web irs form 8971 is the tax form that.

IRS Form 8971 Instructions Reporting a Decedent's Property

Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Web federal information regarding beneficiaries acquiring property from a decedent form 8971 pdf form content report error it appears you don't have a pdf plugin for this browser. It is not clear that form 8971 is required under these circumstances. Web form 8971 (including all attached.

New Basis Reporting Requirements for Estates Meeting Form 8971

Only schedule a of form 8971 should be provided to the beneficiary. Submit form 8971 with a copy of each completed schedule a to the irs. Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? To protect privacy, form 8971 should not.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Web the new form 8971, information regarding beneficiaries acquiring property from a decedent, will be used by executors to report the required information to the irs. Web about form 8971, information regarding beneficiaries acquiring property from a decedent. One schedule a is provided to each beneficiary receiving property from an estate. Download this form print this form Retain copies of.

New IRS Form 8971 Rules to Report Beneficiary Cost Basis Fill Out and

Form 8971 and attached schedule(s) a must be filed with the irs, separate from. It is not clear that form 8971 is required under these circumstances. This item is used to. Only schedule a of form 8971 should be provided to the beneficiary. Web date provided notice to executors:

Fillable Form 8971 Information Regarding Beneficiaries Acquiring

Submit form 8971 with a copy of each completed schedule a to the irs. Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Web the new form 8971, information regarding beneficiaries acquiring.

IRS Form 8971 Instructions Reporting a Decedent's Property

Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? One schedule a is provided to each beneficiary receiving property from an estate. Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is.

IRS Form 8971 Instructions Reporting a Decedent's Property

Web the new form 8971, information regarding beneficiaries acquiring property from a decedent, will be used by executors to report the required information to the irs. To protect privacy, form 8971 should not be provided to any beneficiary. Retain copies of all forms for the estate's records. Only schedule a of form 8971 should be provided to the beneficiary. Web.

Web Form 8971, Along With A Copy Of Every Schedule A, Is Used To Report Values To The Irs.

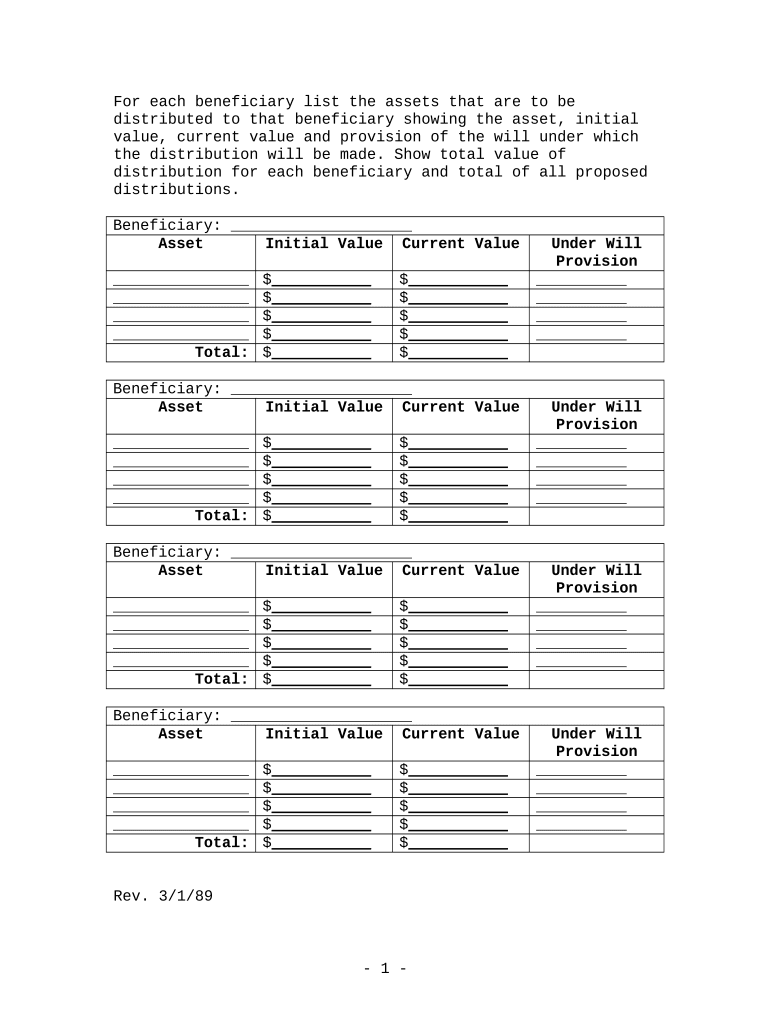

Schedule a, attached to form 8971, is used to provide each beneficiary with information that must be reported under the new statute. Web the new form 8971, information regarding beneficiaries acquiring property from a decedent, will be used by executors to report the required information to the irs. Submit form 8971 with a copy of each completed schedule a to the irs. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate.

Web Form 8971 (Including All Attached Schedule(S) A) Must Be Filed With The Irs And Only The Schedule A Is To Be Provided To The Beneficiary Listed On That Schedule A, No Later Than The Earlier Of:

Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after july 2015. It is not clear that form 8971 is required under these circumstances. To protect privacy, form 8971 should not be provided to any beneficiary.

Web Federal Information Regarding Beneficiaries Acquiring Property From A Decedent Form 8971 Pdf Form Content Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

This item is used to. Web about form 8971, information regarding beneficiaries acquiring property from a decedent. Web date provided notice to executors: Retain copies of all forms for the estate's records.

Web Form 8971 Is Required For Any Estate That Files A 706 After July, 2015, Regardless Of The Decedent’s Date Of Death.

Web form 8971 (including all attached schedule(s) a) must be filed with the irs and only the schedule a is to be provided to the beneficiary listed on that schedule a, no later than the earlier of: Download this form print this form Only schedule a of form 8971 should be provided to the beneficiary. One schedule a is provided to each beneficiary receiving property from an estate.