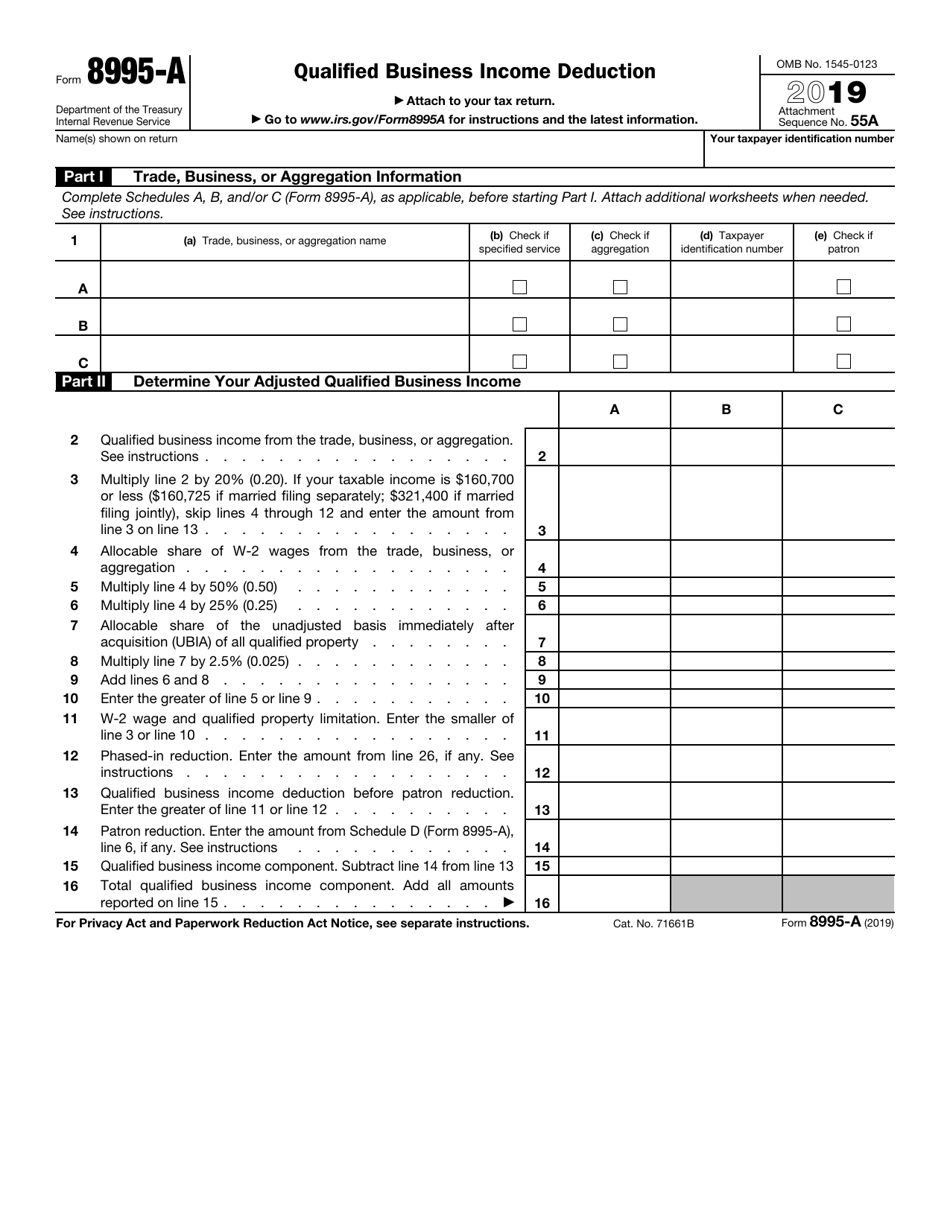

Form 8995-A

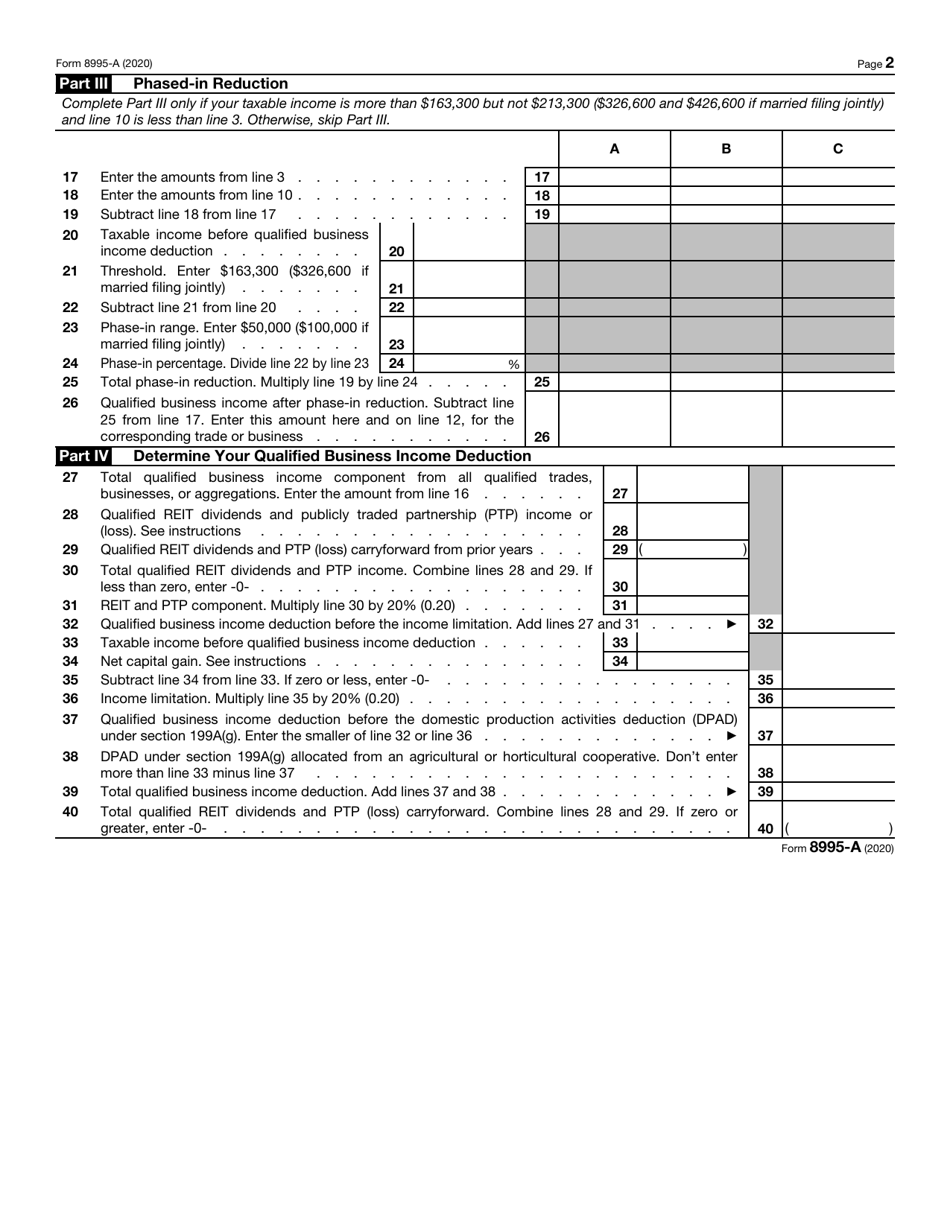

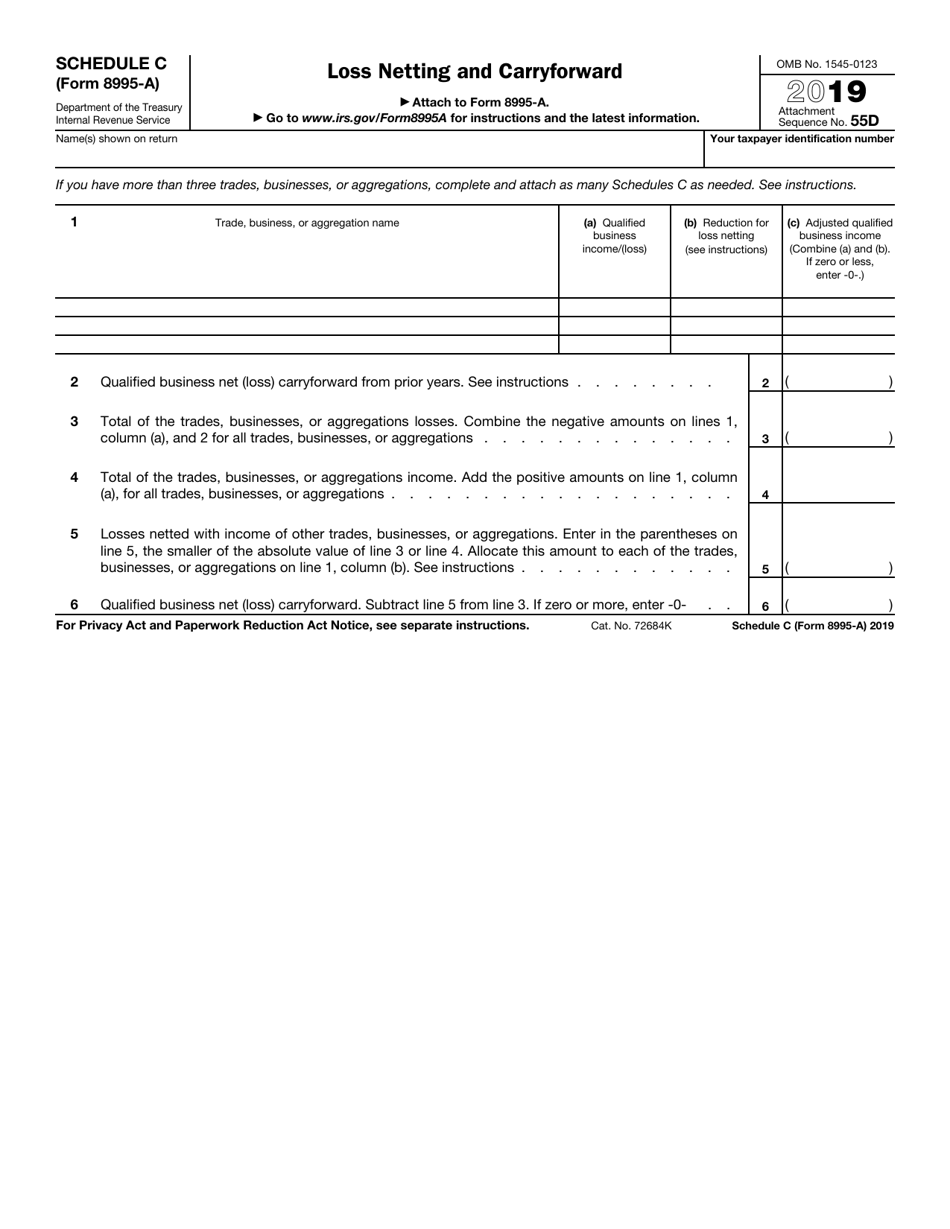

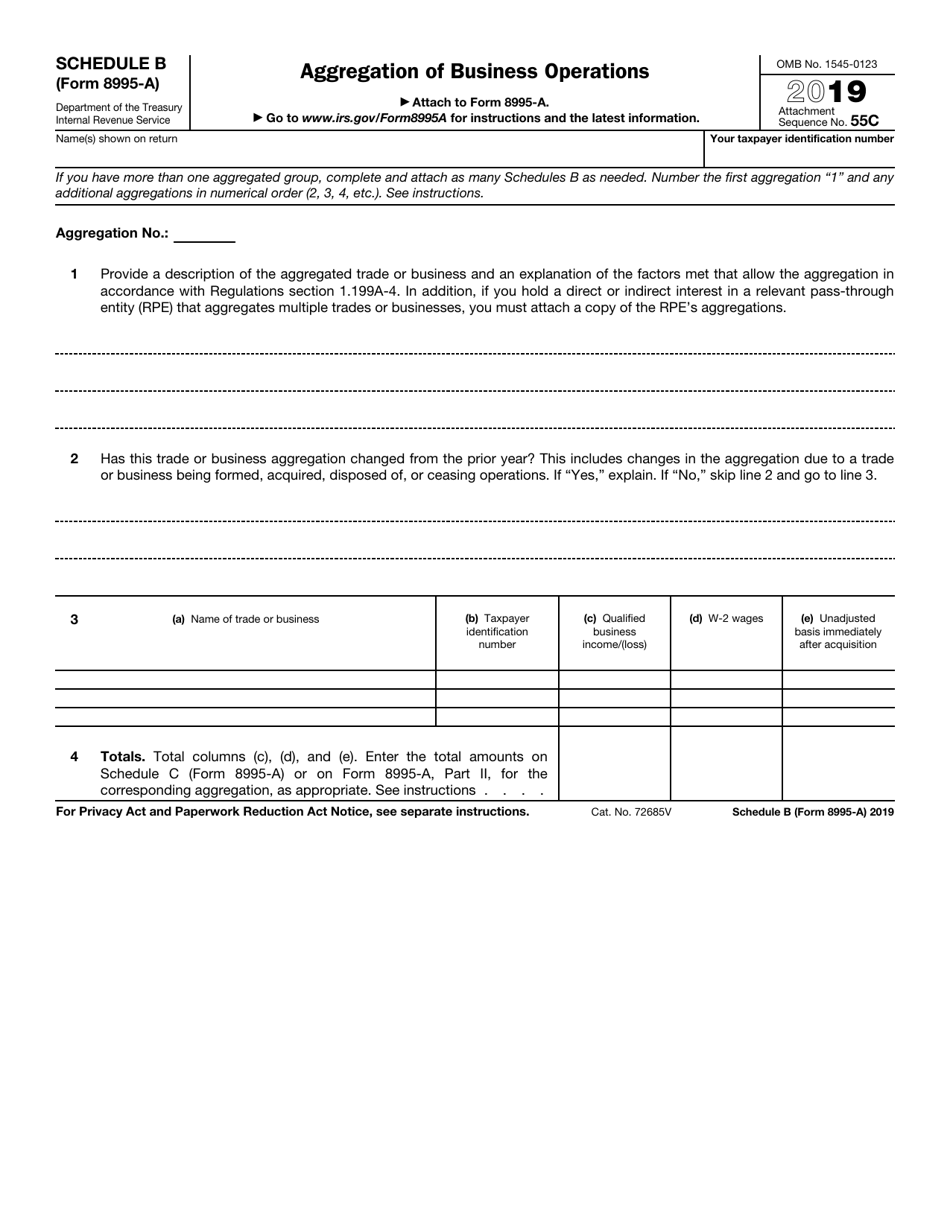

Form 8995-A - Include the following schedules (their specific instructions are shown later), as appropriate: There are two ways to calculate the qbi deduction: The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or loss; More precisely, you should pick a form depending on the following information. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. 55a name(s) shown on return your taxpayer identification number note: Form 8995 is the simplified form and is used if all of the following are true: Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction doesn't reach the threshold. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Form 8995 and form 8995a.

Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction doesn't reach the threshold. 1 (a) trade, business, or aggregation name (b) check if specified service (c) check if aggregation (d) taxpayer identification number (e) Go to www.irs.gov/form8995a for instructions and the latest information. Go to www.irs.gov/form8995a for instructions and the latest information. Attach additional worksheets when needed. Form 8995 is the simplified form and is used if all of the following are true: Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Form 8995 and form 8995a. There are two ways to calculate the qbi deduction: Don’t worry about which form your return needs to use.

Don’t worry about which form your return needs to use. There are two ways to calculate the qbi deduction: Depending on your situation, business owners must choose between these forms to claim your qbit deduction. 1 (a) trade, business, or aggregation name (b) check if specified service (c) check if aggregation (d) taxpayer identification number (e) Taxable income before qbid is less than or equal to certain thresholds: 55a name(s) shown on return your taxpayer identification number note: Form 8995 is the simplified form and is used if all of the following are true: Go to www.irs.gov/form8995a for instructions and the latest information. Form 8995 and form 8995a. Include the following schedules (their specific instructions are shown later), as appropriate:

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

Don’t worry about which form your return needs to use. Attach additional worksheets when needed. Form 8995 and form 8995a. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. The individual has qualified business income (qbi), qualified reit dividends,.

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Go to www.irs.gov/form8995a for instructions and the latest information. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction doesn't reach the threshold..

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction doesn't reach the threshold. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. More precisely, you should pick a form depending on the following information. Don’t worry about which form your return needs to use. 1 (a).

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

More precisely, you should pick a form depending on the following information. Don’t worry about which form your return needs to use. Form 8995 and form 8995a. There are two ways to calculate the qbi deduction: Attach additional worksheets when needed.

Fill Free fillable F8995a 2019 Form 8995A PDF form

Taxable income before qbid is less than or equal to certain thresholds: More precisely, you should pick a form depending on the following information. There are two ways to calculate the qbi deduction: Attach additional worksheets when needed. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or loss;

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Depending on your situation, business owners must choose between these forms to claim your qbit deduction. Attach additional worksheets when needed. Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction doesn't reach the threshold. More precisely, you should pick a form depending on the following information. Go to www.irs.gov/form8995a for instructions and.

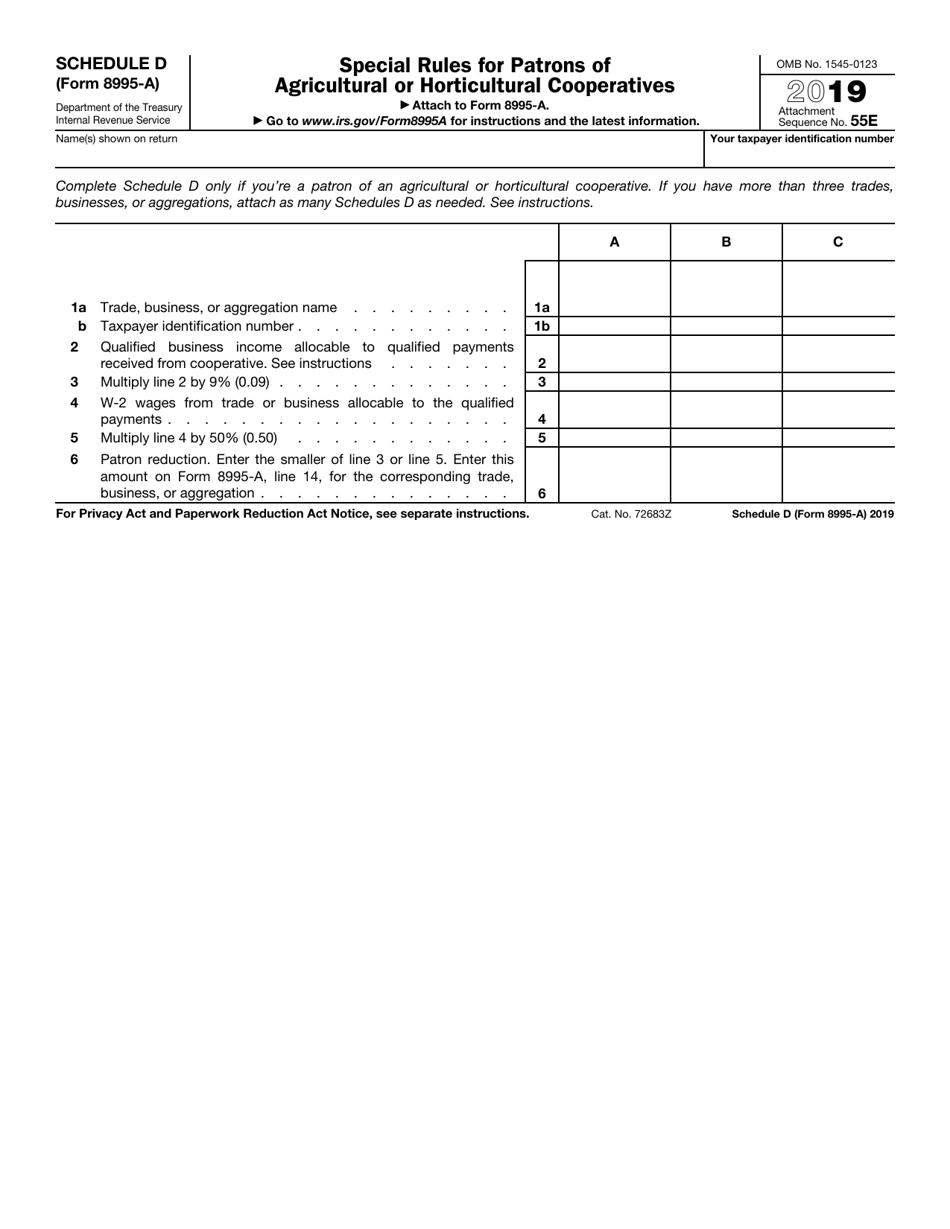

IRS Form 8995A Schedule D Download Fillable PDF or Fill Online Special

Form 8995 and form 8995a. Don’t worry about which form your return needs to use. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or loss; Include the following schedules (their specific instructions are shown later), as appropriate: Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction.

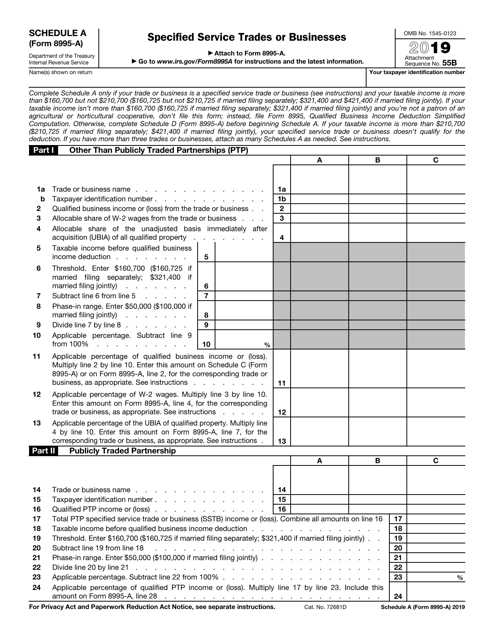

IRS Form 8995A Schedule A Download Fillable PDF or Fill Online

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or loss; Include the following schedules (their specific instructions are shown later), as appropriate: More precisely, you should pick a form depending on the following information. There are two ways to calculate the qbi deduction: 55a name(s) shown on return your taxpayer identification number note:

8995 Form Updates Patch Notes fo 8995 Form Product Blog

Go to www.irs.gov/form8995a for instructions and the latest information. Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction doesn't reach the threshold. 1 (a) trade, business, or aggregation name (b) check if specified service (c) check if aggregation (d) taxpayer identification number (e) Use separate schedules a, b, c, and/or d, as.

Other Version Form 8995A 8995 Form Product Blog

Go to www.irs.gov/form8995a for instructions and the latest information. There are two ways to calculate the qbi deduction: Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction doesn't reach the threshold. Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. More precisely, you should pick a.

More Precisely, You Should Pick A Form Depending On The Following Information.

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or loss; Don’t worry about which form your return needs to use. Form 8995 is the simplified form and is used if all of the following are true: Go to www.irs.gov/form8995a for instructions and the latest information.

Depending On Your Situation, Business Owners Must Choose Between These Forms To Claim Your Qbit Deduction.

Attach additional worksheets when needed. Form 8995 is a simplified version for taxpayers whose taxable income before the qualified business income deduction doesn't reach the threshold. There are two ways to calculate the qbi deduction: Go to www.irs.gov/form8995a for instructions and the latest information.

Form 8995 And Form 8995A.

55a name(s) shown on return your taxpayer identification number note: Include the following schedules (their specific instructions are shown later), as appropriate: Taxable income before qbid is less than or equal to certain thresholds: Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction.

1 (A) Trade, Business, Or Aggregation Name (B) Check If Specified Service (C) Check If Aggregation (D) Taxpayer Identification Number (E)

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate.