Form 926 Filing Requirements

Form 926 Filing Requirements - Web to fulfill this reporting obligation, the u.s. Persons filing this form may be required to file fincen form 114, report of foreign bank and financial accounts (fbar). Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Keep in mind, if you have foreign transactions or assets, you may need to file additional forms. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Web the irs requires certain u.s. Transferor of property, in a transaction in which a gra is required, must report the fair market value, adjusted tax. Taxpayer must complete form 926, return by a u.s. Under the 2014 regulations, a u.s. This article will focus briefly on the history and purpose of this form, followed by a description of changes that were made effective beginning in december 2008.

Web generally, a u.s. Web to fulfill this reporting obligation, the u.s. Other forms that may be required. Attach to your income tax return for the year of the transfer or distribution. Some need to be filed with your tax return. Web irs form 926 is the form u.s. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the reporting threshold requirements: November 2018) department of the treasury internal revenue service. Citizens and residents to file the form 926: Domestic partnership (special rules) transfers of cash & form 926

For instructions and the latest information. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the reporting threshold requirements: Taxpayer must complete form 926, return by a u.s. Keep in mind, if you have foreign transactions or assets, you may need to file additional forms. Some need to be filed with your tax return. November 2018) department of the treasury internal revenue service. Domestic partnership (special rules) transfers of cash & form 926 Web irs form 926 is the form u.s. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Other forms that may be required.

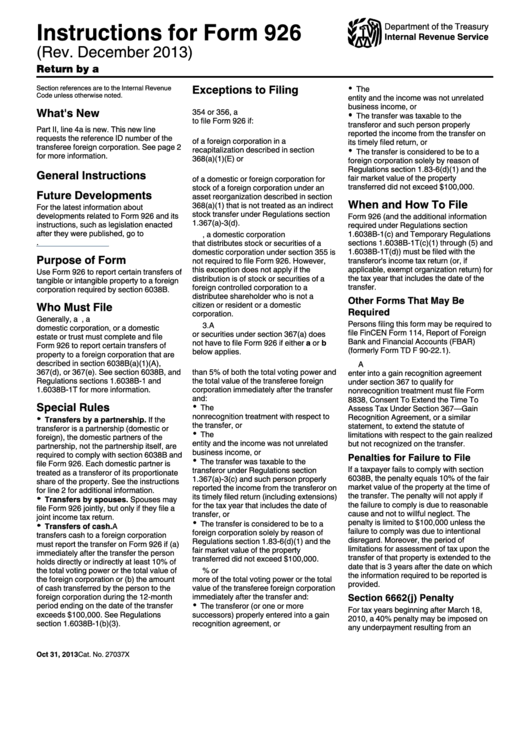

Instructions For Form 926 printable pdf download

Web to fulfill this reporting obligation, the u.s. Taxpayer must complete form 926, return by a u.s. November 2018) department of the treasury internal revenue service. For instructions and the latest information. Web irs form 926 is the form u.s.

Form 926 Return by a U.S. Transferor of Property to a Foreign

Web form 926 is filed as part of your tax return. Web generally, a u.s. Under the 2014 regulations, a u.s. Transferor of property, in a transaction in which a gra is required, must report the fair market value, adjusted tax. Transferor of property to a foreign corporation.

IRS Form 926 What You Need To Know Silver Tax Group

Citizens and residents to file the form 926: Web form 926 is not limited to individuals. November 2018) department of the treasury internal revenue service. Other forms that may be required. Transferor of property to a foreign corporation.

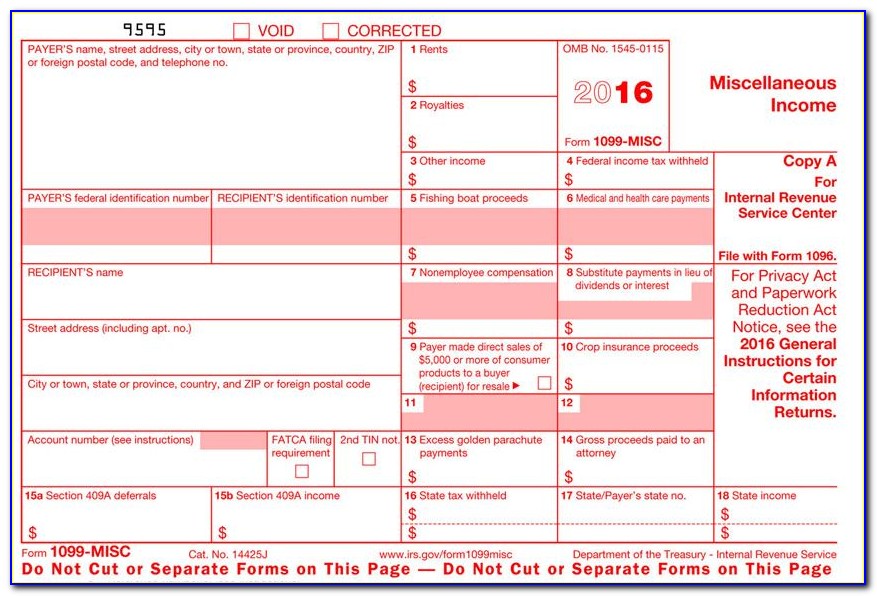

Irs Form 1099 Int Filing Requirements Form Resume Examples o85pxXq5ZJ

This would include transfers of cash over $100,000 to a foreign corporation, or if the transfer of cash resulted in owning more than 10% of the foreign corporation’s stock. Under the 2014 regulations, a u.s. Transferor of property to a foreign corporation. Web the irs and the treasury department have expanded the reporting requirements associated with form 926, return by.

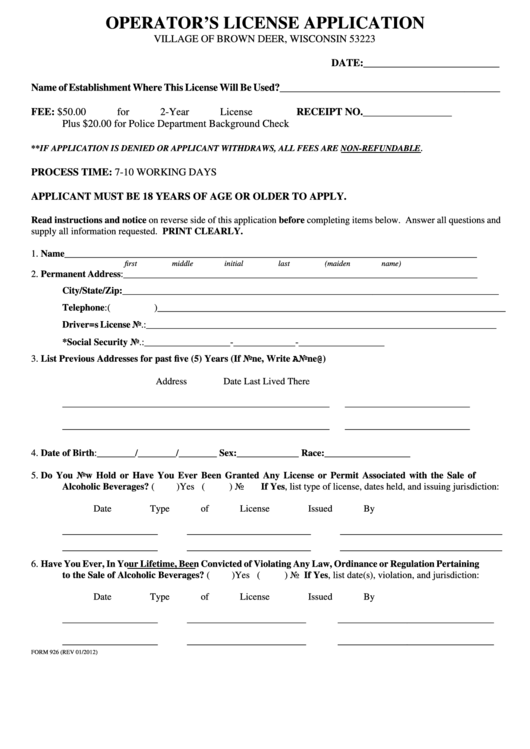

Form 926 Operator'S License Application Village Of Brown Deer

Transferor of property to a foreign corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038b(a)(1)(a) of the internal revenue code to a foreign corporation. Keep in mind, if you have foreign transactions or assets, you may need to file additional forms. Web the irs and the treasury department have expanded the.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

For instructions and the latest information. This article will focus briefly on the history and purpose of this form, followed by a description of changes that were made effective beginning in december 2008. Domestic partnership (special rules) transfers of cash & form 926 Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Keep.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Web irs form 926 is the form u.s. Under the 2014 regulations, a u.s. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Others, like fincen form 114, need to be filed separately. Citizens and residents to file the form 926:

IRS Form 926 What You Need To Know Silver Tax Group

Domestic partnership (special rules) transfers of cash & form 926 For instructions and the latest information. Web form 926 is filed as part of your tax return. Citizens and residents to file the form 926: Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation.

Form 926 Filing Requirements New Jersey Accountant Tax Reduction

Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Web generally, a u.s. Transferor of property to a foreign corporation. Taxpayer must complete form 926, return by a u.s. This article will focus briefly on the history and purpose of this form, followed by a description of changes that were made effective beginning.

Instructions Draft For Form 926 Return By A U.s. Transferor Of

Web form 926 is filed as part of your tax return. Transferor of property to a foreign corporation. Citizens and residents to file the form 926: This article will focus briefly on the history and purpose of this form, followed by a description of changes that were made effective beginning in december 2008. Some need to be filed with your.

Transferor Of Property To A Foreign Corporation, To Report Any Exchanges Or Transfers Of Tangible Or Intangible Property That Are Described In Section 6038B(A)(1)(A) Of The Internal Revenue Code To A Foreign Corporation.

Others, like fincen form 114, need to be filed separately. Taxpayer must complete form 926, return by a u.s. Transferor of property, in a transaction in which a gra is required, must report the fair market value, adjusted tax. Transferor of property to a foreign corporation.

Some Need To Be Filed With Your Tax Return.

Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Other forms that may be required. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the reporting threshold requirements: Web the irs requires certain u.s.

This Would Include Transfers Of Cash Over $100,000 To A Foreign Corporation, Or If The Transfer Of Cash Resulted In Owning More Than 10% Of The Foreign Corporation’s Stock.

Attach to your income tax return for the year of the transfer or distribution. Under the 2014 regulations, a u.s. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign corporation that are described in section 6038b(a)(1)(a), 367(d), or 367(e).

Persons Filing This Form May Be Required To File Fincen Form 114, Report Of Foreign Bank And Financial Accounts (Fbar).

For instructions and the latest information. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign corporation that are described in section 6038b (a) (1) (a), 367 (d), or 367 (e). November 2018) department of the treasury internal revenue service. Web generally, a u.s.