Form 941 Correction

Form 941 Correction - Web employers should use the corresponding x forms listed below to correct employment tax errors as soon as they are discovered. Read the separate instructions before you complete form 941. If you didn’t file a form. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the irs will contact the filer to reconcile the difference prior to completing the processing of form 941. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Taxable social security wages and tips. Deadlines limit your ability to fix errors several years after they’re made. Web correction to the instructions for form 941 (rev. Wages, tips, and other compensation. Taxable medicare wages and tips.

If you didn’t file a form. Web correction to the instructions for form 941 (rev. Taxable social security wages and tips. Web employers should use the corresponding x forms listed below to correct employment tax errors as soon as they are discovered. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the irs will contact the filer to reconcile the difference prior to completing the processing of form 941. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Type or print within the boxes. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. For example, if wages were understated or social security tax on tips was overstated. Employers can submit the correction as soon as they discover an error, and in the case.

Type or print within the boxes. Taxable medicare wages and tips. For example, if wages were understated or social security tax on tips was overstated. Web employers should use the corresponding x forms listed below to correct employment tax errors as soon as they are discovered. Wages, tips, and other compensation. Read the separate instructions before you complete form 941. Income tax withheld from these wages, tips, and compensation. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Web correcting a previously filed form 941. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the irs will contact the filer to reconcile the difference prior to completing the processing of form 941.

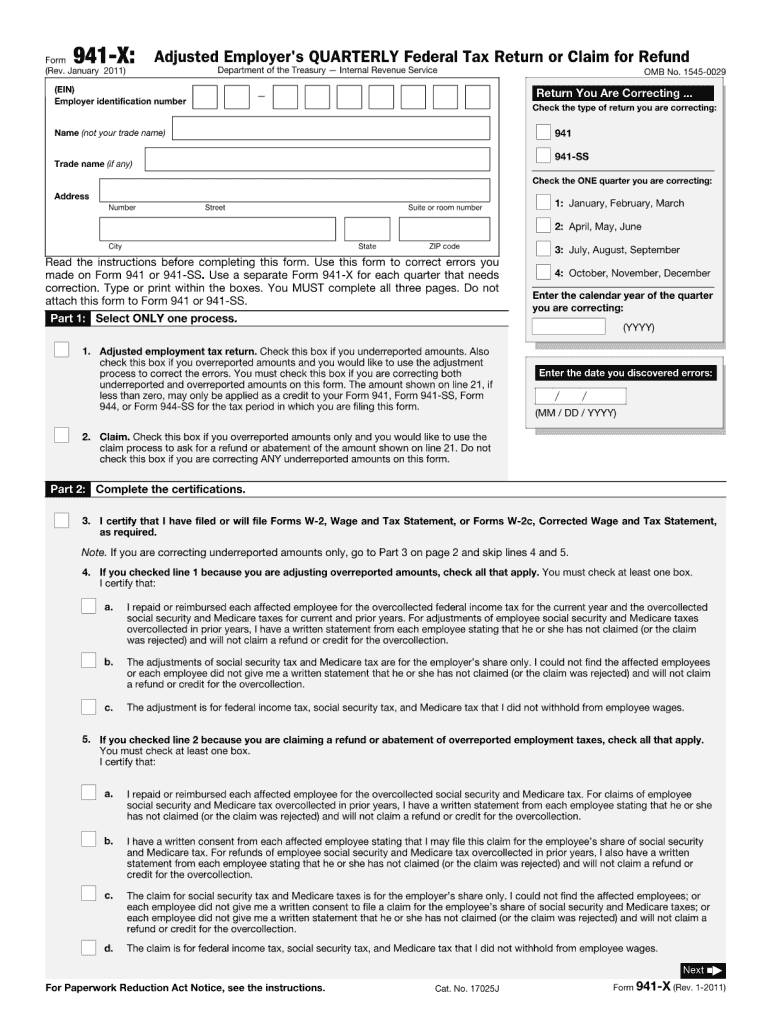

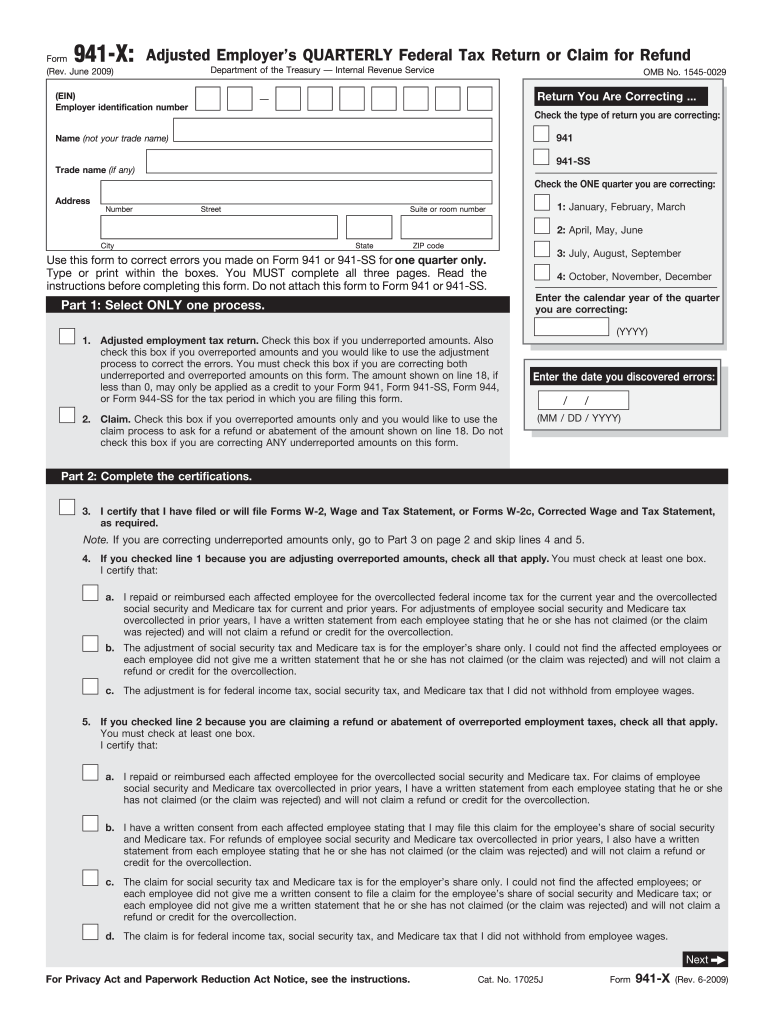

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

For example, if wages were understated or social security tax on tips was overstated. Therefore, you may need to amend your income tax return (for example, forms 1040,. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Taxable social security wages and tips. Correcting your form 941 filing mistake is a fairly easy.

14 Form Correction Attending 14 Form Correction Can Be A Disaster If

Web correcting a previously filed form 941. Read the separate instructions before you complete form 941. Web correction to the instructions for form 941 (rev. Deadlines limit your ability to fix errors several years after they’re made. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the irs will contact the.

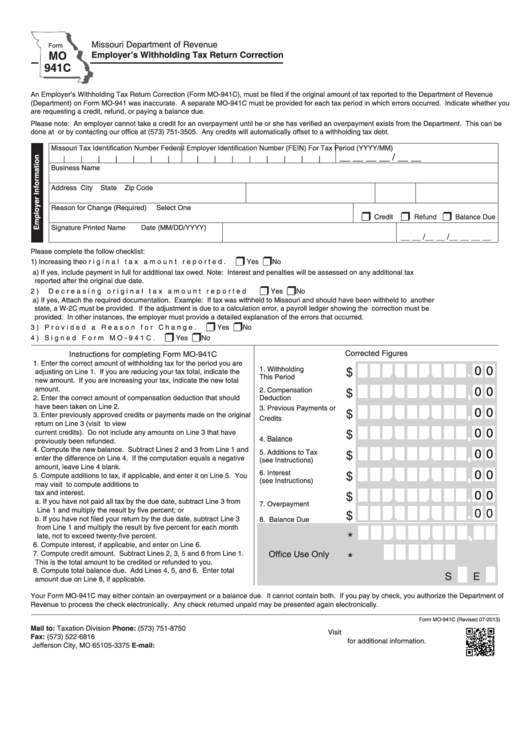

Missouri Employee Tax Forms 2022

Correcting your form 941 filing mistake is a fairly easy. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the irs will contact the filer to reconcile the difference prior to completing the processing of form 941. If you didn’t file a form. Web correction to the instructions for form 941.

8 Form Amended I Will Tell You The Truth About 8 Form Amended In The

Web correcting a previously filed form 941. Income tax withheld from these wages, tips, and compensation. Web employers should use the corresponding x forms listed below to correct employment tax errors as soon as they are discovered. Taxable social security wages and tips. Web correction to the instructions for form 941 (rev.

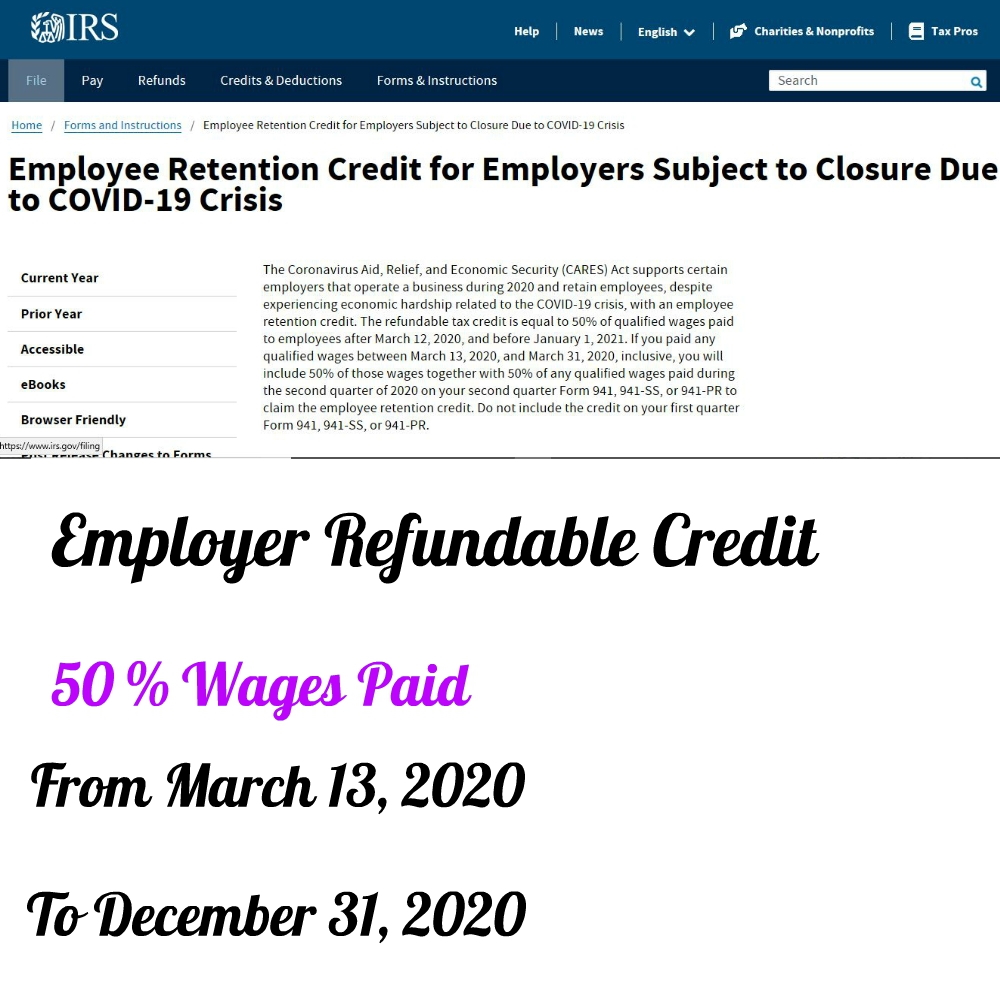

2020 Form 941 Employee Retention Credit for Employers subject to

Correcting your form 941 filing mistake is a fairly easy. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Read the separate instructions before you complete form.

Form 941 X Fill Out and Sign Printable PDF Template signNow

It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Web employers should use the corresponding x forms listed below to correct employment tax errors as soon as they are discovered. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and.

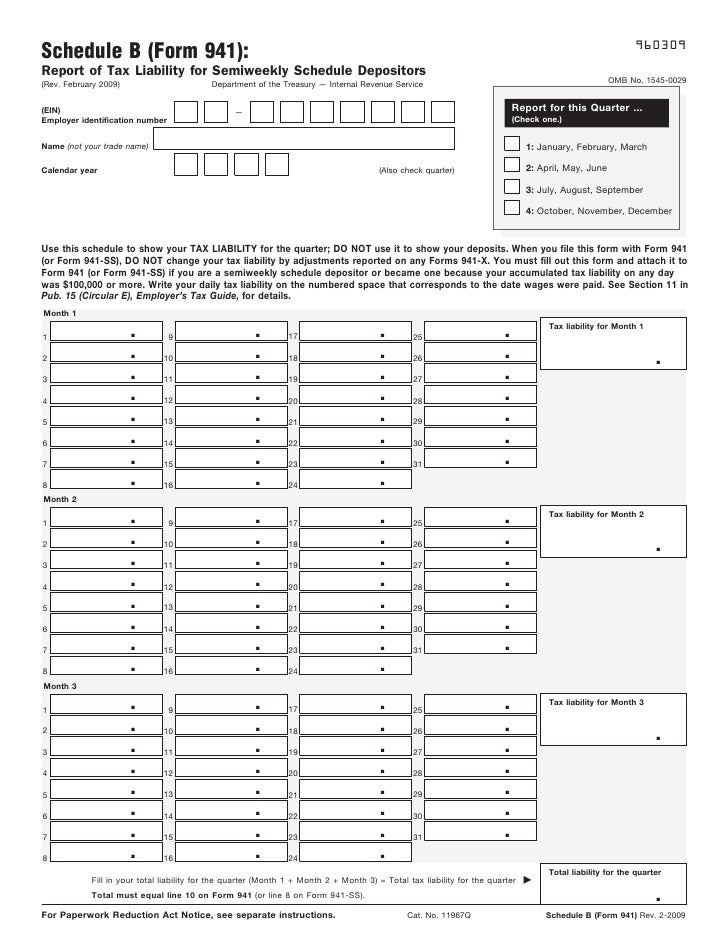

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Taxable medicare wages and tips. Type or print within the boxes. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the.

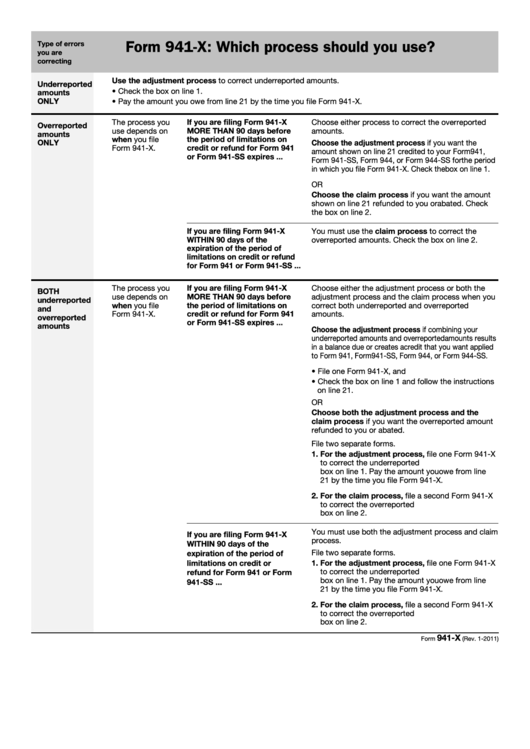

Instructions For Form 941X Adjusted Employer'S Quarterly Federal Tax

Taxable social security wages and tips. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the irs will contact the filer to reconcile the difference prior to completing the processing of form 941. Income tax withheld from these wages, tips, and compensation. Therefore, you may need to amend your income tax.

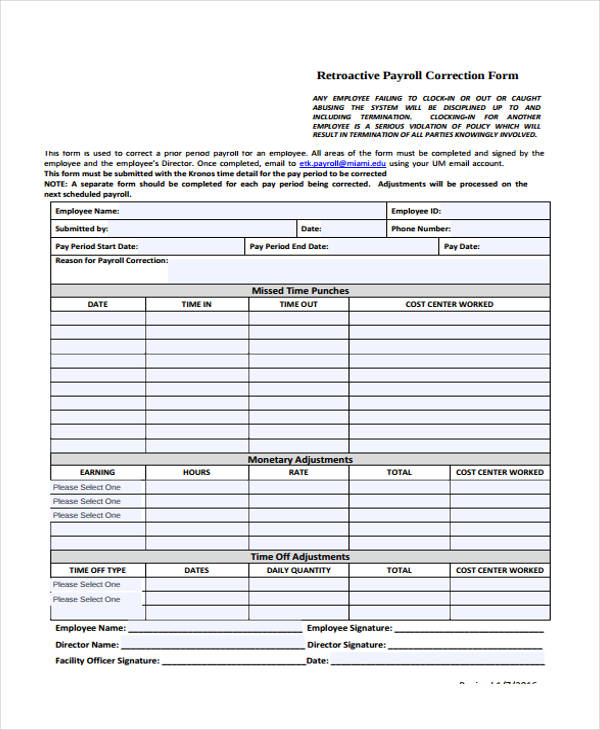

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Deadlines limit your ability to fix errors several years after they’re made. If you didn’t file a form. Read the separate instructions before you complete form 941. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Taxable social security.

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the irs will contact the filer to reconcile the difference prior to completing the processing of form 941. Deadlines limit your ability.

Web Correcting A Previously Filed Form 941.

Therefore, you may need to amend your income tax return (for example, forms 1040,. For example, if wages were understated or social security tax on tips was overstated. Web employers should use the corresponding x forms listed below to correct employment tax errors as soon as they are discovered. Income tax withheld from these wages, tips, and compensation.

Employers Can Submit The Correction As Soon As They Discover An Error, And In The Case.

It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Read the separate instructions before you complete form 941. Deadlines limit your ability to fix errors several years after they’re made. Web the irs will correct the amount reported on line 13f to match any advance payments issued and the irs will contact the filer to reconcile the difference prior to completing the processing of form 941.

Taxable Social Security Wages And Tips.

Web correction to the instructions for form 941 (rev. Taxable medicare wages and tips. Wages, tips, and other compensation. If you didn’t file a form.

You Must Complete All Five Pages.

Type or print within the boxes. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Correcting your form 941 filing mistake is a fairly easy.