Form 941 Q4 2020

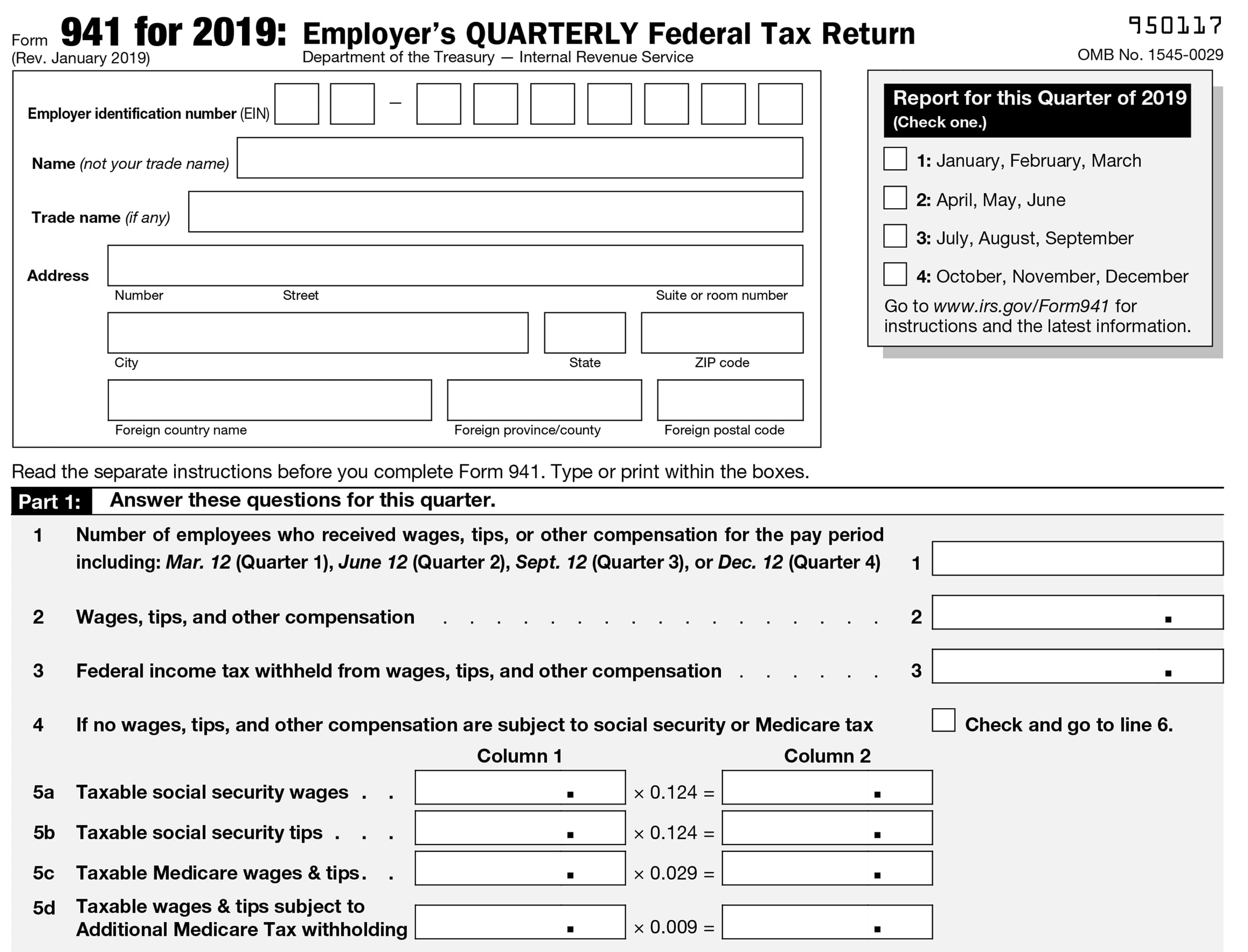

Form 941 Q4 2020 - January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web report for this quarter of 2020 (check one.) 1: Complete, edit or print tax forms instantly. Try it for free now! Number of employees who received wages, tips, or other compensation for the pay period including: Web 2020 form 941 quarterly tax return 2020 form 941 quarterly tax return employers quarterly federal tax return 950120, 2020 quarterly report omb: April, may, june read the separate instructions before completing this form. July 2020) employer’s quarterly federal tax return department of the treasury — internal. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web employer’s quarterly federal tax return form 941 for 2020:

July 2020) employer’s quarterly federal tax return department of the treasury — internal. Web the irs guidance provides a limited 4th quarter procedure by which qualifying erc wage amounts for the 2nd and/or 3rd quarters of 2020 can be reported. Following that, the irs has finalized the form 941 for the 3rd and 4th quarters. Web calculate the amount of your credit for q4 2020, and reduce your form 941, employer's quarterly federal tax return deposit by that amount. October, november, december go to www.irs.gov/form941 for instructions and the latest. Upload, modify or create forms. Answer these questions for this quarter. Web report for this quarter of 2020 (check one.) 1: Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Don't use an earlier revision to report taxes for 2023.

Web up to 10% cash back employers use form 941, worksheet 4 to claim the new erc for wages paid after june 30, 2021. Web the irs guidance provides a limited 4th quarter procedure by which qualifying erc wage amounts for the 2nd and/or 3rd quarters of 2020 can be reported. Web 2020 form 941 quarterly tax return 2020 form 941 quarterly tax return employers quarterly federal tax return 950120, 2020 quarterly report omb: Upload, modify or create forms. June 12 (quarter 2), sept. The nonrefundable portion of the credit is credited. Complete, edit or print tax forms instantly. April, may, june read the separate instructions before completing this form. Following that, the irs has finalized the form 941 for the 3rd and 4th quarters. Try it for free now!

941 Form 2020 941 Forms

Number of employees who received wages, tips, or other compensation for the pay period including: Web report for this quarter of 2020 (check one.) 1: Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; June 12 (quarter 2), sept. Accordingly, if employers claimed this.

2020 Form 941 Employer’s Quarterly Federal Tax Return Business

Web employer’s quarterly federal tax return form 941 for 2020: Ad access irs tax forms. Accordingly, if employers claimed this. Web up to 10% cash back employers use form 941, worksheet 4 to claim the new erc for wages paid after june 30, 2021. March 2021) employer’s quarterly federal tax return department of the treasury — internal.

IRS Schedule R (Form 941) 20202021 Fill and Sign Printable Template

Complete, edit or print tax forms instantly. Answer these questions for this quarter. Web the form 941 instructions indicate that the cares act employee retention credit cannot be claimed in the 2020 first quarter; April, may, june read the separate instructions before completing this form. June 12 (quarter 2), sept.

IRS Releases New Draft of Form 941 for 2020 LaPorte

October, november, december go to www.irs.gov/form941 for instructions and the latest. Web the form 941 instructions indicate that the cares act employee retention credit cannot be claimed in the 2020 first quarter; January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Answer these questions for this quarter. Upload, modify or create.

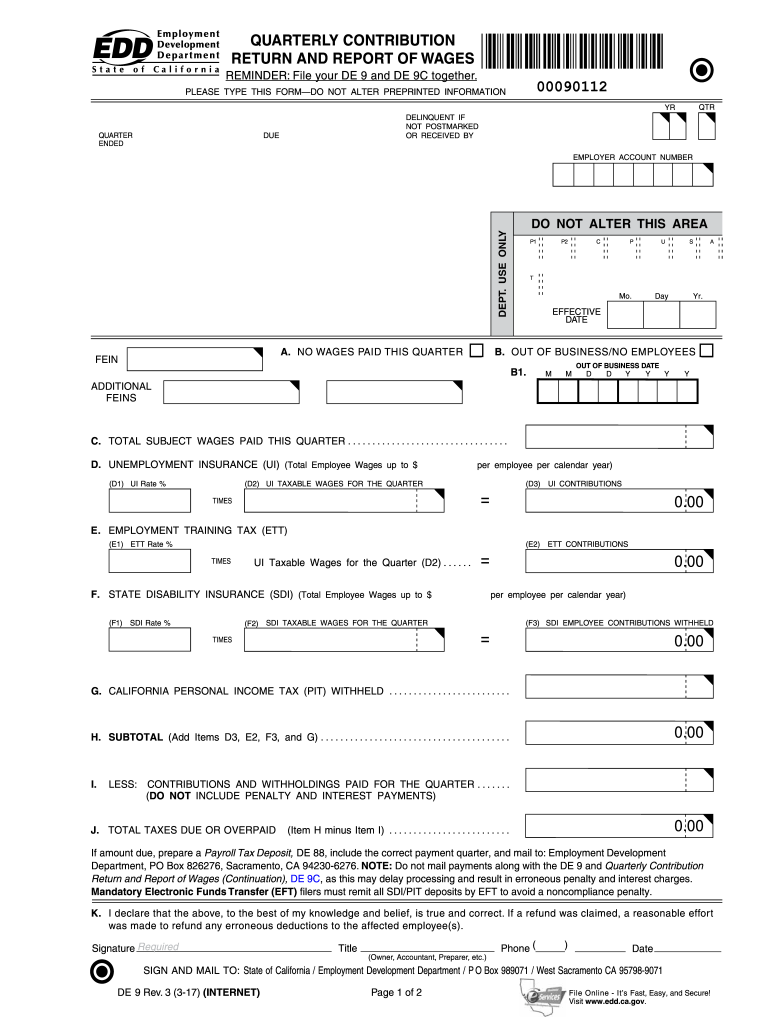

20142021 Form CA DE 9 Fill Online, Printable, Fillable, Blank pdfFiller

October, november, december go to www.irs.gov/form941 for instructions and the latest. The nonrefundable portion of the credit is credited. Web the form 941 instructions indicate that the cares act employee retention credit cannot be claimed in the 2020 first quarter; Complete, edit or print tax forms instantly. June 12 (quarter 2), sept.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Web calculate the amount of your credit for q4 2020, and reduce your form 941, employer's quarterly federal tax return deposit by that amount. Try it for free now! Number of employees who received wages, tips, or other compensation for the pay period including: Accordingly, if employers claimed this. Web use the march 2023 revision of form 941 to report.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Web the irs guidance provides a limited 4th quarter procedure by which qualifying erc wage amounts for the 2nd and/or 3rd quarters of 2020 can be reported. Try it for free now! Following that, the irs has finalized the form 941 for the 3rd and 4th quarters. The nonrefundable portion of the credit is credited. Number of employees who received.

2022 Q4 tax calendar Key deadlines for businesses and other employers

Accordingly, if employers claimed this. Web report for this quarter of 2020 (check one.) 1: Don't use an earlier revision to report taxes for 2023. Web 2020 form 941 quarterly tax return 2020 form 941 quarterly tax return employers quarterly federal tax return 950120, 2020 quarterly report omb: Answer these questions for this quarter.

EFile 941 at 3.99 Fillable Form 941 2019 Create 941 for Free

Upload, modify or create forms. Web the form 941 instructions indicate that the cares act employee retention credit cannot be claimed in the 2020 first quarter; April, may, june read the separate instructions before completing this form. June 12 (quarter 2), sept. March 2021) employer’s quarterly federal tax return department of the treasury — internal.

7 Awesome Reasons To File Your Form 941 With TaxBandits Blog TaxBandits

Complete, edit or print tax forms instantly. The nonrefundable portion of the credit is credited. Web calculate the amount of your credit for q4 2020, and reduce your form 941, employer's quarterly federal tax return deposit by that amount. June 12 (quarter 2), sept. Answer these questions for this quarter.

Ad Access Irs Tax Forms.

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. July 2020) employer’s quarterly federal tax return department of the treasury — internal. Web calculate the amount of your credit for q4 2020, and reduce your form 941, employer's quarterly federal tax return deposit by that amount. Web employer’s quarterly federal tax return form 941 for 2020:

The Nonrefundable Portion Of The Credit Is Credited.

Number of employees who received wages, tips, or other compensation for the pay period including: Web report for this quarter of 2020 (check one.) 1: Web 2020 form 941 quarterly tax return 2020 form 941 quarterly tax return employers quarterly federal tax return 950120, 2020 quarterly report omb: Following that, the irs has finalized the form 941 for the 3rd and 4th quarters.

Web The Form 941 Instructions Indicate That The Cares Act Employee Retention Credit Cannot Be Claimed In The 2020 First Quarter;

March 2021) employer’s quarterly federal tax return department of the treasury — internal. Don't use an earlier revision to report taxes for 2023. June 12 (quarter 2), sept. April, may, june read the separate instructions before completing this form.

Web The Irs Guidance Provides A Limited 4Th Quarter Procedure By Which Qualifying Erc Wage Amounts For The 2Nd And/Or 3Rd Quarters Of 2020 Can Be Reported.

Web this august, the irs released the draft of form 941 with the expected changes. Web up to 10% cash back employers use form 941, worksheet 4 to claim the new erc for wages paid after june 30, 2021. October, november, december go to www.irs.gov/form941 for instructions and the latest. October, november, december go to www.irs.gov/form941 for instructions and the latest.