Form 941 Refund Status

Form 941 Refund Status - Web november 30, 2021 08:20 am hello! If your business qualifies for the employee retention credit refund, you’ll have to amend your filed forms 941 (payroll tax forms ). Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web payroll tax returns. Web getting a refund doesn’t occur automatically. Web you can start checking on the status of your refund within. It is easier than you think. The june 2021 revision of form 941 should be used for the. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web for questions regarding employee plans and exempt organizations determination applications;

It is easier than you think. The june 2021 revision of form 941 should be used for the. If your business qualifies for the employee retention credit refund, you’ll have to amend your filed forms 941 (payroll tax forms ). Web getting a refund doesn’t occur automatically. Web check your federal tax refund status. Check this box if you. Filing deadlines are in april, july, october and january. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Affirmations of tax exempt status; Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021.

If one of your virtues is patience, you’ll find the process of checking the status of. Web you can start checking on the status of your refund within. Web november 30, 2021 08:20 am hello! Web payroll tax returns. Those returns are processed in. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Check the status of your income tax refund for recent tax years. Filing deadlines are in april, july, october and january.

How to Complete Form 941 in 5 Simple Steps

Those returns are processed in. It is easier than you think. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web check your federal tax refund status. Filing deadlines are in april, july, october and january.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Web getting a refund doesn’t occur automatically. Web check your federal tax refund status. Irs2go app check your refund status, make a payment, find free tax. Web november 30, 2021 08:20 am hello! Web you can start checking on the status of your refund within.

Online Tax Tax Online Tax Refund Status

Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. The june 2021 revision of form 941 should be used for the. Web check your federal tax refund status. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Irs2go app check.

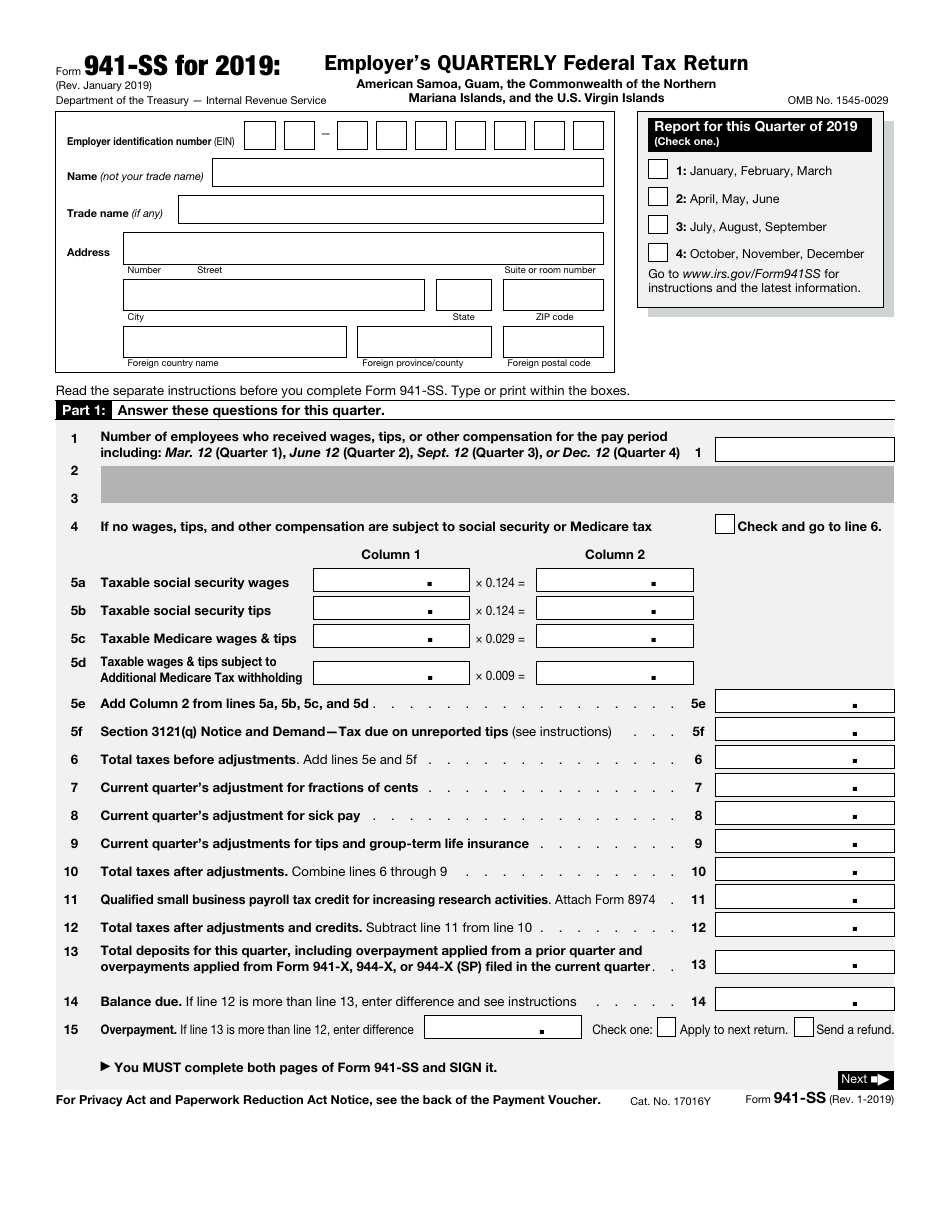

IRS Form 941SS 2019 Fill Out, Sign Online and Download Fillable

Web you can start checking on the status of your refund within. Irs2go app check your refund status, make a payment, find free tax. Web 1 2 3 next 50 comments jonpril moderator april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to. Check the status of your income.

Form 941, Employer's Quarterly Federal Tax Return Workful

Check this box if you. Irs2go app check your refund status, make a payment, find free tax. If your business qualifies for the employee retention credit refund, you’ll have to amend your filed forms 941 (payroll tax forms ). It is easier than you think. Filing deadlines are in april, july, october and january.

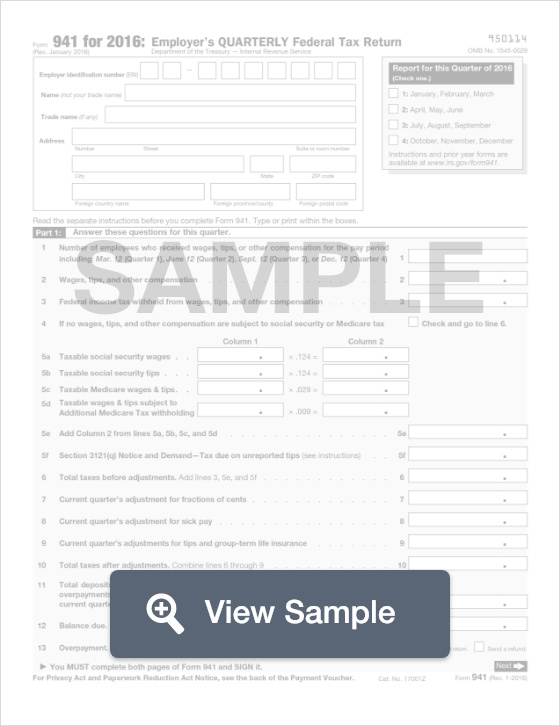

Fillable IRS Form 941 Free Printable PDF Sample FormSwift

Web check your federal tax refund status. Check this box if you. Web november 30, 2021 08:20 am hello! The june 2021 revision of form 941 should be used for the. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021.

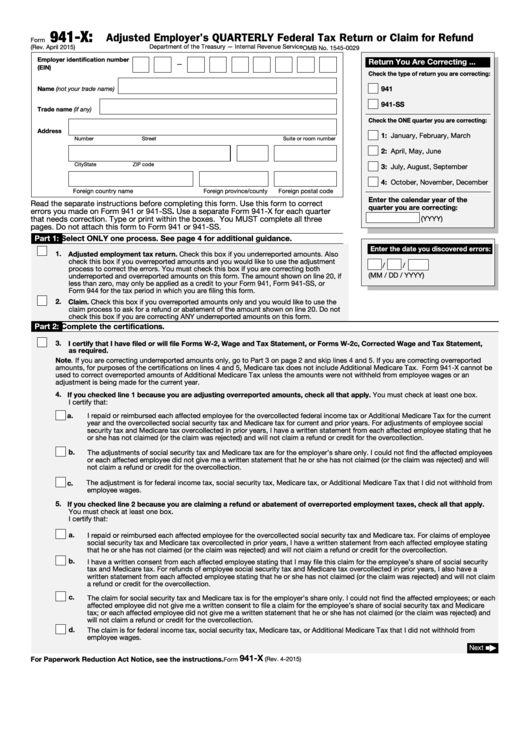

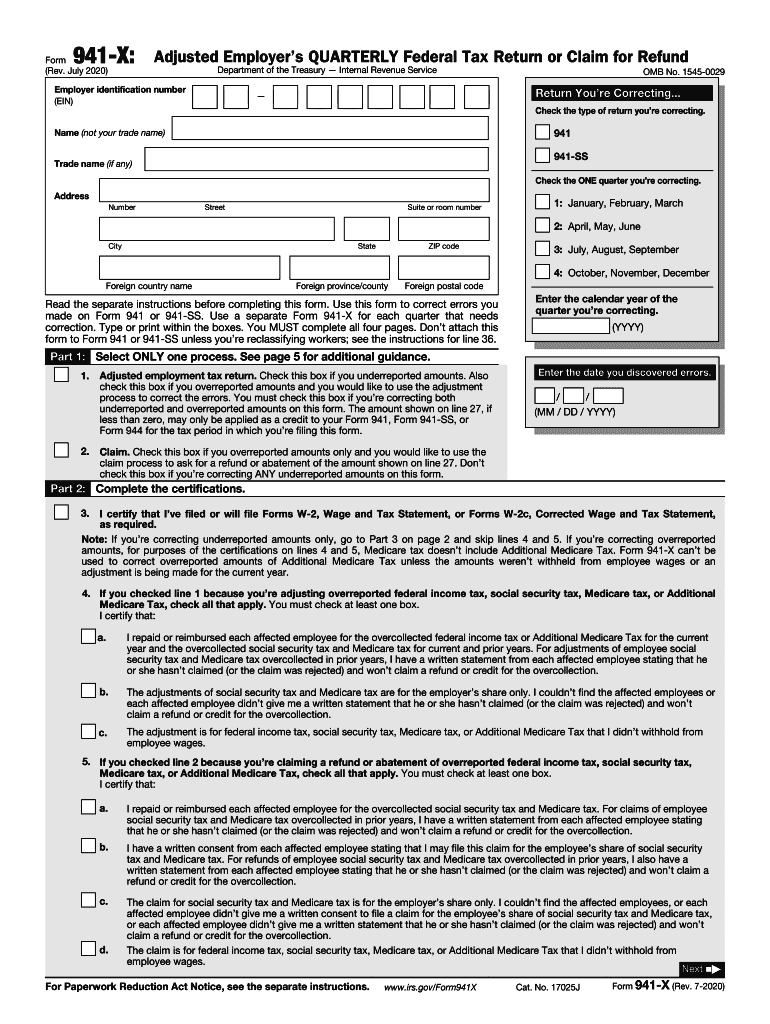

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Web where's my refund? Web for questions regarding employee plans and exempt organizations determination applications; Web check your federal tax refund status. Instead, employers in the u.s.

form 941 updated 2 Southland Data Processing

If your business qualifies for the employee retention credit refund, you’ll have to amend your filed forms 941 (payroll tax forms ). Web getting a refund doesn’t occur automatically. Web check your federal tax refund status. Web november 30, 2021 08:20 am hello! As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

941 X Form Fill Out and Sign Printable PDF Template signNow

Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. The june 2021 revision of form 941 should be used for the. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Irs2go app check your refund status, make a payment, find.

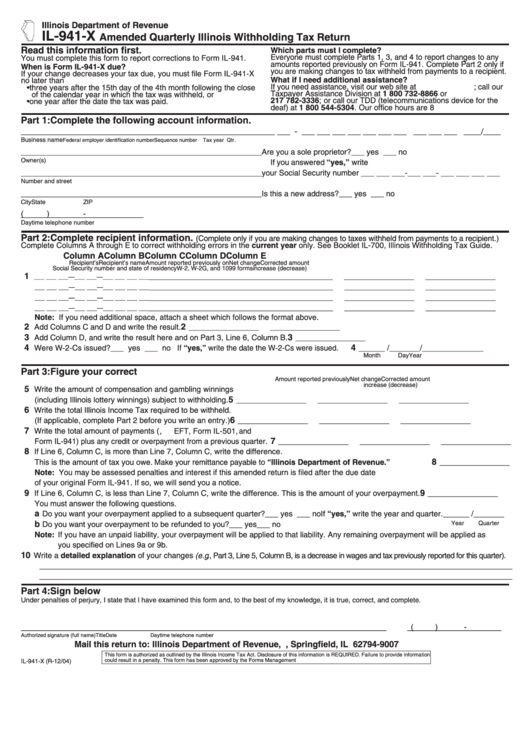

Form Il941X Amended Quarterly Illinois Withholding Tax Return

Web check your federal tax refund status. It is easier than you think. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Affirmations of tax exempt status; The june 2021 revision of form 941 should be used for the.

Irs2Go App Check Your Refund Status, Make A Payment, Find Free Tax.

It is easier than you think. Web payroll tax returns. The june 2021 revision of form 941 should be used for the. How to check status of the f941 refund?

Those Returns Are Processed In.

Web where's my refund? Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web 1 2 3 next 50 comments jonpril moderator april 21, 2021 05:50 pm hello @larryhd2, as of the moment, we're unable to provide the exact turnaround time as to.

Check This Box If You.

Web getting a refund doesn’t occur automatically. If your business qualifies for the employee retention credit refund, you’ll have to amend your filed forms 941 (payroll tax forms ). Web you can start checking on the status of your refund within. Web check your federal tax refund status.

Web For Questions Regarding Employee Plans And Exempt Organizations Determination Applications;

Filing deadlines are in april, july, october and january. If one of your virtues is patience, you’ll find the process of checking the status of. Web november 30, 2021 08:20 am hello! Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks.