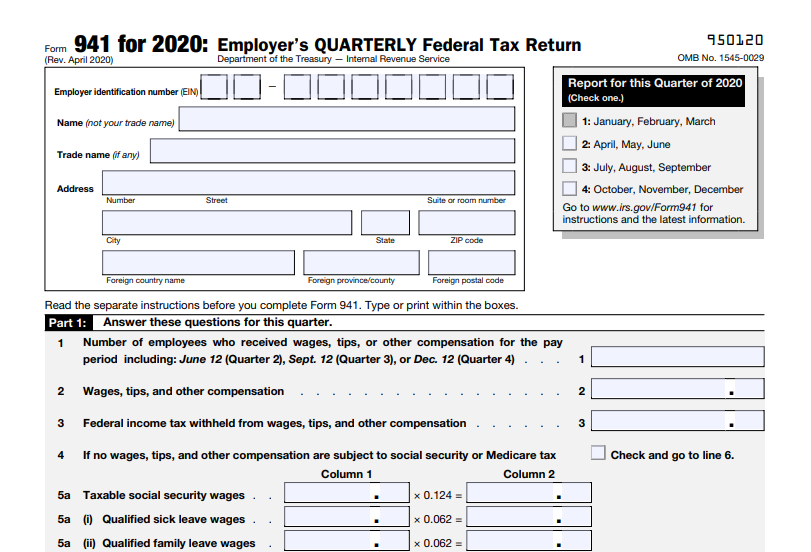

Form 941 Year 2020

Form 941 Year 2020 - Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Therefore, the tax rate on these wages is 6.2%. Instructions for form 941 (2021) pdf. Form 941 is used to determine Since the form seems to have changed 2x since the beginning of the year, i can't seem to find a way to file the q1 2020 941 form late. April, may, june read the separate instructions before completing this form. Type or print within the boxes. Web changes to form 941 (rev. We need it to figure and collect the right amount of tax. Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding.

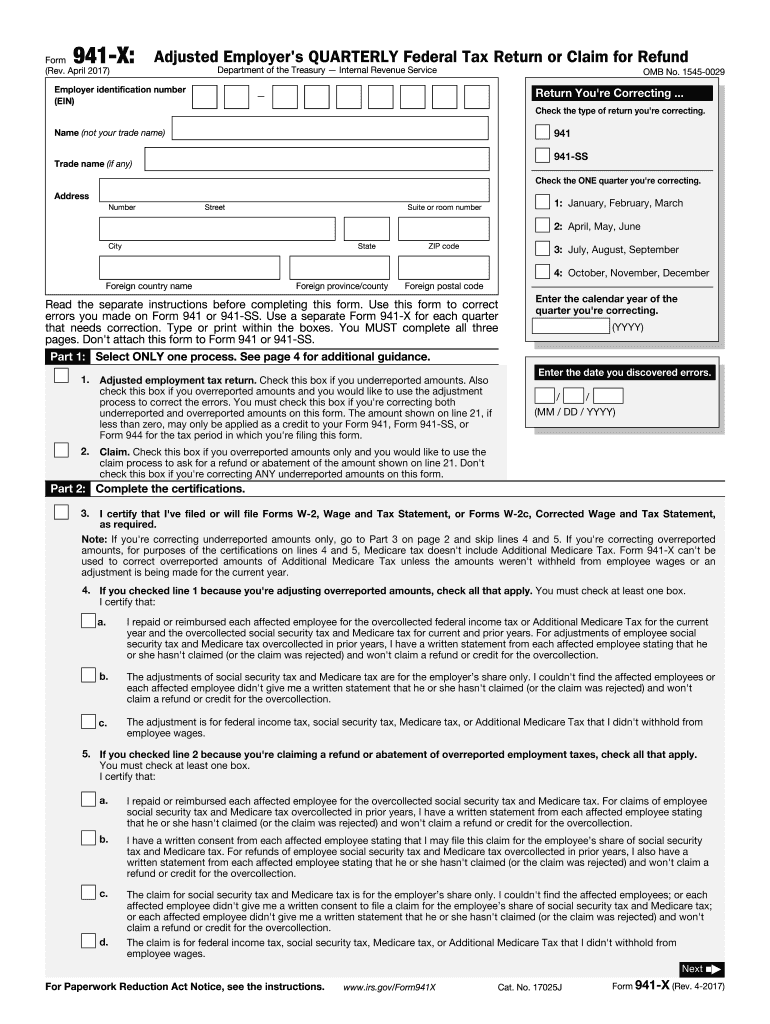

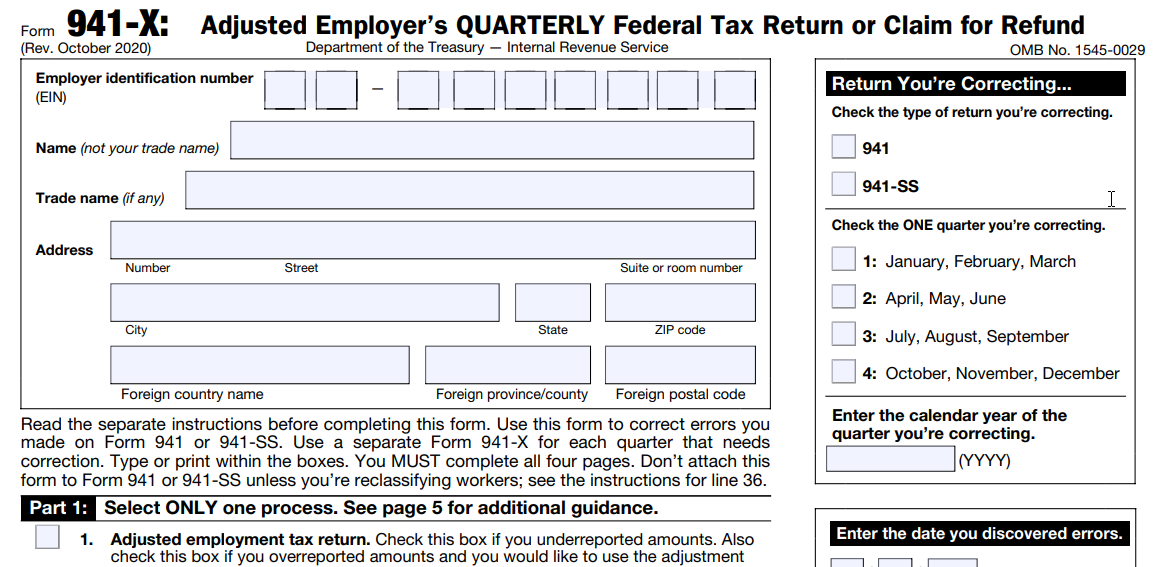

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Therefore, the tax rate on these wages is 6.2%. Web employer's quarterly federal tax return for 2021. Type or print within the boxes. April, may, june read the separate instructions before completing this form. 30 by the internal revenue service. We need it to figure and collect the right amount of tax. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Web get your form 941 (2020) in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately where to find a blank form 941 for 2020? Four lines—1, 13b, 24, and 25—were changed from those that were on this year’s second version of form 941, employer’s quarterly federal tax return, which was released.

Since the form seems to have changed 2x since the beginning of the year, i can't seem to find a way to file the q1 2020 941 form late. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Employer s quarterly federal tax return keywords: For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Form 941 is used to determine Therefore, the tax rate on these wages is 6.2%. 30 by the internal revenue service. Four lines—1, 13b, 24, and 25—were changed from those that were on this year’s second version of form 941, employer’s quarterly federal tax return, which was released. We need it to figure and collect the right amount of tax.

EFile your IRS Form 941 for the tax year 2020

Instructions for form 941 (2021) pdf. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of social security tax; Web get your form 941 (2020) in 3 easy steps 01 fill and edit template 02 sign it online.

The NoWorry Guide To File Form 941 During Tax Year 2020 Blog

Form 941 is used to determine Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. April, may, june read the separate instructions before completing this form. Web employer's quarterly federal tax return for 2021. Four lines—1, 13b, 24, and 25—were changed from those that were on this year’s second.

941 Form Fill Out and Sign Printable PDF Template signNow

Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Employer s quarterly federal tax return keywords: Type.

You Will Probably See These Changes on the Revised Form 941… Blog

Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. Therefore, the tax rate on these wages is 6.2%. Employer s quarterly federal tax return keywords: Type or print within the boxes. Web posted october 05, 2020 05:48 pm last updated october 05, 2020 5:48 pm i forgot to file.

EFile Form 941 for 2022 File 941 Electronically at 4.95

April, may, june read the separate instructions before completing this form. Instructions for form 941 (2021) pdf. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on How do i find the old version of the 941 form so i can send it in?.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

You'll be able to obtain the blank form from the pdfliner catalog. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Form 941 is used to determine Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

30 by the internal revenue service. April, may, june read the separate instructions before completing this form. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The social security wage base limit is $160,200. Web qualified sick leave wages and qualified family leave wages paid in 2023 for.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Web posted october 05, 2020 05:48 pm last updated october 05, 2020 5:48 pm i forgot to file q1 2020 form 941. The social security wage base limit is $160,200. Web changes to form 941 (rev. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The july 2020.

Your Ultimate Form 941 HowTo Guide Blog TaxBandits

April, may, june read the separate instructions before completing this form. 30 by the internal revenue service. Type or print within the boxes. Web get your form 941 (2020) in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately where to find a blank form 941 for 2020? We need it to.

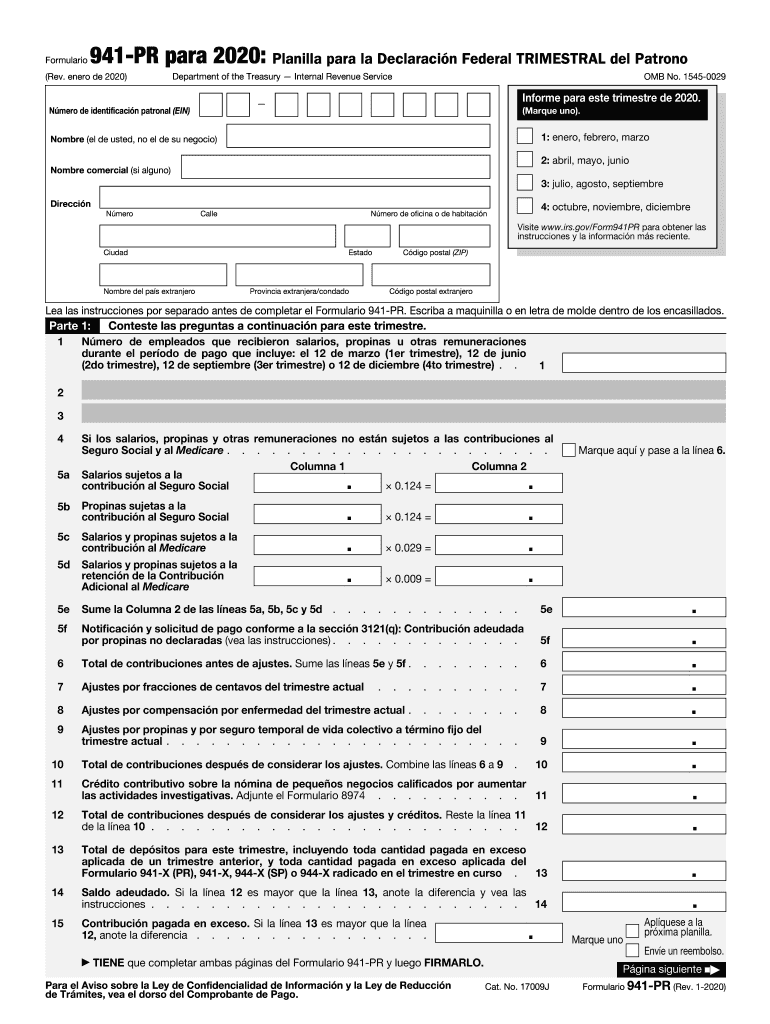

2020 Form IRS 941PR Fill Online, Printable, Fillable, Blank PDFfiller

We need it to figure and collect the right amount of tax. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. 30 by the internal revenue service. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters.

April, May, June Read The Separate Instructions Before Completing This Form.

Web changes to form 941 (rev. The social security wage base limit is $160,200. Form 941 is used to determine Therefore, the tax rate on these wages is 6.2%.

Subtitle C, Employment Taxes, Of The Internal Revenue Code Imposes Employment Taxes On Wages And Provides For Income Tax Withholding.

How do i find the old version of the 941 form so i can send it in? You'll be able to obtain the blank form from the pdfliner catalog. Web posted october 05, 2020 05:48 pm last updated october 05, 2020 5:48 pm i forgot to file q1 2020 form 941. 30 by the internal revenue service.

Instructions For Form 941 (2021) Pdf.

Type or print within the boxes. Web employer's quarterly federal tax return for 2021. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Since the form seems to have changed 2x since the beginning of the year, i can't seem to find a way to file the q1 2020 941 form late.

Web Get Your Form 941 (2020) In 3 Easy Steps 01 Fill And Edit Template 02 Sign It Online 03 Export Or Print Immediately Where To Find A Blank Form 941 For 2020?

The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on We need it to figure and collect the right amount of tax.