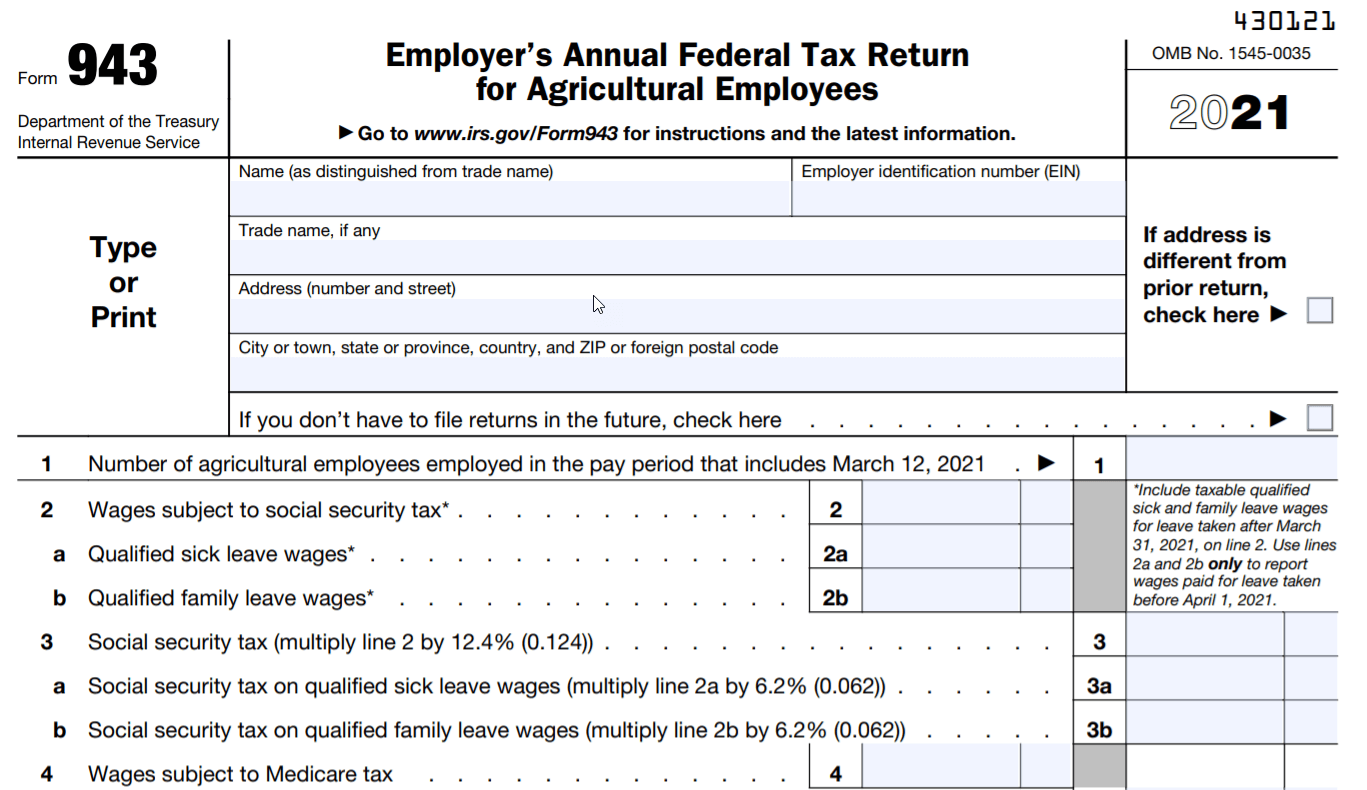

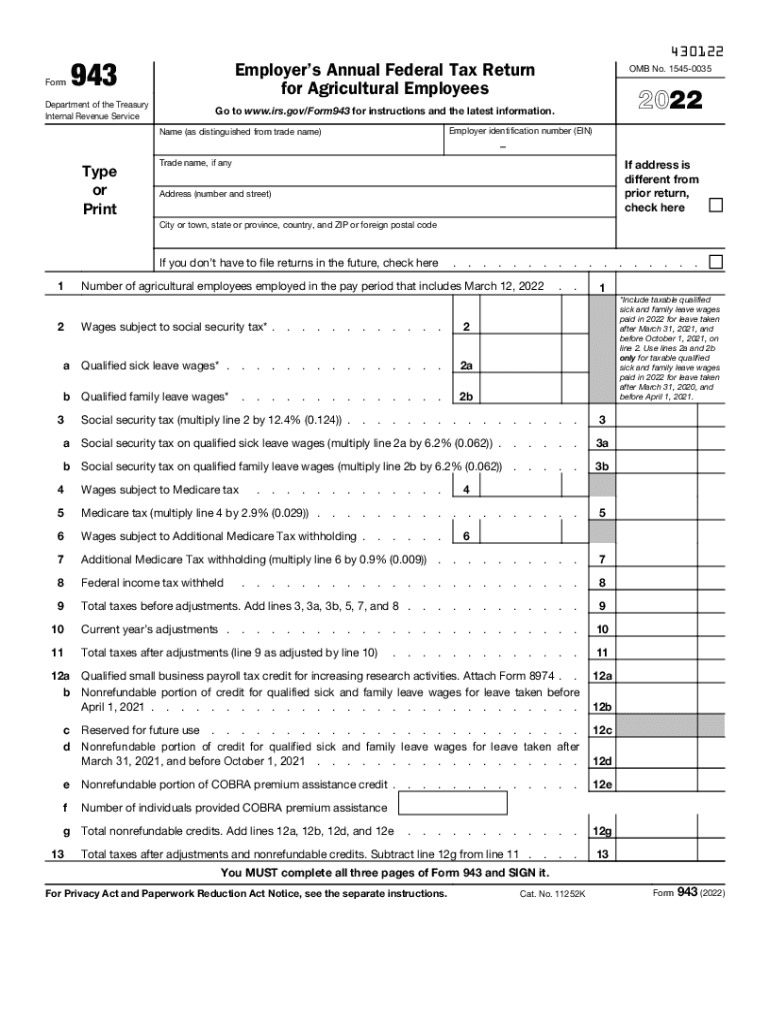

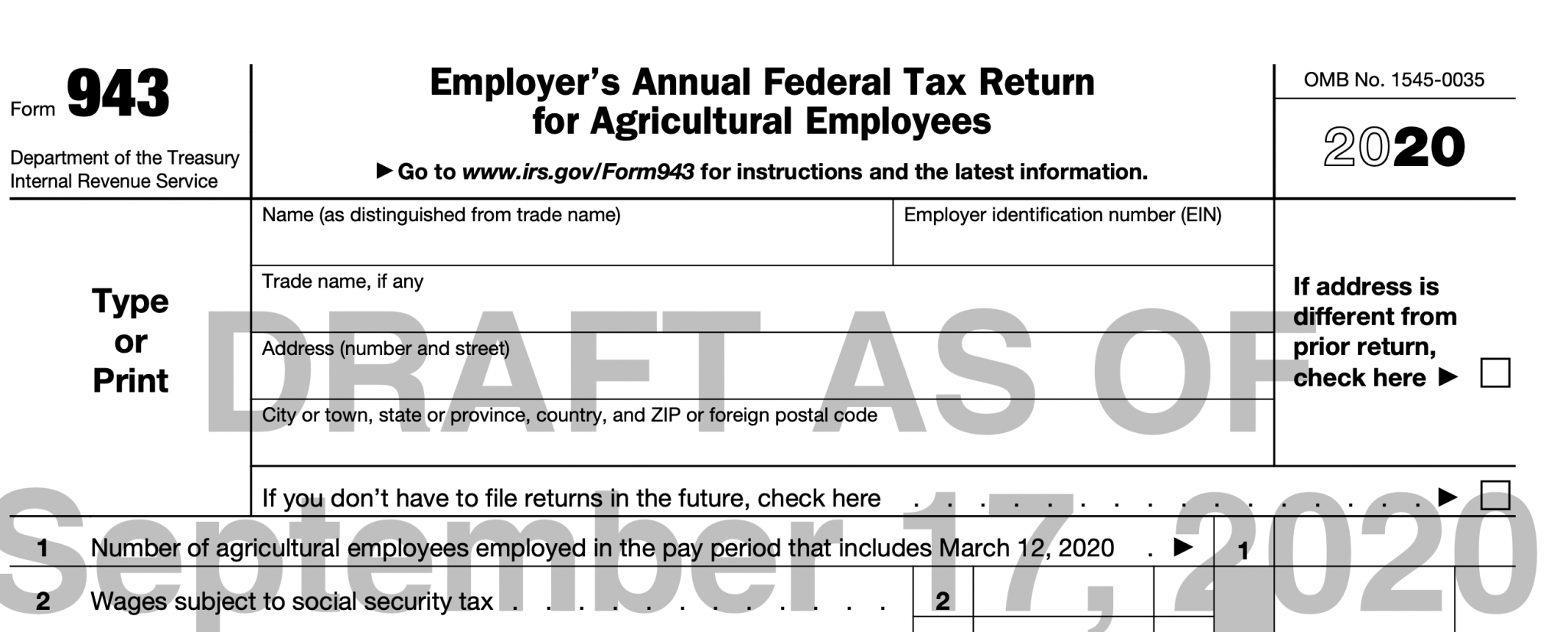

Form 943 For 2022

Form 943 For 2022 - Web (form 943, line 12d). Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Employers use this form in the agriculture industry to report the medicare,. The instructions include three worksheets, two of which cover. Ad download or email form 943 & more fillable forms, register and subscribe now! Web for 2022, the due date for filing form 943 is january 31, 2023. Web form 943 is the employer's annual federal tax return for agricultural employees. Connecticut, delaware, district of columbia, georgia, illinois,. For more information, see the instructions for.

Web form 943 create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report. For more information, see the instructions for. About form 943, employer's annual federal tax return for agricultural employees. 29 by the internal revenue. The instructions include three worksheets, two of which cover. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Web draft versions of revised forms 943 and 944 for 2022 were released june 28 by the internal revenue service. Ad download or email form 943 & more fillable forms, register and subscribe now! • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your.

Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022. Web draft versions of revised forms 943 and 944 for 2022 were released june 28 by the internal revenue service. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Enter the number of employees employed during your pay period, including march 12, 2022. Employers use this form in the agriculture industry to report the medicare,. Complete, edit or print tax forms instantly. Web address as shown on form 943. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Web mailing addresses for forms 943. Signnow allows users to edit, sign, fill and share all type of documents online.

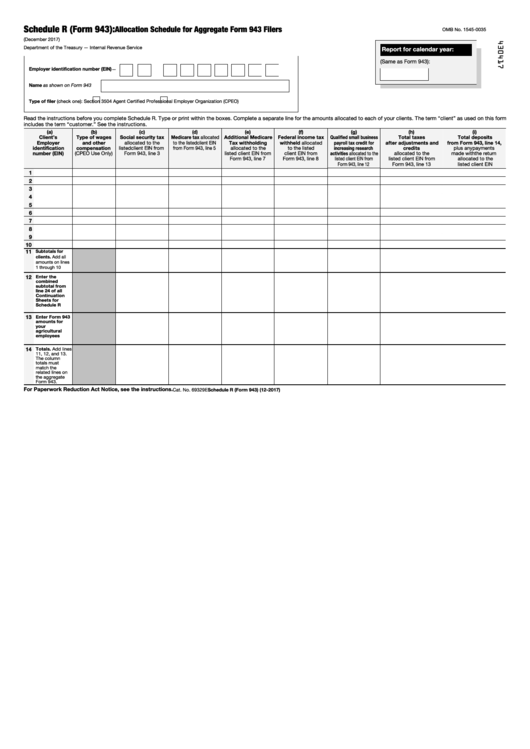

Fillable Schedule R (Form 943) Allocation Schedule For Aggregate Form

Web for 2022 tax year, file form 943 by january 31, 2023. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Enter the number of employees employed during your pay period, including march 12, 2022. Web what is.

IRS Form 943 for 2022 Employer's Annual Federal Tax Return for

The draft form 943, employer’s annual federal tax. Web form 943 is the employer's annual federal tax return for agricultural employees. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022. Web a draft of the 2022 schedule r for form 943, employer’s.

Fill Free fillable F943x Accessible Form 943X (Rev. February 2018

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. About form 943, employer's annual federal tax return for agricultural employees. Web form 943 create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the.

2018 form 943 fillable Fill out & sign online DocHub

Web address as shown on form 943. Web mailing addresses for forms 943. Ad complete irs tax forms online or print government tax documents. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. 29 by the internal revenue.

IRS Form 943 Complete PDF Tenplate Online in PDF

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web form 943 is the employer's annual federal tax return for agricultural employees. Irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report. The instructions include three.

2022 Form IRS 943 Fill Online, Printable, Fillable, Blank pdfFiller

Enter the number of employees employed during your pay period, including march 12, 2022. Web for 2022, file form 943 by january 31, 2023. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Employers use this form in the agriculture industry to report.

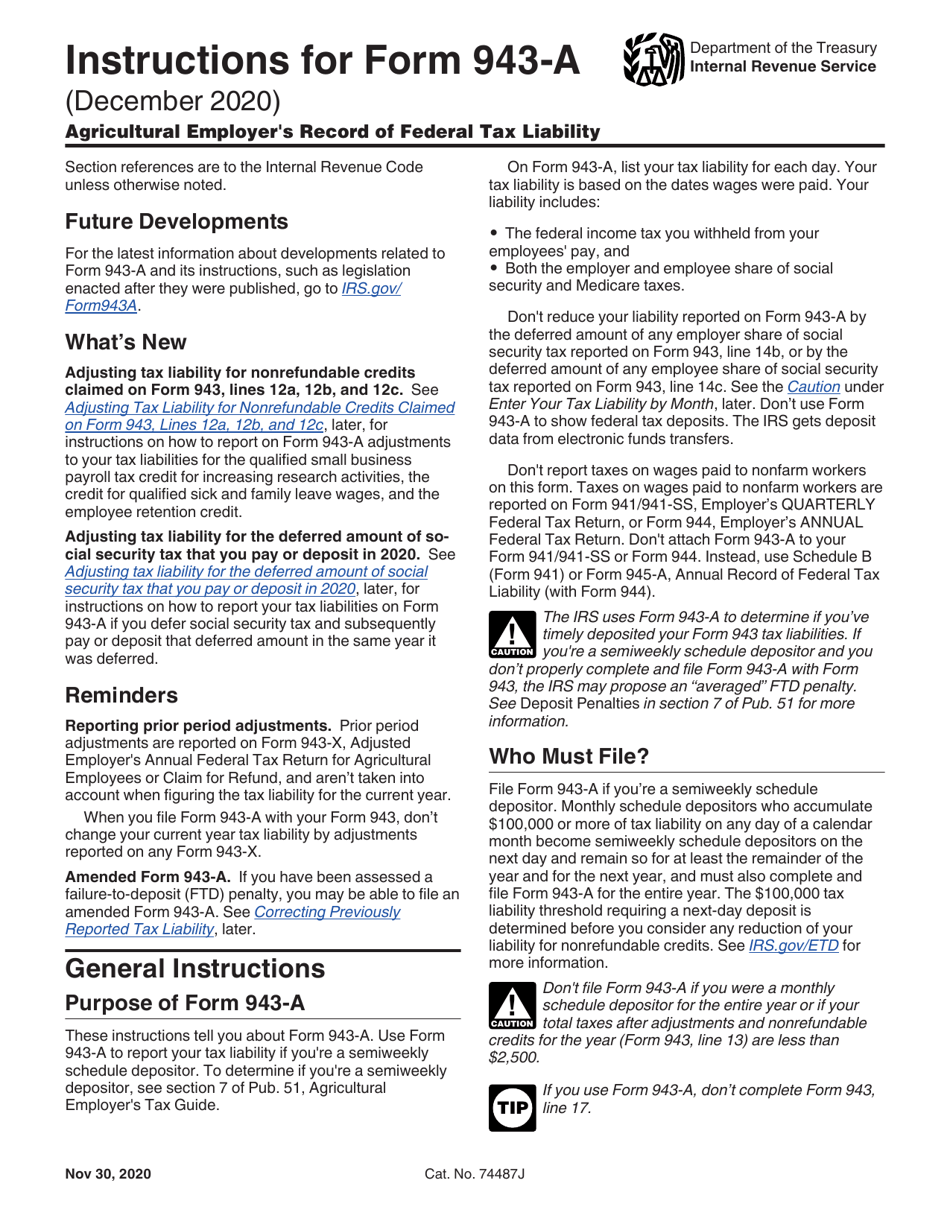

943a Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web a draft of the 2022 schedule r for form 943, employer’s annual federal tax return for agricultural employees, was released aug. About form 943, employer's annual federal tax return for agricultural employees. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report.

Download Instructions for IRS Form 943A Agricultural Employer's Record

1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax. Web for 2022 tax year, file form 943 by january 31, 2023. For more information, see the instructions for. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by.

Drafts of Form 943, 944 and 940 are Now Available with COVID19 Changes

Web form 943 is the employer's annual federal tax return for agricultural employees. 29 by the internal revenue. The instructions include three worksheets, two of which cover. Connecticut, delaware, district of columbia, georgia, illinois,. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your.

However, If You Made Deposits On Time In Full Payment Of The Taxes Due For The Year, You May File The.

Ad download or email form 943 & more fillable forms, register and subscribe now! Connecticut, delaware, district of columbia, georgia, illinois,. Web mailing addresses for forms 943. Employers use this form in the agriculture industry to report the medicare,.

• Enclose Your Check Or Money Order Made Payable To “United States Treasury.” Be Sure To Enter Your Ein, “Form 943,” And “2022” On Your.

Web draft versions of revised forms 943 and 944 for 2022 were released june 28 by the internal revenue service. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022.

1 Choose Form And Tax Year 2 Enter Social Security & Medicare Taxes 3 Enter Federal Income Tax.

Web what is irs form 943 for 2022? Web for 2022, file form 943 by january 31, 2023. Enter the number of employees employed during your pay period, including march 12, 2022. Web a draft of the 2022 schedule r for form 943, employer’s annual federal tax return for agricultural employees, was released aug.

For More Information, See The Instructions For.

Web form 943 is the employer's annual federal tax return for agricultural employees. The instructions include three worksheets, two of which cover. About form 943, employer's annual federal tax return for agricultural employees. Web for 2022 tax year, file form 943 by january 31, 2023.