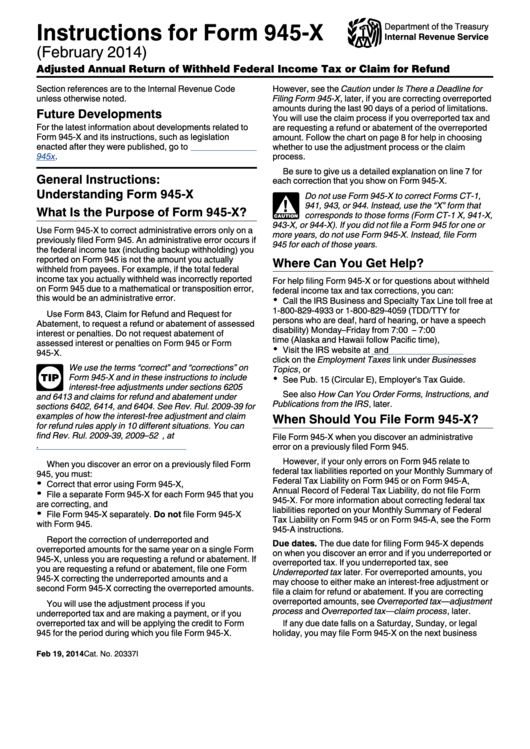

Form 945 Instructions

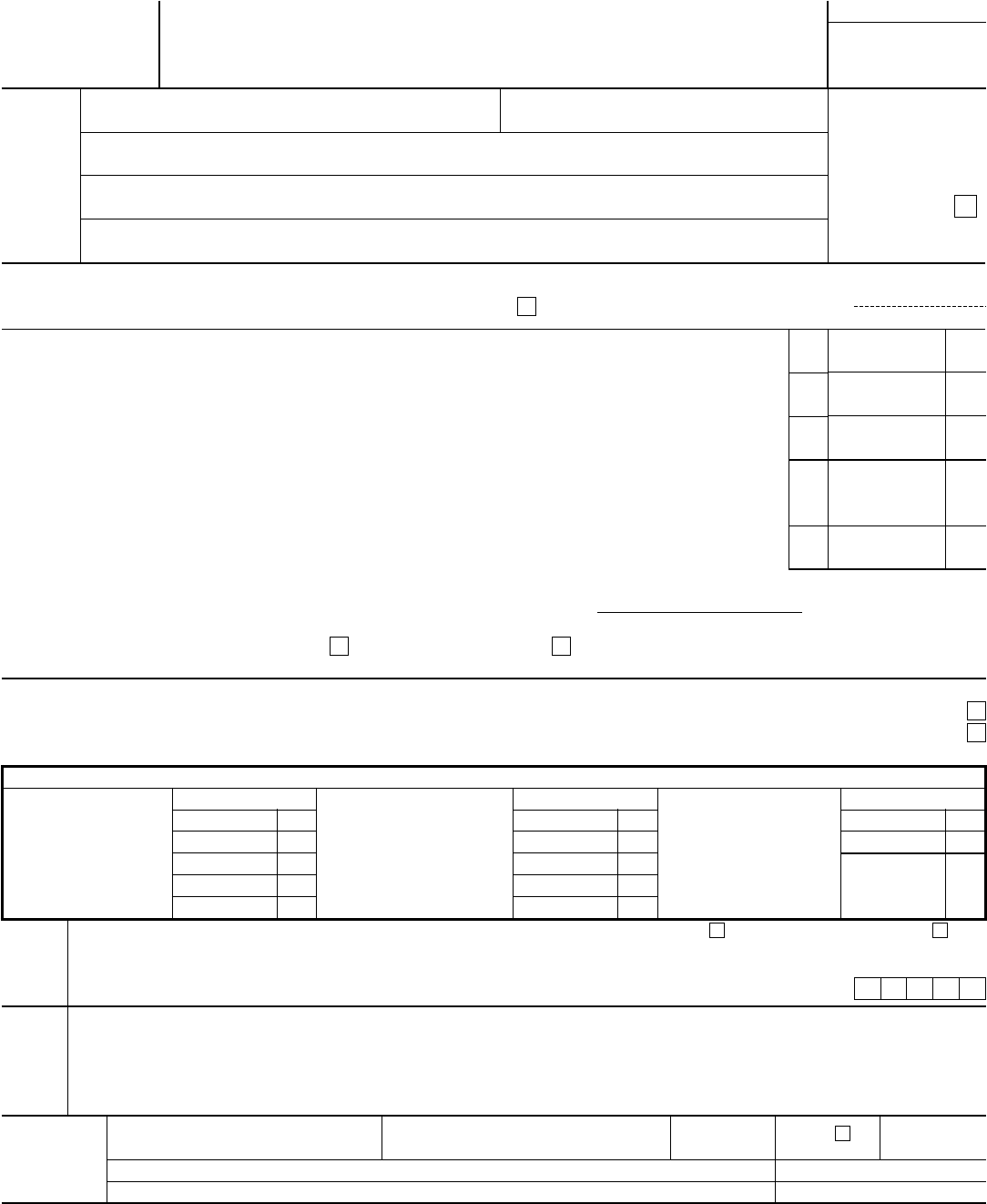

Form 945 Instructions - Payers of nonpayroll amounts registered for connecticut income tax withholding are required to file form ct‑945 even if no tax is due, tax was not required to be withheld, or federal form 945 is not required to be filed. Web you’re required to withhold 20% of the distribution for federal income taxes. Web when is irs form 945 due? 2017) instructions regarding use of the dhhs form 945, verification of medicaid. Use form 945 to report withheld federal income tax from nonpayroll payments. You’d file form 945 to report and pay the amount withheld. If the taxpayer has already made all payments in a timely matter, the irs generally allows an additional 10 calendar days, to. You file form 945 to report withholding for other types. These instructions give you some background information about form 945. Use this form to correct administrative errors only on a previously filed form 945.

Web when is irs form 945 due? These instructions give you some background information about form 945. Business entities may not need to file form 945 with the irs every year, so it can be easy to forget what exactly this form requires and when and how to fill it out. Web dhhs form 945 (sept. The dhhs form 945, verification of medicaid is designed for use in the following situations: Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Web address as shown on form 945. Here is what all businesses need to know about form 945 and its instructions going into. Use this form to correct administrative errors only on a previously filed form 945. When medicaid is approved for the retroactive period (up to three months prior to the date of application) but was not entered in the

Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. Web you’re required to withhold 20% of the distribution for federal income taxes. Web form 945 instructions for 2022. These instructions give you some background information about form 945. Web when is irs form 945 due? 2017) instructions regarding use of the dhhs form 945, verification of medicaid. Here is what all businesses need to know about form 945 and its instructions going into. The dhhs form 945, verification of medicaid is designed for use in the following situations: Use this form to correct administrative errors only on a previously filed form 945. They tell you who must file form 945, how to complete it line by line, and when and where to file it.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

Web dhhs form 945 (sept. Use form 945 to report withheld federal income tax from nonpayroll payments. Business entities may not need to file form 945 with the irs every year, so it can be easy to forget what exactly this form requires and when and how to fill it out. Web address as shown on form 945. Web form.

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

They tell you who must file form 945, how to complete it line by line, and when and where to file it. Web dhhs form 945 (sept. When medicaid is approved for the retroactive period (up to three months prior to the date of application) but was not entered in the Use form 945 to report federal income tax withheld.

2022 irs form 945 instructions Fill Online, Printable, Fillable Blank

Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Business entities may not need to file form 945 with the irs every year, so it can be easy to forget what exactly this form requires and when and how to fill it out. When medicaid is approved for the retroactive period.

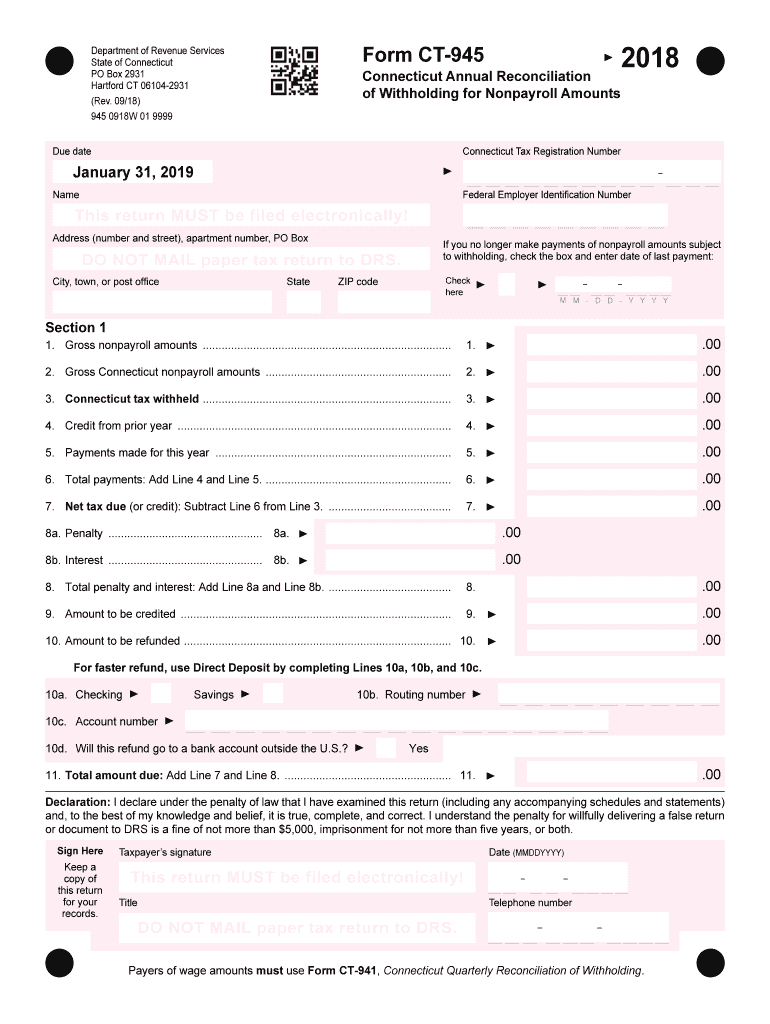

Instructions For Form 945X printable pdf download

You’d file form 945 to report and pay the amount withheld. Web form 945 instructions for 2022. Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. Web information about form 945, annual return of withheld federal income tax, including recent updates, related forms and instructions on how to file. Web address as.

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

Web when is irs form 945 due? Web form 945 instructions for 2022. Web you’re required to withhold 20% of the distribution for federal income taxes. Payers of nonpayroll amounts registered for connecticut income tax withholding are required to file form ct‑945 even if no tax is due, tax was not required to be withheld, or federal form 945 is.

Form 945 Instructions Fill online, Printable, Fillable Blank

2017) instructions regarding use of the dhhs form 945, verification of medicaid. Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. You’d file form 945 to report and pay the amount withheld. Use this form to correct administrative errors only on a previously filed form 945. Here is what all businesses need.

Form 945 Edit, Fill, Sign Online Handypdf

Web you’re required to withhold 20% of the distribution for federal income taxes. You’d file form 945 to report and pay the amount withheld. Use this form to correct administrative errors only on a previously filed form 945. When medicaid is approved for the retroactive period (up to three months prior to the date of application) but was not entered.

Ct 945 Fill Out and Sign Printable PDF Template signNow

Use this form to correct administrative errors only on a previously filed form 945. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. 2017) instructions regarding use of the dhhs form 945, verification of medicaid. You’d file form 945 to report and pay the amount withheld. Use form 945 to report.

Instructions for Form 945 X Rev February IRS Gov Fill Out and Sign

When medicaid is approved for the retroactive period (up to three months prior to the date of application) but was not entered in the Web you’re required to withhold 20% of the distribution for federal income taxes. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Business entities may not need.

IRS Form 945 instructions How to fill out 945 for 2021

If the taxpayer has already made all payments in a timely matter, the irs generally allows an additional 10 calendar days, to. You file form 945 to report withholding for other types. 2017) instructions regarding use of the dhhs form 945, verification of medicaid. They tell you who must file form 945, how to complete it line by line, and.

Use Form 945 To Report Federal Income Tax Withheld (Or Required To Be Withheld) From Nonpayroll Payments.

Business entities may not need to file form 945 with the irs every year, so it can be easy to forget what exactly this form requires and when and how to fill it out. Use form 945 to report withheld federal income tax from nonpayroll payments. Web form 945 instructions for 2022. Here is what all businesses need to know about form 945 and its instructions going into.

These Instructions Give You Some Background Information About Form 945.

Web you’re required to withhold 20% of the distribution for federal income taxes. They tell you who must file form 945, how to complete it line by line, and when and where to file it. Web information about form 945, annual return of withheld federal income tax, including recent updates, related forms and instructions on how to file. The dhhs form 945, verification of medicaid is designed for use in the following situations:

Generally, Taxpayers Must File Irs Form 945 By January 31St Of The Year Following The Tax Year Filed.

You’d file form 945 to report and pay the amount withheld. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your check or money order. When medicaid is approved for the retroactive period (up to three months prior to the date of application) but was not entered in the You file form 945 to report withholding for other types.

Web When Is Irs Form 945 Due?

Web address as shown on form 945. Payers of nonpayroll amounts registered for connecticut income tax withholding are required to file form ct‑945 even if no tax is due, tax was not required to be withheld, or federal form 945 is not required to be filed. 2017) instructions regarding use of the dhhs form 945, verification of medicaid. Web dhhs form 945 (sept.