Form 990 Due Date 2022

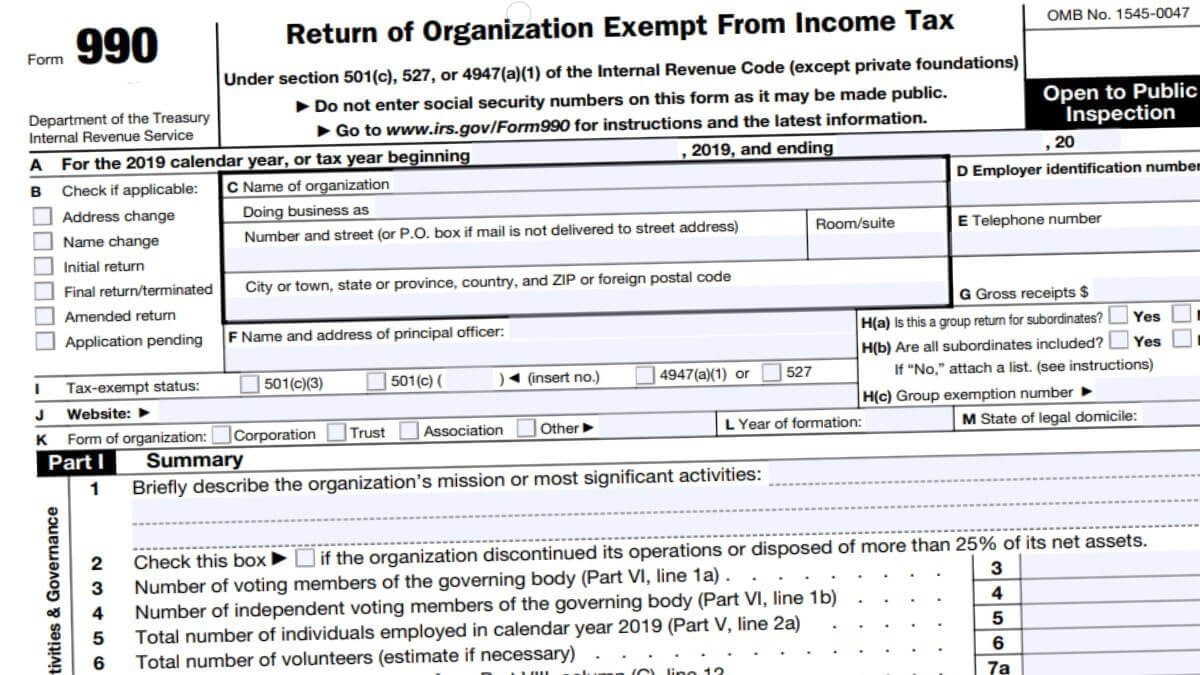

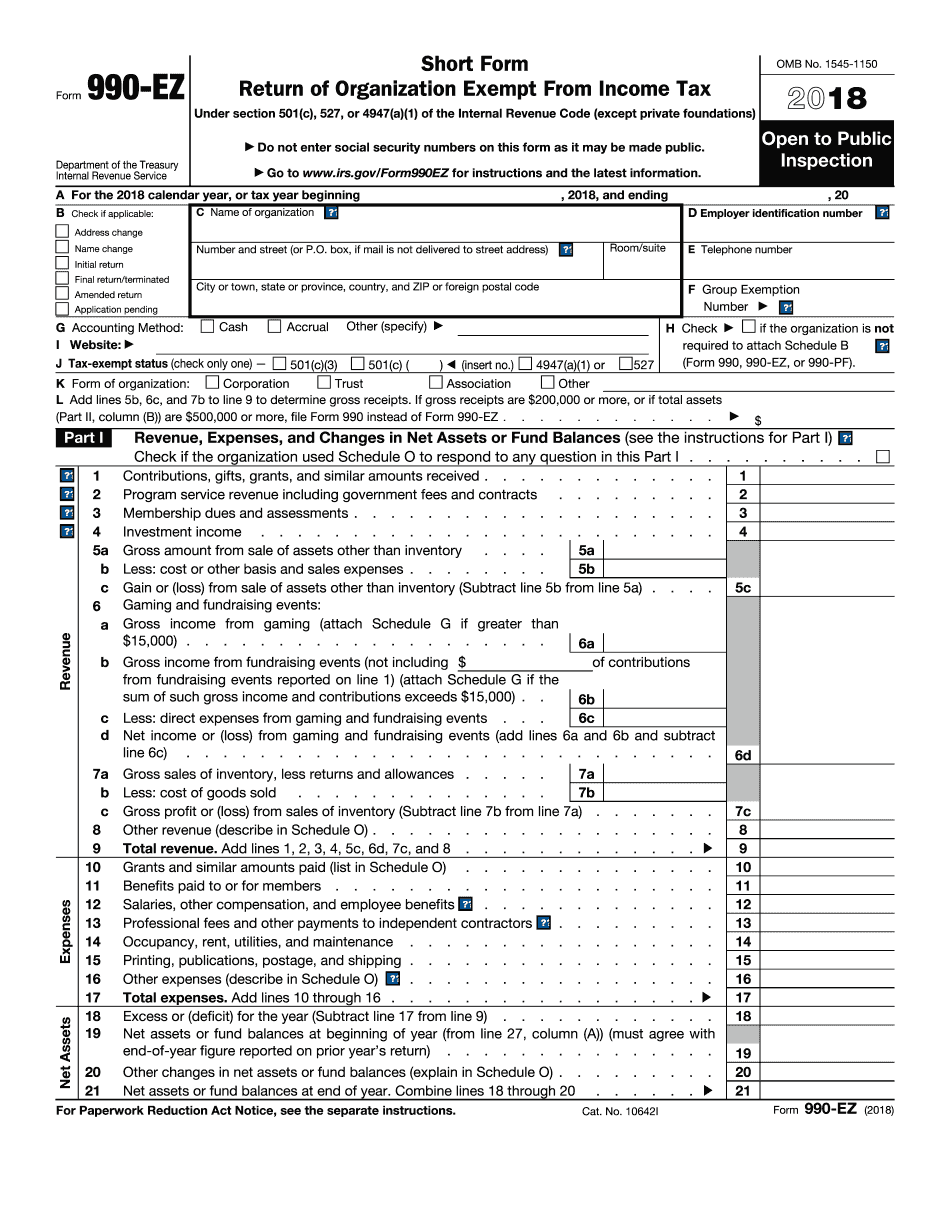

Form 990 Due Date 2022 - In plain english, your due date is four months and 15 days after your organization’s year ends. Six month extension due date: An organization with revenue of $200,000 or more or assets of $500,000 or more file form 990. Exempt organizations should also be aware that these thresholds are for filing the federal form 990 (or related form) only. For organizations on a calendar year, form 990 is due on may 15 of the following year. Web index support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. The table above does not reflect the. Exempt organizations with a filing obligation must submit the appropriate version of form 990 or an extension request by the 15 th day of the fifth month following the close of their tax year. Web form 990 return due date: Web monday, april 25, 2022 by justin d.

The due dates are as follows for afge affiliates with a fiscal year end date of december 31, 2021: Click here to learn more about choosing the right 990 form for your organization. Web monday, april 25, 2022 by justin d. Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is july 17, 2023. Operating on a fiscal tax year? Web for calendar year tax returns reporting 2021 information that are due in 2022, the following due dates will apply. If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. Some of the above due dates are different from standard filing dates due to holidays or weekends. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Expresstaxexempt offers exclusive features to simplify your form 990 filing

Web index support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. For organizations on a calendar year, the form 990 is due on may 15th of the following year. Find your due date using our due date finder. Click here to learn more about choosing the right 990 form for your organization. Web fiscal year not sure about which form to file for your organization? Some of the above due dates are different from standard filing dates due to holidays or weekends. To use the table, you must know when your organization’s tax year ends. Operating on a fiscal tax year? Web for calendar year tax returns reporting 2021 information that are due in 2022, the following due dates will apply. This must be filed by the original due date for your 990 form.

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

To use the table, you must know when your organization’s tax year ends. Exempt organizations with a filing obligation must submit the appropriate version of form 990 or an extension request by the 15 th day of the fifth month following the close of their tax year. Nonprofit filing deadline for form 990 is may 17. Corporations, for example, still.

What You Need To Meet the Form 990 Due Date 2019 Blog TaxBandits

If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Corporations, for example, still had to file by april 15, 2021. Trusts other than section 401 (a) or. Web upcoming 2023 form 990 deadline: If a due date falls on a saturday, sunday, or legal holiday, the due date is delayed until.

How To Never Mistake IRS Form 990 and Form 990N Again

Web form 990 return due date: For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. You can find information from the irs in publication 4163. In plain english, your due date is four months and 15 days after your organization’s year ends. Some.

990 Form 2021

All deadlines are 11:59:59 pm local time. To use the table, you must know when your organization’s tax year ends. Nonprofit filing deadline for form 990 is may 17. For organizations on a calendar year, form 990 is due on may 15 of the following year. Also, if you filed an 8868 extension on january 15, 2023, then your form.

2020 Form IRS 990 or 990EZ Schedule N Fill Online, Printable

All deadlines are 11:59:59 pm local time. Six month extension due date: Nonprofit filing deadline for form 990 is may 17. Operating on a fiscal tax year? Click here to learn more about choosing the right 990 form for your organization.

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Web for calendar year tax returns reporting 2022 information that are due in 2023, the following due dates will apply: Web index support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due dates for 990 returns. Nonprofit filing deadline for form 990 is may 17. The table above.

What Is A 990 Tax Form For Nonprofits Douroubi

Find your due date using our due date finder. If a due date falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. A business day is any day that isn't a saturday, sunday, or legal holiday. Web for calendar year tax returns reporting 2021 information that are due in 2022, the.

File 990N Online in 3Simple Steps IRS Form 990N (ePostcard)

To use the tables, you must know when your organization's tax year ends. Some of the above due dates are different from standard filing dates due to holidays or weekends. The appropriate 990 form depends upon your organization's gross receipts and total assets value. An organization with revenue of $200,000 or more or assets of $500,000 or more file form.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. This must be filed by the original due date for your 990 form. The appropriate 990 form depends.

Web Fiscal Year Not Sure About Which Form To File For Your Organization?

Trusts other than section 401 (a) or. For organizations on a calendar year, the form 990 is due on may 15th of the following year. Nonprofit filing deadline for form 990 is may 17. Exempt organizations with a filing obligation must submit the appropriate version of form 990 or an extension request by the 15 th day of the fifth month following the close of their tax year.

Not All Organizations And Due Dates Were Affected When The Irs Pushed The Annual Tax Filing Deadline Back To May 17.

When there is so much going on with changing tax law, filing dates, and funding opportunities,. All deadlines are 11:59:59 pm local time. Operating on a fiscal tax year? Find your due date using our due date finder.

The Due Dates Are As Follows For Afge Affiliates With A Fiscal Year End Date Of December 31, 2021:

Web monday, april 25, 2022 by justin d. In plain english, your due date is four months and 15 days after your organization’s year ends. This year, may 15 falls on a sunday, giving exempt organizations until may 16 to either get the proper version of form 990 filed with the irs or to submit form 8868 claiming an automatic. Web this is a reminder that the deadlines to file your lm and 990 reports with the department of labor and internal revenue service, respectively, are fast approaching.

To Use The Table, You Must Know When Your Organization’s Tax Year Ends.

Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is july 17, 2023. The table above does not reflect the. Web file charities and nonprofits return due dates for exempt organizations: Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

.PNG)