Form 990 Due Date 2023

Form 990 Due Date 2023 - Web upcoming 2023 form 990 deadline: Web resources form 990 due date calculator 1 choose your appropriate form to find the due date. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web find the right 990 form for your organization. Web calendar year organization filing deadline. Due to the large volume. To use the table, you must know. Web irs form 990 and similar forms. 2 the month your tax year ends december 31 (calendar) other than december. Web when is form 990 due?

The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. For a calendar year organization (where the accounting year ends on december 31st), the due date for form 990 / 990. Web irs form 990 and similar forms. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web more about the deadline. Web calendar year organization filing deadline. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web upcoming 2023 form 990 deadline: Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Due to the large volume.

Web more about the deadline. Web irs form 990 and similar forms. To use the table, you must know. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web resources form 990 due date calculator 1 choose your appropriate form to find the due date. Web find the right 990 form for your organization. Web 990 series forms are due on july 17, 2023! Web when is form 990 due? Due to the large volume.

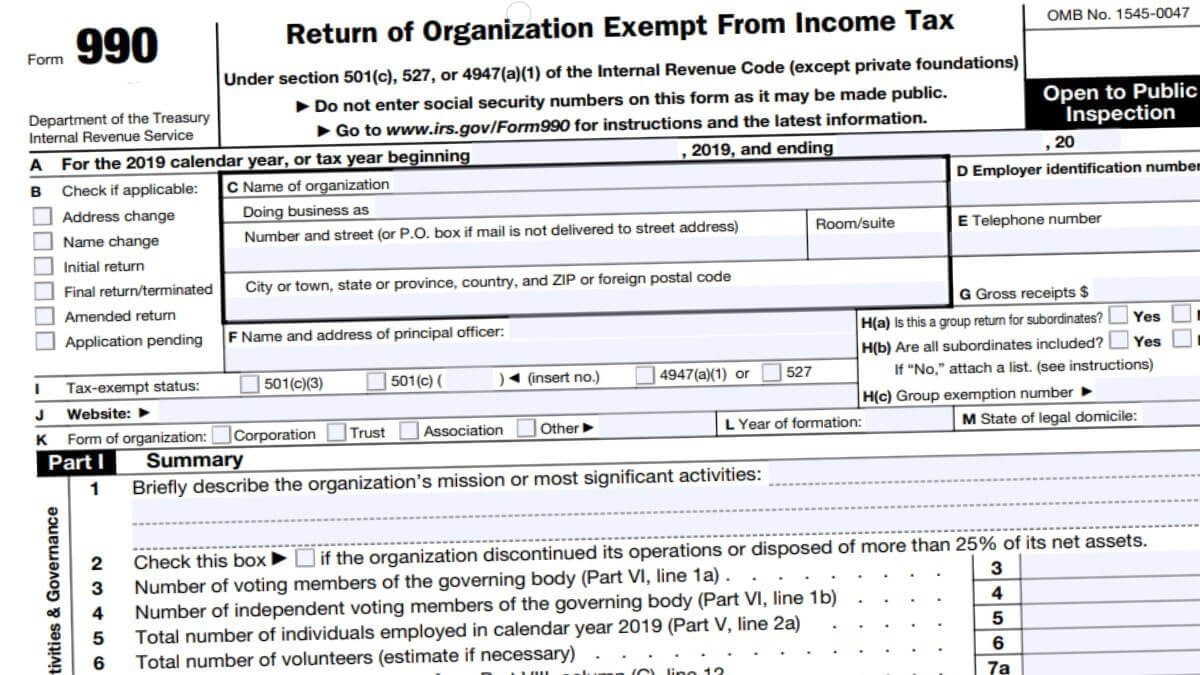

2020 Form IRS 990 Fill Online, Printable, Fillable, Blank pdfFiller

Web when is form 990 due? Web more about the deadline. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web irs form 990 and similar forms. Web file charities and nonprofits return due dates for exempt organizations:

The Form 990 Deadline is Approaching! Avoid IRS Penalties

Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. 2 the month your tax year ends december 31 (calendar) other than december. Web when is.

Form 990 IRS NonProfit Tax Returns & Tax Form 990 Community Tax

For organizations on a calendar. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. Web find the right 990 form for your organization. Web file charities and nonprofits return due dates for exempt organizations: Web when is form 990 due?

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

For a calendar year organization (where the accounting year ends on december 31st), the due date for form 990 / 990. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. The internal revenue service (irs) has postponed the due date for the form.

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

Web file charities and nonprofits return due dates for exempt organizations: Web calendar year organization filing deadline. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. Web 990 series forms are due on july 17, 2023! Form 990 due date calculator find your 990 filings.

990 Form 2021

Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web calendar year organization filing deadline. For organizations on a calendar. To use the table, you must know. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023.

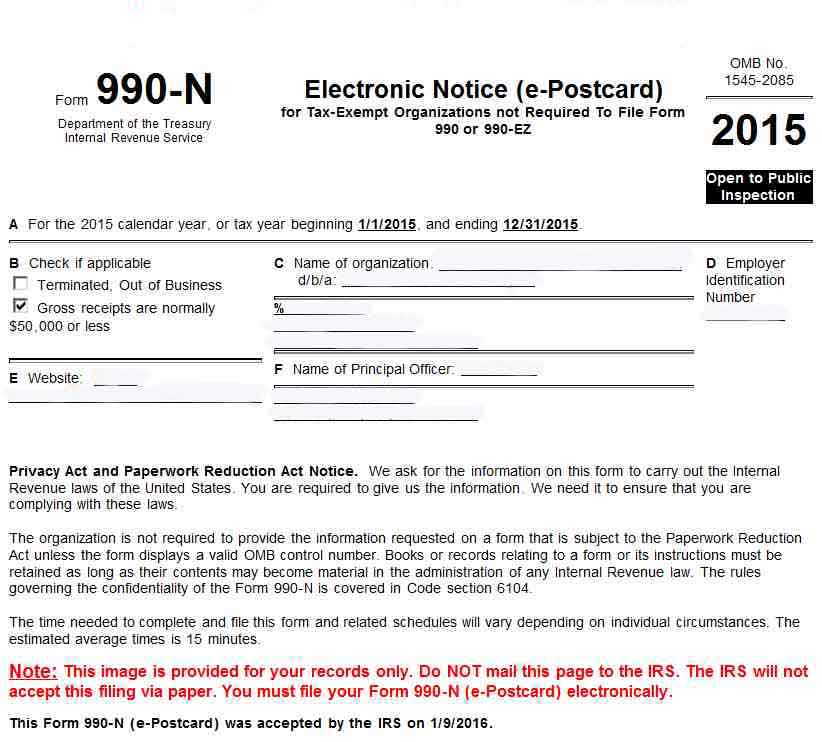

Printable 990 N Form Printable Form 2022

Web resources form 990 due date calculator 1 choose your appropriate form to find the due date. Web file charities and nonprofits return due dates for exempt organizations: For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web when is form 990 due?.

How To Never Mistake IRS Form 990 and Form 990N Again

For organizations on a calendar. Web find the right 990 form for your organization. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web calendar year organization.

What You Need To Meet the Form 990 Due Date 2019 Blog TaxBandits

Due to the large volume. Web 990 series forms are due on july 17, 2023! 2 the month your tax year ends december 31 (calendar) other than december. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date For a calendar year organization (where the accounting year ends on december 31st), the due date.

Web More About The Deadline.

Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web when is form 990 due? Web calendar year organization filing deadline.

For Organizations With An Accounting Tax Period Starting On April 1, 2022, And Ending On March 31, 2023, Form 990 Is Due By August 15, 2023.

Web resources form 990 due date calculator 1 choose your appropriate form to find the due date. Web 990 series forms are due on july 17, 2023! Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. For organizations on a calendar.

Web File Charities And Nonprofits Return Due Dates For Exempt Organizations:

Web upcoming 2023 form 990 deadline: Due to the large volume. Web monday, april 25, 2022 by justin d. Web irs form 990 and similar forms.

To Use The Table, You Must Know.

Web find the right 990 form for your organization. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. 2 the month your tax year ends december 31 (calendar) other than december. For a calendar year organization (where the accounting year ends on december 31st), the due date for form 990 / 990.

.PNG)