Form 990 Postcard

Form 990 Postcard - Request for transcript of tax return. Organizations not permitted to file. Employers engaged in a trade or business who pay compensation. This form serves as an electronic notice to the irs. We offer a complete and reliable solution for. Sign in/create an account with login.gov or id.me: Request for taxpayer identification number (tin) and certification. Employer's quarterly federal tax return.

Request for taxpayer identification number (tin) and certification. We offer a complete and reliable solution for. Organizations not permitted to file. This form serves as an electronic notice to the irs. Sign in/create an account with login.gov or id.me: Employer's quarterly federal tax return. Employers engaged in a trade or business who pay compensation. Request for transcript of tax return.

This form serves as an electronic notice to the irs. Request for transcript of tax return. Request for taxpayer identification number (tin) and certification. We offer a complete and reliable solution for. Employers engaged in a trade or business who pay compensation. Employer's quarterly federal tax return. Sign in/create an account with login.gov or id.me: Organizations not permitted to file.

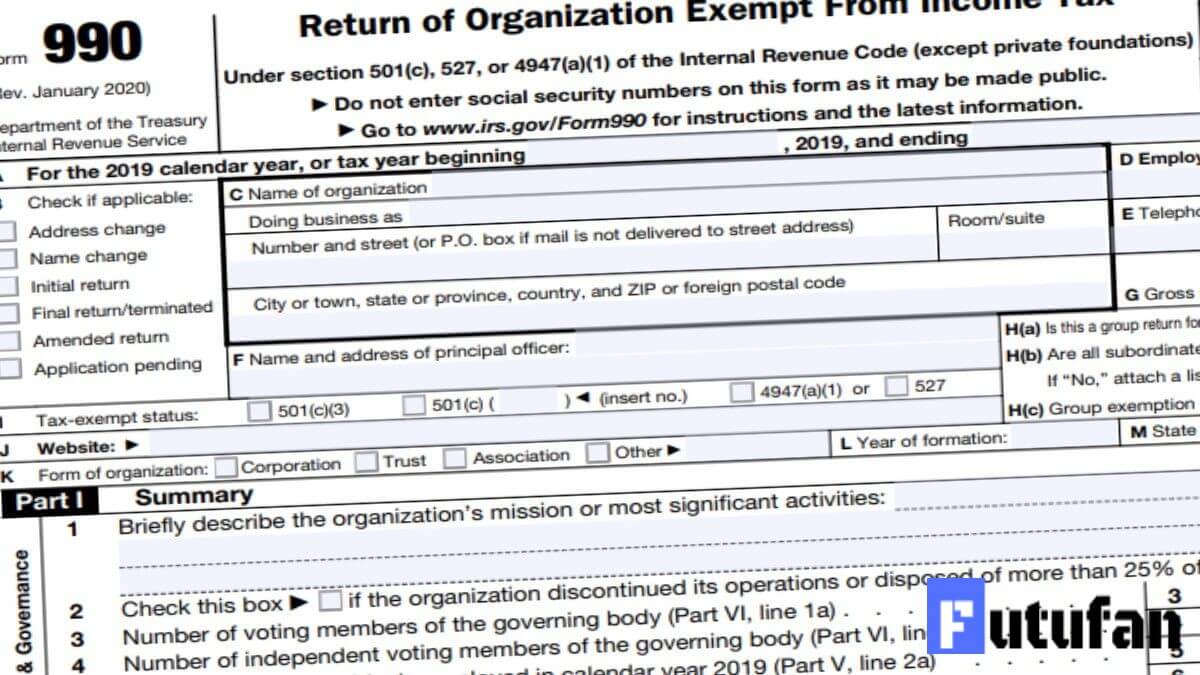

Form 990EZ for nonprofits updated Accounting Today

This form serves as an electronic notice to the irs. Request for transcript of tax return. We offer a complete and reliable solution for. Organizations not permitted to file. Sign in/create an account with login.gov or id.me:

What Is A 990 N E Postcard hassuttelia

We offer a complete and reliable solution for. Request for taxpayer identification number (tin) and certification. Employers engaged in a trade or business who pay compensation. Employer's quarterly federal tax return. This form serves as an electronic notice to the irs.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Employers engaged in a trade or business who pay compensation. Sign in/create an account with login.gov or id.me: Request for taxpayer identification number (tin) and certification. This form serves as an electronic notice to the irs. Request for transcript of tax return.

Where to Find the 990 Electronic Postcard File 990

Organizations not permitted to file. Employers engaged in a trade or business who pay compensation. Request for taxpayer identification number (tin) and certification. We offer a complete and reliable solution for. Sign in/create an account with login.gov or id.me:

form 990 postcard Fill Online, Printable, Fillable Blank form990

Organizations not permitted to file. We offer a complete and reliable solution for. Employer's quarterly federal tax return. This form serves as an electronic notice to the irs. Request for transcript of tax return.

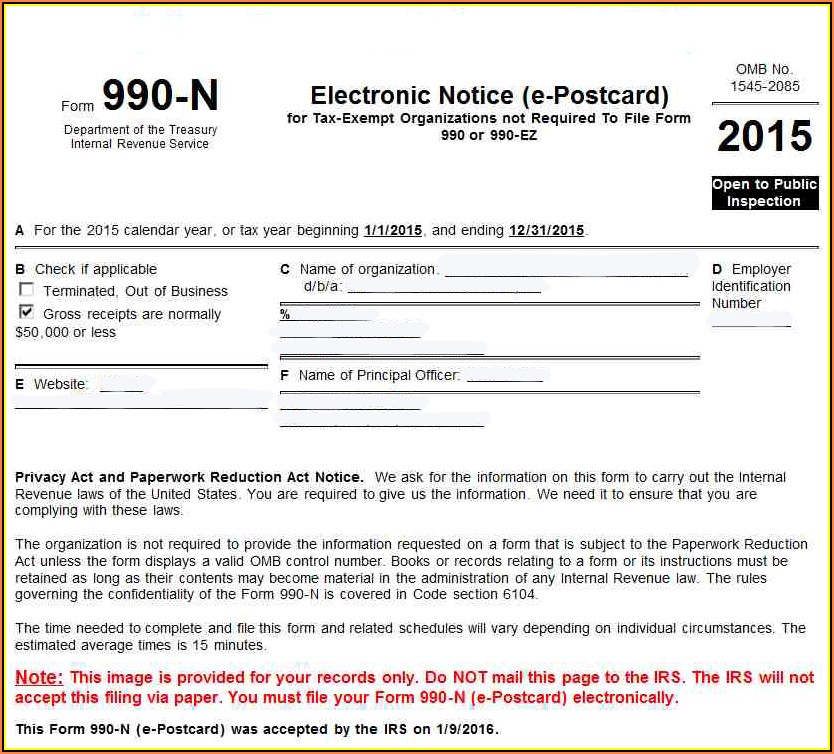

Form 990N (ePostcard) Online View and Print Returnpage001

Sign in/create an account with login.gov or id.me: This form serves as an electronic notice to the irs. Employer's quarterly federal tax return. Employers engaged in a trade or business who pay compensation. Request for transcript of tax return.

Tax exempt organizations to file form 990N (ePostcard) by express990

Sign in/create an account with login.gov or id.me: Request for transcript of tax return. Request for taxpayer identification number (tin) and certification. Employers engaged in a trade or business who pay compensation. We offer a complete and reliable solution for.

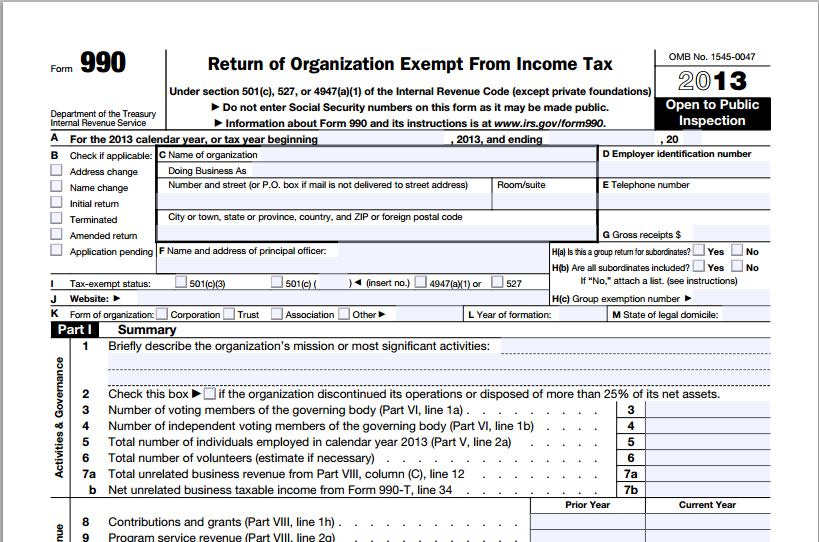

2013 Irs Form 990 N (e Postcard) Form Resume Examples BpV53Ml91Z

This form serves as an electronic notice to the irs. Organizations not permitted to file. Employers engaged in a trade or business who pay compensation. Request for taxpayer identification number (tin) and certification. Request for transcript of tax return.

Efile Form 990N 2020 IRS Form 990N Online Filing

Employer's quarterly federal tax return. Request for taxpayer identification number (tin) and certification. Organizations not permitted to file. Sign in/create an account with login.gov or id.me: This form serves as an electronic notice to the irs.

Employer's Quarterly Federal Tax Return.

This form serves as an electronic notice to the irs. We offer a complete and reliable solution for. Organizations not permitted to file. Sign in/create an account with login.gov or id.me:

Employers Engaged In A Trade Or Business Who Pay Compensation.

Request for transcript of tax return. Request for taxpayer identification number (tin) and certification.