Form 990T Instructions

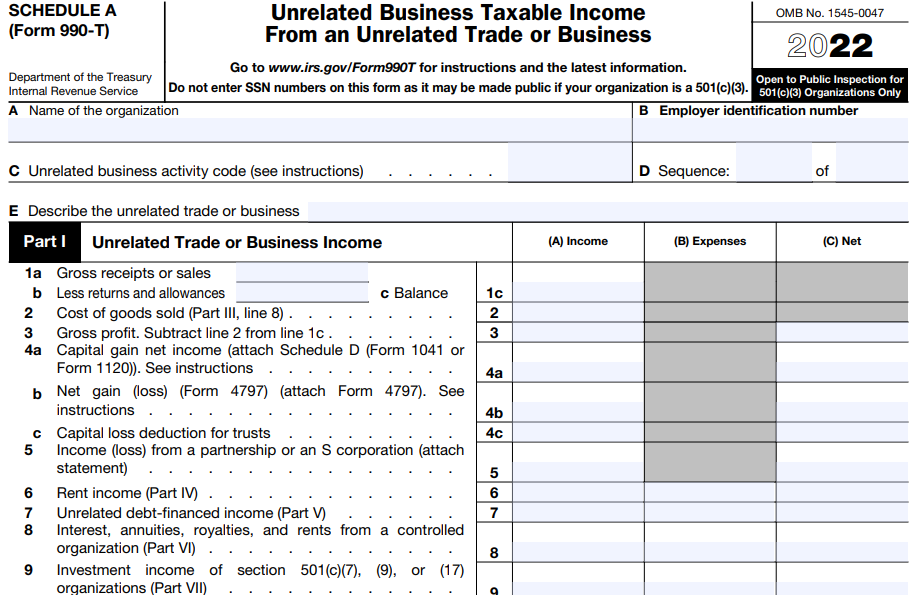

Form 990T Instructions - Web instructions for the form 990 schedules are published separately from these instructions. For instructions and the latest information. Open to public inspection for 501(c)(3) organizations only. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). An organization must pay estimated tax if it expects its tax for the year to be $500 or more. The taxpayer certainty and disaster relief act of 2020 amended section 274(n)(2) to allow a deduction for 100% of certain business meal expenses from restaurants paid or incurred. The annotated form and instructions show what changes the irs has made for tax year 2021. Enter your ein and search for your organization’s details. Unrelated business activity code (see instructions. Web for instructions and the latest information.

Web for instructions and the latest information. Web for paperwork reduction act notice, see instructions. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). Web instructions for the form 990 schedules are published separately from these instructions. An organization must pay estimated tax if it expects its tax for the year to be $500 or more. The taxpayer certainty and disaster relief act of 2020 amended section 274(n)(2) to allow a deduction for 100% of certain business meal expenses from restaurants paid or incurred. For instructions and the latest information. Open to public inspection for 501(c)(3) organizations only. The annotated form and instructions show what changes the irs has made for tax year 2021. Unrelated business activity code (see instructions.

For instructions and the latest information. The taxpayer certainty and disaster relief act of 2020 amended section 274(n)(2) to allow a deduction for 100% of certain business meal expenses from restaurants paid or incurred. Open to public inspection for 501(c)(3) organizations only. Web for paperwork reduction act notice, see instructions. The annotated form and instructions show what changes the irs has made for tax year 2021. Unrelated business activity code (see instructions. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). An organization must pay estimated tax if it expects its tax for the year to be $500 or more. Enter your ein and search for your organization’s details. Web for instructions and the latest information.

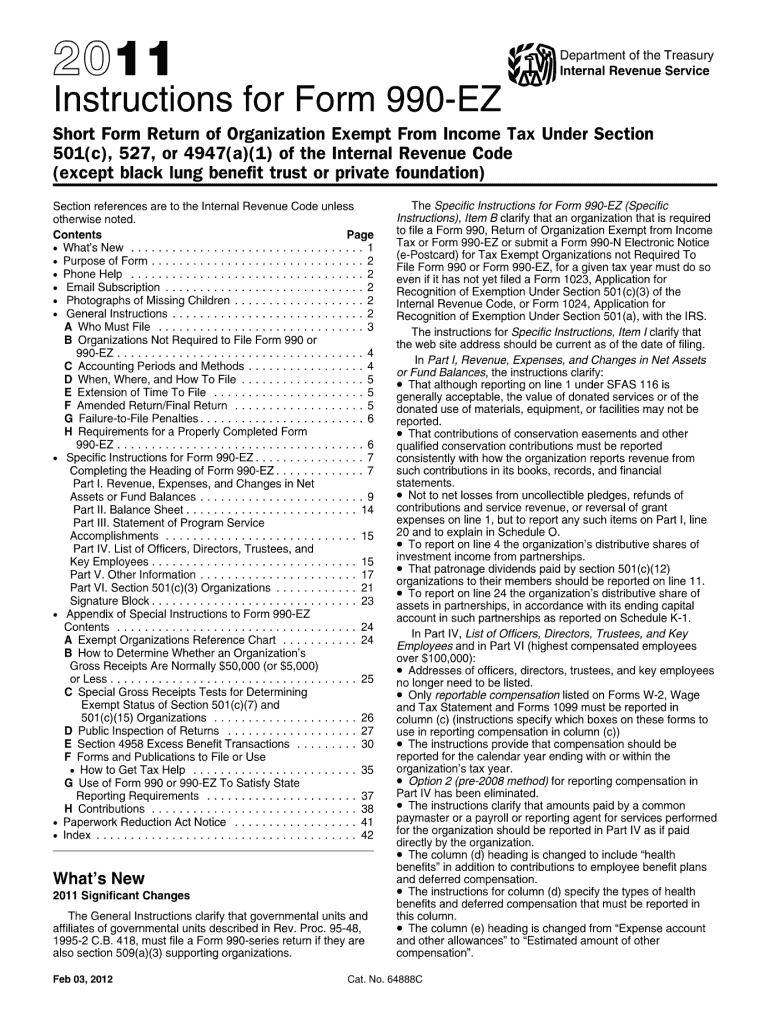

form 990 instructions Fill Online, Printable, Fillable Blank form

Web for paperwork reduction act notice, see instructions. Enter your ein and search for your organization’s details. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). Open to public inspection for 501(c)(3) organizations only. An organization must pay estimated tax if it expects its tax for the year to.

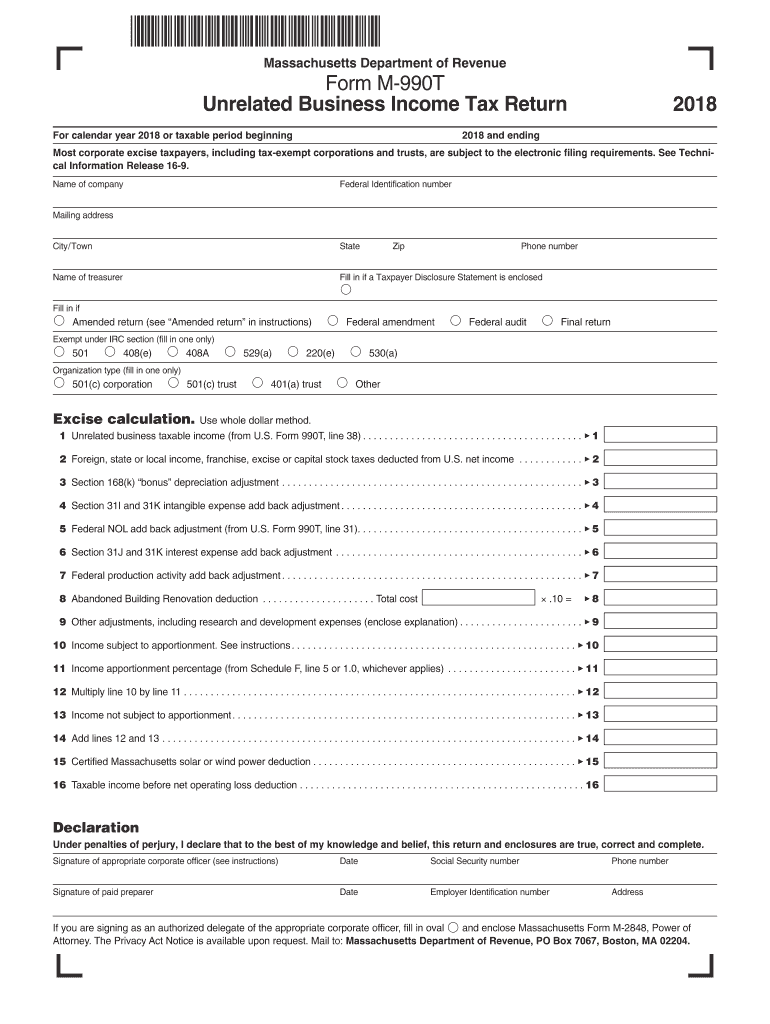

2018 Form M 990T Fill Out and Sign Printable PDF Template signNow

The annotated form and instructions show what changes the irs has made for tax year 2021. An organization must pay estimated tax if it expects its tax for the year to be $500 or more. The taxpayer certainty and disaster relief act of 2020 amended section 274(n)(2) to allow a deduction for 100% of certain business meal expenses from restaurants.

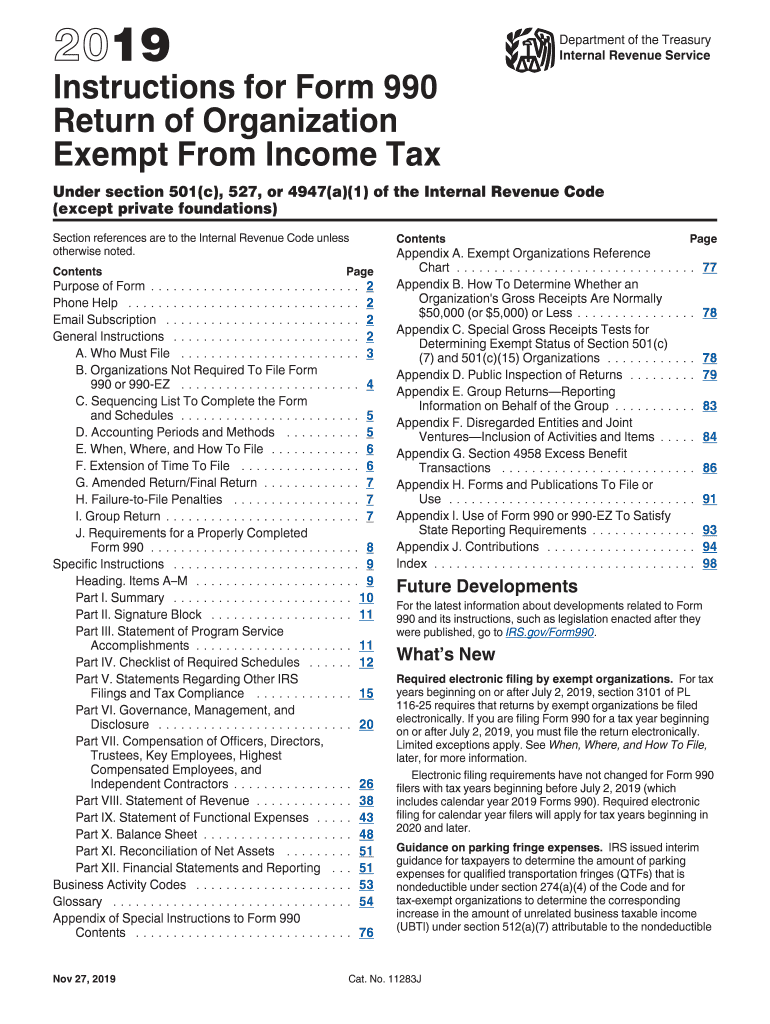

990 Revenue Service Form Fill Out and Sign Printable PDF Template

Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). The taxpayer certainty and disaster relief act of 2020 amended section 274(n)(2) to allow a deduction for 100% of certain business meal expenses from restaurants paid or incurred. Enter your ein and search for your organization’s details. An organization must.

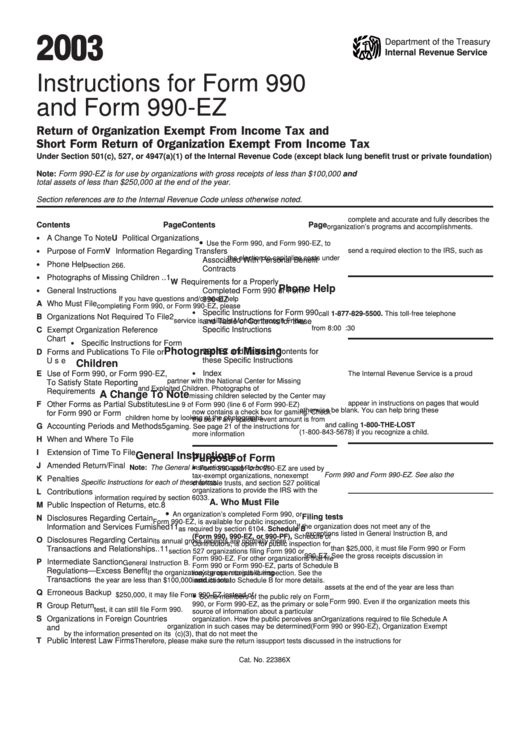

Instructions For Form 990 And Form 990Ez 2003 printable pdf download

Open to public inspection for 501(c)(3) organizations only. Web for instructions and the latest information. An organization must pay estimated tax if it expects its tax for the year to be $500 or more. Unrelated business activity code (see instructions. The taxpayer certainty and disaster relief act of 2020 amended section 274(n)(2) to allow a deduction for 100% of certain.

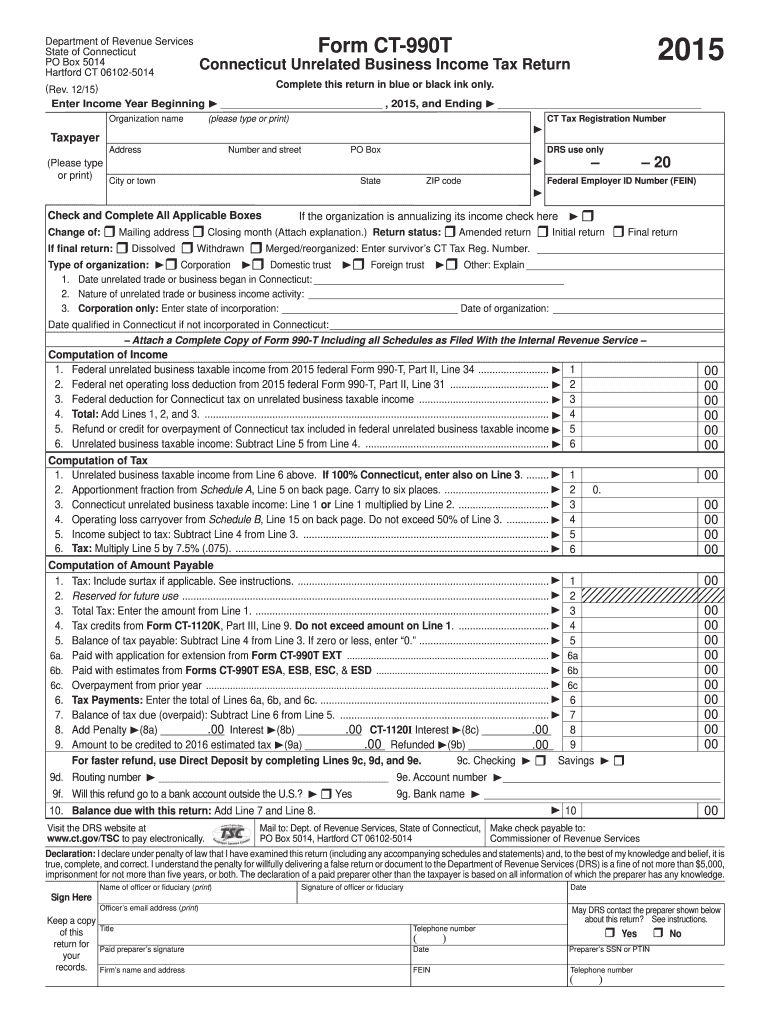

Ct 990t Form Fill Out and Sign Printable PDF Template signNow

Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). The annotated form and instructions show what changes the irs has made for tax year 2021. Open to public inspection for 501(c)(3) organizations only. Unrelated business activity code (see instructions. Web for instructions and the latest information.

Efile 990T Form 990T Online 990T electronic filing

Open to public inspection for 501(c)(3) organizations only. The annotated form and instructions show what changes the irs has made for tax year 2021. Unrelated business activity code (see instructions. Enter your ein and search for your organization’s details. Web for instructions and the latest information.

IRS 990EZ Instructions 2019 Fill and Sign Printable Template Online

The annotated form and instructions show what changes the irs has made for tax year 2021. Web for instructions and the latest information. Web for paperwork reduction act notice, see instructions. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). Web instructions for the form 990 schedules are published.

Instructions for Form 990T, Exempt Organization Business Tax

Web for instructions and the latest information. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). For instructions and the latest information. Open to public inspection for 501(c)(3) organizations only. Enter your ein and search for your organization’s details.

Form 990 T Fillable Fill Out and Sign Printable PDF Template signNow

Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). Web for paperwork reduction act notice, see instructions. For instructions and the latest information. The annotated form and instructions show what changes the irs has made for tax year 2021. An organization must pay estimated tax if it expects its.

2022 IRS Form 990T Instructions ┃ How to fill out 990T?

Web for instructions and the latest information. The taxpayer certainty and disaster relief act of 2020 amended section 274(n)(2) to allow a deduction for 100% of certain business meal expenses from restaurants paid or incurred. Web instructions for the form 990 schedules are published separately from these instructions. An organization must pay estimated tax if it expects its tax for.

Do Not Enter Ssn Numbers On This Form As It May Be Made Public If Your Organization Is A 501(C)(3).

Web for instructions and the latest information. The taxpayer certainty and disaster relief act of 2020 amended section 274(n)(2) to allow a deduction for 100% of certain business meal expenses from restaurants paid or incurred. Web instructions for the form 990 schedules are published separately from these instructions. Enter your ein and search for your organization’s details.

Unrelated Business Activity Code (See Instructions.

For instructions and the latest information. The annotated form and instructions show what changes the irs has made for tax year 2021. Web for paperwork reduction act notice, see instructions. Open to public inspection for 501(c)(3) organizations only.