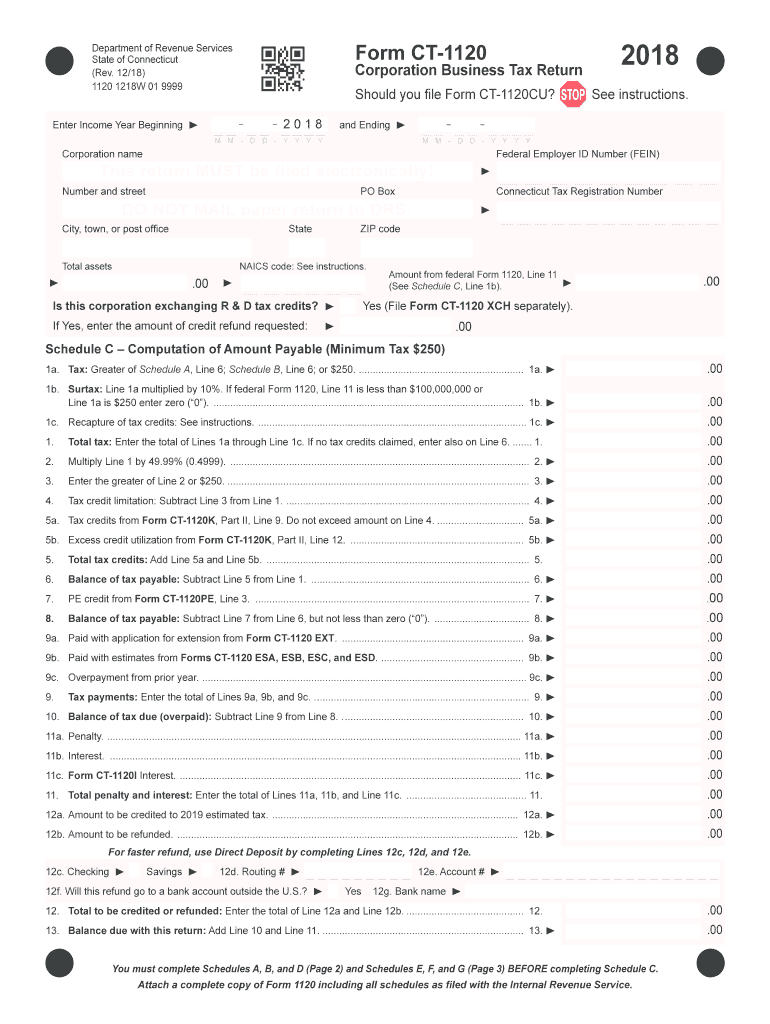

Form Ct 1120

Form Ct 1120 - Web file form ct‑1120kelectronically when filing form ct‑1120, corporation business tax return, using myconnect. Web information about form 1120, u.s. Capital loss carryover (if not deducted in computing federal capital gain). Tax is paid on the basis that yields the higher. Drs myconnect allows taxpayers to electronically file, pay. Web full years following its acquisition. Form ct‑1120 ext, application for extension of time. Web page 1 of form ct‑1120. Tax is paid on the basis that yields the higher. Use this form to report the.

Tax is paid on the basis that yields the higher. 2022 corporation business tax return. Drs myconnect allows taxpayers to electronically file, pay. Web full years following its acquisition. Tax is paid on the basis that yields the higher. Form ct‑1120 ext, application for extension of time. Web information about form 1120, u.s. Tax is paid on the basis that yields the higher. Web form ct‑1120k, business tax credit summary, is used to summarize a corporation’s claim for available business tax credits. Web file form ct‑1120kelectronically when filing form ct‑1120, corporation business tax return, using myconnect.

Tax is paid on the basis that yields the higher. Web full years following its acquisition. Web form ct‑1120k, business tax credit summary, is used to summarize a corporation’s claim for available business tax credits. Corporation income tax return, including recent updates, related forms and instructions on how to file. Tax is paid on the basis that yields the higher. Use this form to report the. 2022 corporation business tax return. Web page 1 of form ct‑1120. Drs myconnect allows taxpayers to electronically file, pay. Web information about form 1120, u.s.

Form Ct 1120 Fill Out and Sign Printable PDF Template signNow

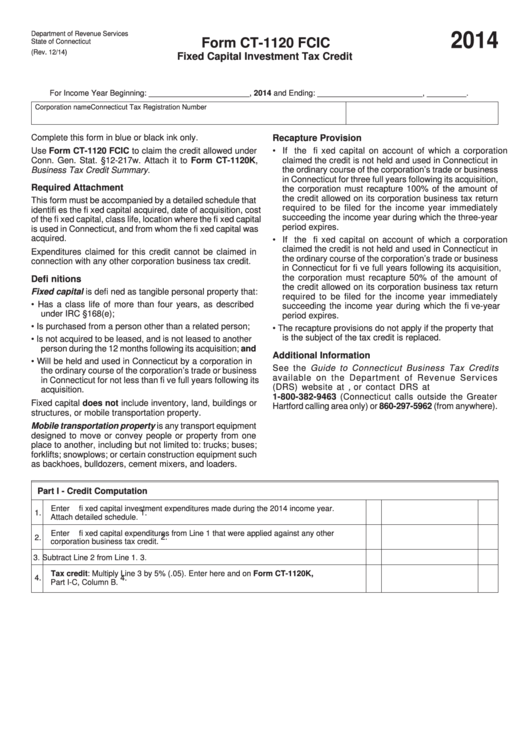

Tax is paid on the basis that yields the higher. You can download or print. See form ct‑1120 fcic, fixed capital investment tax credit, to calculate the amount of tax credit that must be recaptured. 2022 corporation business tax return. Tax is paid on the basis that yields the higher.

Form CT1120 PIC Download Printable PDF or Fill Online Information

Tax is paid on the basis that yields the higher. Tax is paid on the basis that yields the higher. Tax is paid on the basis that yields the higher. Capital loss carryover (if not deducted in computing federal capital gain). 2022 corporation business tax return.

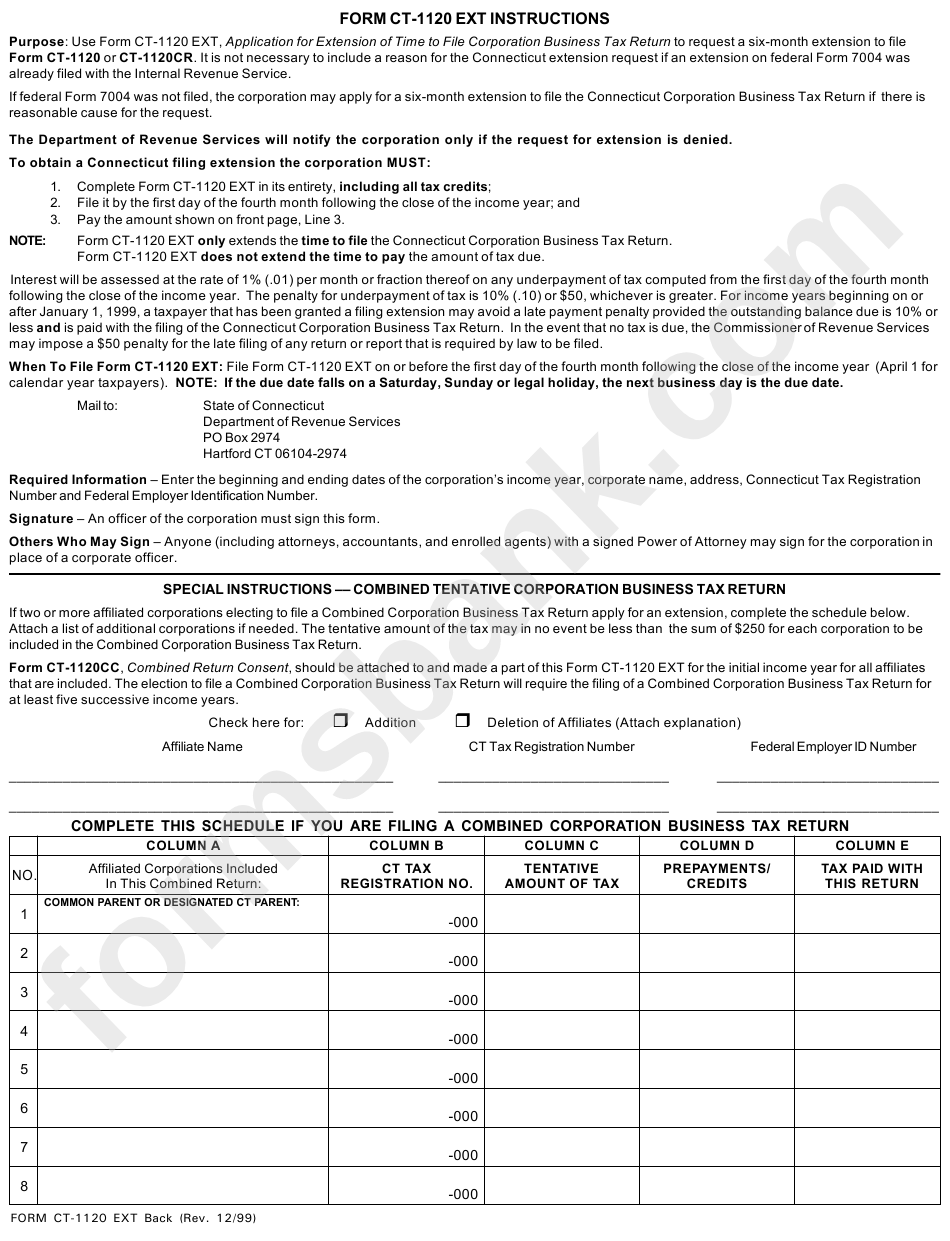

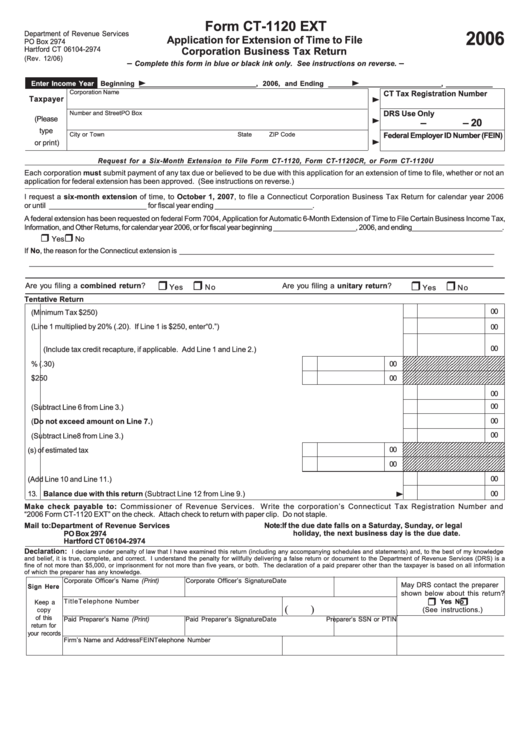

Form Ct1120 Ext Instructions printable pdf download

Tax is paid on the basis that yields the higher. Form ct‑1120 ext, application for extension of time. Tax is paid on the basis that yields the higher. Corporation income tax return, including recent updates, related forms and instructions on how to file. You can download or print.

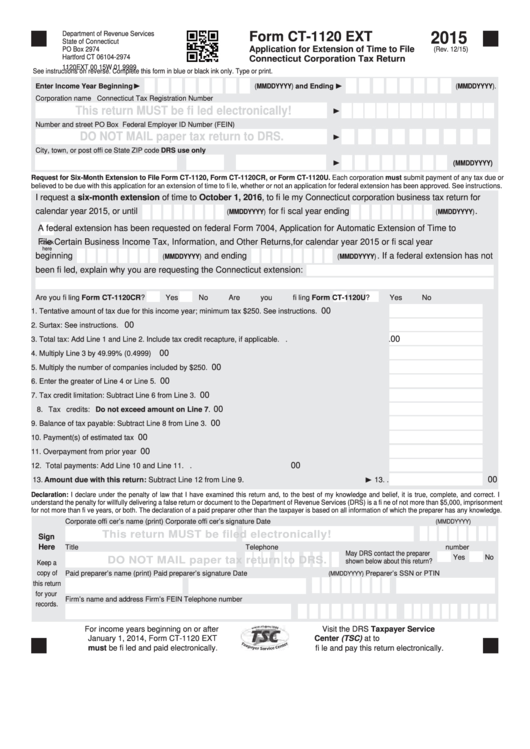

Form Ct1120 Ext Connecticut Application For Extension Of Time To

Web full years following its acquisition. 12/20) 1120 1220w 01 9999 2020 attach a complete copy of form. You can download or print. Tax is paid on the basis that yields the higher. Tax is paid on the basis that yields the higher.

Form Ct 1120 Fill Out and Sign Printable PDF Template signNow

Tax is paid on the basis that yields the higher. See form ct‑1120 fcic, fixed capital investment tax credit, to calculate the amount of tax credit that must be recaptured. Web full years following its acquisition. Corporation income tax return, including recent updates, related forms and instructions on how to file. Drs myconnect allows taxpayers to electronically file, pay.

Form Ct1120 Ext Application Form For Extension Of Time To File

Tax is paid on the basis that yields the higher. Capital loss carryover (if not deducted in computing federal capital gain). Tax is paid on the basis that yields the higher. You can download or print. Web file form ct‑1120kelectronically when filing form ct‑1120, corporation business tax return, using myconnect.

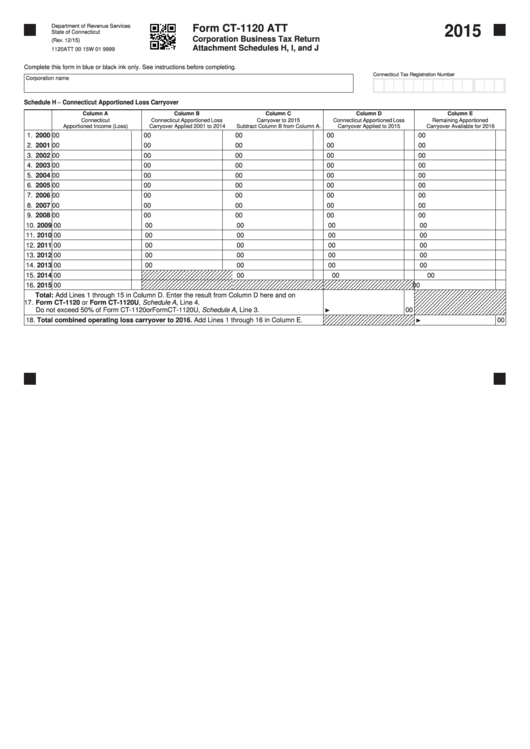

Form Ct1120 Att Corporation Business Tax Return Attachment Schedules

Web page 1 of form ct‑1120. 2022 corporation business tax return. Web full years following its acquisition. Tax is paid on the basis that yields the higher. Tax is paid on the basis that yields the higher.

Form Ct1120 Fcic Connecticut Fixed Capital Investment Tax Credit

Web page 1 of form ct‑1120. Tax is paid on the basis that yields the higher. Tax is paid on the basis that yields the higher. Web full years following its acquisition. Tax is paid on the basis that yields the higher.

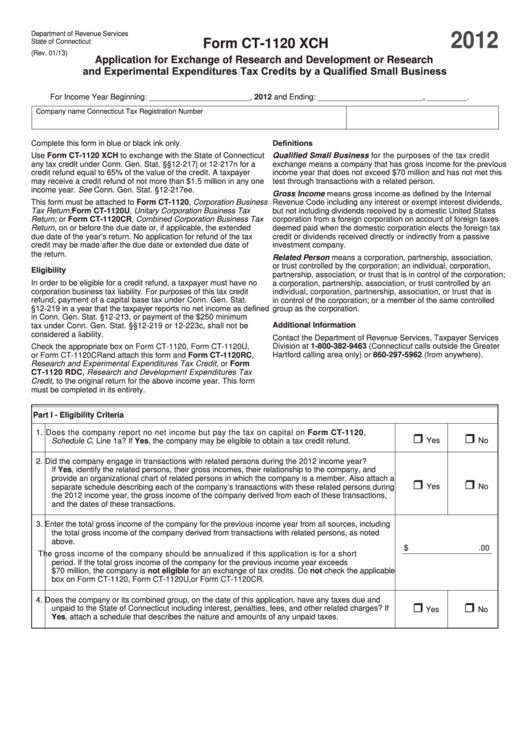

Form Ct1120 Xch Application For Exchange Of Research And Development

12/20) 1120 1220w 01 9999 2020 attach a complete copy of form. Drs myconnect allows taxpayers to electronically file, pay. Web full years following its acquisition. Web form ct‑1120k, business tax credit summary, is used to summarize a corporation’s claim for available business tax credits. 2022 corporation business tax return.

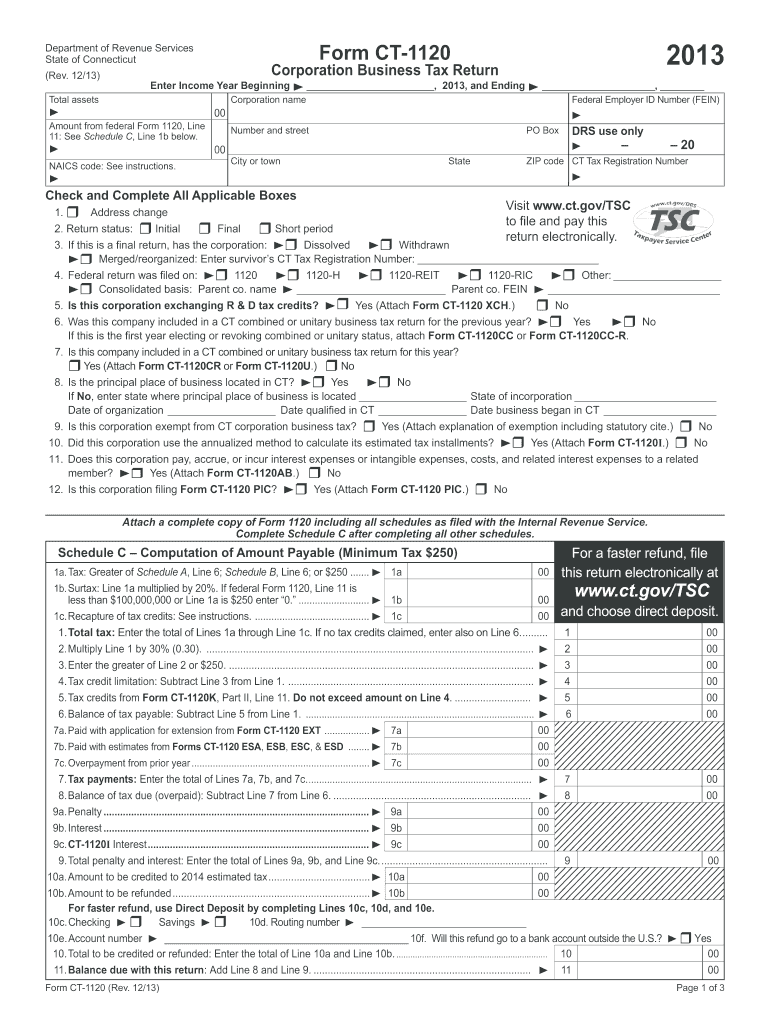

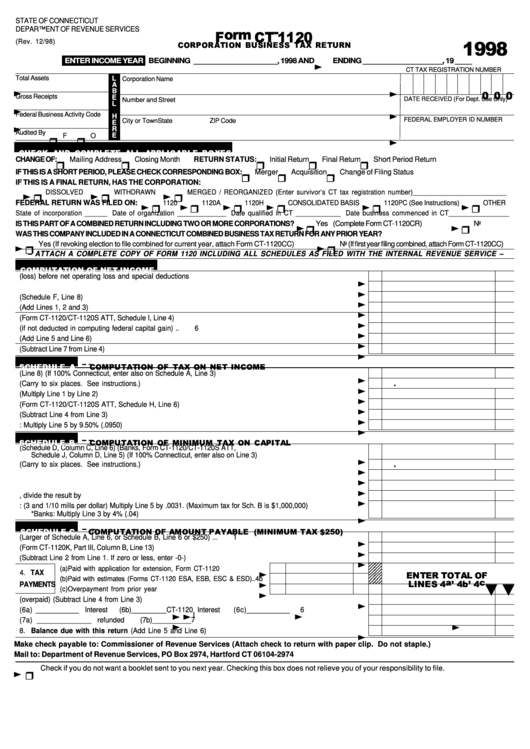

Fillable Form Ct1120 Corporation Business Tax Return 1998

Tax is paid on the basis that yields the higher. You can download or print. See form ct‑1120 fcic, fixed capital investment tax credit, to calculate the amount of tax credit that must be recaptured. 2022 corporation business tax return. Tax is paid on the basis that yields the higher.

Corporation Income Tax Return, Including Recent Updates, Related Forms And Instructions On How To File.

Tax is paid on the basis that yields the higher. Web file form ct‑1120kelectronically when filing form ct‑1120, corporation business tax return, using myconnect. Web full years following its acquisition. 2022 corporation business tax return.

Web Page 1 Of Form Ct‑1120.

Drs myconnect allows taxpayers to electronically file, pay. You can download or print. Tax is paid on the basis that yields the higher. Tax is paid on the basis that yields the higher.

12/20) 1120 1220W 01 9999 2020 Attach A Complete Copy Of Form.

See form ct‑1120 fcic, fixed capital investment tax credit, to calculate the amount of tax credit that must be recaptured. Tax is paid on the basis that yields the higher. Web information about form 1120, u.s. Web form ct‑1120k, business tax credit summary, is used to summarize a corporation’s claim for available business tax credits.

Capital Loss Carryover (If Not Deducted In Computing Federal Capital Gain).

Use this form to report the. Form ct‑1120 ext, application for extension of time. Tax is paid on the basis that yields the higher.