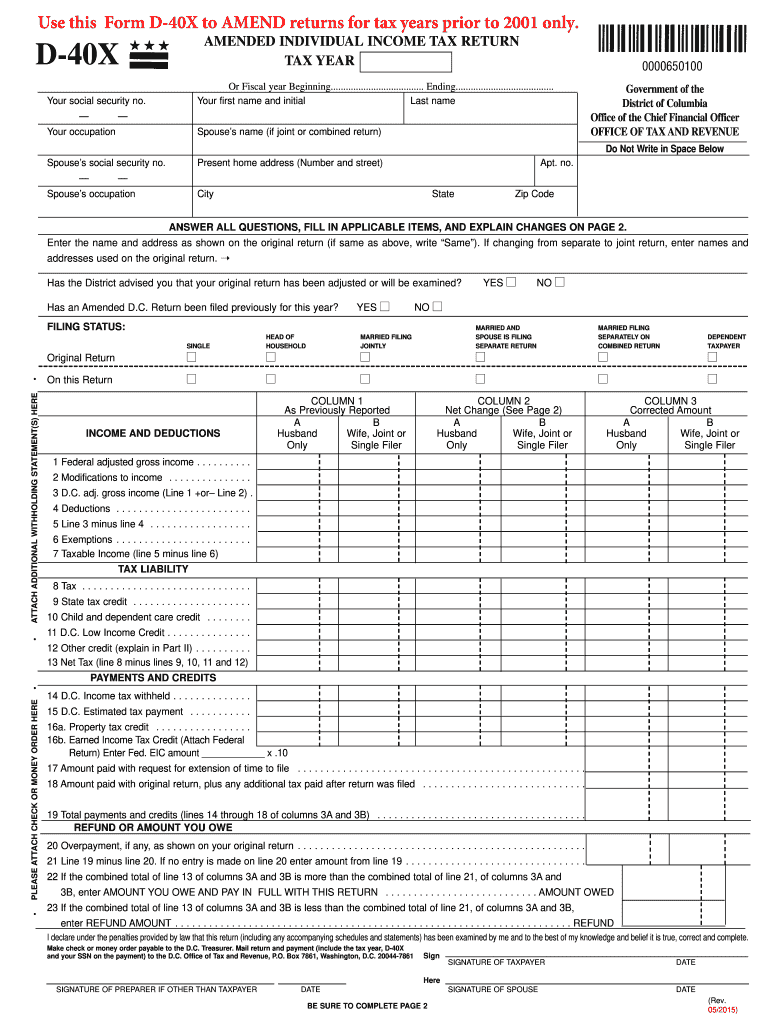

Form D40 Dc

Form D40 Dc - On or before may 17, 2021. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers: Your filing status is single; Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web certified copy of form d40 by the dc office of tax and revenue, with evidence of payment of dc taxes for the current or most recent tax year and must bear the dc office of tax. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web 14 other subtractions from dc schedule i, calculation b, line 16. Tax amendment on efile.com, however you cannot submit it. If the due date for filing a. Visit the district’s new online tax portal to view and pay your taxes.

Visit the district’s new online tax portal to view and pay your taxes. On or before april 15,. Web 14 other subtractions from dc schedule i, calculation b, line 16. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers: Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. This form is for income earned in tax year 2022,. On or before april 18, 2023. Web form # title filing date; Your filing status is single; On or before may 17, 2021.

Web 14 other subtractions from dc schedule i, calculation b, line 16. Visit the district’s new online tax portal to view and pay your taxes. Tax amendment on efile.com, however you cannot submit it. On or before may 17, 2021. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. On or before april 18, 2023. On or before july 15, 2020. On or before april 15,. This form is for income earned in tax year 2022,. You can prepare a current washington, d.c.

Dc D 30 Fillable Fill Out and Sign Printable PDF Template signNow

On or before may 17, 2021. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers: Visit the district’s new online tax portal to view and pay your taxes. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Your filing status is.

District of columbia tax form d 40 Fill out & sign online DocHub

Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. On or before may 17, 2021. Your filing status is single; On or before april 18, 2023. Web form # title filing date;

D40Ez Fill Out and Sign Printable PDF Template signNow

Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. On or before april 18, 2023. Web 14 other subtractions from dc schedule i, calculation b, line 16. Web certified copy of form d40.

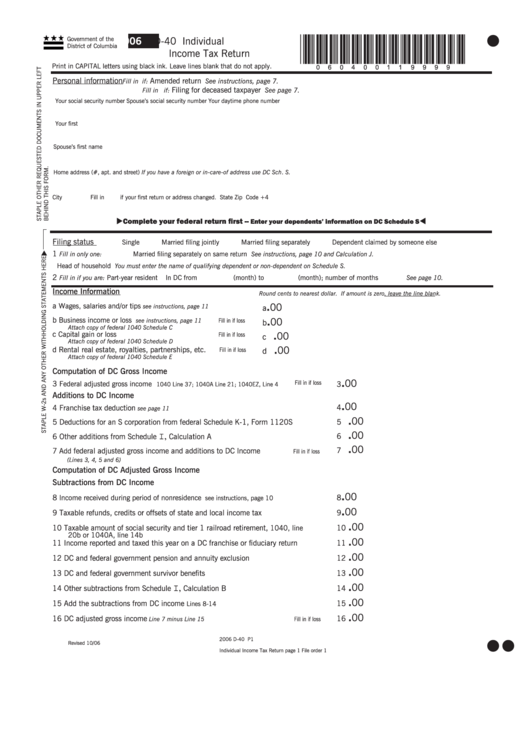

Fillable Form D40 Individual Tax Return 2006 printable pdf

Web 14 other subtractions from dc schedule i, calculation b, line 16. Tax amendment on efile.com, however you cannot submit it. You can prepare a current washington, d.c. Web form # title filing date; Your filing status is single;

2011 Form DC D40EZ & D40 Fill Online, Printable, Fillable, Blank

Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web form # title filing date; On or before april 18, 2023. Tax amendment on efile.com, however you cannot submit it. On or before april 15,.

Sample Supporting Documents DC One App

Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. On or before april 18, 2023. Tax amendment on efile.com, however you cannot submit it. Web 14 other subtractions from dc schedule i, calculation b, line 16. This form is for income earned in tax year 2022,.

Gray Velvet with Silver Base Stool Andrew Martin Chandler in 2022

You can prepare a current washington, d.c. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. 16 dc adjusted gross income, line 7 minus line 15. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers: On or before july 15, 2020.

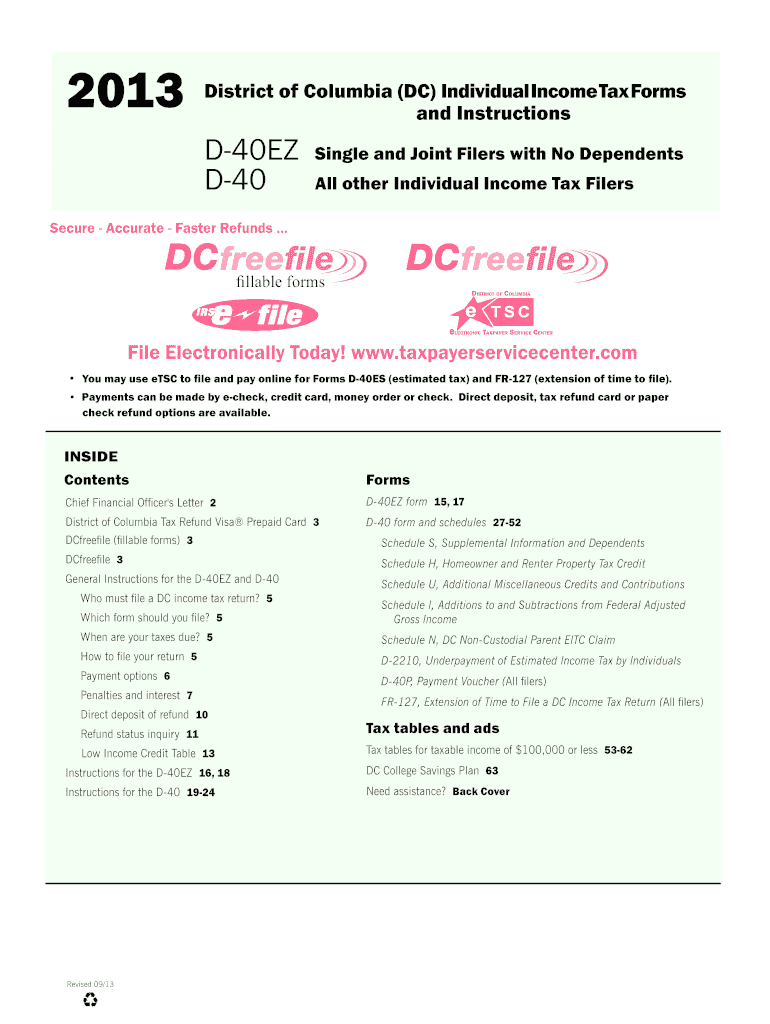

2013 Form DC D40EZ & D40 Fill Online, Printable, Fillable, Blank

Tax amendment on efile.com, however you cannot submit it. This form is for income earned in tax year 2022,. On or before july 15, 2020. On or before may 17, 2021. If the due date for filing a.

Nissan D40 DC. 33" 35" Fjallasport Fender Flares

On or before april 18, 2023. If the due date for filing a. You can prepare a current washington, d.c. Web 14 other subtractions from dc schedule i, calculation b, line 16. Web certified copy of form d40 by the dc office of tax and revenue, with evidence of payment of dc taxes for the current or most recent tax.

Web 14 Other Subtractions From Dc Schedule I, Calculation B, Line 16.

Your filing status is single; Web form # title filing date; On or before april 18, 2023. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers:

Individual Income Tax Forms And Instructions For Single And Joint Filers With No Dependents And All Other Filers.

On or before may 17, 2021. This form is for income earned in tax year 2022,. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers. If the due date for filing a.

Visit The District’s New Online Tax Portal To View And Pay Your Taxes.

On or before july 15, 2020. On or before april 15,. Tax amendment on efile.com, however you cannot submit it. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers.

You Can Prepare A Current Washington, D.c.

16 dc adjusted gross income, line 7 minus line 15. Web certified copy of form d40 by the dc office of tax and revenue, with evidence of payment of dc taxes for the current or most recent tax year and must bear the dc office of tax.