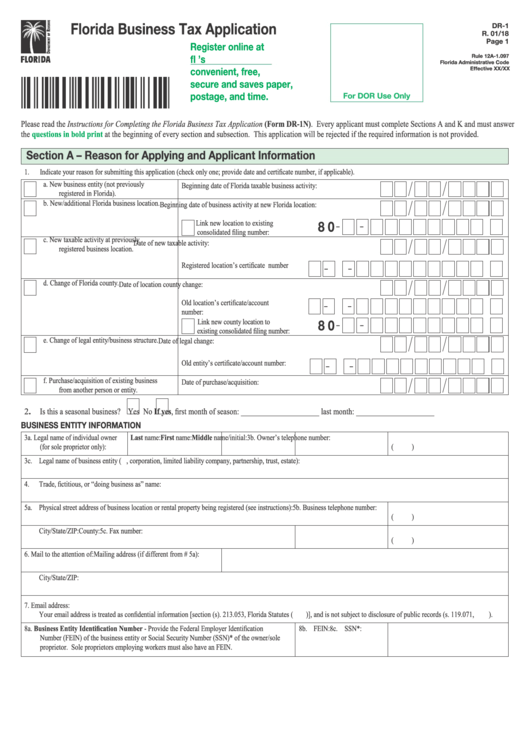

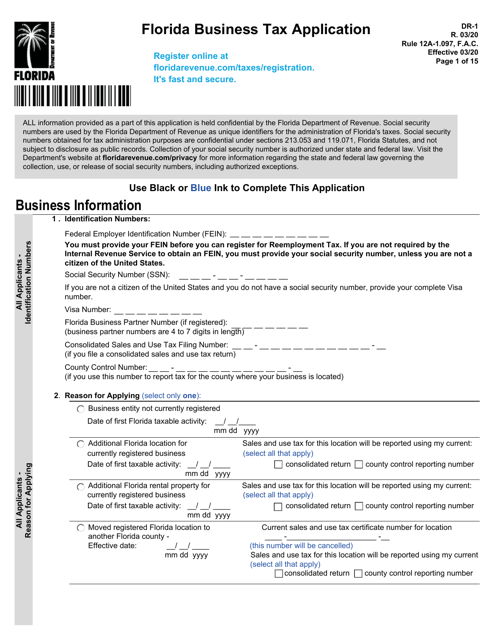

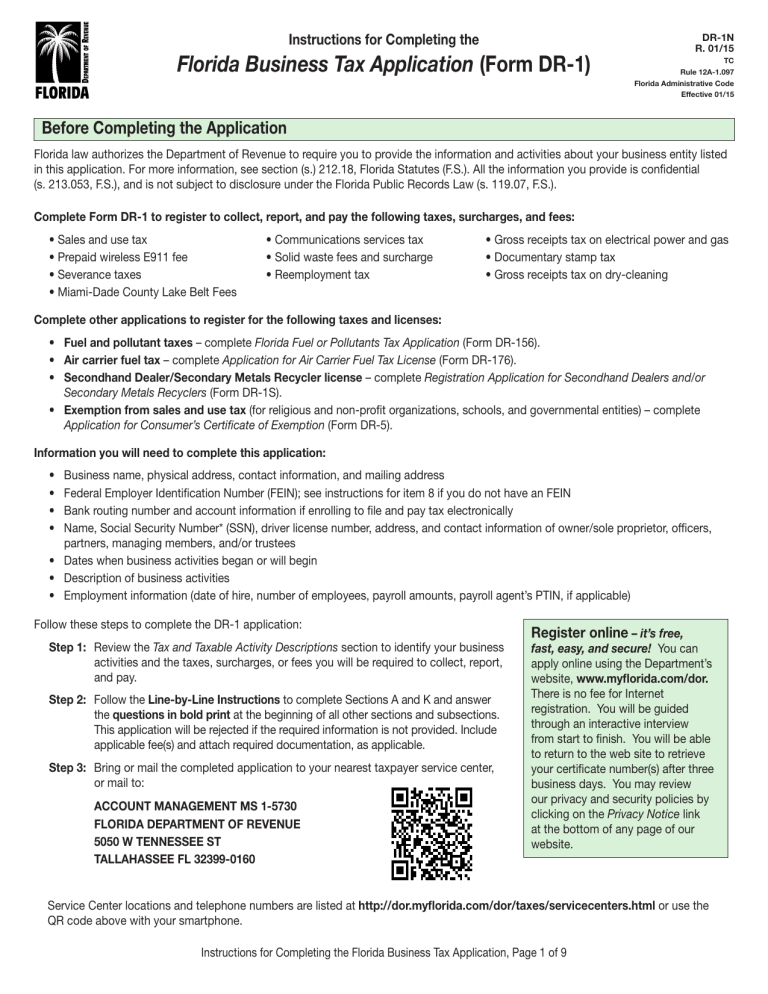

Form Dr-1

Form Dr-1 - Communications services tax documentary stamp tax Change the ownership of your business. If you are not required by the internal revenue service to obtain an fein, you must provide your social security number, unless you are not a citizen of the united states. You must provide your fein before you can register for reemployment tax. Application for abatement (english, pdf 139.71 kb) change of address Office of appeals form (english, pdf 67.2 kb) open pdf file, 139.71 kb, form abt: Move your business location from one florida county to another; You can download or print current. $ 6.00 | | 2a. • sales and use tax • communications services tax • gross receipts tax on electrical power and gas • prepaid wireless e911 fee • solid waste fees and surcharge • documentary stamp tax

Application for registered businesses to add a new florida location: You can download or print current. Move your business location from one florida county to another; Office of appeals form (english, pdf 67.2 kb) open pdf file, 139.71 kb, form abt: Communications services tax documentary stamp tax Application for abatement (english, pdf 139.71 kb) change of address $ 6.00 | | 2a. • sales and use tax • communications services tax • gross receipts tax on electrical power and gas • prepaid wireless e911 fee • solid waste fees and surcharge • documentary stamp tax Federal employer identification number (fein): If you are not required by the internal revenue service to obtain an fein, you must provide your social security number, unless you are not a citizen of the united states.

If you are not required by the internal revenue service to obtain an fein, you must provide your social security number, unless you are not a citizen of the united states. Change the ownership of your business. Communications services tax documentary stamp tax $ 6.00 | | 2a. You must provide your fein before you can register for reemployment tax. Application for registered businesses to add a new florida location: $ 4.00 | | 2. • sales and use tax • communications services tax • gross receipts tax on electrical power and gas • prepaid wireless e911 fee • solid waste fees and surcharge • documentary stamp tax Office of appeals form (english, pdf 67.2 kb) open pdf file, 139.71 kb, form abt: Move your business location from one florida county to another;

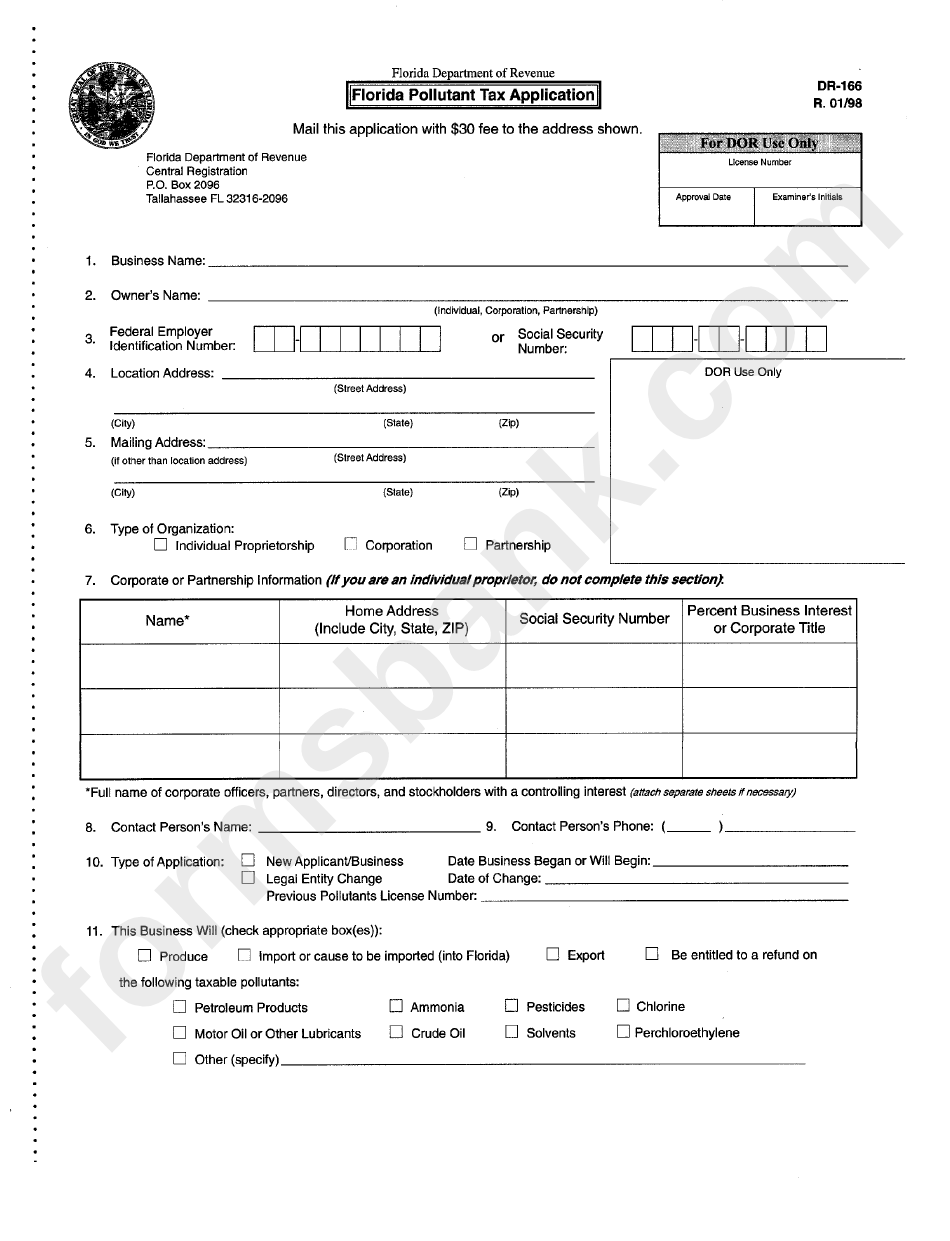

Fillable Form Dr166 Florida Pollutant Tax Application 1998

Application for abatement (english, pdf 139.71 kb) change of address Office of appeals form (english, pdf 67.2 kb) open pdf file, 139.71 kb, form abt: If you are not required by the internal revenue service to obtain an fein, you must provide your social security number, unless you are not a citizen of the united states. Change the ownership of.

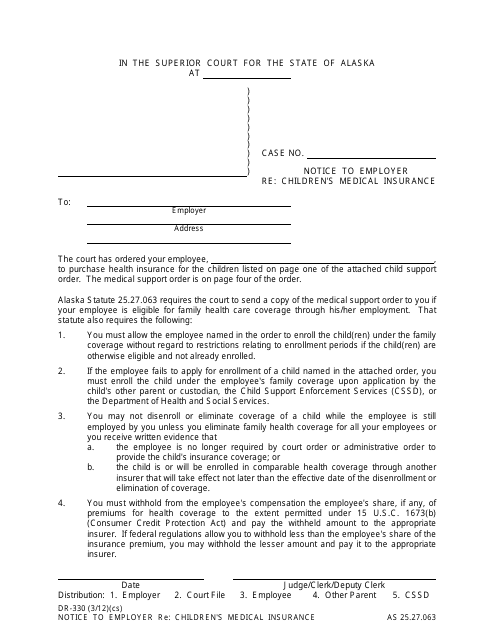

Form DR330 Download Fillable PDF or Fill Online Notice to Employer Re

Application for registered businesses to add a new florida location: $ 4.00 | | 2. Communications services tax documentary stamp tax You must provide your fein before you can register for reemployment tax. You can download or print current.

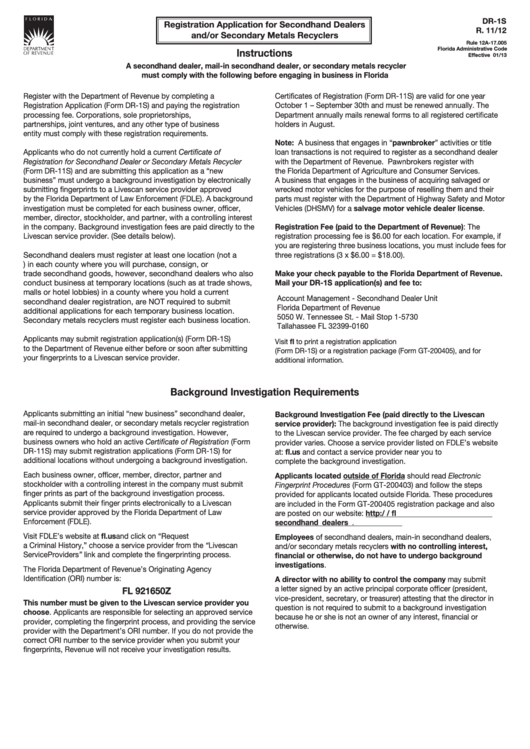

Form Dr1s Registration Application For Secondhand Dealers And/or

Office of appeals form (english, pdf 67.2 kb) open pdf file, 139.71 kb, form abt: Communications services tax documentary stamp tax Application for abatement (english, pdf 139.71 kb) change of address $ 6.00 | | 2a. $ 4.00 | | 2.

Form Dr1 Florida Business Tax Application printable pdf download

Federal employer identification number (fein): You can download or print current. $ 4.00 | | 2. $ 6.00 | | 2a. Change the ownership of your business.

Form DR1 Download Printable PDF or Fill Online Florida Business Tax

You must provide your fein before you can register for reemployment tax. Office of appeals form (english, pdf 67.2 kb) open pdf file, 139.71 kb, form abt: Move your business location from one florida county to another; Change the ownership of your business. $ 4.00 | | 2.

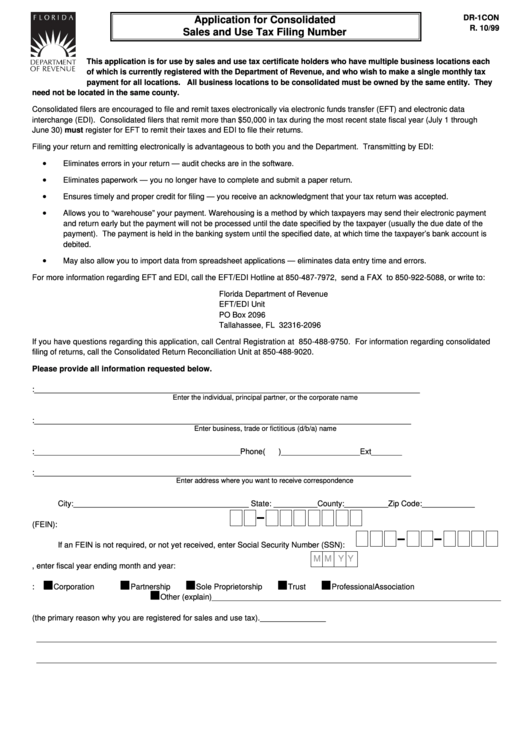

Form Dr1con Application Form For Consolidated Sales And Use Tax

Application for abatement (english, pdf 139.71 kb) change of address Application for registered businesses to add a new florida location: Federal employer identification number (fein): Change the ownership of your business. • sales and use tax • communications services tax • gross receipts tax on electrical power and gas • prepaid wireless e911 fee • solid waste fees and surcharge.

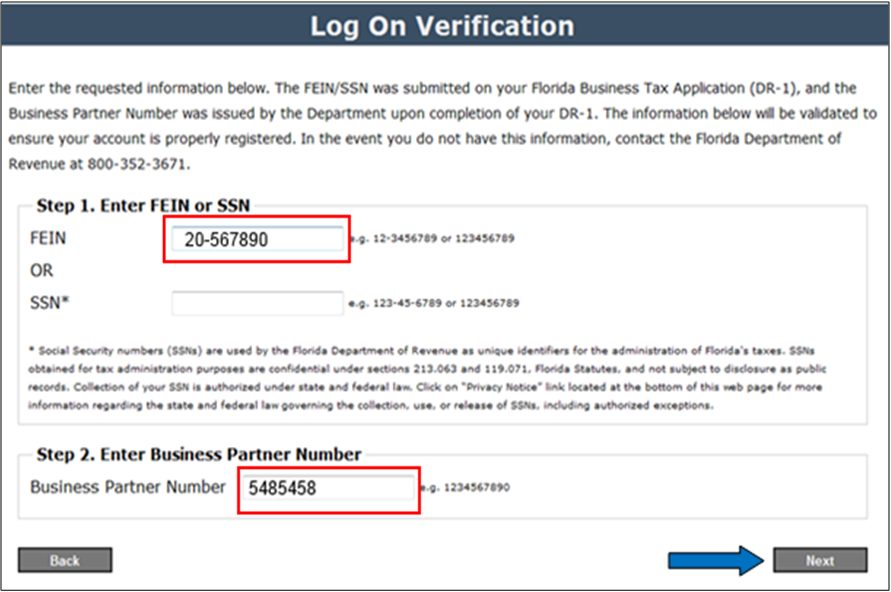

How To Get A Tax Id Number For Business In Florida Gallery Wallpaper

Office of appeals form (english, pdf 67.2 kb) open pdf file, 139.71 kb, form abt: Application for abatement (english, pdf 139.71 kb) change of address If you are not required by the internal revenue service to obtain an fein, you must provide your social security number, unless you are not a citizen of the united states. Communications services tax documentary.

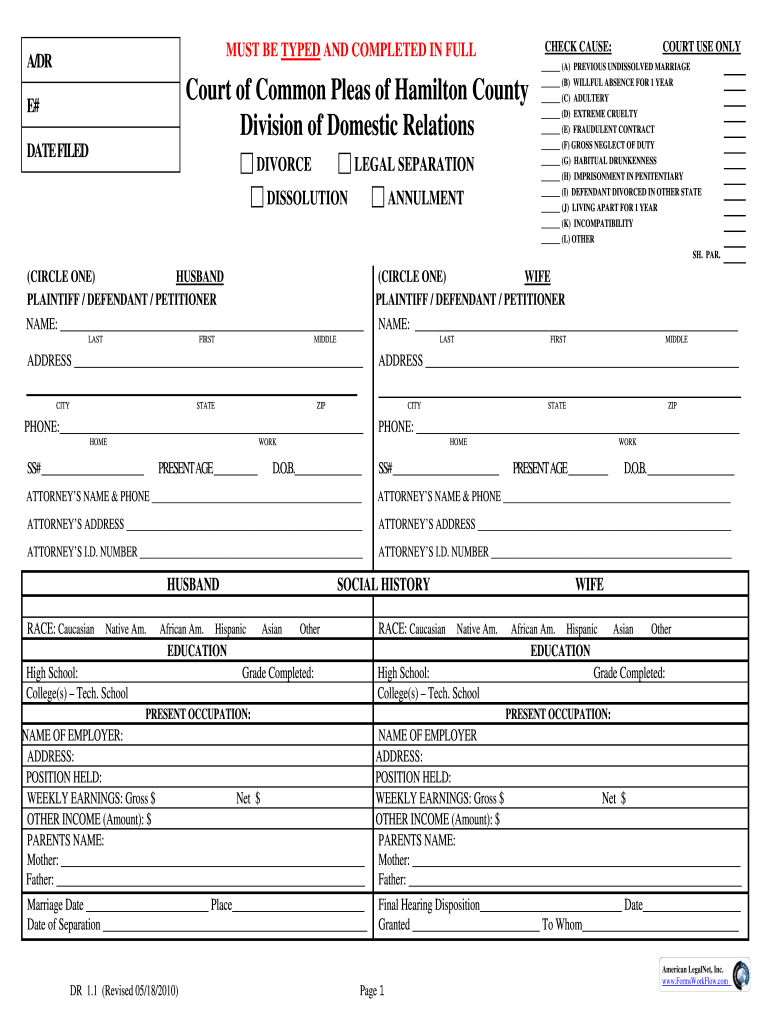

OH Domestic Relations Form DR 1.1 2010 Complete Legal Document Online

$ 4.00 | | 2. Federal employer identification number (fein): Office of appeals form (english, pdf 67.2 kb) open pdf file, 139.71 kb, form abt: If you are not required by the internal revenue service to obtain an fein, you must provide your social security number, unless you are not a citizen of the united states. Change the ownership of.

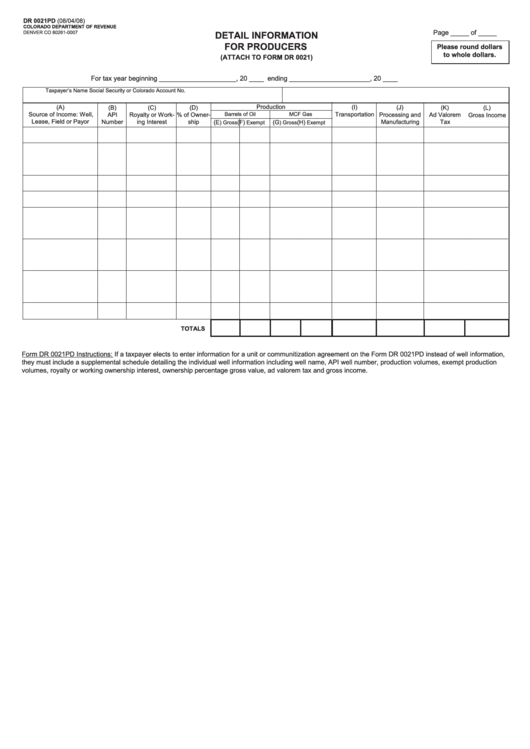

Form Dr 0021pd Attach To Form Dr 0021 Detail Information For

Communications services tax documentary stamp tax Move your business location from one florida county to another; $ 4.00 | | 2. Federal employer identification number (fein): Change the ownership of your business.

Application For Abatement (English, Pdf 139.71 Kb) Change Of Address

You must provide your fein before you can register for reemployment tax. You can download or print current. Change the ownership of your business. Application for registered businesses to add a new florida location:

Office Of Appeals Form (English, Pdf 67.2 Kb) Open Pdf File, 139.71 Kb, Form Abt:

$ 4.00 | | 2. Federal employer identification number (fein): $ 6.00 | | 2a. Move your business location from one florida county to another;

If You Are Not Required By The Internal Revenue Service To Obtain An Fein, You Must Provide Your Social Security Number, Unless You Are Not A Citizen Of The United States.

Communications services tax documentary stamp tax • sales and use tax • communications services tax • gross receipts tax on electrical power and gas • prepaid wireless e911 fee • solid waste fees and surcharge • documentary stamp tax