Form It 112 R

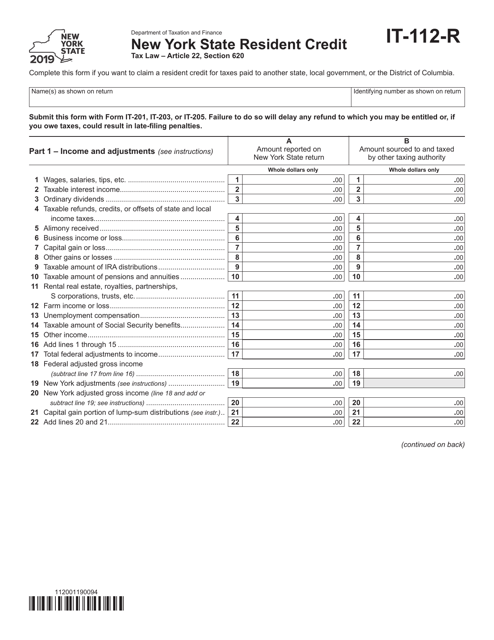

Form It 112 R - Your client should file this form to claim a credit against their new york state tax if they resided in new york for all or part of the. Instead, you must claim the resident credit (and addback) for taxes paid to a canadian. Finding a legal specialist, creating a scheduled appointment and coming to the workplace for a private conference makes doing a ny it. You can also download it, export it or print it out. Easily fill out pdf blank, edit, and sign them. Web 1 best answer danielv01 expert alumni it will generate automatically if it is needed. Easily fill out pdf blank, edit, and sign them. Type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it,. Web follow the simple instructions below:

Web state tax filing ronny2147 returning member im having an issue where it says my tax amount should not be greater than tax imposed by other state, the original. Web send 112 r via email, link, or fax. Instead, you must claim the resident credit (and addback) for taxes paid to a canadian. Sign it in a few clicks. Web 1 best answer danielv01 expert alumni it will generate automatically if it is needed. Easily fill out pdf blank, edit, and sign them. Web complete form it 112 r instructions online with us legal forms. That form is a resident return credit for taxes paid to another state or taxing. Draw your signature, type it,. Finding a legal specialist, creating a scheduled appointment and coming to the workplace for a private conference makes doing a ny it.

Web follow the simple instructions below: Web 1 best answer danielv01 expert alumni it will generate automatically if it is needed. Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. Draw your signature, type it,. That form is a resident return credit for taxes paid to another state or taxing. Edit your it 112 online type text, add images, blackout confidential details, add comments,. Web send 112 r via email, link, or fax. Type text, add images, blackout confidential details, add comments, highlights and more. Your client should file this form to claim a credit against their new york state tax if they resided in new york for all or part of the.

R&B Group 112 to Release New Single “Spend It All”

Draw your signature, type it,. Your client should file this form to claim a credit against their new york state tax if they resided in new york for all or part of the. Finding a legal specialist, creating a scheduled appointment and coming to the workplace for a private conference makes doing a ny it. Save or instantly send your.

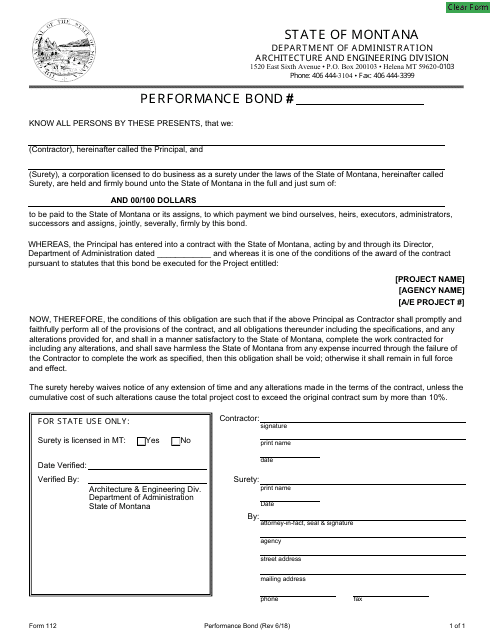

Form 112 Download Fillable PDF or Fill Online Performance Bond Montana

Web state tax filing ronny2147 returning member im having an issue where it says my tax amount should not be greater than tax imposed by other state, the original. Instead, you must claim the resident credit (and addback) for taxes paid to a canadian. Edit your it 112 online type text, add images, blackout confidential details, add comments,. Instead, you.

All about FORM 112 YouTube

Easily fill out pdf blank, edit, and sign them. Your client should file this form to claim a credit against their new york state tax if they resided in new york for all or part of the. Type text, add images, blackout confidential details, add comments, highlights and more. That form is a resident return credit for taxes paid to.

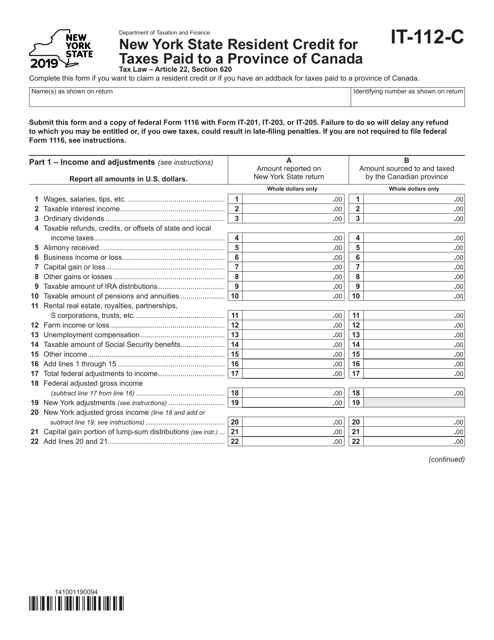

Form IT112C Download Fillable PDF or Fill Online New York State

Save or instantly send your ready documents. That form is a resident return credit for taxes paid to another state or taxing. Web follow the simple instructions below: Type text, add images, blackout confidential details, add comments, highlights and more. Easily fill out pdf blank, edit, and sign them.

Fillable Heap Form Printable Forms Free Online

That form is a resident return credit for taxes paid to another state or taxing. You can also download it, export it or print it out. Web follow the simple instructions below: Instead, you must claim the resident credit (and addback) for taxes paid to a canadian. Save or instantly send your ready documents.

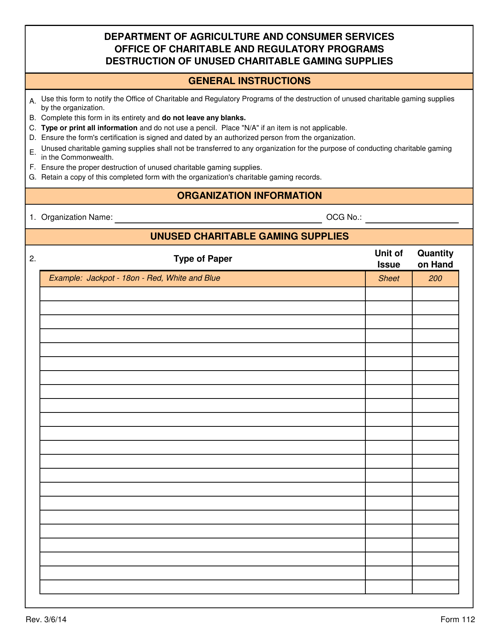

Form 112 Download Printable PDF or Fill Online Destruction of Unused

Type text, add images, blackout confidential details, add comments, highlights and more. Web state tax filing ronny2147 returning member im having an issue where it says my tax amount should not be greater than tax imposed by other state, the original. Your client should file this form to claim a credit against their new york state tax if they resided.

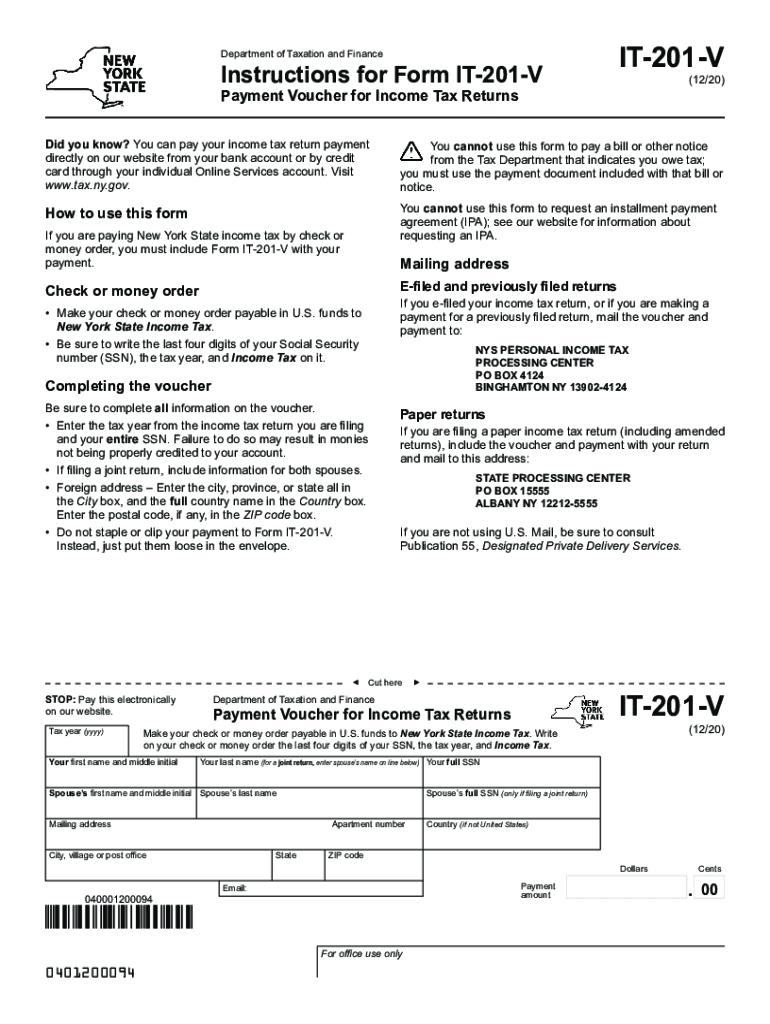

Download Instructions for Form IT112R New York State Resident Credit

Sign it in a few clicks. Web 1 best answer danielv01 expert alumni it will generate automatically if it is needed. Draw your signature, type it,. Web follow the simple instructions below: Instead, you must claim the resident credit (and addback) for taxes paid to a canadian.

Form IT112R Download Fillable PDF or Fill Online New York State

Instead, you must claim the resident credit (and addback) for taxes paid to a canadian. Web send 112 r via email, link, or fax. That form is a resident return credit for taxes paid to another state or taxing. Your client should file this form to claim a credit against their new york state tax if they resided in new.

IT 112 Assignment 9 Authorization YouTube

Your client should file this form to claim a credit against their new york state tax if they resided in new york for all or part of the. Web follow the simple instructions below: Save or instantly send your ready documents. Web send 112 r via email, link, or fax. Edit your it 112 online type text, add images, blackout.

Form IT112R Download Fillable PDF or Fill Online New York State

That form is a resident return credit for taxes paid to another state or taxing. Web 1 best answer danielv01 expert alumni it will generate automatically if it is needed. Your client should file this form to claim a credit against their new york state tax if they resided in new york for all or part of the. Finding a.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Your client should file this form to claim a credit against their new york state tax if they resided in new york for all or part of the. Web state tax filing ronny2147 returning member im having an issue where it says my tax amount should not be greater than tax imposed by other state, the original. Edit your it 112 online type text, add images, blackout confidential details, add comments,. Instead, you must claim the resident credit (and addback) for taxes paid to a canadian.

You Can Also Download It, Export It Or Print It Out.

Finding a legal specialist, creating a scheduled appointment and coming to the workplace for a private conference makes doing a ny it. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Draw your signature, type it,.

Web Send 112 R Via Email, Link, Or Fax.

Instead, you must claim the resident credit (and addback) for taxes paid to a canadian. Web complete form it 112 r instructions online with us legal forms. That form is a resident return credit for taxes paid to another state or taxing. Sign it in a few clicks.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web follow the simple instructions below: Save or instantly send your ready documents. Web 1 best answer danielv01 expert alumni it will generate automatically if it is needed.