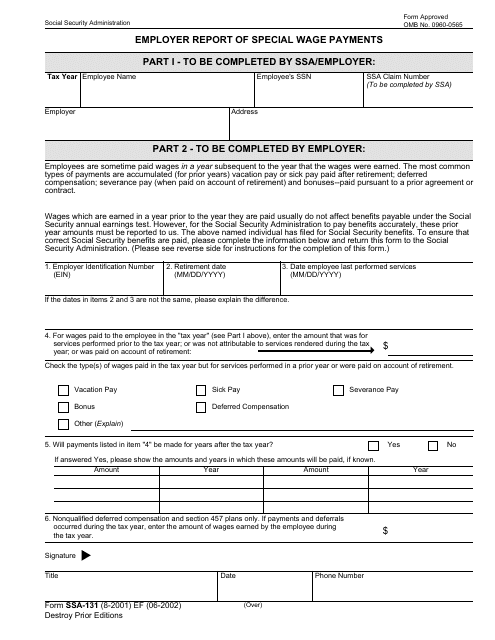

Form Ssa 131

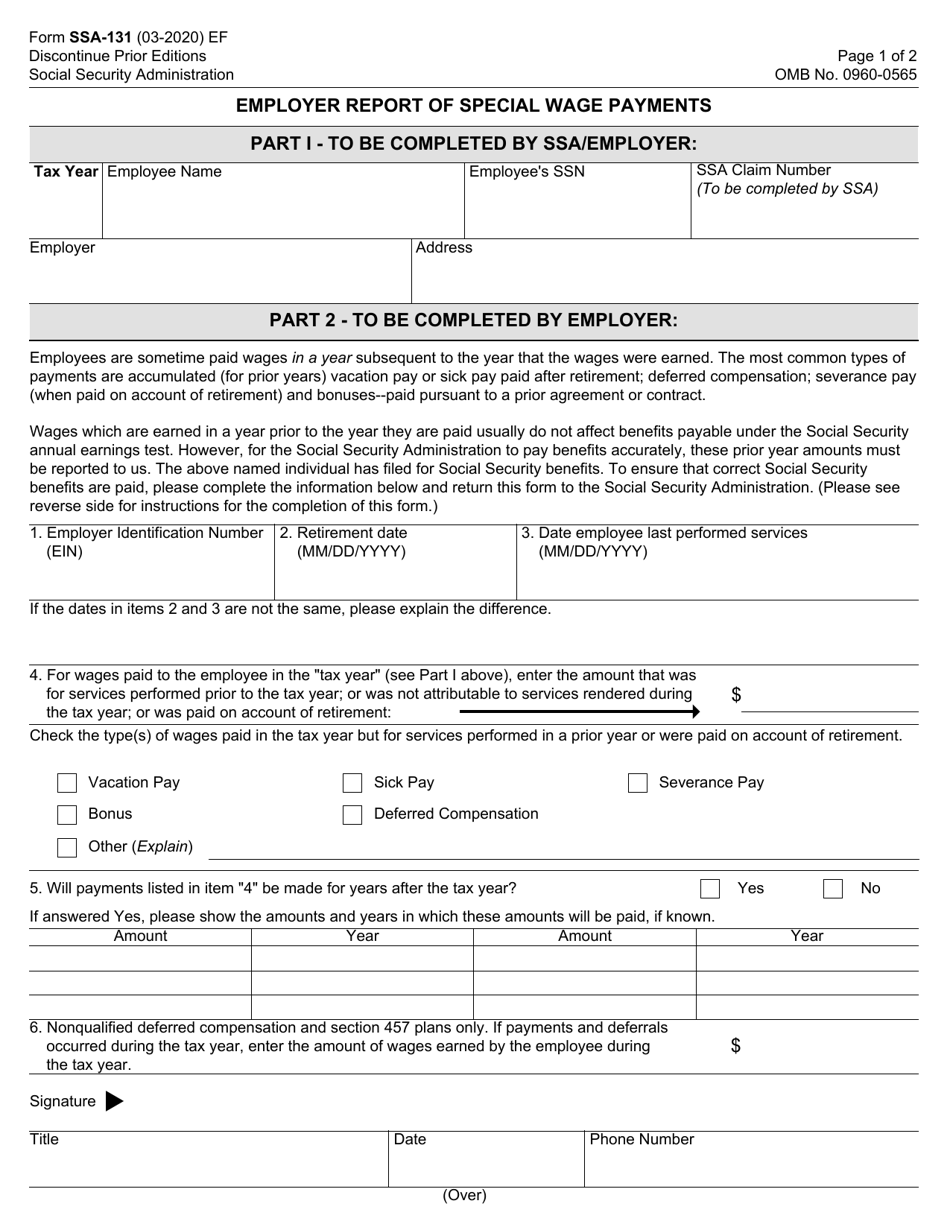

Form Ssa 131 - To get started on the document, utilize the fill camp; Enter the date the employee retired. Employer instructions for completing special wage payment form 1. Certification of low birth weight for ssi eligibility: Nonqualified deferred compensation and section 457 plans only. If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. Employer reporting to the social security administration special wage payments made to an employee for a prior year. Nonqualified deferred compensation and section 457 plans only. Social security administration, united states federal legal forms and united states legal forms. Sign online button or tick the preview image of the form.

Enter the date the employee retired. Employees are sometime paid wages in a year. To get started on the document, utilize the fill camp; This applies if the last task you did to earn the payment was completed before you stopped work. Involved parties names, addresses and phone numbers etc. Web social security forms | social security administration forms all forms are free. Nonqualified deferred compensation and section 457 plans only. The respondents are employers who provide special wage payment verification. Show details this website is not affiliated with any governmental entity. If you worked for wages, income received after retirement counts as a special payment.

Web ssa form 131 use a ssa form 131 template to make your document workflow more streamlined. Certification of election for reduced widow(er)'s and surviving divorced spouse. The respondents are employers who provide special wage payment verification. Employer instructions for completing special wage payment form 1. If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. The intent is to have a standard form that employers are familiar with and that can be sent to employers and returned directly to ssa. Show details this website is not affiliated with any governmental entity. Employees are sometime paid wages in a year. Open it with online editor and start altering. Enter the date the employee retired.

Form SSA131 Edit, Fill, Sign Online Handypdf

Certification of election for reduced widow(er)'s and surviving divorced spouse. Fill out the employer report of special wage payments online and print it out for free. Web ssa form 131 use a ssa form 131 template to make your document workflow more streamlined. If you worked for wages, income received after retirement counts as a special payment. Sign online button.

Form SSA131 Fill Out, Sign Online and Download Fillable PDF

If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. Enter not retired if the employee has not. Sign online button or tick the preview image of the form. Web social security forms | social security administration forms all forms are free. Web ssa form 131 use.

SSA3441BK 2004 Fill and Sign Printable Template Online US Legal Forms

Change the blanks with exclusive fillable areas. Web social security forms | social security administration forms all forms are free. Certification of election for reduced widow(er)'s and surviving divorced spouse. Enter not retired if the employee has not. Fill out the employer report of special wage payments online and print it out for free.

Form SSA131 Edit, Fill, Sign Online Handypdf

The respondents are employers who provide special wage payment verification. If you worked for wages, income received after retirement counts as a special payment. Involved parties names, addresses and phone numbers etc. Web what qualifies as a special payment? Open it with online editor and start altering.

Form SSA789 Edit, Fill, Sign Online Handypdf

If you worked for wages, income received after retirement counts as a special payment. Enter the date the employee retired. Employer reporting to the social security administration special wage payments made to an employee for a prior year. Not all forms are listed. This applies if the last task you did to earn the payment was completed before you stopped.

Publication 957 Reporting Back Pay and Special Wage Payments to SSA

Sign online button or tick the preview image of the form. Employer instructions for completing special wage payment form 1. If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. If you worked for wages, income received after retirement counts as a special payment. Nonqualified deferred compensation.

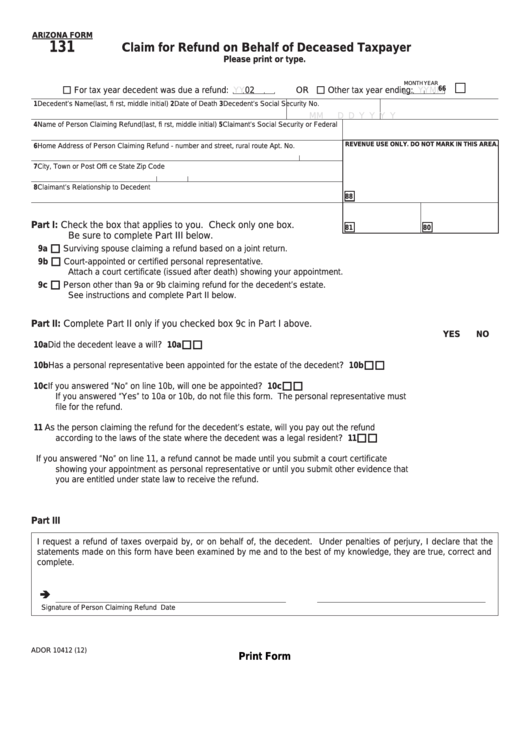

Fillable Form 131 Claim For Refund On Behalf Of Deceased Taxpayer

The intent is to have a standard form that employers are familiar with and that can be sent to employers and returned directly to ssa. Show details this website is not affiliated with any governmental entity. This applies if the last task you did to earn the payment was completed before you stopped work. Nonqualified deferred compensation and section 457.

2020 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

Sign online button or tick the preview image of the form. If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. This applies if the last task you did to earn the payment was completed before you stopped work. Employer reporting to the social security administration special.

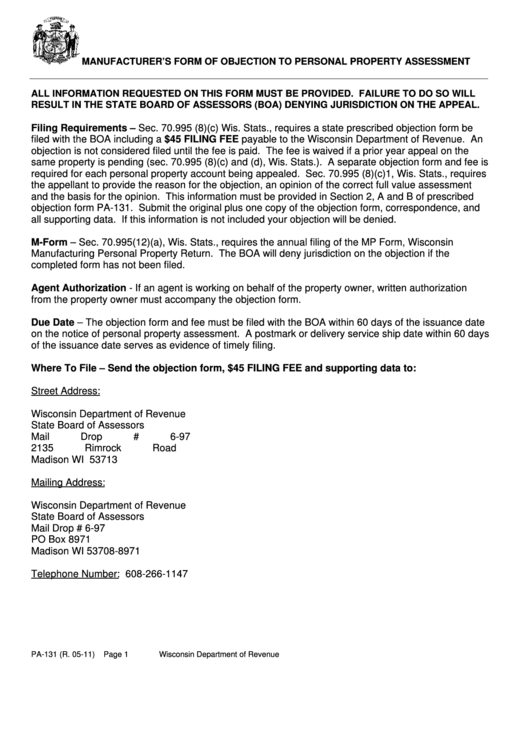

Form Pa131 Manufacturer'S Form Of Objection To Personal Property

The respondents are employers who provide special wage payment verification. Certification of low birth weight for ssi eligibility: Not all forms are listed. If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year. Nonqualified deferred compensation and section 457 plans only.

Form SSA131 Download Fillable PDF or Fill Online Employer Report of

Enter not retired if the employee has not. Questionnaire for children claiming ssi benefits: How it works open the omb no 0960 0565 and follow the instructions easily sign the ssa131 with your finger send filled & signed form ssa 131 ocr mailing address or save Change the blanks with exclusive fillable areas. How you can complete the ssa 131.

Change The Blanks With Exclusive Fillable Areas.

Enter the date the employee retired. Web what qualifies as a special payment? How it works open the omb no 0960 0565 and follow the instructions easily sign the ssa131 with your finger send filled & signed form ssa 131 ocr mailing address or save If payments and deferrals occurred during the tax year, enter the amount of wages earned by the employee during $ the tax year.

Show Details This Website Is Not Affiliated With Any Governmental Entity.

Employer instructions for completing special wage payment form 1. How you can complete the ssa 131 form on the internet: Nonqualified deferred compensation and section 457 plans only. Nonqualified deferred compensation and section 457 plans only.

Not All Forms Are Listed.

Involved parties names, addresses and phone numbers etc. Web ssa form 131 use a ssa form 131 template to make your document workflow more streamlined. Employees are sometime paid wages in a year. If you worked for wages, income received after retirement counts as a special payment.

Web Social Security Forms | Social Security Administration Forms All Forms Are Free.

Employer reporting to the social security administration special wage payments made to an employee for a prior year. The respondents are employers who provide special wage payment verification. This applies if the last task you did to earn the payment was completed before you stopped work. Open it with online editor and start altering.