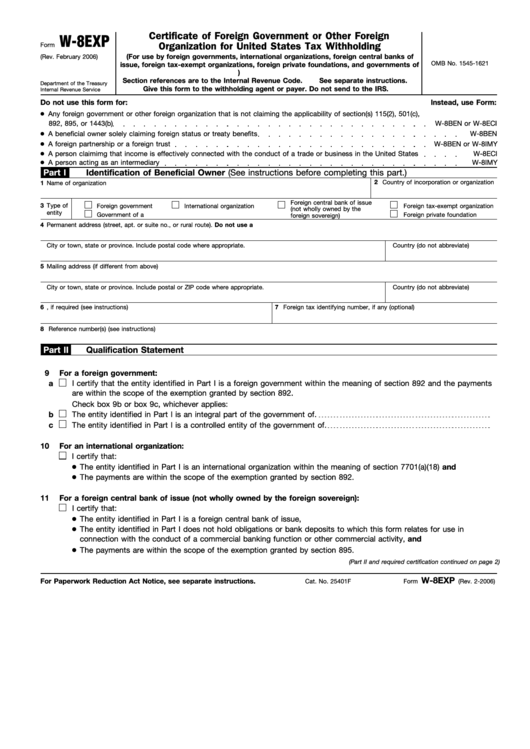

Form W 8Exp

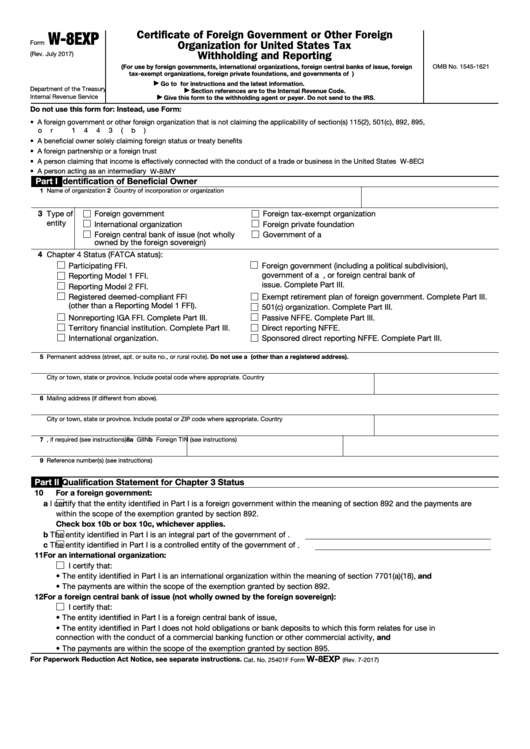

Form W 8Exp - The irs recently released new final versions of the following forms and instructions: October 2023) department of the treasury internal revenue service certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign Complete, edit or print tax forms instantly. Certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign Possessions.) department of the treasury internal revenue service For general information and the purpose of each of the forms described in these instructions. Branches for united states tax withholding. Establish that you are not a u.s. Upload, modify or create forms. There's some overlap here with the ben and eci forms.

If any of the income to which this certification relates constitutes income includible under section 512 in computing the For general information and the purpose of each of the forms described in these instructions. July 2017) department of the treasury internal revenue service. The irs recently released new final versions of the following forms and instructions: Complete, edit or print tax forms instantly. Possessions.) department of the treasury internal revenue service Certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign Try it for free now! Branches for united states tax withholding. Establish that you are not a u.s.

October 2023) department of the treasury internal revenue service certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign The irs recently released new final versions of the following forms and instructions: Establish that you are not a u.s. Try it for free now! Certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign July 2017) department of the treasury internal revenue service. If any of the income to which this certification relates constitutes income includible under section 512 in computing the Possessions.) department of the treasury internal revenue service Complete, edit or print tax forms instantly. Upload, modify or create forms.

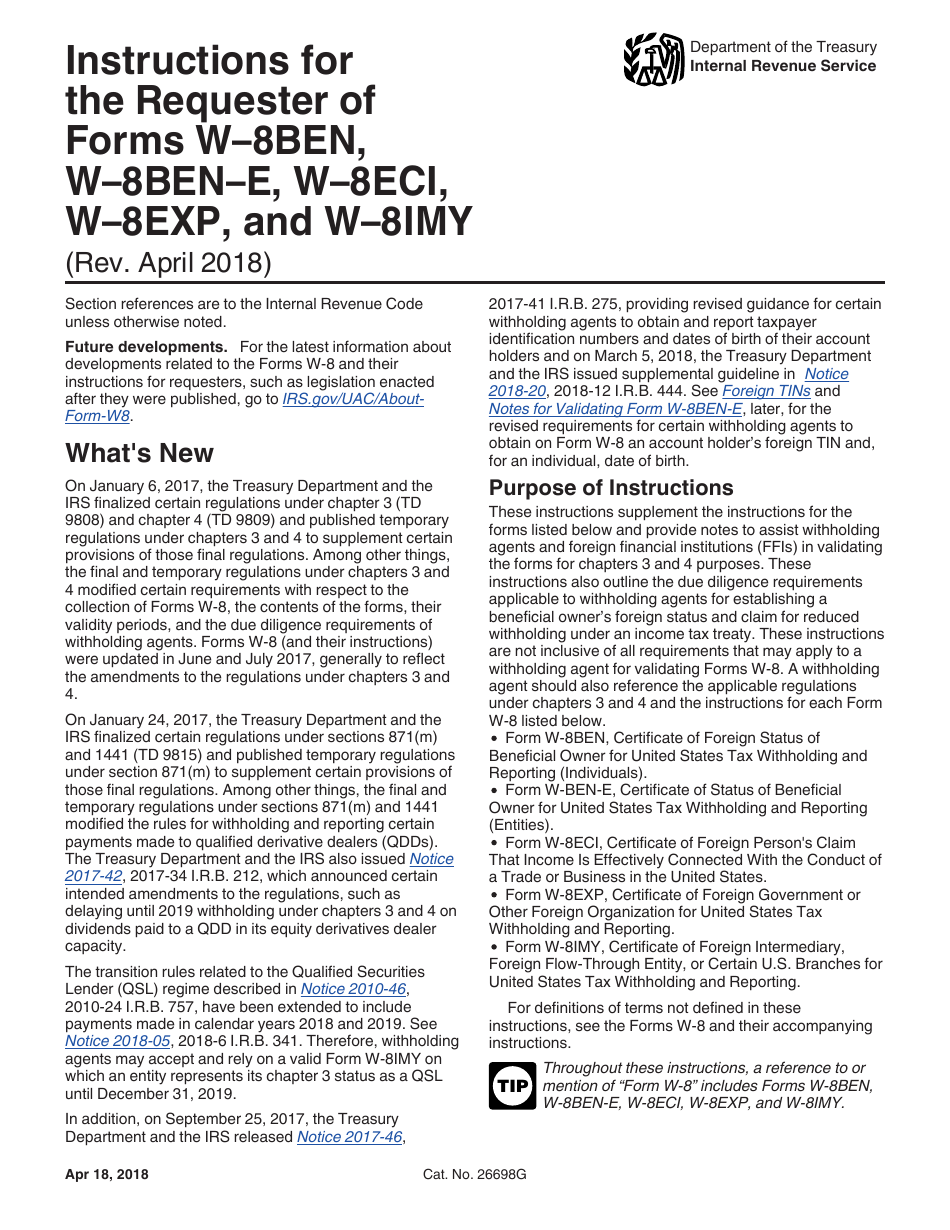

W 8imy Instructions 2016

For general information and the purpose of each of the forms described in these instructions. July 2017) department of the treasury internal revenue service. Branches for united states tax withholding. Upload, modify or create forms. Complete, edit or print tax forms instantly.

Fill Free fillable FORM W8EXP (REVISION DATE FEBRUARY 2006) UPDATED

Certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign Try it for free now! Branches for united states tax withholding. For general information and the purpose of each of the forms described in these instructions. October 2023) department of the treasury.

Fillable Form W8exp Certificate Of Foreign Government Or Other

July 2017) department of the treasury internal revenue service. October 2023) department of the treasury internal revenue service certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign Complete, edit or print tax forms instantly. Certificate of foreign government or other foreign.

Form W8EXP Certificate of Foreign Organization for U.S. Tax

Certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign Complete, edit or print tax forms instantly. If any of the income to which this certification relates constitutes income includible under section 512 in computing the July 2017) department of the treasury.

Download Instructions for IRS Form W8BEN, W8BENE, W8ECI, W8EXP, W

The irs recently released new final versions of the following forms and instructions: Certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign There's some overlap here with the ben and eci forms. Try it for free now! Complete, edit or print.

Form W8EXP Edit, Fill, Sign Online Handypdf

If any of the income to which this certification relates constitutes income includible under section 512 in computing the The irs recently released new final versions of the following forms and instructions: For general information and the purpose of each of the forms described in these instructions. Try it for free now! July 2017) department of the treasury internal revenue.

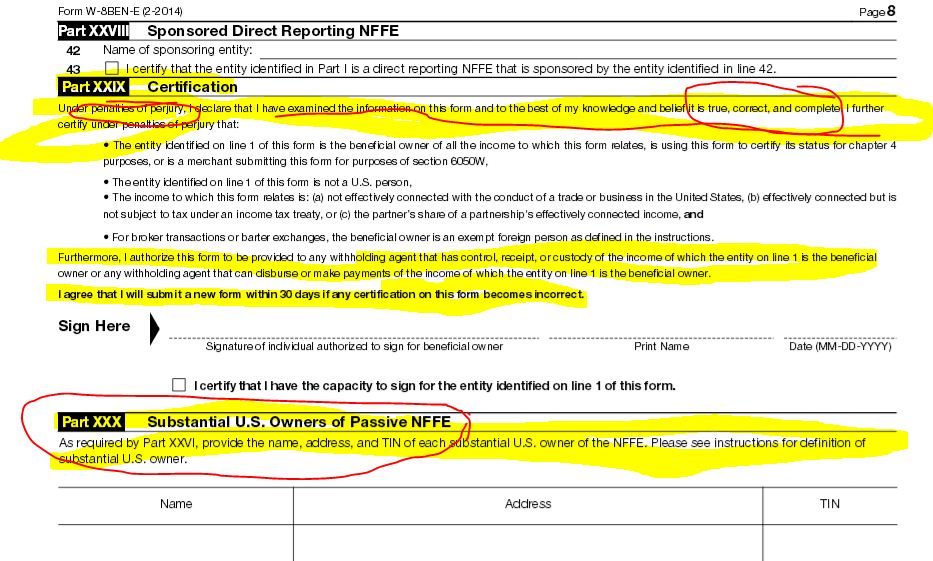

W8BEN vs W8BENE What is the Difference?

Upload, modify or create forms. Possessions.) department of the treasury internal revenue service October 2023) department of the treasury internal revenue service certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign If any of the income to which this certification relates.

Fillable Form W8exp Certificate Of Foreign Government Or Other

There's some overlap here with the ben and eci forms. July 2017) department of the treasury internal revenue service. Possessions.) department of the treasury internal revenue service The irs recently released new final versions of the following forms and instructions: Branches for united states tax withholding.

What is a W8 Form definition and meaning Bookstime

Try it for free now! Possessions.) department of the treasury internal revenue service For general information and the purpose of each of the forms described in these instructions. Certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign The irs recently released.

Form W8EXP Certificate of Foreign Organization for U.S. Tax

Possessions.) department of the treasury internal revenue service For general information and the purpose of each of the forms described in these instructions. Branches for united states tax withholding. October 2023) department of the treasury internal revenue service certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations,.

For General Information And The Purpose Of Each Of The Forms Described In These Instructions.

Upload, modify or create forms. The irs recently released new final versions of the following forms and instructions: Possessions.) department of the treasury internal revenue service July 2017) department of the treasury internal revenue service.

October 2023) Department Of The Treasury Internal Revenue Service Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding And Reporting (For Use By Foreign Governments, International Organizations, Foreign Central Banks Of Issue, Foreign

Complete, edit or print tax forms instantly. Establish that you are not a u.s. Branches for united states tax withholding. Try it for free now!

There's Some Overlap Here With The Ben And Eci Forms.

If any of the income to which this certification relates constitutes income includible under section 512 in computing the Certificate of foreign government or other foreign organization for united states tax withholding and reporting (for use by foreign governments, international organizations, foreign central banks of issue, foreign